- Shop Around to Get the Best Price

- Research the Actual Cost of the Car

- Look Up the Average Sale Price of the Car

- Get Pre-Approved for a Car Loan

- Take Your Time to Decide and Analyze the Cost

- Watch Out For Extras

- Buy At the Right Time

- Frequently Asked Questions

Buying a new car can be a stressful experience. Not only are you about to drop thousands of dollars and make one of the most significant purchases you'll ever make, but you're also about to experience some of the pushiest sales techniques and pressure tactics.

The key to not getting ripped off when buying a car is doing plenty of research—it may seem time-consuming and like a lot of hard work, but it could save you thousands of dollars.

Here are seven key ways to ensure you're getting the best price on a new car.

Shop Around to Get the Best Price

Before you get started, you should be prepared to visit multiple dealerships. First, look up all of the local dealerships in your area and plan to visit each one.

If you have a specific car make and model in mind, make sure you're hitting all of the dealerships that sell it—even if they don't have it in stock, they could get it in soon. If you're not entirely sold on a specific car, you should also keep an open mind and consider other makes and models.

As a general rule of thumb, you should get prices from at least seven other car dealerships before making a final decision.

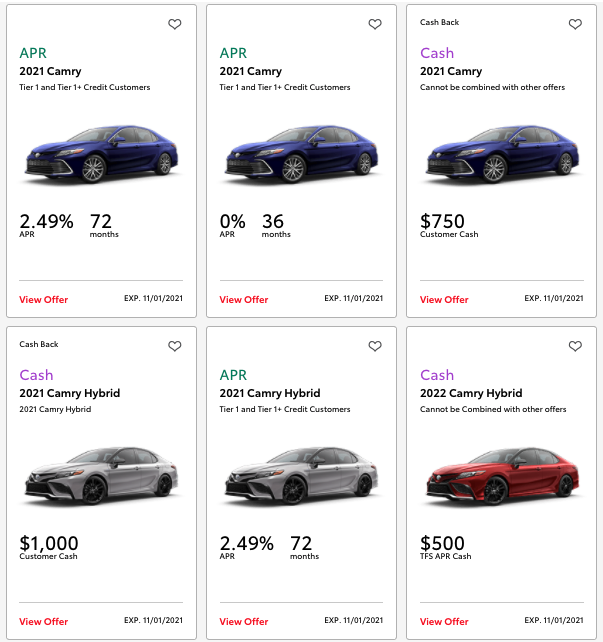

Look for Deals and Incentives

When making your list of dealerships to visit, look for special deals and incentives they each have to offer. Some examples include:

- Cashback offers (immediate discounts on vehicles)

- Low (or even 0%) auto loan interest rates

- Bonus cash with auto loans

- State and/or federal rebates (usually for electric vehicles)

If you're used to negotiating or pushy sales tactics, the best thing to do is bring moral support with you to the dealership and have a good game plan. Bring someone who won't let you get pushed into a sale when you're not ready and can help you leave the dealership when you need to.

