- Loan Flipping

- Fake Escrow

- Rental Scams

- Foreclosure Relief

- How to Protect Yourself From Real Estate Scams

- Red Flags of Real Estate Scams to Watch Out For

- How to Report Real Estate Scams

The real estate market is rife with scams and fraudulent activity. According to the FBI's Internet Crime Complaint Center, about 35% of all internet theft consists of real estate and rental frauds. In addition, data also shows that real estate wire fraud cost about $213 million in losses in 2020, making it the seventh most common type of fraud tracked by the department.

If you're considering buying or selling property, you should familiarize yourself with the most common real estate scams—this is the first step to beating them and protecting your assets.

Loan Flipping

In a loan flipping scam, a lender repeatedly contacts a homeowner to convince them to refinance their mortgage, persuading them to borrow more money every time. The scammer charges high fees and points with each transaction, leaving homeowners with higher loan payments that they can't afford.

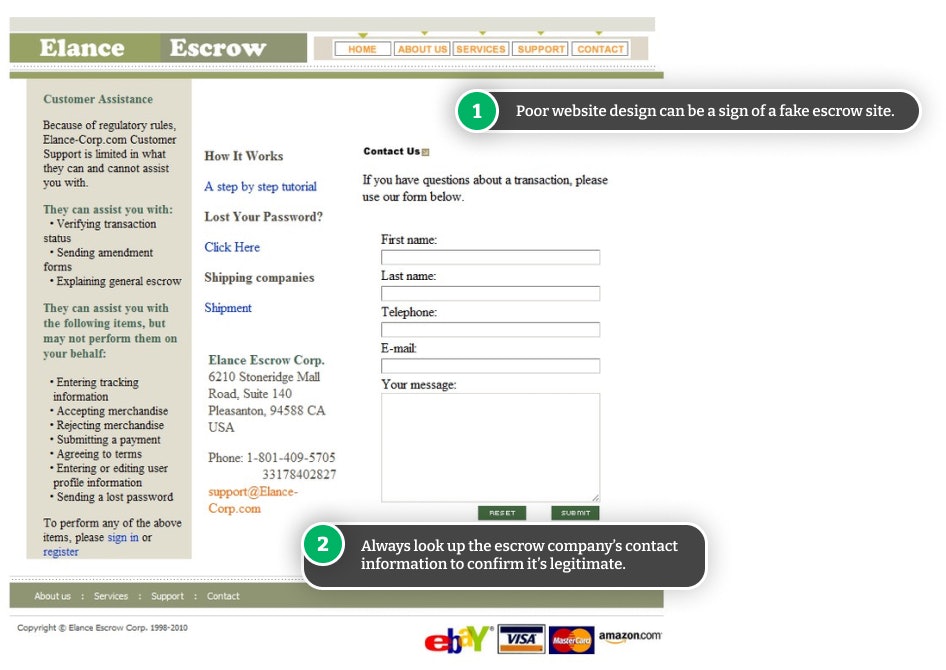

Fake Escrow

Fake escrows are very common real estate scams to look for. In this scam, fraudsters set up fake companies and websites to trick both buyers and sellers into giving up their money and information.

A typical scenario involves someone insisting on using an escrow company that you've never heard of. A standard script they'll use is that they don't feel comfortable completing the transaction using another service. They'll say they've used this particular company before and can vouch for them.

There are two things at risk if you fall for a fake escrow scam:

- Your money: This can be thousands of dollars since your deposit or earnest money goes into an escrow account.

- Your information: Even if you don't deposit any money into the fake escrow, you may have entered your data into the website. This can lead to identity theft which can take years to recover from.

