- How Much is Pet Insurance?

- What Does Pet Insurance Cover?

- Who Should Have Pet Insurance?

- Is Pet Insurance Worth It?

If you've recently got a new pet, whether it be a dog, cat, bird, rabbit, or other fabulous creature, you're probably wondering whether it's worth getting pet insurance. The thing is, not many people purchase pet insurance, with just over 1% of cats and dogs in the U.S. being insured. So why does such a small population invest in insurance for their pets? We look at what pet insurance covers, how much it costs, and if it's worth it.

How Much is Pet Insurance?

The amount you'll pay for pet insurance will depend on a variety of factors, such as:

- The type of pet you have

- The age of your pet

- Your pet's current state of health

- What coverage you choose

- Whether you pay monthly or annually

- The insurance company you choose

- Your deductible

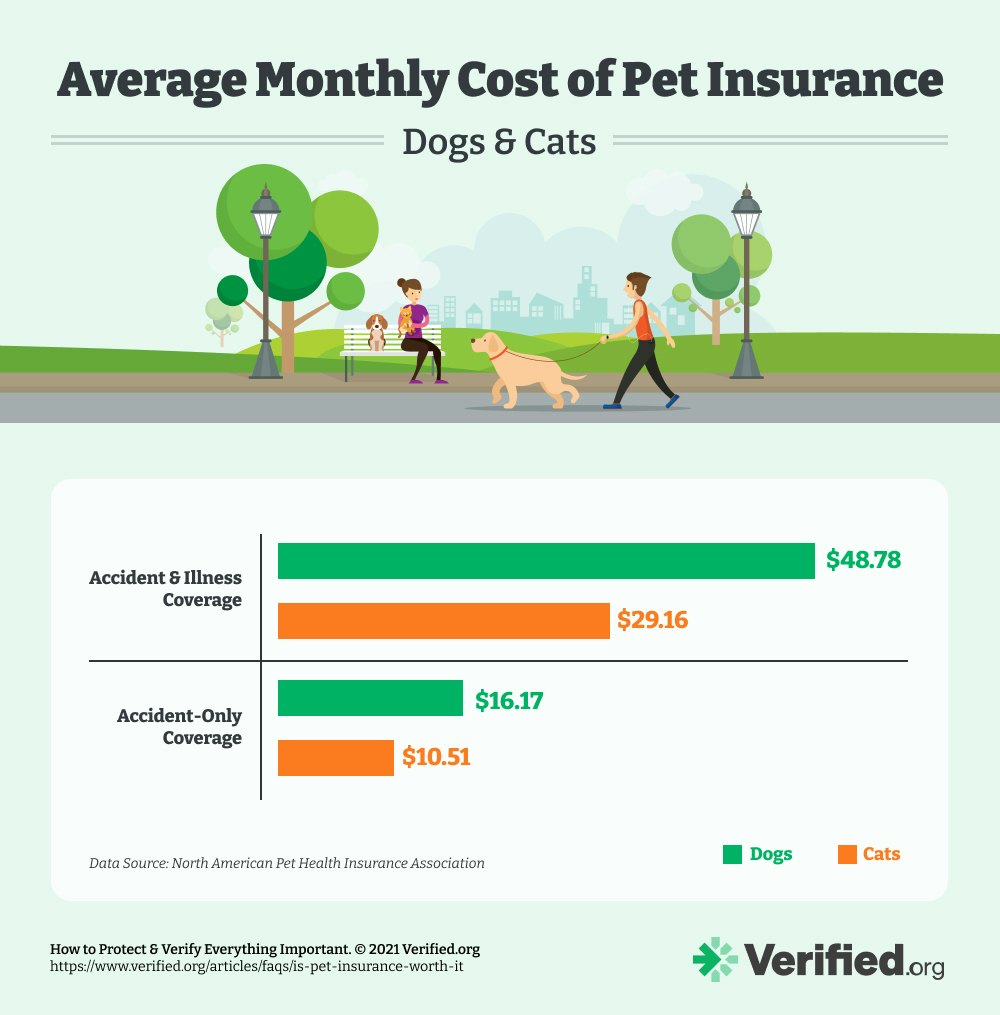

On average, pet insurance varies anywhere between:

- $141 - $354 per year for cats

- $190 - $566 per year for dogs

(If you want a higher coverage limit or lower deductible on your plan, your monthly rate will be higher.)

Basic vs. Full Coverage

Pet insurance companies usually offer at least two types of coverage:

- Accident/illness coverage: Helps you cover the cost of veterinary visits, medications, surgeries, etc., due to an accident or illness. (It is sometimes split into two types of coverage.)

- Wellness/preventative coverage (basic): Helps you cover the cost of preventive measures and general wellness checks (e.g., vaccinations, dental check-ups, etc.)

