- Phishing Scams & Identity Theft

- Credit and Debit Card Fraud

- Robocalls and Common Scams by Phone

- Common Scams via Pyramid Schemes

- Cash App Scams

- Prize and Lottery Fraud

- COVID-19 Scams

- Common Scams on Craigslist

- Frequently Asked Questions

Anyone can be the target of a scammer, and depending on the type of fraud, the effects of the scam can have serious financial consequences, particularly if it goes unnoticed. Knowing what the most common scams are can help you protect your money and identity from getting into the wrong hands.

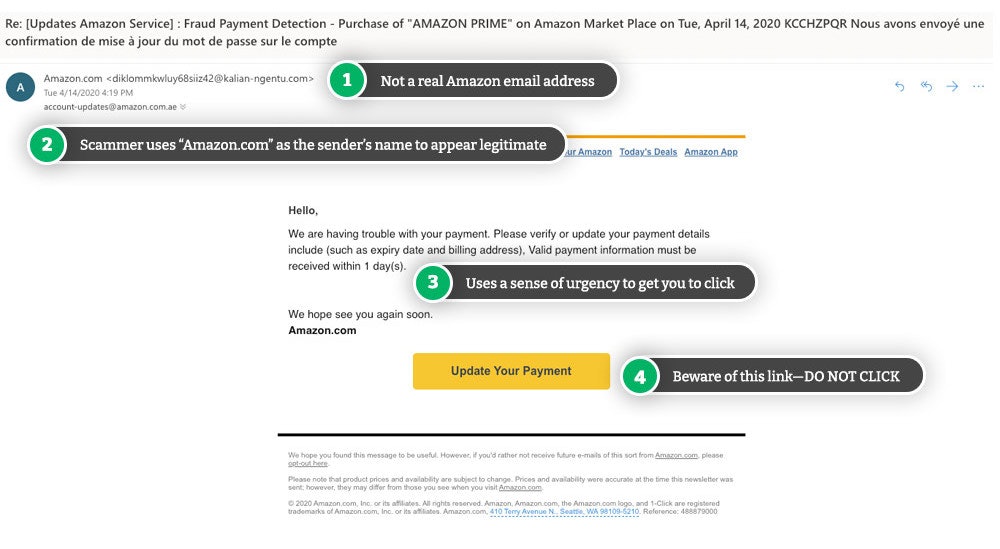

Phishing Scams & Identity Theft

Every year, millions of Americans fall victim to identity theft which can take years to recover from. Identity theft occurs when a scammer steals your personal data, like your:

- Account and credit card numbers

- Login credentials

- Social Security number (SSN)

- Address

This information is often obtained through data mining or phishing which are some of the most common scams to be aware of.

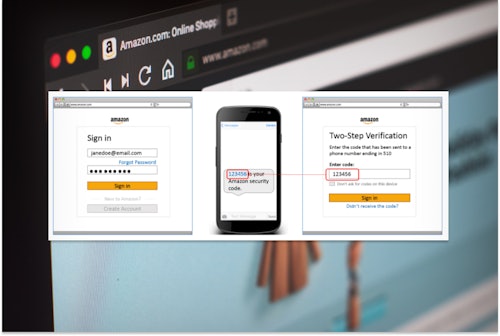

What is Phishing?

According to the FBI, phishing was the most common form of cybercrime in 2020. It’s a technique scammers use to steal personal data by impersonating legitimate companies, organizations, or individuals.

The aim of a phishing scam is to fool you into clicking on a malicious link or download within an email.

You’ll either be prompted to enter your login details on a legitimate-looking website or download malware that gives scammers remote access to your computer and accounts.

The ultimate goal for scammers in phishing scams is to use your personal information to gain access to your financial accounts, open new lines of credit, use your health insurance, or commit tax fraud. They will essentially pretend to be you to get money.

How to Stay Safe From Phishing Scams

Paying close attention to your financial accounts allows you to catch any suspicious activity as soon as possible to reduce the damage of identity theft caused by these common scams. Warning signs that you’re the victim of identity theft or a phishing scam include:

- Unexplained withdrawals or credit card charges

- Unauthorized new lines of credit appearing on your credit reports

- Debt collection demands for debts that aren’t yours

- Bills for utilities or medical services you haven’t used

- Incorrect tax information (e.g., claims that you've claimed unemployment when you haven't)

Keeping your personal information secure online behind strong passwords, being knowledgeable of phishing scams, and monitoring your credit reports and bank statements, will help prevent you from falling victim to potentially devastating identity theft.

