- What is Day Trading?

- Why the Pattern Day Trading Rule Exists

- How the Pattern Day Trading Rule Works

- Implications of the Pattern Day Trader Flag

- Frequently Asked Questions

The Pattern Day Trading (PDT) rule was introduced in the wake of the market crashes after the dot-com boom. It was designed to protect brokers and investors alike in the wake of the dot-com crash of the 2000s.

The rule was introduced by the Financial Industry Regulatory Authority (FINRA), not the Internal Service Revenue (IRS). This is not a law against day trading. It is a protocol to stop investors with small accounts from causing issues with their brokers. It's a protection mechanism for small investors and brokers.

What is Day Trading?

Day trading simply means buying and selling securities, exchange-traded funds (ETFs), or options on the same day. The day trading rule looks to whether an investor is buying and selling the same product within a single day or buying to invest.

A traditional long-horizon investor might have a much longer outlook for their investments and will conduct slower transactions to "buy" shares, options, or ETFs throughout the year.

A day trade opens and closes a trade within the same day on the same security.

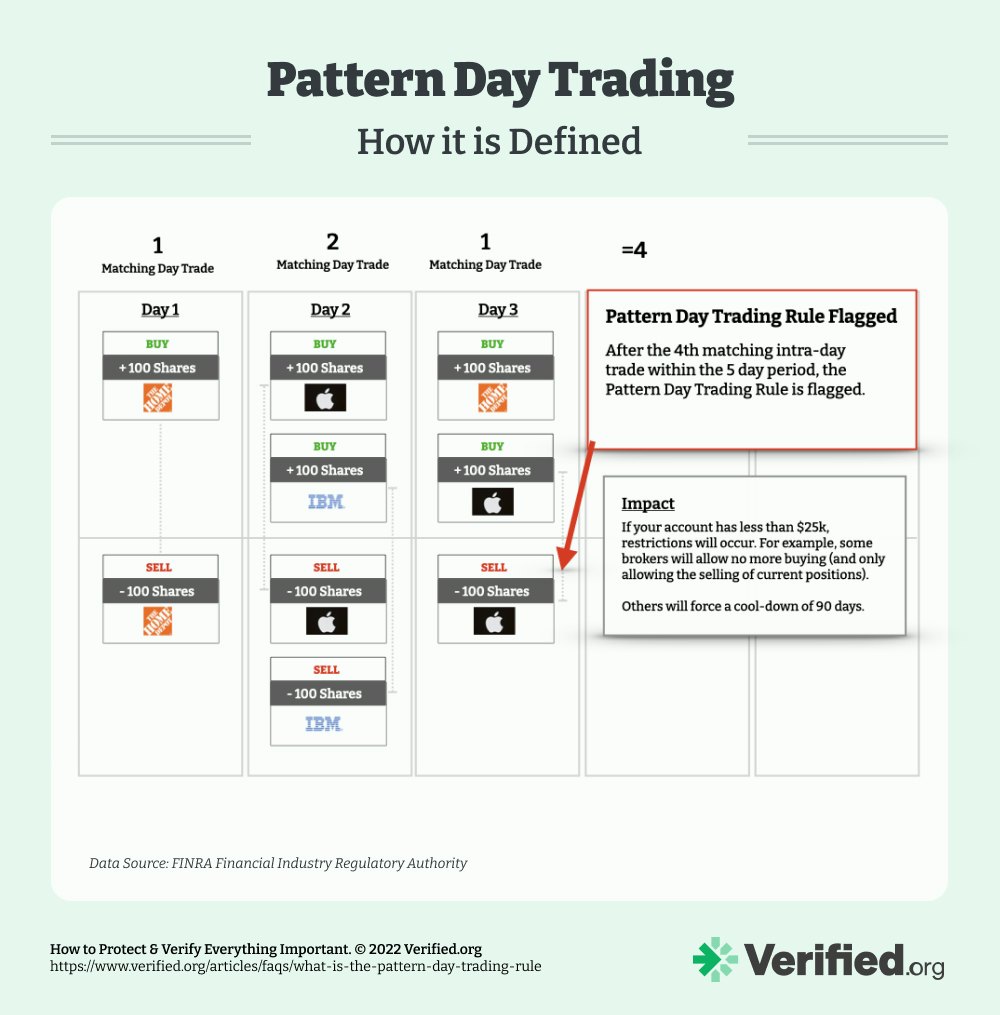

Conducting a trade on the same day does not cause any specific issues with regulators and is perfectly legal. However, day trading 4 times within 5 days will put a "Pattern Day Trading" flag on your account, bringing it under scrutiny. This flag can have different restrictions based on your broker. It's not a flag for the IRS or regulators per se, it's a flag for the broker, and the broker may restrict your account if it meets this requirement.

