- What is Gap Insurance?

- Gap Insurance Cost

- What Gap Insurance Covers

- Should You Purchase Gap Insurance?

- Alternatives to Gap Insurance

- Frequently Asked Questions

When you're going through the paperwork after buying a new car, signing endless documents, and saying yes or no to all of the add-ons that dealerships like to tack on, you'll no doubt be asked whether or not you want to buy gap insurance (guaranteed asset protection insurance). When the finance guy at the dealership explains it to you, the obvious answer seems to be yes. But is gap insurance worth it?

The short answer is yes. If you end up in a situation where gap insurance kicks in, it's well worth it. Gap insurance can save you thousands of dollars while only costing you a few hundred dollars total. However, getting your car totaled in the first couple of years of owning it can be rare, which means you could pay for gap insurance without ever needing it.

What is Gap Insurance?

Gap insurance is additional car insurance that can help you pay off your auto loan if your new car is totaled or stolen and you owe more than what it's worth.

It's common knowledge that after you drive a new car off the lot, its value depreciates pretty much immediately. According to Ramsey Solutions, a brand new car is worth 9-11% less the minute you drive it off the lot. The general consensus is that your car's value depreciates about 20-30% in the first year alone, losing even more value in the following years.

How Gap Insurance Works

If your new car is totaled or stolen, your car insurance policy will only cover you for what the car was worth at the time. Even if your vehicle was totaled right after you bought it, its value is worth less than what your loan or lease valued the car at.

