- How Are Insurance Premiums Determined?

- How to Get Discounts on Car Insurance

- Policy Discounts on Car Insurance

- Safety Discounts on Car Insurance

- Driver Discounts on Car Insurance

- Vehicle-Based Discounts on Car Insurance

- Getting the Best Price for Car Insurance

- Frequently Asked Questions

Across the U.S., car insurance rates can vary based on several factors, including the type of car you drive, your gender, driving record, and age. On average, Americans spend approximately 2.44% of their household income on auto insurance each year, according to recent data.

But how can you be sure you're getting the best rate?

According to 2021 data pulled from Quadrant Information Services, the average cost of car insurance is about $139.50/month or $1,674/year for full coverage.

The average cost of car insurance is on the rise, with premiums increasing 30% between 2014 and 2018, according to data by The National Association of Insurance Commissioners (NAIC). The cost of car insurance also depends on your state, with Louisiana having the highest rates at around $227/month for full coverage while Maine boasts the lowest rates at around $80/month for full coverage.

Regardless of where you live, though, there are plenty of ways to cut those costs and get the best rates for you and your family. Learn what discounts on car insurance may be available to you and what you can do to lower your premium.

How Are Insurance Premiums Determined?

The amount you'll pay for car insurance is affected by several factors, including your age, gender, and the type of car you drive. Companies will typically give you an insurance rating which helps them assess the likelihood of you filing a claim with them.

Not all insurance carriers use the same parameters to assess potential policyholders, so your score may vary between companies. However, here are some common factors that may affect your auto insurance rates:

- Driving record

- Location

- Age

- Gender

- Annual mileage

- Type of car

- Credit score

- Coverage options

How to Get Discounts on Car Insurance

Most major car insurance providers offer discounts to help consumers lower their annual premiums. Luckily, many rebates apply automatically when you sign up; however, other discounts require driver initiative to secure savings.

This could mean taking a defensive driving course or installing anti-theft devices in your vehicle. Read on to find out which types of discounts you may qualify for.

4 Quick and Easy Ways to Save

Going paperless, paying in full, staying loyal to one provider, and bundling your insurance policies (such as home and auto), are quick ways to save on car insurance rates.

Policy Discounts on Car Insurance

There are a number of ways you can review your policy and get your premium down simply by adjusting your coverage options and payment choices.

Payment in Full: 5%-10%

As mentioned above, an easy way to lower your bill is to pay your premium in full when you sign up or at the time of your renewal. If it's within your budget, customers who can pay their six-month or annual premium upfront may qualify for a 5% to 10% discount.

Go a step further and opt for electronic billing for extra savings on your premiums which may be available from larger or national insurance companies.

Multi-Car/Bundling: 5%-25%

If your household has more than one car, consider using the same company for all drivers. Typically, multi-car discounts on car insurance only apply to households in which drivers are related by blood or marriage and live at the same residence.

It's possible for two unrelated individuals to get these savings, but they usually have to own a vehicle together. Ask your insurance agent about further rebates if the additional drivers qualify for driver discounts such as student, military, or senior discounts.

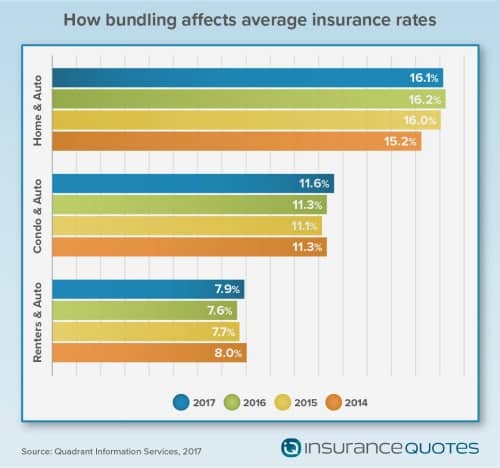

Auto insurance companies also offer rebates to drivers who bundle their policies, such as homeowner or renter's insurance. You may qualify for up to 25% off your premium when bundling.

Homeowner: 3%-25%

If you're a homeowner, you may qualify for a discount with your insurance carrier, regardless of whether you purchased home insurance through them. Without bundling your insurance, you may be eligible for around a 3% savings.

