- Report Cash App Scams

- How to Avoid Losing Money to a Cash App Scammer

- Should I Still Use Cash App?

- How Common Are Scams on Cash App?

- Common Cash App Scams To Be Aware Of

Cash App has quickly become a go-to for many people looking to easily and seamlessly transfer money between parties. Unfortunately, while it’s super convenient, it's no stranger to scams, and it’s not always possible to get your money back after being scammed.

Cash App payments are instantaneous, and they’re not protected from fraud, which is different than traditional payments. Essentially, Cash App works like cash, making it difficult to trace. If you store money in Cash App as you would keep it in a bank, it could lead to more trouble.

There are a few options for getting your money back, however:

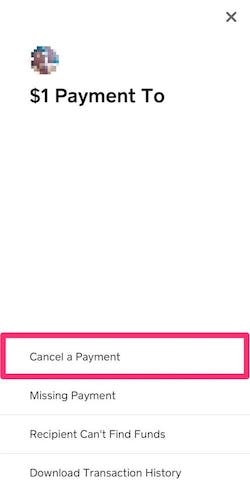

- Cancel a payment: Go to the Activity tab, locate the specific payment, and select cancel. Please note that this only works on pending transactions, not completed ones.

- Ask for a refund: This works similarly to cancellation. Just go to the activity tab and find the charge you want to be refunded. If it’s a legitimate merchant, it shouldn’t be a problem. However, it can be a problem if the person doesn’t refund the money.

Report Cash App Scams

You do have the option of reporting a potential scam to the Federal Trade Commission, the Internet Crime Complaint Center (IC3), or Cash App itself. To help these organizations with stopping further fraud, you should provide as much information as possible, including:

- Your name

- Your address

- Your phone number

- Your email address

- The transaction type (i.e., mobile payment, cash, etc.)

- The transaction amount

- The transaction date

- Your Cash App and/or bank information (e.g., your Cash App username, the name of your bank)

- A thorough description of the incident

- The type of scam (e.g., paying for a product you never received)

Report Scams to Cash App

You can also report to Cash App by filing a dispute. You can find “Dispute This Transaction” in the activity tab. Afterward, Cash App will investigate the claim and decide whether it was fraudulent or not.

It's important to verify links and contact details to beat imposters.

Will Reporting Cash App Scams Get My Money Back?

Whether you report to the government or Cash App, you are not likely to get your money back. There are two reasons for this. First, when reporting to the government, their primary function is to find and prosecute the scammers behind the act. While beneficial for future transactions, it won’t help you get your money back now.

Second, when you report it to Cash App, you’re also protecting yourself and others against future scams, not necessarily working on getting your money back. Cash App is not FDIC insured, meaning they’re not legally bound to return the money.

There are instances when you can get your money back. If the person is a legitimate merchant, like a retail store, the odds are better since they will reverse the transaction. However, if it’s a scammer, given the instantaneous nature of the site, you might be out the money.

How to Avoid Losing Money to a Cash App Scammer

There are several things you can do to avoid being scammed on Cash App, including:

- Only sending money to people you know and trust. Cash App recommends never sending money to people you don’t know.

- Double-check all information before you send any money. This ensures the correct amount is sent to the right person.

- Don’t send money to businesses that only accept payment via Cash App. This is a warning sign for a scam. Legitimate companies should accept payment via other methods, such as credit cards and PayPal.

- Look for red flags of a Cash App scam. There are a few buzzwords to look out for that will warn you of potential fraud. If someone is offering free money, to increase your money, or telling you to claim a payment, it’s too good to be true.

- Link your Cash App account to a credit card. If you are scammed, this will add additional protection.

In general, the same rules that apply to email phishing scams apply to Cash App scams, so the same precautions apply, including:

- Being wary of unfamiliar senders and links

- Being cautious around messages asking for personal information, such as social security numbers or credit card information

Should I Still Use Cash App?

Although scammers use Cash App frequently to steal money, that doesn’t mean you should avoid using the app altogether—use it with caution.

Cash App is best used with trusted friends and family members only—it’s perfect for splitting a meal or a movie ticket. When strangers or companies request payment via Cash App, you should avoid the transaction altogether.

Cash App does have safety features, which include:

- Use of artificial intelligence

- Sending text messages when there’s an unusual login attempt

- Prompting you to confirm a transfer to someone who is not a saved contact

How Common Are Scams on Cash App?

The stories are horrifying. In just a matter of minutes, a man in Virginia lost hundreds of dollars on Cash App. As he’s looking at his app, he saw over $200 leave his account.

Another man in North Carolina lost $24,000.

Cash App scams are not uncommon. The Better Business Bureau reports getting more than twice as many complaints about Cash App compared to Venmo, even though Venmo has twice as many users as Cash App. In general, payment apps are three to four times more likely to have fraud than credit and debit cards. For Cash App, reviews that mention fraud rose by 165% in 2020.

Though many use Cash App regularly without incident, it’s essential to know that scams can happen.

Common Cash App Scams To Be Aware Of

There are several common scams to watch out for when using Cash App:

- No delivery: Since scammers know there’s no protection on the app, they will ask you to pay for fake, expensive items. Once the money is transferred, the person will never deliver the item.

- COVID-19 scam: Some con artists will pretend to have relief programs, taking advantage of those out of work due to the pandemic. They will ask for fees in return for more money.

- Fake giveaways: There’s a legitimate #CashAppFriday giveaway that offers cash prizes for users and is usually done on social media. Scammers come up with fake giveaways that look real but will ask for money in advance and never pay any money back.

- Fake Customer Support: Some scammers try to impersonate Cash App customer support, so remember that Cash App’s actual customer support team won’t ask for PINs or other information. And they’ll never ask you to send a payment or download an app.

Comments