- Use Legitimate and Trustworthy Websites

- Verify Your Real Estate Agent/Broker

- Verify Your Home Inspector

- Verify Your Mortgage Broker

- Use a Trusted Mortgage Escrow Company

- Hire a Lawyer for the Real Estate Transaction

- Look for Red Flags of Scams

- Frequently Asked Questions

Whether you're buying or selling a home or property, you'll need to be cautious and be on the lookout for scams and sketchy people. Unfortunately, real estate scams are widespread, with wire fraud in real estate transactions resulting in $213 million in losses in 2020. Here are vital steps you can take to protect your real estate transaction and keep your money safe.

Use Legitimate and Trustworthy Websites

Only use trustworthy websites when you first start searching for a home or want to list your home. Sites like Craigslist, where anyone can post listings, are generally scam magnets—scammers use these sites to prey on vulnerable people who aren't aware of the different types of scams out there.

Some of the most common sites to use when buying/selling a home include:

Licensed agents list houses on these sites, so you know they're legitimate and actually exist.

If you're selling your home, to get your property listed on sites like these, you'll need a real estate agent or broker to represent you. This brings us to our next point—verifying your real estate agent.

Verify Your Real Estate Agent/Broker

Using a licensed real estate agent is key to buying/selling your home safely and without additional hassle, especially if you're unaware of all the steps involved.

A licensed professional will:

- Help you get a good deal (they will negotiate the sale price on your behalf)

- Ensure you complete the necessary paperwork

- Help you get your house ready for sale (if you're a seller)

- Help you find homes to view and consider (if you're a buyer)

- Communicate with the other parties involved (e.g., the other real estate agent representing the other party)

- Guide you through the entire process (e.g., home inspections, closing, finding a mortgage broker)

In addition, a good real estate agent will be able to spot potentially bad deals and scams. For example, if you're buying a home and the seller is giving you unrealistic guarantees on the appliances, the realtor will be able to spot these and dismiss them.

An Unrealistic Guarantee (Example)

Joe is in the process of negotiating a price of a home he's interested in buying. Joe's agent is trying to negotiate the cost of the house due to the age of some of the appliances in the home (e.g., the water heater, oven/stovetop, dishwasher, and refrigerator).

These appliances will need to be replaced soon, so Joe's agent requests an $8,000 price reduction. The seller responds by saying that they will not lower the price and guarantee that all appliances mentioned will be good for another 10 years.

To Joe, this sounds great. However, Joe's agent flags that the home warranty is only good for one year, and the seller's "guarantee" is not legally binding and not a valid guarantee.

Steps to Verify a Real Estate Agent

- Verify that the agent has a valid real estate license in your state.

- Look at the agent's recent sales history.

- Look at the agent's past client reviews, paying particular attention to negative reviews and if they responded.

Verify Your Home Inspector

Once you've made a purchase offer, you should have it inspected by a professional home inspector. They will let you know of any potential issues with the home before you hand over your money and are stuck with a bad investment.

Home Inspections Can Be Used as a Contingency

If you have a home inspection contingency within your real estate contract, you can still back out of your agreement if the inspector finds significant defects or issues with the home.

To avoid being scammed by a home inspector, you should:

- Ask your realtor to recommend inspectors that they trust and have used before.

- Check the home inspector's license.

- Look for reviews online (e.g., on Yelp, Google reviews, the Better Business Bureau).

- Ask for a sample home inspection report to ensure that they will cover everything you need them to.

Verify Your Mortgage Broker

If you're buying a house (and not paying cash), you'll also need to find a good mortgage broker that you trust with getting you a good rate. While your real estate broker may have a dedicated mortgage agent they will recommend, you aren't required to go with them.

Do your research before choosing a mortgage broker—the difference between a good broker and a sketchy one can be thousands of dollars.

Upfront Fees Are a Red Flag

If your mortgage broker asks for an upfront fee, don't do business with them. A broker's fees are paid by the lender of your mortgage, not when you first decide to do business with them.

Steps to Verify a Mortgage Banker/Broker

- Verify that the banker/broker has a valid broker license in your state.

- Check to see which associations and groups the broker belongs to.

- Ask for community references or search for public reviews online.

Use a Trusted Mortgage Escrow Company

Once you've gone through the process of finding a house or a buyer for your home, you'll want to make sure you're using a legitimate escrow company to handle the financial side of the transaction.