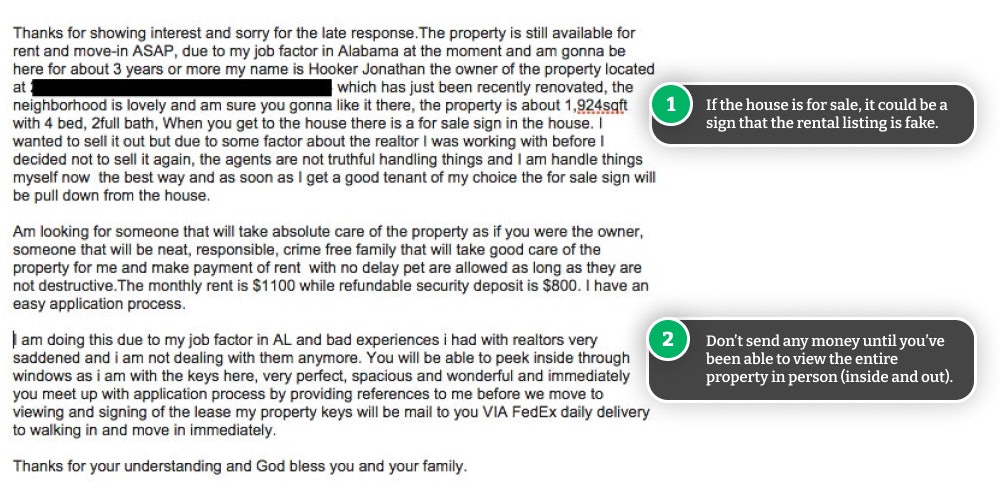

Rental Scams

If you're not looking to buy or sell property, you can still get caught up in a common real estate scam that targets renters.

These scams usually start on a website like Craigslist, where scammers can post property rental ads. Scammers will usually lift photos from genuine listings to make them look legitimate.

The main goal of rental scams is to have you hand over a deposit and other fees for credit checks. To beat this scam, don't make a deposit before seeing the rental property in person first. In some cases, you may have to pay a small fee for a credit check before the landlord shows you the property—this is usually fine, although not ideal.

If the landlord gives excuses and cannot show you the property at all in person (including the inside of the property), do not go through with the transaction.

Foreclosure Relief

The common targets for foreclosure relief scams are distressed homeowners. Scammers will contact homeowners and tell them that they can save their homes or pay their mortgages, which is welcome news for those having a hard time making mortgage payments.

These schemes are meant to strip away the value of the owner's home and produce a quick profit to the scammer. In really unfortunate circumstances with desperate victims, some scam artists can convince a homeowner to give up their ownership completely.

How to Protect Yourself From Real Estate Scams

To avoid real estate scams, you should remain vigilant with your personal and bank account information. This means being wary of people that contact you making promises that sound too good to be true.

Do Your Research

Before giving out any personal information or money, do your research first. For example, if someone is adamant about using an escrow service that you've never heard of, research the company and the website to ensure they're legitimate.

Check sites like the Better Business Bureau (BBB) to see whether others have complained about them or flagged them as scams. It could also signal a scam if you can't find any information or reviews about the company online.

Don't Click Links You Can't Verify

If you receive unsolicited emails or text messages from people, don't click on any links. Pay close attention to the sender's email address to verify who is sending you messages. If you do click on the link, don't enter any information until you can verify the website is legitimate.

Verify Your Real Estate Agent

Scammers can pose as real estate agents when they're not licensed or trained at all. In some cases, they may not even be located in the U.S. There are steps you can take to verify that who you're doing business with is licensed in your state to help you buy or sell your home.

Don't Hand Money Over So Quickly

If it's the first time you're buying, selling, or renting, you may not realize what the usual process is. If someone is being incredibly pushy, requiring you to hand over money quickly (even without seeing the property first), it's usually a scam.

Consult a Professional

There's nothing wrong with consulting a professional of your choice to help you with the transaction, especially if you feel it might be a scam. These professionals could be licensed real estate agents or trusted financial consultants.

Red Flags of Real Estate Scams to Watch Out For

Some of the most common real estate red flags that you should watch out for are:

- Vague listings

- A landlord or seller who can't show you the property in person

- Pushy sellers or landlords who want you to act quickly

- Demands to wire money to them immediately

- Promises that seem too good to be true or unrealistic guarantees

- Lack of proper contracts or documentation

How to Report Real Estate Scams

If you're a victim of a real estate scam, you can report it to:

- Your local authorities, such as police officers

- Federal agents, such as the Federal Bureau of Investigation (FBI) or Federal Trade Commission (FTC)

Be sure to have as much information about the transaction as possible, including:

- The original listing you responded to

- Any email and text messages that have been exchanged between you and the scammer

- Any websites you've used that you think are fraudulent (even if they've been taken down since)

- Any phone numbers or other contact information you have of the scammer

- What accounts you transferred money to

These professionals are trained to respond to scam reports and catch fraudsters. Moreover, today's training programs and courses for law enforcement authorities factor in evolving frauds and scams in the real estate industry.

Comments