Research the Actual Cost of the Car

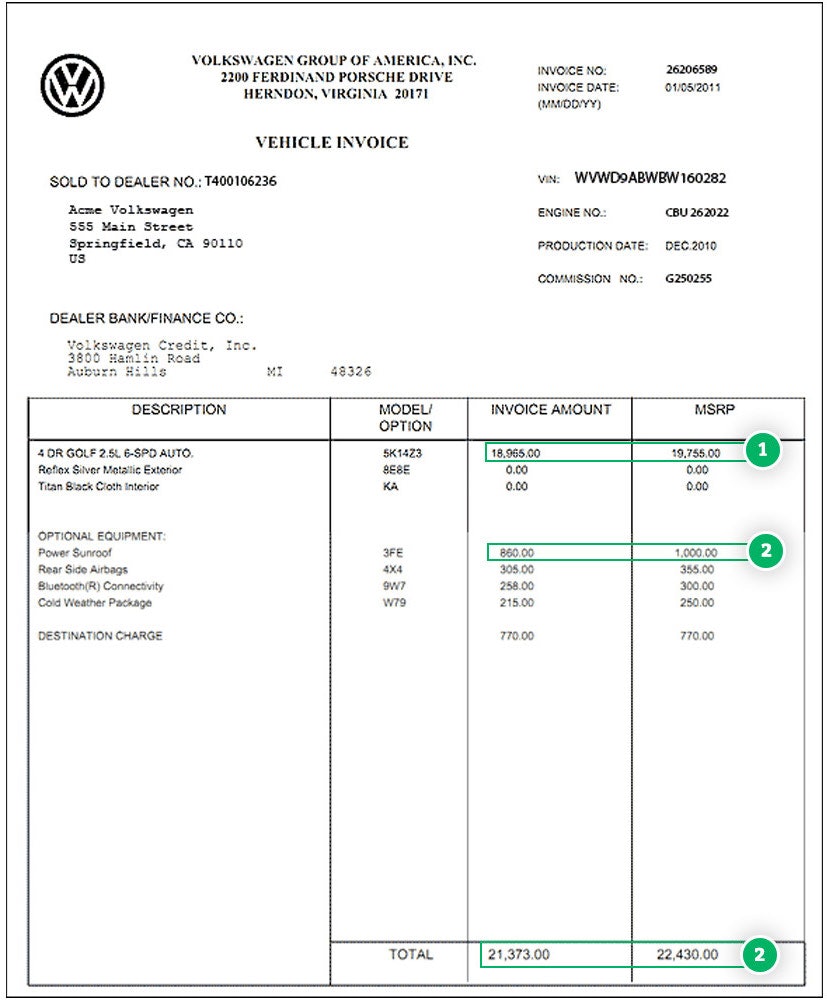

Before deciding how much you want to pay for the car, you should look up how much the car cost the dealership. This isn't the advertised price of the car that you see online or the sticker price that you see on the car itself, this is the price that the dealership paid for it. Of course, this isn't the price you should be expecting to pay for the car, but it will give you a good idea of how much you can negotiate down.

When you visit the dealership, ask the sales representative for the car's factory invoice—this will show you the actual price they paid for the vehicle, including delivery fees. Unfortunately, not all dealerships will give you this information, and some will even tell you that the "sticker price" is what they paid for it—this is usually untrue.

If you're unable to get the true price from the dealership, several online services will give you a factory invoice estimate, such as:

Once you know what the dealership paid for the car, you'll have a good idea of how much they will accept as a sale price. The general rule is that dealerships will usually accept at least 3-5% above the factory invoice cost.

Look Up the Average Sale Price of the Car

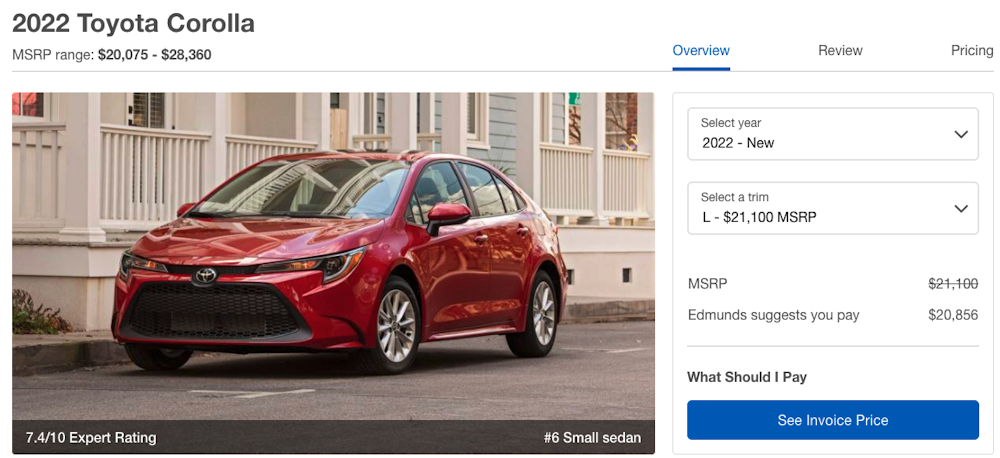

Now that you know what dealerships are likely to accept for the car, you should check the fair market value of the vehicle. The fair market value is what an average buyer is expected to pay for a particular vehicle.

You can use sites like Edmunds and Kelley Blue Book to find the fair market value. Once you know this number, you should aim to stay below this price.

You Can Negotiate Below the Suggested Retail Price

When you visit a car lot, you'll see the manufacturer's suggested retail price on the car (i.e., the sticker price)—this price isn't set in stone. So you should prepare to negotiate down.

Get Pre-Approved for a Car Loan

(If you're paying cash for a new car, then this step won't apply to you.) Before you start visiting dealerships, you should get pre-approved for a car loan, whether it's through your bank or other financial institution.