However, many companies will increase that discount when bundling your home and auto insurance, and customers can save up to 25% off their premium. Be sure to ask whether your provider honors both a homeowner and a bundling discount to save even more.

Loyalty Programs: Varies

Insurers want your business and will provide loyalty rebates to those who remain with them over the years. If you've been with the same company for an extensive amount of time, this may be available to you. Some companies also offer tiered loyalty programs, which may not mean less on your premium but have perks such as accident forgiveness once a year.

Safety Discounts on Car Insurance

It pays to be cautious. Showing you have safe driving habits is one of the best ways to get discounts on car insurance.

Safe & Good Driver Discounts: 10%-23%

Safe driver rebates can save drivers between 10% to 23% off their premiums. This discount on car insurance is given to drivers who demonstrate cautious driving habits such as low driving speeds or all passengers wearing seatbelts. Some carriers will also offer this discount if you agree to use an app through a telematics program for them to track your driving habits.

You can also qualify for savings if you have no claims on your record and you've been accident-free for 3-5 years. While this discount is typically applied when you sign up with a provider, you can adjust your premium at your next renewal if you didn't qualify initially (once the required length of time between accidents has passed).

Defensive Driving: 10%

One easy way to lower your insurance premium is to take a 2.5-hour defensive driving course designed to teach drivers safety techniques and how to respond to emergencies. This course may also reduce the number of points you have on their driving record.

Low Mileage: Up to 20%

When signing up for car insurance, you'll typically be asked the number of miles you drive each year. This is because drivers with low annual mileage qualify for a lower rate if they don't drive their cars often.

On average, a person drives around 12,000 miles a year, and those who drive less than 7,500 a year may benefit from low-mileage discounts on car insurance. If you work remotely, carpool to work, or use mass transit often, you may qualify for this savings.

Speak with an insurance agent to ask what mileage thresholds qualify for this discount and check to see what mileage you initially signed up with. With more people working from home these days, you may have cut your mileage down significantly without realizing it.

Driver Discounts on Car Insurance

Driver discounts are based on you and not solely on your driving habits. Many companies offer reduced rates for military, students, seniors, and professionals.

Federal Employees & Military: 8%-15%

As an active-duty service member, veteran, or federal employee, you may qualify for anywhere between an 8% to 15% discount. Some insurers even cater to veterans and active-duty personnel by providing special coverage options based on their unique situations. In addition, companies that offer military-specific coverage choices will sometimes extend those reduced rates to their family members up to two generations.

Federal employees may also qualify for additional savings since providers tend to see them as less of a driving risk and have steady salaries, making them ideal applicants.

Students: 5%-25%

Students can qualify for a reduced rate in two ways: by being a "good student" driver or a "student away." Since age is one of the main factors determining your insurance premium, students tend to have high rates until they turn 25.

But young drivers can typically qualify for a 25% "good student" discount by maintaining a B average or ranking in the top 20% of their class. To qualify, you must show proof of academic records and be enrolled full-time.

As a parent, if your student's college is located more than 100 miles away and they left their car at home, they may also qualify for a "student away" discount. Some providers offer as much as a 25% discount for this category.

Seniors: 5%-10%

With age comes wisdom…and additional savings. Individuals aged 55 or above may qualify for a "senior" or "mature" discount ranging from 5% to 10%. Additionally, seniors who complete a mature driver improvement course online may even see savings on their premiums. Like a defensive driving course, this certification helps older adults brush up on their defensive driving techniques, motor vehicles laws, and any updated road rules.

Professionals & Academic Organizations: 2%-10%

Some companies offer reduced rates of up to 10% for drivers who use group insurance plans through employers, professional associations, or alumni groups that have affiliations with certain insurance providers.

These are often trade associations, university alumni groups, or professional organizations. You may even qualify for this savings by joining a professional society such as the National Society of Professional Engineers or your local Chamber of Commerce. Contact your alumni organization as well to see if your university has partnered with any insurance providers to which this discount may apply.

Vehicle-Based Discounts on Car Insurance

Vehicle-based discounts are usually automatic, but there are a few ways you can purchase additional safety products for your car to qualify for these savings.