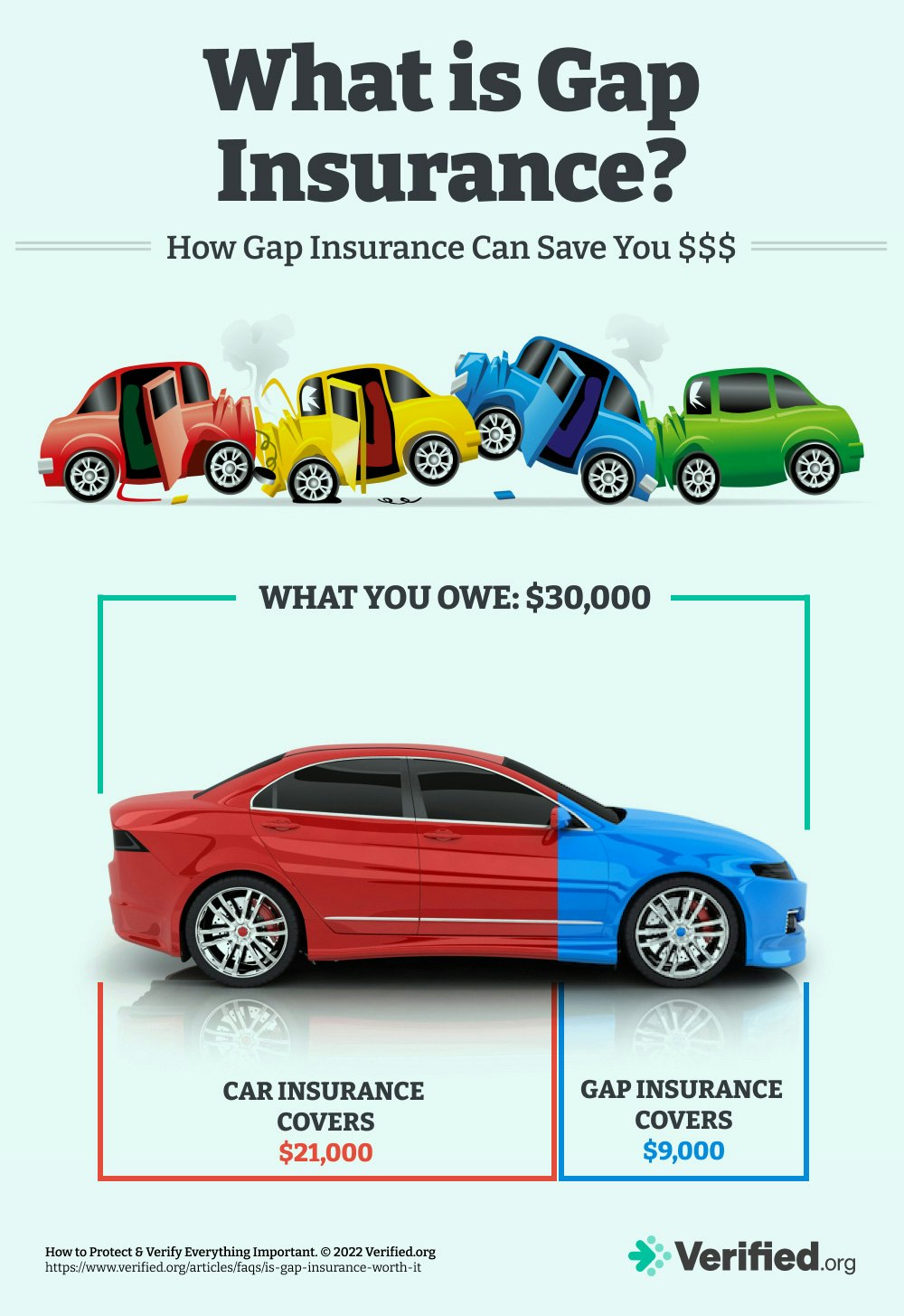

For example, let's say you bought a car for $30,000 on an auto loan. Soon after buying it, it's totaled, so you put in an insurance claim. Your insurance company will cover you for the total value of your car, which is now $21,000. However, at this point in time, you still owe $30,000 on your car loan, so you're not only on the hook to pay the deductible on your car insurance claim, but you also owe the additional $9,000 that your insurance company won't cover.

This is where gap insurance comes in—it helps you pay for that "gap" in coverage due to the car's value decreasing so quickly.

Gap Insurance Reimbursement Goes to Your Lender

If gap insurance kicks in to help you pay off your car loan, the money is sent to your auto lender—you can't keep the money yourself.

How Long Do I Need Gap Insurance For?

Generally, you only need gap insurance for one or two years when your car is worth more than your car loan. After this time, there's no point in getting gap insurance because your regular auto policy should cover the cost of your vehicle's actual cash value.

A good rule of thumb is to cancel your gap insurance coverage once your auto loan or lease balance is about $1,000-$2,000 less than the actual cash value of the car. Check sites like Kelley Blue Book to keep track of how much your vehicle is worth.

Gap Insurance Cost

The cost of gap insurance usually costs around $400 to $700 total if you buy it from your dealership. If you purchase gap insurance from a car dealership, they'll charge you the lump sum, but you can also add it to your regular car insurance policy for a smaller monthly payment, for less than $5/month (this varies depending on your insurance company).

Note that you won't be paying for gap insurance forever. You'll only need it for a couple of years at most. So, if you purchase gap insurance from your insurance company, remember to cancel it when it no longer makes sense.

What Gap Insurance Covers

Gap insurance only covers a total loss of your vehicle. So if your car insurance company doesn't declare your car a total loss, your gap insurance won't kick in.

A total loss includes if your car is stolen or if the damage is so extensive that the costs to repair it exceed the vehicle's value. Your car insurance company determines this.

Additionally, it only covers what your regular car insurance policy won't—i.e., the gap between the cash value of your car and what you owe on your auto loan.

Should You Purchase Gap Insurance?

Gap insurance really only makes sense if you bought a brand new car and have an auto loan or lease. Additionally, gap insurance is only worth it for the first couple of years of owning your car.

If out of convenience, you agree to have your auto dealer or loan company add gap insurance to your auto loan payments, you may want to reconsider. While it's a one-time add-on and more convenient, you'll likely save yourself hundreds of dollars if you add gap coverage to your regular car insurance policy. Gap insurance with your traditional car insurance company may cost less than $5/month.

The best way to decide if you need gap insurance is to look at the actual cash value of your vehicle and compare it to how much you still owe on your auto loan or lease. If your loan or lease balance is still several thousand dollars more than your car is worth, gap coverage is worth it.

Alternatives to Gap Insurance

If you don't want to buy gap insurance, there is another option you can consider. Your insurance company may have an option to upgrade your current policy to include new car replacement insurance.

Note that this option is only for cars less than 12 months old and less than 15,000 miles on the odometer. New car replacement insurance would cover the total value of replacing the vehicle with a new one, so you would get a new car and continue to pay your current auto loan as usual.

Your auto loan or lease company isn't affected at all.

So, while gap insurance covers the difference between what your insurance policy covers and what you owe to the loan company, new car replacement insurance will replace your car completely. The benefit of this option is that you don't need to go through the hassle of getting another car loan or lease.

Comments