Wellness/preventative plans are usually offered as an add-on for an additional fee onto an accident-only or accident and illness plan.

What Does Pet Insurance Cover?

Depending on your pet insurance provider, you may have different options when it comes to coverage. Some common types of plans you can choose from include:

- Accident only

- Accident and illness

- Preventative and wellness

Pet Insurance Doesn't Cover Everything

Note that your pet insurance won't cover the total cost of treatments and exams. You'll need to pay your deductible and the difference between what your insurance does and doesn't cover.

Accident Only Pet Insurance

Accident pet insurance plans cover any treatment needed after your pet has suffered an accident of any kind, such as:

- X-rays

- Ultrasounds

- Medications

- Hospitalization

- Emergency care

- Lab tests

- CT scans and MRIs

- Surgery

- Pet ambulance

Treatment could be required for any number of reasons, such as:

- Bee stings

- Snake bites

- Bite wounds

- Cuts and lacerations

- Eye injuries

- Sprains

- Broken bones

- Poisoning

- Car accidents

Accident and Illness Pet Insurance

Accident and illness insurance covers everything that regular accident plans cover, but also cover treatment for illnesses, including:

- Allergies

- Cancer

- Thyroid problems

- Urinary tract infections

- Digestive issues

Preventative and Wellness Pet Insurance

The most basic level of pet insurance covers routine pet care and maintenance only, such as:

- Regular wellness exams

- Microchipping

- De-worming

- Vaccinations

- Spaying/neutering

- Heartworm tests and prevention

- Blood, fecal, and parasite examinations

- Flea and tick prevention

- Dental cleaning

This plan is usually offered as an add-on to an accident plan.

Pet Liability Insurance is Different

Pet insurance covers your veterinary bills, while liability insurance offers protection if your pet harms someone else. E.g., if your dog bites another person or animal, liability insurance will help cover associated medical and legal bills.

Who Should Have Pet Insurance?

Most veterinarians and pet lovers will tell you it's definitely in your (and your pet's) best interest to invest in pet insurance. The main reason is that you cannot predict what will happen to your pet in the future, and veterinary bills can be overwhelmingly expensive.

Even if your pet isn't prone to accidents, you never know what illnesses they may have later in life. If you don't want to pay for basic preventative coverage, you should at least consider accident and/or illness coverage.

Younger Pets May Not Need As Much Coverage

When your pet is still young, it's less likely that it will need expensive veterinary care. Many pets rack up their vet bills later in life when they suffer injuries or illnesses that come with age.

You should especially consider buying accident and/or illness pet insurance coverage if:

- Your pet is older

- Your cat is allowed outdoors

- Your pet is prone to illnesses (e.g., Pugs are known to have breathing problems)

- Your pet is prone to injuries (e.g., Toy Poodles are prone to knee cap issues)

- Your pet is prone to health conditions (e.g., larger breeds are prone to arthritis)

- You don't' have funds available to pay for treatment that may cost thousands of dollars

- Your pet is very active, and you take them outdoors often (e.g., on hikes where they could come across a snake or get injured on their walk)

- You have multiple pets that interact and play with each other regularly

Is Pet Insurance Worth It?

So, is pet insurance worth it? First, let's break down the cost of a plan with ASPCA for a cat and dog vs. the average cost of treatment.

| Deductible | Accident/Illness Coverage | Preventative Plan | Yearly Cost | |

| Cat | $100 |

|

Basic | $505.58 |

| Dog | $250 |

|

Basic | $484.56* |

* Includes a multiple pet discount of $40.56.

Together, these plans cost around $82/month (for two pets), which is less than the average price of a cell phone plan.