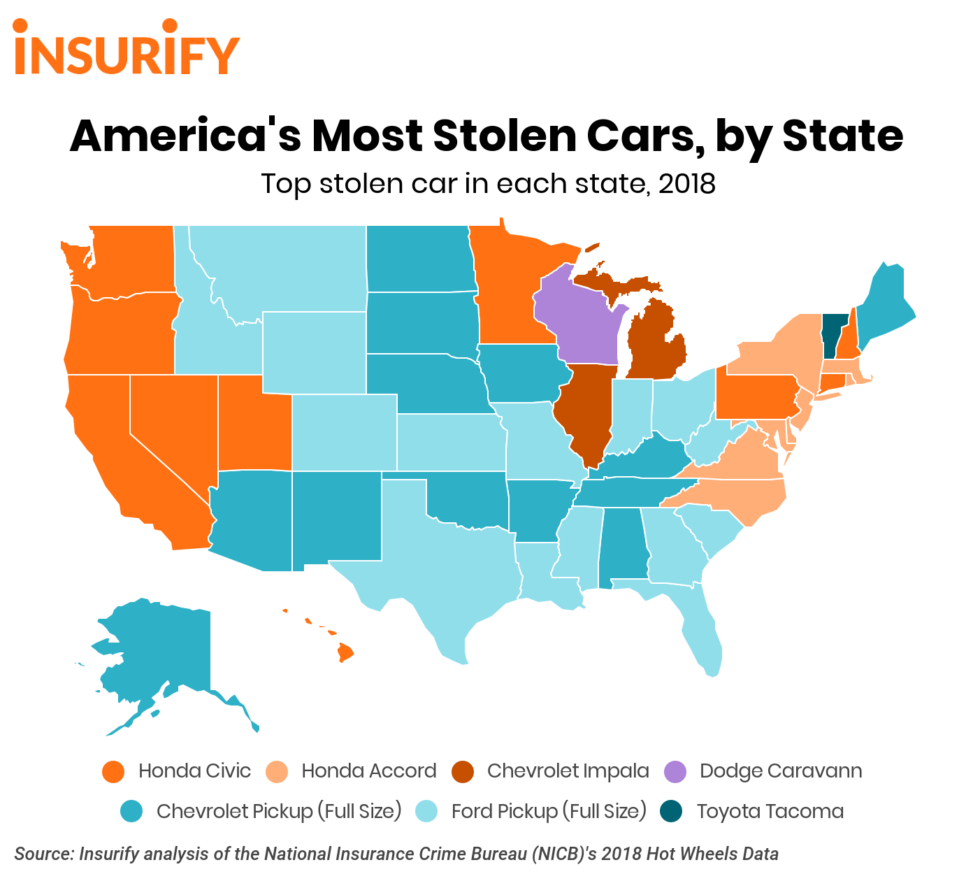

Anti-Lock Brakes & Anti-Theft Devices: 5%-10%

Adding additional safety features or purchasing a car that already includes them can cut the cost of your car insurance. For example, many providers offer lower rates to drivers who have anti-lock brakes or anti-theft devices installed.

If you don't have anti-theft devices, you may want to consider purchasing them if it makes sense for you financially. The savings may not add up to have them installed, but if you consider them an investment, they may pay off, in the long run, to keep your car safe.

Passive Restraint: 25%-30%

Since 1983, most new cars have come with passive restraint equipment. This includes automatic seatbelts or factory-installed vehicle airbags. If your car meets these requirements, it could save you up to 30% on your medical payments or personal injury protection coverage premium.

Daytime Running Lights: 3%

Daytime running lights are believed to minimize the risk of accidents. Because of this, cars equipped with daytime headlights can receive around a 3% discount on their insurance. These come standard with most new cars but may need to be installed for older models, which can be costly and not worth the small discount. Investing in them, though, could potentially minimize the risk of future accidents, so you'll need to weigh your options accordingly.

Getting the Best Price for Car Insurance

At the end of the day, the best way to ensure you're getting the best price on your car insurance is to shop around and talk to insurance agents. Ask about all the discounts that may be available to you and see whether you can take extra steps to qualify for ones you may not yet be approved for.

With nearly 6,000 car insurance companies in the U.S., doing your homework ahead of time can help you find the carrier that best meets your needs and budget.

Comments