- Block Spam Text Messages

- Don't Click Any Links

- Look for Spelling and Grammatical Errors

- Call Your Bank

- Real vs. Fake Bank Text Messages

Scam text messages are becoming more and more popular as fraudsters come up with new ways to steal your identity and money. One of the most common text message scams involves someone impersonating a bank and either requesting information from you or requiring you to log into your bank account.

These fraudulent text messages can be catastrophic, leading to identity theft (which can take years to recover from) and loss of money from your bank account.

Luckily, there are some easy ways to identify whether a text message from your bank is legitimate or not and protect yourself from any loss of money.

Block Spam Text Messages

To prevent these scam text messages from reaching your inbox in the first place, use a spam blocker on your phone.

Activate the Spam Text Blocker (Android)

- Open your text message app.

- Tap the three dots in the top right-hand corner.

- Tap Settings.

- Tap Spam Protection.

- Switch on Enable spam protection.

Any spammy text will now be automatically forwarded to your phone's Spam & blocked folder, which you can access by tapping the three dots in your messaging app.

Filter Unknown Senders (iPhone)

iPhones don't have an option to filter out spam text messages specifically, but there is an option to filter out text messages from unknown senders. However, this may also filter out texts that you do want to see, so it's not the best option.

- Open your iPhone Settings app.

- Tap Messages.

- Switch on Filter Unknown Senders.

Texts from people you don't know will now be sent to your Unknown Senders folder within your Messages app.

Report Spam Texts

If you receive a scam/spam text message, you can block and report the number on both Android phones and iPhones.

Don't Click Any Links

If you receive a text message claiming to be from your bank, it's best not to click any links or call the number, especially if you're unsure whether or not it's legitimate. Scammers will put fake links and phone numbers in the text message to trick you into giving them your information.

When you click the link, you'll be taken to a fake bank website that steals your information.

When you call the phone number, a scammer will pick up, pretending to work for the bank.

Most banks won't require you to click a link or call a number if they need to confirm whether or not you made a transaction. Instead, they will ask you to respond using a single number or letter to confirm whether or not it was an approved payment.

Log into your bank account directly from the website or app when in doubt. You can also call the phone number on the back of your card to speak to a bank representative.

Check the URL

You can confirm whether or not a text message is legit by looking at the URL included in the message (if there is one). Scammers will include fake URLs that don't match what the actual bank's website address looks like.

For example, a scammer who sends a fake Citibank text message may include a URL that looks like Citiurl.com, which isn't the actual Citi.com address.

Look for Spelling and Grammatical Errors

Scam texts, emails, letters, and websites are notorious for having several spelling mistakes and typos. The people who write these things aren't professional editors and writers, and they also likely rush through the process, resulting in errors.

On the other hand, banks and financial institutions have a professional team of marketers responsible for sending out official messages. So you can be sure there won't be any typos or grammatical errors on genuine texts sent by your bank.

Call Your Bank

If you've responded to the scammer or visited a scam website, you must call your bank and let them know what happened as soon as you can. Time is of the essence, as scammers act quickly once they've got your information and will start emptying your bank account or charging things to your credit the minute they can.

Depending on the information that you gave the scammer, your bank may cancel your credit/debit cards and issue you replacements with new card numbers.

It's also important to check your bank statement and look for unauthorized transactions—dispute these charges with your bank to get a refund or have the payments reversed.

Real vs. Fake Bank Text Messages

Here are some examples of what actual banks send you versus the fake text messages scammers will send you.

