The new SQUID token launched late October has officially been classified as a scam, with the coin being cashed out by the creators after peaking just a week after launch. The scammers made off with $3.38 million of investor money.

Although there were several red flags of this scam, investors quickly purchased the cryptocurrency with pre-sales of the SQUID token selling out within one second.

The creators were smart, playing off the international success of the South Korean Netflix series, Squid Games. The coin jumped from $0.01 to $3.05 in a matter of days and peaked at $2,861 after just one week. Within five minutes of peaking, the creators “pulled the rug” and cashed out, making off with more than $3 million.

What is a “Rug Pull” in Cryptocurrency?

A “rug pull” happens when the creators of a token, such as SQUID, exchange their coins for cash, essentially abandoning their crypto project. They sell when the price is high, making off with a killing while driving the coin’s value to $0, leaving other investors with nothing.

How Was This Possible?

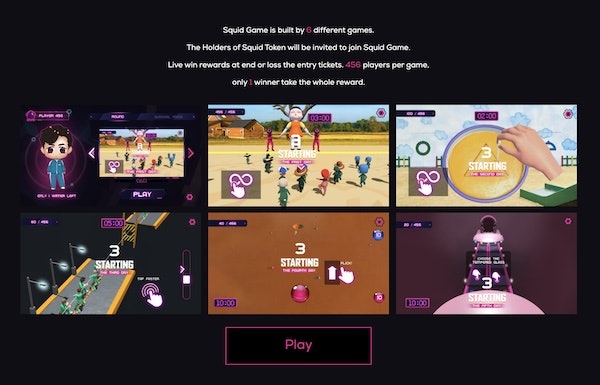

The creators of the SQUID token first posted a website (SquidGame.cash) to legitimize the fake coin. Complete with a whitepaper and roadmap, the site lured in investors with an added gaming element, capitalizing on the popularity of the series. (The website even used real footage of the series as its home page background.)

The gaming element involved a second token—Marbles—which you could only earn by playing the game. Only those who had Marbles were able to sell their SQUID coin. This should have been a red flag from the beginning. You should never invest in a cryptocurrency that you can’t exchange on the open market.

What made the pay-to-earn game even worse was the cost—a 456 SQUID entry fee.

Despite showing signs of a scam early on, several publishers promoted the token, and it was also shared across several social media platforms. The scam’s Twitter and Telegram channels gained tens of thousands of subscribers within days.

When the currency started gaining value, many investors tried to sell their coins but couldn’t.

Protect Yourself from Fake Cryptocurrency

There were several red flags of this coin that should have made investors think twice before investing, including:

- Capitalizing on another’s name or success (especially from TV shows or movies) without permission.

- No evidence that you can withdraw your SQUID coins once purchased.

- A very new website (only registered October 12, 2021).

- A white paper filled with spelling errors, typos, and poor grammar.

- A Twitter account that started blocking post replies.

- Several people posting on the project’s Twitter account (before replies were turned off) that it was a scam.

- Inability to buy the currency on mainstream platforms, such as Coinbase.

- A warning from Coin Market Cap that there is no way to cash out on your SQUID coin after purchasing.

Before buying any cryptocurrency, make sure you do your own research and pay attention to any scam warning signs (such as the above).

Are News Outlets to Blame?

Many victims of this SQUID token scam blame news outlets and publishers for promoting the coin without doing their due diligence. Many say that the additional marketing made the token feel legitimate and a good investment.

SQUID HolderI guess this will serve as a valuable lesson for me to not just jump into meme coins … I am not blaming anyone except myself, but I think there must be some mechanism to avoid this in the future, and for news outlets to stop giving attention to these scammer type tokens.

Many news outlets that promoted the cryptocurrency have now archived their original posts. This should be a warning to all not to trust everything you read and to do your own thorough research before buying into a new cryptocurrency.

Comments