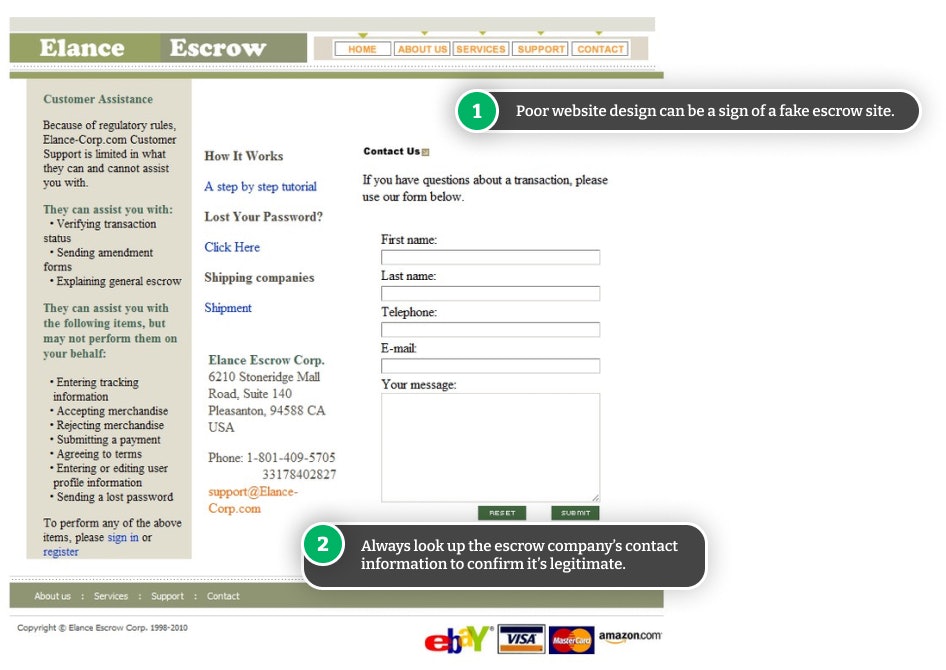

There are several reports of mortgage escrow scams in the U.S., with fraudsters using fake websites and other tactics to steal hundreds of thousands of dollars from unsuspecting victims.

You can:

- Use an escrow company recommended by your mortgage broker or lender.

- Verify the company is legitimate by searching for them in your state's database.

- Look for reviews about the company on third-party sites like the Better Business Bureau (BBB).

- Look for red flags of scams (more on that below).

Hire a Lawyer for the Real Estate Transaction

Whether you're the buyer or seller in a real estate transaction, you have the option to hire a real estate attorney or lawyer to help you navigate the contracts and agreements. Although there is added cost to hiring a real estate attorney, it will ensure a smooth transaction and give you peace of mind, especially if this is the first time you're buying/selling a home.

When a Lawyer is Required for Real Estate Transactions

Some states and lenders require that you have a real estate lawyer. For example, many states require that a licensed attorney put together all of the legal documents needed for a real estate transaction (i.e., closing documents). In addition, some states require a lawyer to be present during a home's closing process.

Cost of a Real Estate Lawyer

The cost of a real estate lawyer will vary, depending on several factors, such as:

- Your location

- The lawyer's experience

- How the lawyer charges (hourly vs. fixed)

- How involved the lawyer will be in the transaction

- The purchase price of the property

It's common for real estate attorneys to charge anywhere from $150 - $350 per hour or a fixed rate of $500 - $1,500.

Look for Red Flags of Scams

Even after verifying that all of the key players in your real estate transaction are legitimate and trustworthy, you're still vulnerable to scams. For example, one of the biggest scams in real estate is escrow wire fraud that targets buyers. Here a fraudster impersonates your escrow company to steal your money.

The scam usually goes like this:

- You receive a phone call or email from what you think is your escrow company (but is actually an impersonator).

- The impersonator tells you that you must deposit the required funds (whether for your home deposit or earnest money) as soon as possible.

- They send you to a fake escrow website, where you can deposit your funds in the escrow account.

- You deposit your money—the scammer empties the account, your money is gone, and you still need to pay your actual deposit.

To protect yourself from mortgage escrow scams, you should:

- Contact your realtor to confirm the escrow agent is who they say they are.

- Look for the escrow agent's information online to verify they are who they say they are.

- Visit the office in person (if possible) and verify their information.

- Look for red flags of an escrow scam, such as:

- Deposit options using questionable methods (e.g., MoneyGram).

- Emails riddled with spelling and grammatical errors.

- A pushy escrow agent who doesn't want you to call your realtor.

- Not being able to find any information about the agent to verify their information.

- Don't call the phone number provided in the email—contact the escrow company via the number you find on their website.

Comments