The PDT rule says that brokers must place restrictions on the account unless it holds $25k. If your account has more than this, it will get a flag but no restriction.

Why the Pattern Day Trading Rule Exists

A day trader can buy and sell the same securities many times within a day, with millions of trades happening every day. When trading is done at scale with several active traders, there are millions of debits, credits, and stock certificates to take care of. Investors want their money, there are brokers tracking everything, and there are clearinghouses.

The actual cash for each trade is not sent instantly—there are several middle agents (brokers and clearinghouses to settle the transaction in cash) who transact (settle) their balances at scale each day.

An obvious gap would be that people can create new trading accounts with new online brokers and then create hundreds of fast transactions without enough funds to pay for the settled transactions if their transactions settle negatively. This was more of an issue during the dot-com days as the technology was less sophisticated than it is today.

The Pattern Day Trading rule is designed to stop an investor with a small cash account from running a complex web of fast buy and sell transactions beyond their ability to pay for those transactions when everything is tallied up.

Therefore, if you don't have $25,000 in your account, and you conduct 4 or more matching day trades within 5 days, you will be flagged as a day trader and will be restricted for a period, depending on your broker. Some brokers will give you one warning before the restriction for an accidental flag, and others will put you on a 90-day cool off.

How the Pattern Day Trading Rule Works

The key to triggering the PDT rule is the frequency of matching trades—4 matching trades within a 5-day period and an account with less than $25k.

A matching trade is the opening and closing of the same number of securities on the same day. For example, buying 100 Home Depot shares and then selling those 100 Home Depot shares on the same day is considered a matching trade. This will count as 1 trade towards the limit of 4 within a 5-day period.

It would be perfectly fine to open 10 new trades in the 5-day period if you are investing for the first time in a basket of securities. However, it is the closing order that signals that you are a Pattern Day Trader.

Remember, if you have more than $25k in your account, this won't be an issue.

6% Rule

Additionally, there is an exemption to PDT restrictions if the number of day trades is less than 6% of the total trades that have been done in the 5 day period. In this scenario, you would have to have more than 66 other trades in the 4 day period for your 4 day trades to get an exemption. This is difficult to do if the total value of the account is under $25k.

Implications of the Pattern Day Trader Flag

The key implications of receiving the PDT flag are:

- A restriction from trading (only able to close old positions)

- Inability to open new positions

- Cooling-off period of up to 90 days (unless the account is brought up to the $25k minimum)

Importantly, with newer platforms that merge both stock trading and cryptocurrency, the value of the cryptocurrency in your account does not count towards the $25k minimum.

If the PDT restriction is flagged, you will only be able to close existing trades. You won't be able to open any new positions, even if it is the "opportunity of a lifetime," and you really want to get back into the market. You must bring the account to a balance of $25k to remove the restriction.

Any further implications depend on your broker. Some brokerages will simply make a minimum equity call (to get your account to $25k).

Here are the PDT rules and implications as stated by each major broker.

Schwab

Schwab does allow a one-time exception for traders who inadvertently trigger this flag, so long as they commit not using the account for pattern day trading going forward. If the account is flagged, a margin call may be issued to bring the account to $25k.

TD Ameritrade

Customers will receive a day trade minimum equity maintenance call—you will not need to meet this requirement unless you want to continue to trade. If you don't, you will be restricted to closing transactions only. You will only be able to close existing positions and won't be able to open any new ones.

The "equity maintenance" flag will end after 90 days or when you increase the account to over $25k.

Robinhood

With Robinhood, you will be issued a day trade violation and be restricted from purchasing (stocks or options with Robinhood Financial and cryptocurrency with Robinhood Crypto) for 90 days. However, this restriction will be removed if you close the trading day above the $25k equity requirement.

Pattern Day Trading restrictions don't apply to cash accounts, only Instant and Gold accounts.

You will be flagged as a pattern day trader when you place your fourth-day trade. To continue trading the next day, you'll need portfolio value (minus any cryptocurrency positions) greater than $25k at the end of the trading day.

Your portfolio value is the sum of your cash + stocks + options and—for the purposes of pattern day trading calculations—doesn't include cryptocurrency positions.

Fidelity

Your account will be classified as a Pattern Day Trader with Fidelity if you have:

- Four or more day trades executed within a rolling five-business-day period

OR - Two unmet Day Trade Calls within a 90-day period

This classification will require the account to abide by day trading rules and minimum equity requirements of $25k (not including type Cash market value and options).

Comments