Phishing, Smishing, and Vishing

Scammers can trick you into giving away your sensitive information via various forms of communications, including:

- Email: Phishing

- Text messages: Smishing

- Phone calls: Vishing

What to Do After a Phishing Attack

If you've fallen for a phishing scam, you need to act quickly to minimize the damage and prevent identity theft that can take years to recover from. Depending on the type of phishing scam, you may need to:

- Change your passwords

- Cancel your debit or credit cards

- Freeze your credit or place a fraud alert on your credit

- Report the scam to the company being impersonated

Credit and Debit Card Fraud

Credit or debit card fraud occurs when a scammer steals your card or your account details and uses it to:

- Withdraw cash

- Purchase goods

- Pay for services without your consent

Thankfully, with most banks and credit card providers, you will only be liable for a max of $50 of fraudulent charges, thanks to the Fair Credit Billing Act. Be sure to report any fraudulent activity on your bank statement as soon as you notice it.

How to Spot Credit Card Fraud

If you regularly check your card statements, it should be easy to spot the red flags that indicate these common scams have taken place, which include:

- Charges or withdrawals that you don’t recognize

- Several small-dollar charges indicate your card is being tested for a larger purchase

- New direct debits you didn’t set up

- An unexplained drop in your account balance or available credit balance

Robocalls and Common Scams by Phone

Robocalls and scam calls are on the rise, being the most common scams carried out today. Americans lost almost $20 billion to phone scams in 2020, a 50% increase from the previous year. Scammers utilize computerized auto-dialers to send out thousands of robocalls (pre-recorded messages) every single day. The aim is to fool you that you’re receiving a message from a legitimate company or government agency, so you engage with the telephone operator.

If a scammer does get through to you on the phone, they will use various tactics, including threats, false promises, and aggressive sales pitches, to convince you to hand over your sensitive information and/or money.

Stop Scam Calls

Various apps (including free ones) are available to help stop scam calls and robocalls from even reaching your phone.

The Debt Collection Scam

The Scam: A caller claims to be from a debt collection agency and demands repayment, or there will be potential legal repercussions, including jail time.

The Reality: You never need to pay a debt collector over the phone immediately. Legitimate debt collection agencies must provide you with verifiable information, like the creditor and amount owed, and provide it in writing within five days of the call.

Always be wary of callers demanding immediate payment. Hang up and call the organization requesting payment directly for verification.

The more scam or robocalls you answer, the more you’re likely to receive in the future. Protect yourself from these common scams by hanging up on such calls as soon as possible and block the number immediately, as well as never answer calls from unknown numbers.

Social Security Scam Calls (One of the Most Common Scams)

In 2020, $45 million was lost to Social Security telephone scams. These are some of the most commons scams that occur daily.

The Scam: You receive a call from an individual or robocaller claiming your Social Security number (SSN) has been compromised by criminal activity. You must respond immediately by sending cash, gift cards, or personal information, or your SSN will be suspended.

The Reality:

- Social Security numbers can’t be suspended.

- The Social Security Administration (SSA) will never call you unsolicited (they will send mail regarding your account and will only call you if you have an appointment).

- No government agency will threaten legal action if you don’t immediately send cash.

- The government won’t ask for unconventional payment methods, such as gift cards.

- The SSA cannot freeze your accounts.

Common Scams via Pyramid Schemes

Pyramid schemes are scams that require a constant flow of new recruits to keep them running and making money. The unsustainable (and illegal) business model involves a few top-level members recruiting newer members for an upfront cost. Then, these new members recruit new participants for a portion of their sign-up fee, and so on.

The lower down the pyramid you are, the less chance you have to sign up new members as the recruitment pool dries up. The pyramid scheme then shuts down with the top-level members walking away with full pockets and those low down the pyramid leaving with nothing.