Don't just get one pre-approval either—look at several lenders to get an idea of what rates are available to you.

When you do start visiting dealerships, you should keep yourself open to the loans that they offer. And feel free to show them the quotes you received from other lenders—they will likely try to at least match the rates you were previously approved for.

Knowing your pre-approval rates will help you negotiate your monthly payments with other lenders or dealerships.

Take Your Time to Decide and Analyze the Cost

When you start visiting dealerships, you'll quickly realize one of their primary sales tactics—to push you into a quick sale. Car salespeople will often get you a quote for your monthly payments then tell you that the deal is only available if you sign that day. Don't fall for it—salespeople don't want you to shop around and find a better price. If you come back a week later, you'll still be able to negotiate a great price.

When figuring out if you're getting the best price for a car, you need to first focus on the overall cost. Make sure you're getting the best deal of the overall price first before focusing on your monthly payment.

When looking at your monthly payment, make sure you calculate the total cost that you'll be paying over the life of the loan. For example, your new car could be $25,000, but if you're paying $450/month for 60 months (including interest), your total will be $27,000—$2,000 more than the car's sale price. This will help you understand whether you have an affordable interest rate or not.

When you negotiate the price of the car with the dealership, make sure you're both talking about the total cost of the vehicle, including all taxes, fees, and extras that they will try to add on.

What Fees Should You Be Paying?

When looking at the cost of your new car, you'll see additional fees on top of the actual price of the car itself. In general, these are some of the fees you may be charged:

- Car registration fees

- Sales tax

- Documentation fees

- Dealer fees

- Advertising fees

Some fees, like your car registration and sales tax, are unavoidable, but you should ask your dealer why you're being charged other fees. Additionally, some states put limits on what dealers can charge for documentation fees.

What Will Your Car Be Worth?

It's common knowledge that once you drive your car off the lot, the value goes down dramatically—up to 30% by the end of the first year of ownership. Before buying a new car, you should have a good understanding of what your vehicle will be worth after three or five years, especially if you're considering replacing it with a new one around that time. This will help you decide on the final price you're willing to pay for the car.

Lease or Buy?

If you're someone who likes to have a new car every few years, you might want to consider leasing. Although the saying goes, "rent money is dead money," with cars, it may just be worth it since car values depreciate so quickly.

Watch Out For Extras

Another sales technique used at many dealerships is to continue to add on extras even after you've approved your monthly rate. After you've talked to a sales representative and nailed down the exact car and auto loan rate, you'll be sent to see the finance manager, who will get all the final paperwork completed and signed.

At this stage, you may think that you've already finalized your monthly payment and overall cost of the vehicle, but that's usually untrue. The finance manager will try to add on things like:

- Gap insurance

- Extended warranty

- A prepaid maintenance plan

- Security upgrades

- Aesthetic and other general car upgrades

You'll likely feel pressured into adding these extras but make sure you consider them all carefully before agreeing to any. The finance representative will probably explain them very quickly, telling you all of the benefits (and none of the cons), to entice you to agree to them—don't be afraid to ask questions and deny any of them.

Buy At the Right Time

Any time you visit a dealership, it'll feel like the best time to buy a vehicle. Salespeople will always make you feel like you're getting the best deal possible simply because they want to make a sale today.

However, there are better times, as a consumer, to buy a car, specifically:

- At the end of the month: The end of the month is usually the cutoff date for salespeople to meet their quotas which can win them a big bonus. You're more likely to get a better deal when salespeople are more desperate to make a sale.

- At the end of the year: According to Edmunds, the end of the year is when you'll find the best savings on cars. Not only are manufacturers and dealerships wanting to finish the year off strong, but they also want to make room for older models taking up space.

- The months that new cars are released, including:

- October

- November

- December

- At the start of the week: You want to visit a dealership on their slow days so you'll get the most attention, and they won't try to rush through a sale. When you visit on the weekend, there'll likely be a lot of customers, and your salesperson might be juggling you plus other customers at the same time. If you visit on a Monday or Tuesday (i.e., slow days), you'll have more time to ask more questions, negotiate, and get yourself a great deal.

- During long weekends: Some of the best car deals come out during long weekends, including:

- Memorial Day

- Fourth of July

- Labor Day

Specific car models are also generally discounted when they're about to be discontinued, or a newer model is due to be released or redesigned. As long as you don't need the latest model, opting for the previous year's model can mean huge discounts.

Comments