- 4 Common Zelle Scams

- Only Use Zelle With People You Know & Trust

- What to Do After Falling for a Zelle Scam

- Frequently Asked Questions

When paying for goods and services, you don't have to go too far to realize just how quickly things have changed. We have gone from cash to real-time digital payments in less than 50 years—a remarkable evolution. Technology has meant that the way we access and move money has multiplied exponentially to where we can do almost everything in real-time. Unfortunately, while the added convenience has made many things much easier, it has also provided new opportunities for criminals.

Zelle is one of the most popular money transfer services in the U.S. that was created in 2017 by a consortium of major U.S. banks. It allows easy and free money transfers straight from your bank account to anyone with an email address or phone number connected to a Zelle account.

Zelle transactions are similar to sending someone cash in the mail. You can't get it back, and there is no dispute process to try to recover your money. Once the money has been transferred from your account, it is gone for good.

While Zelle is safe, it is not safe to use to transfer money to people that you don't know. The fact that a Zelle transaction is non-refundable and non-traceable makes it the perfect tool for scammers.

4 Common Zelle Scams

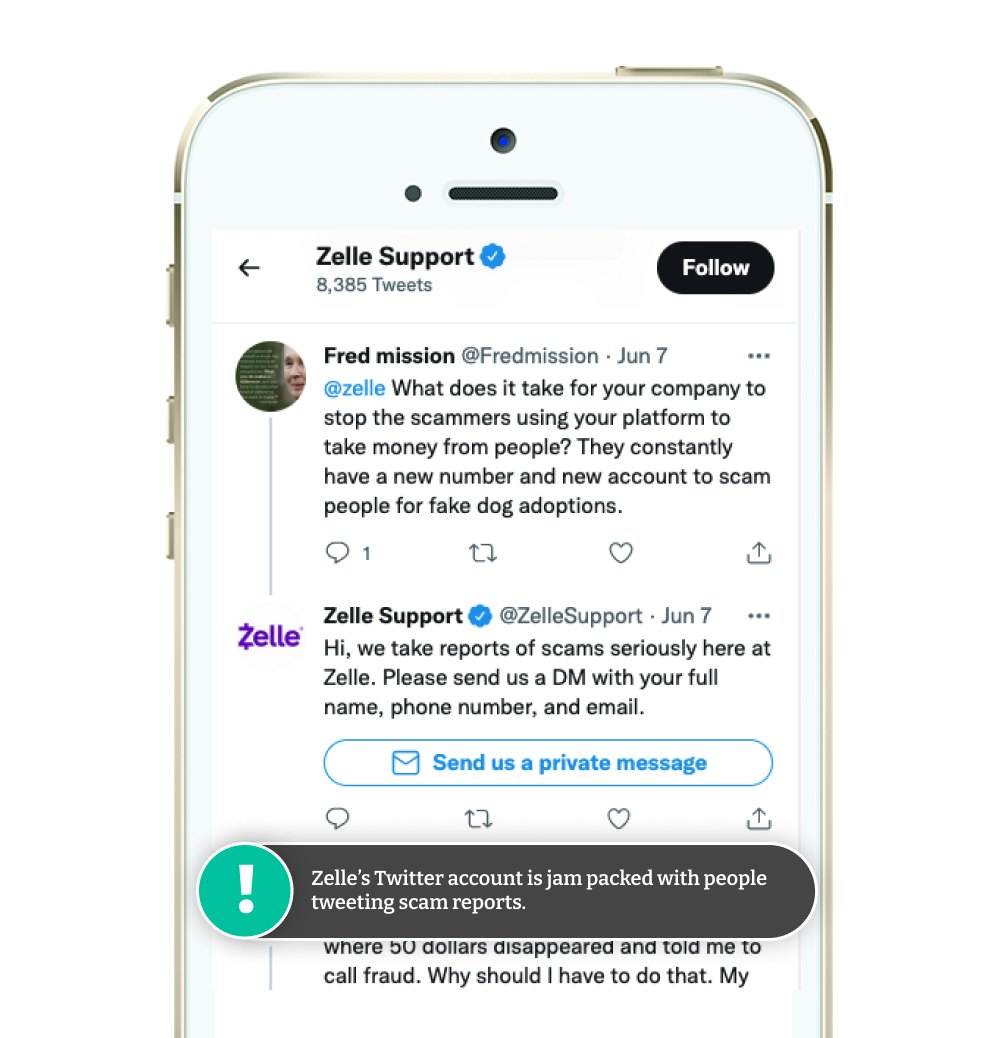

Pet scams are by far the most common type of scam that utilize Zelle as a payment method. The Better Business Bureau (BBB) received 93 scam reports in the past 30 days where scammers used Zelle to try to steal money. 47% of those reports were pet scams. The four most common Zelle scams are:

- Pet scams: Scammers use fake websites and social media for advertising puppies and kittens. They ask for a deposit to be paid upfront via Zelle.

- Employment scams: You're offered a job, and the scammer sends you a check to cover setup costs. The scammers ask them to send part of the setup money to a 3rd party via Zelle. When the check bounces, there is no way to get your money back.

- Utility scams: Scammers impersonate utility companies and tell you that your services will be shut off unless you make a payment via Zelle.

- Firearm/ammunition scams: Scammers create fake websites selling firearms and ammunition. You pay for your items via Zelle, but they never arrive.

Although it is possible to lose your money when using Zelle, it is still safe to use as long as you use best practices and know the red flags of a scam.

Only Use Zelle With People You Know & Trust

Zelle was designed to make transferring money to friends and family easy, and that is the only circumstance where you should use it. It was never intended to be used to send money for business transactions or to people that you don't know, which is why payments can't be disputed or reversed.

If someone you don't know asks you to make any payment via Zelle, it's a red flag. Legitimate businesses should accept other forms of payment, such as credit/debit cards and even PayPal.

What to Do After Falling for a Zelle Scam

For most people that get scammed via Zelle, that is the end of it. The money is gone, and there is no way to get it back—a hard lesson learned. However, it may not be the end of the scam—scammers can continue to scam you out of your money depending on the information you gave them.

If you have provided the scammer with personal details, you might need to take some extra precautions:

- Do not make any more transfers to the scammer.

- Contact your bank. The scammer does not have access to your bank account, so in theory, they cannot access your money. However, it is a good idea to talk to your bank and let them know. Because the transfer is instant, they cannot help you get your money back.

- Monitor your accounts for any suspicious activity. If you notice any unusual transactions, contact your bank immediately. You can dispute the charges, and the bank will take steps to secure your account.

- Report the scam to the Federal Trade Commission (FTC).

- Report the scam to Zelle. While they cannot assist you in getting your money back, they will pass on the report to the recipient's (i.e., the scammer's) bank.

Comments