They’re often sold as multi-level marketing programs, which are legitimate businesses or investment schemes. Whatever they are marketed as pyramid schemes rely on recruitment fees and rarely involve sales of valuable products or services.

Similar Models

- Multi-level marketing (MLM): Unlike pyramid schemes, MLM businesses are legal. This model involves the sale of products, but you’re also rewarded for recruiting new members.

- Ponzi schemes: An illegal investment con that involves later investors paying out returns to earlier investors.

- Chain emails/letters: These urge recipients to send a small amount of money or valuable token to a list of several people, remove one name, add their own, and forward the email in bulk to others.

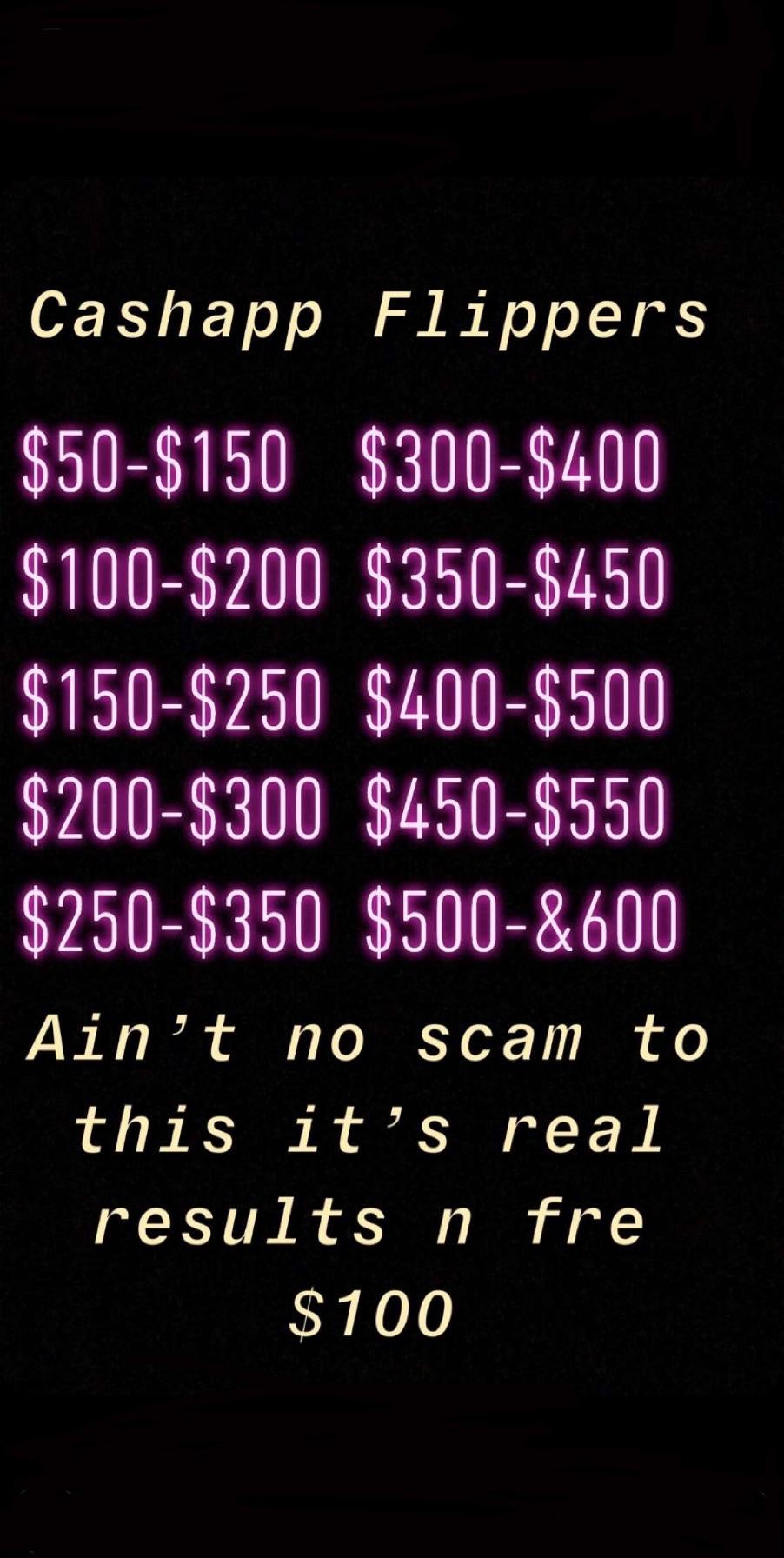

Cash App Scams

Peer-to-peer apps for sending money have become popular in recent years, with Cash App being one of the favored ones amongst consumers. However, the fact that users are not protected against fraud or theft as they would be with their bank means Cash App has become the main target for scammers. Here are some of the most common scams to watch out for when using the app.

