- What Are Card Skimmers?

- How to Check for a Card Skimmer: 4 Easy Steps

- Where Else Could You Find Card Skimmers?

- What Happens After Your Card is Skimmed

- Report Credit Card Skimming

Pumping gas may not seem like a prime location to be scammed out of your hard-earned cash, but it can be. Scammers install card skimmers on gas pump card readers to steal your card information and, ultimately, your money. There are a few simple things you should be doing every time you swipe your card at the gas pump that could save you from losing all of the money in your bank account.

Card Skimming Statistics

- Fraud from card skimmers is increasing by 10% every year.

- The U.S. Secret Service finds up to 20 skimming devices attached to gas pumps every week.

- Each card skimmer holds information on up to 80 cards.

- In 2018, there were more than 1,000 card skimmers found in Florida alone.

Source: Experian, 2019

What Are Card Skimmers?

Credit and debit card skimmers are devices that scammers attach to card readers, usually at gas pumps and ATMs. They are designed to steal your card information, including the:

- Card number

- Expiry date

- Name on the card

- 3-digit security number

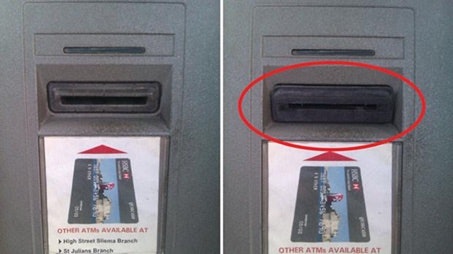

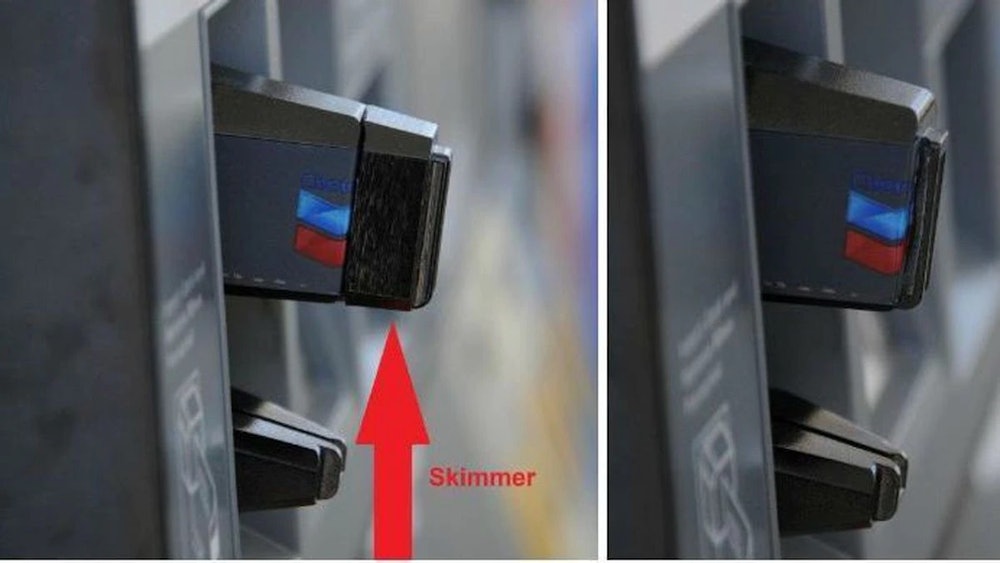

Credit card skimmers are generally well-disguised—they will look just like a card reader but with an attachment. As a result, they can be easy to miss, but there is one quick thing you can do to check for a skimmer before you insert or swipe your card.

How to Check for a Card Skimmer: 4 Easy Steps

There are several easy steps to take before swiping or inserting your credit/debit card to ensure the reader hasn't been tampered with in any way.

1. Wiggle the Card Reader

To check for a credit card skimmer at an ATM or gas pump, pull on the card reader and wiggle it a bit to see if it loosens or completely comes off. Card skimmers will usually come off easily, as scammers don't have time to work with equipment that's hard to install—they need something that can be easily installed and removed from the machines, so they don't get caught.

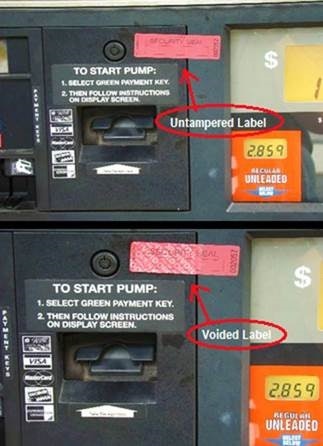

2. Check the Security Seal

Card readers on gas pumps are located on a door that approved personnel can access. Along the edges of these doors, look for a security seal and ensure that it hasn't been lifted or torn previously. If the seal has been tampered with, don't trust the card reader and move to another pump.