Accident + Illness Plans

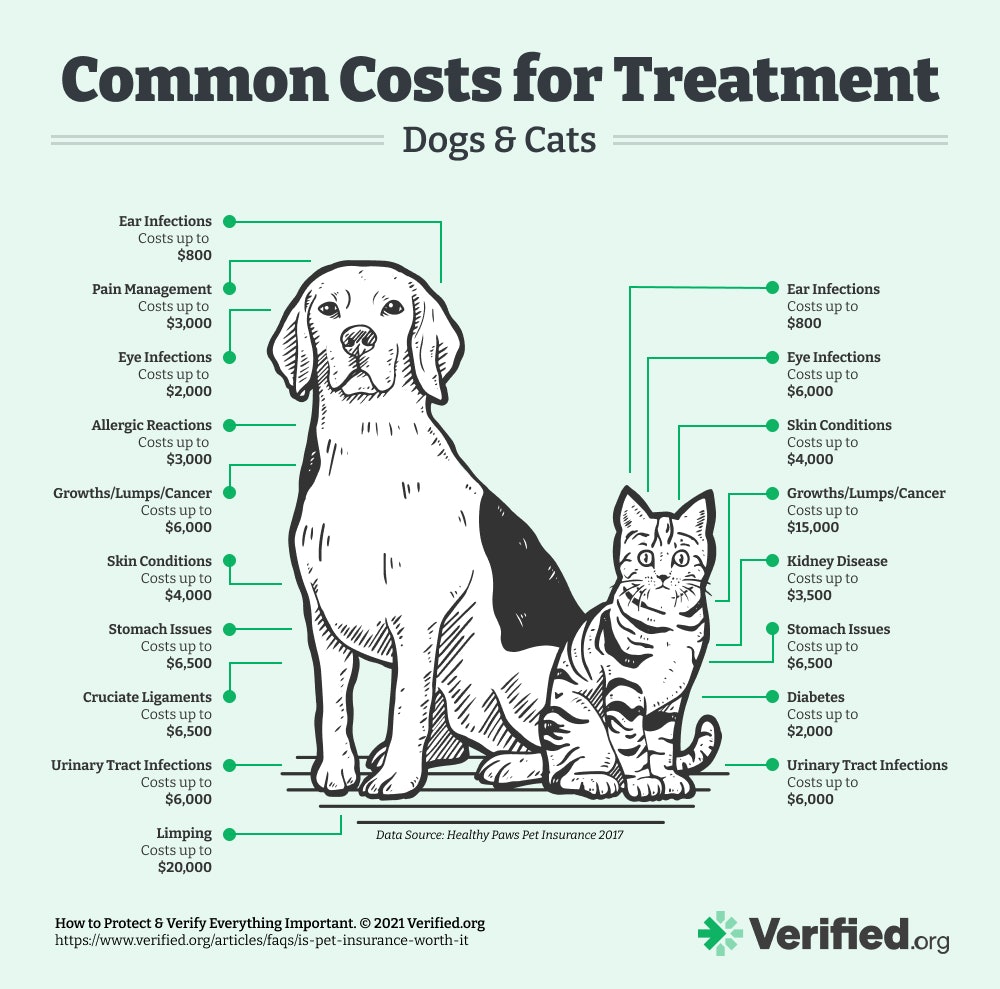

These accident and illness plans are by far the best value since pet treatment, and surgeries can get very expensive very quickly.

For example, if the cat in this scenario has diabetes, which is very common for cats treating it can cost up to $2,000 in a single year. With this plan, here's what you would be paying:

- $505.58 ( insurance)

- $100 (deductible)

- $400 (20% not covered by insurance)

- TOTAL: $1,005.58 versus $2,000 without insurance

In another example, let's say the dog has stomach issues. Treating severe stomach issues in dogs can cost up to $6,500. Here you would pay:

- $484.56 (insurance)

- $250 (deductible)

- $1,300 (20% not covered by insurance)

- $1,950 (remaining cost after reaching limit)

- Calculation: $5,200 - $250 - $3,000

- TOTAL: $3,984.56 versus $6,500 without insurance

You're Not Always Covered

If you take your pet in because you think it is injured or sick, but the veterinarian cannot find anything wrong with it, your pet insurance may not cover the costs of the exam and any tests that were run.

Preventative/Wellness Plans

Preventative Coverage for these ASPCA plans cover:

- Dental cleaning: $100

- Wellness exam: $50

- FVRCP vaccine/Titer (cats): $20

- DHLPP vaccine/titer (dogs): $20

- Rabies vaccine/titer OR FIP vaccine/titer (cats): $20

- Lyme vaccine/titer (dogs): $20

- Fecal test: $20

- Heartworm test: $20

- Deworming: $20

(ASPCA also offers Standard and Prime preventative plans which cover additional tests and preventative treatments.)

Preventative plans may not be as valuable as accident and illness plans since only a set amount can be used for each treatment. Here's how pricing differs according to one veterinary practice in San Diego, California.

| Dog Treatment | Basic ASPCA Preventative Coverage | Total Billed | Total Paid |

| Heartworm test | $20 | $48 | $28 |

| Rabies vaccine | $20 | $32 | $12 |

| Bordetella vaccine | $0 | $40 | $40 |

| Wellness exam | $50 | $52 | $2 |

| Deworming | $20 | $28.56 | $8.56 |

| Heartworm/flea medication | $0 | $32.50 | $32.50 |

| TOTAL | $233.06 | $123.06 |

Total Savings with Pet Health Insurance

Using the scenarios above, here's how much money having pet insurance would save you (in one year).

| With Pet Insurance | Without Pet Insurance | |

| Insurance Cost | $990.14 | $0 |

| Cat illness | $1,005.58 | $2,000 |

| Dog illness | $3,984.56 | $6,500 |

| Dog preventative | $233.06 | $123.06 |

| TOTAL | $6,213.34 | $8,623.06 |

That's a difference of $2,409.72 or 28% less than what you would pay if you didn't have pet insurance.

Comments