Fake Customer Support

The Scam: Users are fooled by scammers who impersonate Cash App customer support with fake websites or phishing texts and emails.

The Reality: Cash App doesn’t provide live customer support and instead asks its users to report issues directly through the app. Cash App will never ask you for your sign-in code or other sensitive information like bank account details. They will also never ask you to send a payment or provide remote access via an app download.

Cash Flipping

The Scam: You’re contacted by someone who guarantees they can “flip” your money for huge returns. You just need to send them an initial payment, and they will double or triple your money in a short amount of time.

The Reality: Once you’ve sent the money, the scammer will disappear, leaving you out of pocket. Never send money through Cash App to people you don’t know, and be wary of promises of significant returns with little or no risk.

Pet Deposit Scam

The Scam: You’re asked to pay a deposit via Cash App to secure a puppy from a new litter that you’ve seen online. The desirable breed is usually expensive, but the seller is offering a great deal.

The Reality: There is no litter. Scammers have used fake pictures of puppies and used a low price to entice victims. As Cash App can’t guarantee refunds for scam payments, always meet the seller in person before sending over any money.

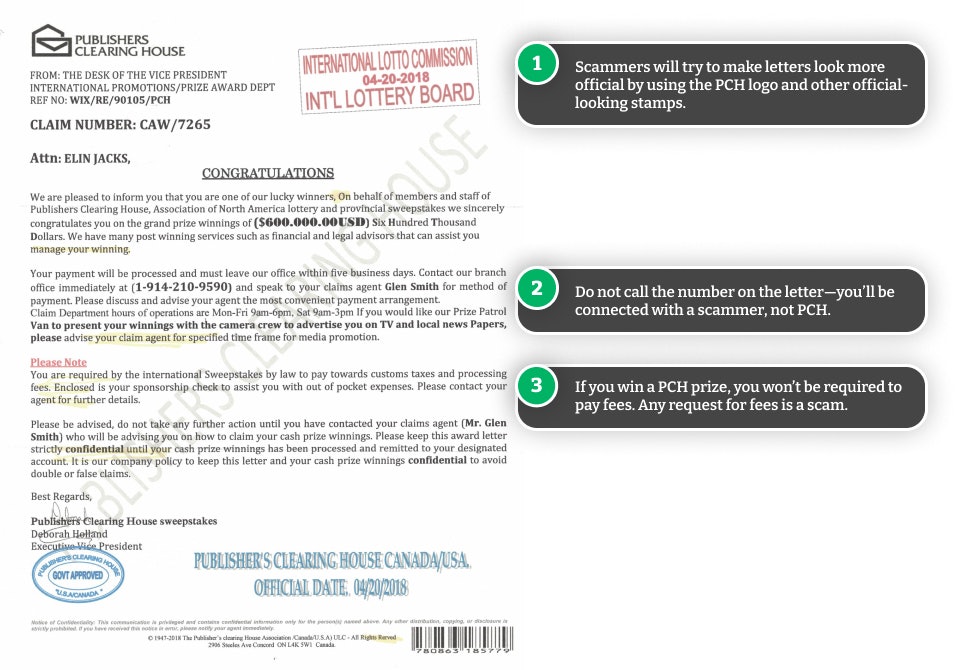

Prize and Lottery Fraud

These scams usually target the elderly over the phone or via postcard. You’re informed that you’ve won an unexpected prize, sweepstakes, or lottery and need to hand over personal details or pay a fee to claim your prize. Signs of a lottery or sweepstake scam include:

- A requirement to pay a fee or to attend a meeting to claim your winnings

- Further requests for cash or more messages claiming you’ve won their sweepstakes even after you’ve paid your fee

