- What is an Experian Fraud Alert?

- How Do You Place an Experian Fraud Alert

- What Happens Next?

- If You See Signs of Fraud on Your Credit Report

- Why Add an Experian Fraud Alert?

- How to Remove an Experian Fraud Alert

- Review Your Credit Report: What to Look For

- Frequently Asked Questions

Are you a victim of credit fraud or identity theft? Or have you recently fallen for a scam that could put your credit at risk? If so, we can help you understand what a fraud alert entails, how to place an Experian fraud alert, and what to do after you've added a fraud alert to your credit file.

What is an Experian Fraud Alert?

An Experian fraud alert is a notification you can add to your credit report for free. It notifies creditors who obtain a credit application in your name to verify your identity before proceeding with your application. This adds an extra layer of security when opening a line of credit to prevent criminals and identity thieves from using your name or identity for credit accounts or loans.

There are three different types of alerts you can request:

- Temporary fraud alert

- Extended fraud victim alert

- An active duty fraud alert

Temporary Fraud Alert

A temporary fraud alert, or an initial fraud alert, is a less stringent type of notice you can place on your credit report to ensure lenders contact you to verify your identity before proceeding with any credit application.

You can add this type of alert to your account anytime and for any reason. Additionally, you can renew a temporary fraud alert as many times as you want.

Duration: 1 Year

Extended Fraud Alert

An extended fraud victim alert is a more stringent type of notice designed for credit fraud or identity theft victims. To obtain an extended fraud alert, you must submit a copy of a police report you filed with law enforcement to indicate you're a victim of identity theft.

Duration: 7 Years

Active Duty Fraud Alert

An active duty fraud alert is a special notice design for active-duty service members. This alert protects active-duty service members who are on assignment away from home.

Duration: 1 Year

How Do You Place an Experian Fraud Alert

The process of placing a fraud alert on your credit report via Experian varies depending on the type of alert.

NOTE: Placing a fraud alert with any of the three credit bureaus is free.

Experian

Website: https://www.experian.com/

Contact page: https://www.experian.com/contact/personal-services-contacts.html

Contact page: https://www.experian.com/contact/personal-services-contacts.html

It's important to verify links and contact details to beat imposters.

Temporary and Active Duty Alerts

You can add temporary and active duty fraud alerts via Experian easily online or by calling 1-888-EXPERIAN (I-888-397-3742).

Extended Alerts

For extended fraud victim alerts, you will need:

- To complete a form

- A copy of a government-issued ID card (e.g., your driver's license)

- Proof of your mailing address (e.g., a utility bill)

- Credit card statements and magazine subscriptions are not accepted.

Submit all the above documents and the completed form to Experian online or by mail to:

Experian

PO Box 9554

Allen, TX 75013

When you request a fraud alert with Experian, it automatically applies additional alerts at the other credit bureaus. Therefore, you do not need to separately place a fraud alert with all three credit bureaus.

What Happens Next?

After you submit a fraud alert request, Experian will immediately:

- Place a temporary fraud alert or security notice on your credit file

- Remove your name from prescreened credit solicitation lists for six months

- Notify other nationwide credit bureaus of your request

You can also ask Experian to send you a free credit report by mail. This free credit report is also accessible online, so you can review your account immediately upon submitting the request. Experian will also provide a Federal Trade Commission-approved summary of your rights as a victim of identity theft.

You Only Need to Place One Fraud Alert

You only need to place a fraud alert with one of the three credit bureaus—Experian, Equifax, or TransUnion. The other two will be notified immediately and will set up fraud alerts for you.

If You See Signs of Fraud on Your Credit Report

If you review your credit report and see signs of fraud, you can dispute the information:

We recommend submitting an identity theft report with the authorities as soon as possible. Once you have done this, you'll be able to request an extended fraud victim alert (if you haven't done so already), which is good for seven years.

Once you place an extended alert, Experian completes an investigation and deletes any fraudulent information from your file. They will then notify creditors if any information is blocked, deleted, or modified. Experian also contacts other credit bureaus to request they also block fraudulent data.

Why Add an Experian Fraud Alert?

Anyone can be a victim of identity theft, so it's essential to take precautions to ensure cybercriminals and scammers can't hijack your personal or financial information. According to Javelin Strategy & Research, $16.9 billion was lost to identity theft in 2019. Some of the most common types of identity fraud include opening new credit card and mobile phone accounts and taking out business, personal, and auto loans.

You should add a fraud alert if you believe you're at risk of fraud or identity theft. You should also add an extended fraud alert or an active duty fraud alert if you've been a victim of identity theft in the past or you want to protect yourself while you're away from home on active duty.

To reduce your risk of identity theft, you should:

- Never carry your social security card in your wallet.

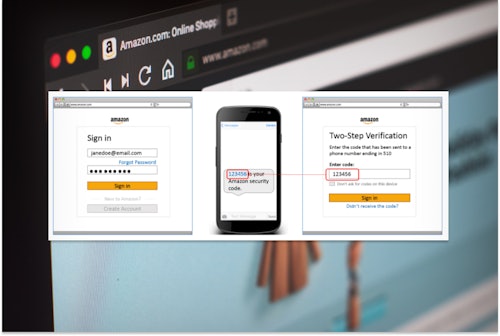

- Always use unique and strong passwords for your online accounts (don't ever use the same password for more than one account).

- Never make your financial information (e.g., bank account numbers, credit card numbers) easily accessible to anyone.

- Review your financial statements and credit reports regularly, looking for suspicious transactions and activity.

- Be aware of the common phishing tactics that can occur via:

How to Remove an Experian Fraud Alert

Once you are sure an identity thief is no longer targeting you, you can remove the Experian fraud alert from your credit report—you can do this at any time.

To remove a fraud alert via Experian, you'll want to mail an identification information form along with a copy of a government-issued ID card and proof of your mailing address to:

Experian

PO Box 9554

Allen, TX 75013

You may also submit documents supporting your claim electronically.

Review Your Credit Report: What to Look For

Your credit report may vary based on the bureau providing the data, but generally, there are four standard sections you should examine for errors:

- Your personal information (i.e., your name, address, date of birth, Social Security number)

- Credit history (e.g., current loans, payments made, remaining balances)

- Public records (e.g., bankruptcies and foreclosures)

- Number of credit inquiries

You should examine each of these sections and look for any:

- Typos and spelling errors

- Inaccurate personal information (e.g., address, name, date of birth)

- Open accounts that should be closed

- Accounts with incorrect balances or credit limits

- Credit inquiries you don't recognize or didn't authorize

- New lines of credit you're unaware of (e.g., loans or property purchases)

- Accounts opened under another person with the same or similar name as yours.

Comments