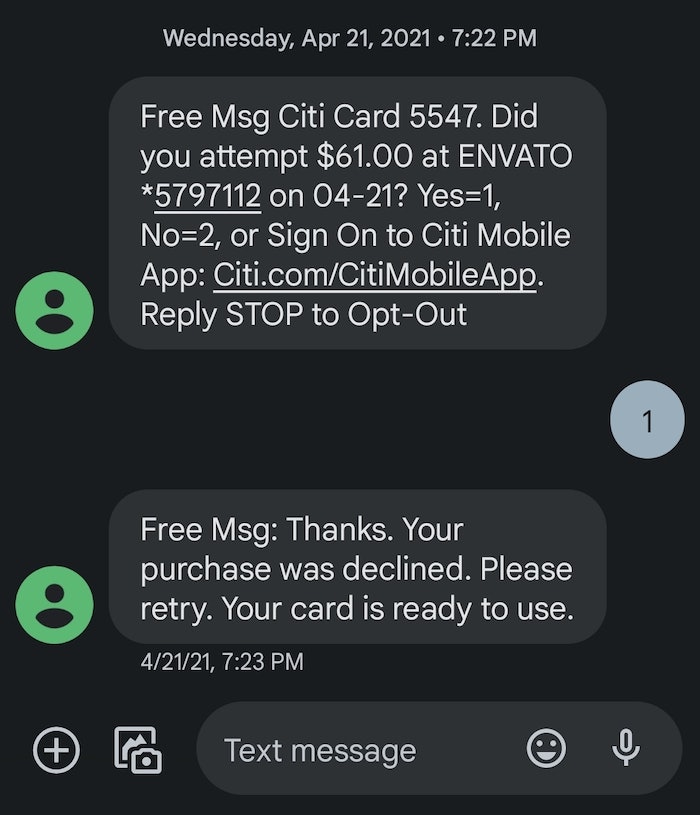

Citibank - Real vs. Fake Texts

Citibank is a commonly impersonated brand, with Citi scam text messages becoming more common.

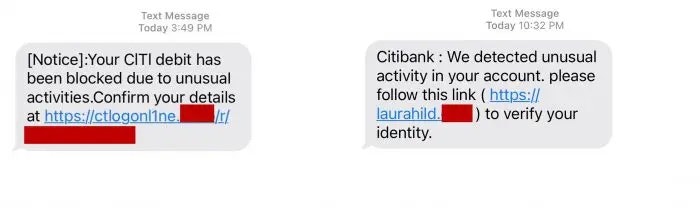

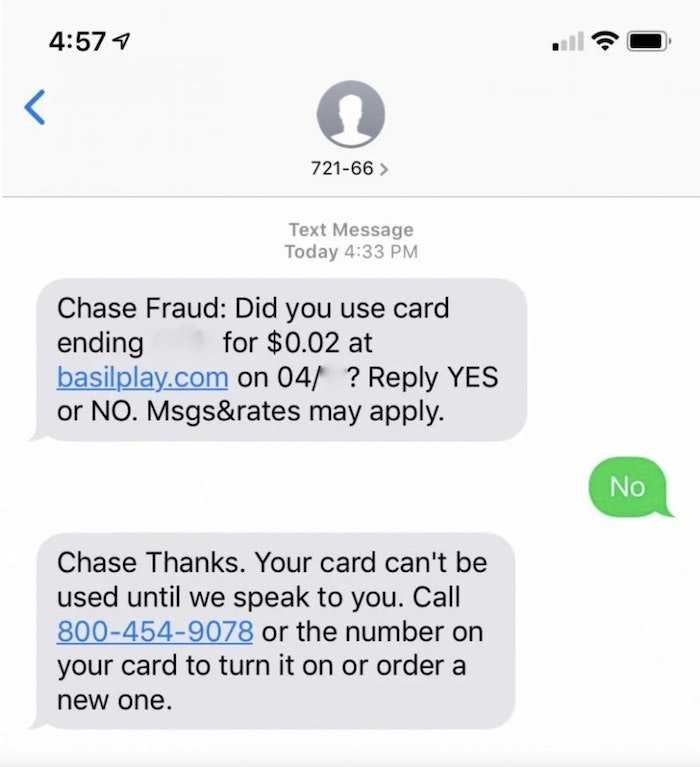

Chase Bank - Real vs. Fake Texts

There have also been several reports of scam texts being sent by scammers who are impersonating Chase Bank.