- Your prize notification is sent via bulk mail and not addressed directly to you

- Winning a competition that you did not enter

- Pressure to take immediate action or face losing your winnings

Publishing Clearing House: A Common Target for Scammers

Publishing Clearing House (PCH) is a prime target for scammers, with criminals impersonating the company to fool you into believing you’ve won a prize. So, it’s important to remember:

- PCH doesn’t call or email its big winners (they will inform you in person or by mail)

- You don’t ever have to pay a fee to claim your PCH prize

- You don’t need to give out confidential information to enter, like your address, SSN, or bank account number

- A check doesn’t always mean a win, especially if you’re asked to send back some of the funds

- You can verify your win by contacting PCH directly

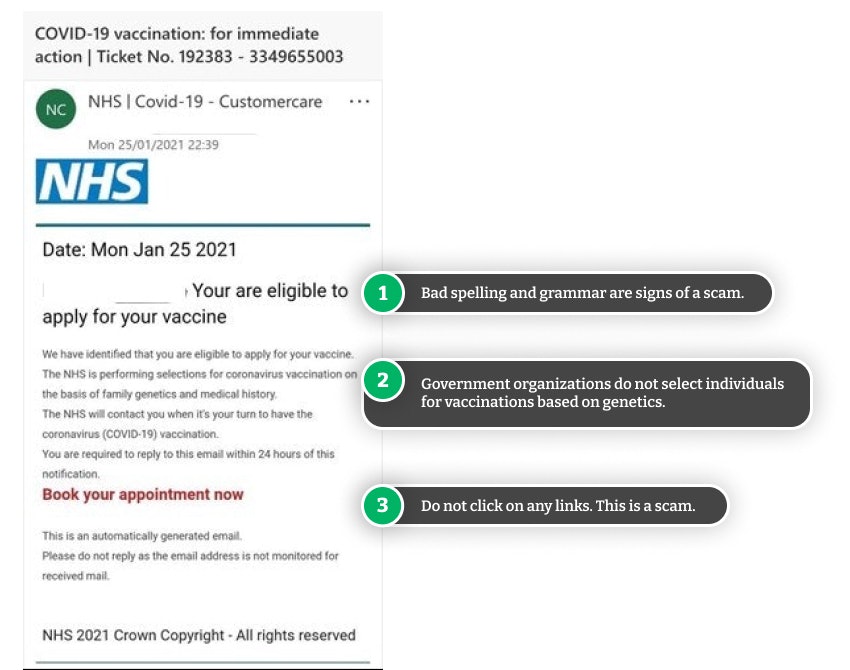

COVID-19 Scams

Many scammers have taken advantage of the unknowns and new legislation surrounding the Coronavirus pandemic. Current COVID-19 scams include:

- Identity theft when you post a picture of your vaccination card online, as it contains your name, birth date, and other personal information.

- Government grant scams where a scammer claims they are from a government agency asking for your personal information so they can issue your stimulus check. The scammer then uses this information to collect your check on your behalf. Scammers may also try to convince you that you need to pay a fee to receive your grant.

- COVID-19 testing and vaccine scams where scammers offer fake testing or vaccines in exchange for your personal information or a fee.

- Grandparent scam in which a scammer claims to be a sick grandchild with Coronavirus and needs money to pay for fake medical expenses.

- Funeral assistance scam where scammers pretend to be from FEMA’s COVID-19 Funeral Assistance Program offering registration to family members who have died. This enables the scammer to steal your Social Security number and other personal data.

Furthermore, scammers may unfairly increase the prices of in-demand items during a crisis like the COVID-19 pandemic. This is known as price gouging and is illegal. If you suspect someone is price gouging, you can report it to your state attorney general.

Common Scams on Craigslist

Craigslist is an online marketplace that’s a popular target for scammers as it allows its users to post anonymously or create multiple fraudulent accounts. These scammers usually offer deals that are too good to be true—like selling luxury goods for a knockdown price—to encourage you to hand over your money without asking questions.

There are many red flags to a Craigslist scam, including asking for payments in gift cards, pushy sales tactics, and requests for personal details, but the biggest warning sign of all is when the seller will not let you see the item in person before payment.

Comments