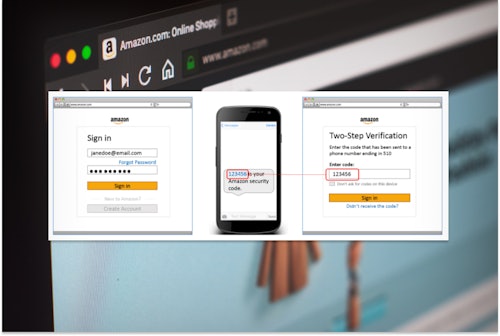

3. Always Cover the PIN Pad

Whether you're entering your debit card PIN or your zip code for your credit card, you should always cover the number pad so prying eyes can't see what you're entering. This is important even if you don't think there's anyone around watching—scammers will install hidden cameras designed to steal your PIN and zip code.

4. Don't Use Pumps in Sketchy Locations

Whenever possible, only use gas stations that are in well-lit areas and are somewhat busy. Gas stations in areas with less foot traffic are more likely to be hit by scammers.

You should also try to use the pump closest to the gas station entrance—scammers are less likely to install skimmers onto pumps that others, including gas station attendants, can easily see.

Card Skimmer Detection Apps

Although not entirely reliable, there are some card skimming detection apps available for iPhone and Android. These apps scan the immediate area for card skimmers using Bluetooth signals.

Where Else Could You Find Card Skimmers?

Card skimmers aren't just found at gas pumps—scammers can install them on pretty much any card reader that they have access to. Some of the most common places to find card skimmers include:

- Gas stations

- ATMs

- Restaurants and bars

- Stores

Cards Skimmers on ATMs

Criminals install card skimmers on ATMs, much like how they install them on card readers on gas pumps. They will tend to target standalone ATMs (versus ones attached to banks or located inside a restaurant/store) and in quieter locations.

You can spot an ATM card skimmer the same ways you can spot skimmers at gas stations.

Skimming at Restaurants and Bars

Card skimmers aren't just in the form of machines attached to card readers—some thieves steal your information while working at a restaurant or bar. When giving your card to your server or bartender to pay for your meal and drinks, you could be unwittingly giving your card to a thief who scans your card details using a mobile card reader, storing it for later.

It's difficult to spot when someone at a bar or restaurant is skimming your card since they usually take your card away to swipe it and complete the transaction.

Stores

It's also possible for your card to be skimmed when at stores, whether a convenience store or a department store. The person ringing up your items can easily reach under the counter and scan your card when you're not watching.

Be wary of people who hold on to your card for longer than is needed or who take your card out of your site. When swiping your card, they should do it in front of you.

Contactless Payments Are Safer

Whenever possible, it's safest to use contactless payment. Card skimmers don't work on these devices, and your credit/debit card information is safe from these scammers.

What Happens After Your Card is Skimmed

You won't immediately know if/when your credit card/debit card is skimmed. The scammer needs time to collect their skimming machine and start using your card. You'll only know when you see fraudulent transactions in our account. Armed with your card information, the scammer may:

- Buy items online using your card (they'll have the packages sent to a different address, so you can't track them)

- Create a copy of your card to buy items in person

- Withdraw funds from your checking/savings account (they will have recorded you entering your PIN at the gas pump)

- Use your card to buy gift cards which they can then use without being tracked

Example of Card Skimming

One of our very own at Verified.org (who would like to remain anonymous) was the unfortunate victim of card skimming after using her debit card at a local gas pump. Unfortunately, she wasn't aware of the scam until someone withdrew money from her checking account from an ATM about three hours away from her house.

Victim of Card SkimmingI use this gas station almost every week, so I didn't even think twice about how safe it was.

One day I received a text from my bank alerting me to suspicious withdrawals on my account. Turns out, someone withdrew two lots of $1,000, so $2,000 total, from my checking account. I was at work that day and the ATM they used was in a different city, so it definitely wasn't me.

I never use my debit card other than to get gas because that particular gas station doesn't allow credit card payments at the pump, so I knew the skimming happened there.

They copied my card and I obviously didn't hide my PIN well enough. Lesson learned.

Report Credit Card Skimming

If you notice fraudulent transactions on your card, contact your bank immediately and cancel your cards and dispute the transactions. Your bank should refund any charges or withdrawals that were not your own and get a new card with a new card number sent to you.

You can also report card skimming scams to the local authorities and to the gas station or store that you think it happened.

Comments