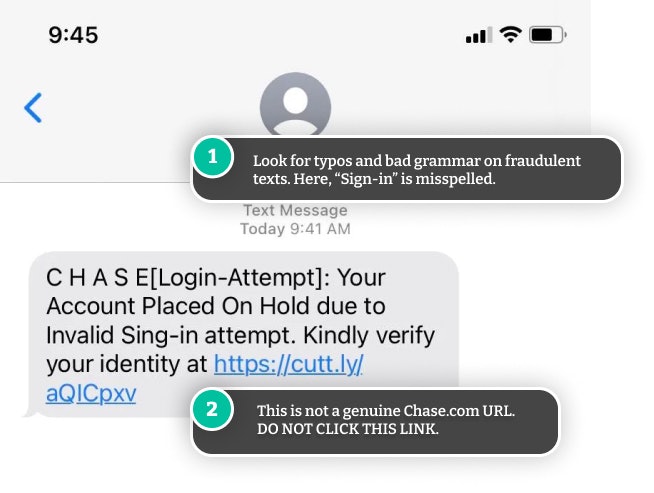

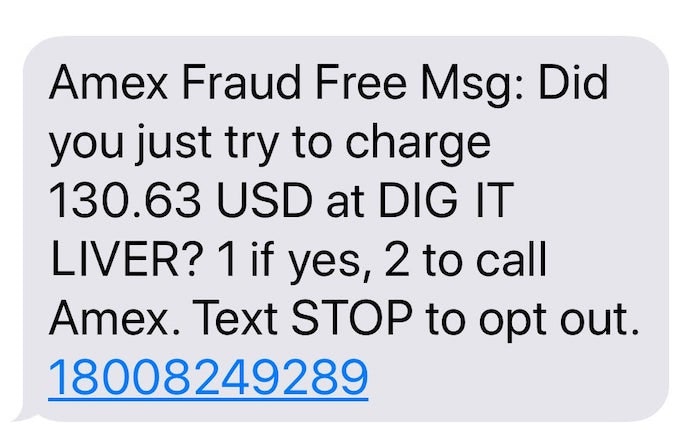

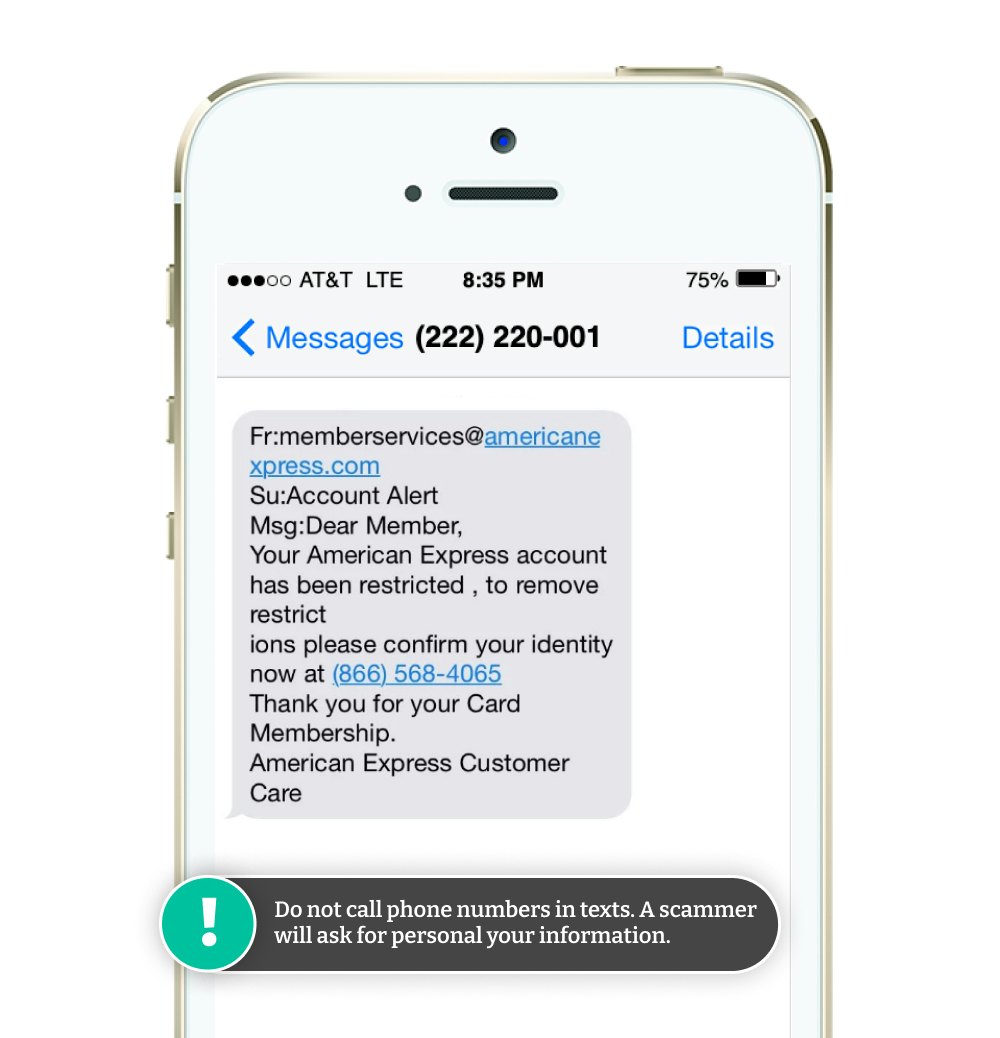

Amex - Real vs. Fake Texts

There are several different versions of fake American Express text messages, including those threatening to suspend your account unless you respond.

Comments