- What Are Advanced Fee Scams?

- How to Avoid Advance Fee Scams

- Common Types of Advance Fee Scams

- Fallen for an Advance Fee Scam?

- Frequently Asked Questions

Beating advance fee scams is a breeze if you can recognize the warning signs. There are several red flags to look out for, including businesses that operate out of P.O. boxes, asking you to sign non-disclosure agreements or keeping an "opportunity" secret, and being contacted out of the blue by an individual or organization. And remember, if something seems too good to be true, it probably is.

What Are Advanced Fee Scams?

An advanced fee scheme is a type of fraud where scammers ask you for an upfront payment with the promise of receiving something of greater value—such as significant investment returns, loans, stocks, or gifts—but you receive little or nothing for your money.

The advanced payment may be described as a finder's fee, commission, tax, deposit, administrating fee, or some other incidental expense that will be repaid at a later date. Spoiler alert: it won't.

A scammer directs you to send advance fees to escrow agents or lawyers to give their scam an air of legitimacy. They will also use official-sounding email addresses to further fool you into believing an opportunity is genuine and set up professional-looking websites.

How to Avoid Advance Fee Scams

If you're contacted unexpectedly by an individual or company with an urgent request for payment or with a great opportunity that requires an upfront payment, ask yourself the following questions.

- Does the opportunity, deal, or prize seem too good to be true? If so, then it probably is.

- Do you really know who you're dealing with? If you haven't heard of a company before, learn more about them and contact the better business bureau if necessary.

- Why does the business only operate out of post office boxes? If a company you're thinking of doing business with doesn't have a street address, proceed with caution. Also, be suspicious if they can't provide a direct telephone number.

- Do you fully understand the arrangement? Are the terms of an investment opportunity needlessly complex? If so, then have them reviewed by a competent attorney before proceeding.

- Have you been asked to pay a fee to receive a prize or money? You should never be required to pay money to receive a prize, no matter how convincing the reason.

- Are you being put under pressure to pay quickly? Always be wary of individuals or companies that demand payment right away, or you face missing out.

- Do you need to provide personal information or account details? Never hand over personal information to someone who has contacted you via phone call or email, as this leaves you vulnerable to identity theft.

Common Types of Advance Fee Scams

The variety to advance fee schemes is limited only to the imagination of the scammers who invent them. Usually, they involve the offering of investments, sale of products or services, lottery winnings, or another kind of "unmissable opportunity."

Investment Advance Fee Scam

There is a wide selection of advanced fee investment scams. However, scammers often impersonate legitimate brokers or firms to help investors recover previous stock market losses by exchanging worthless stock for an established stock. You're required to pay an upfront "security deposit" or another fee, which you will never see again.

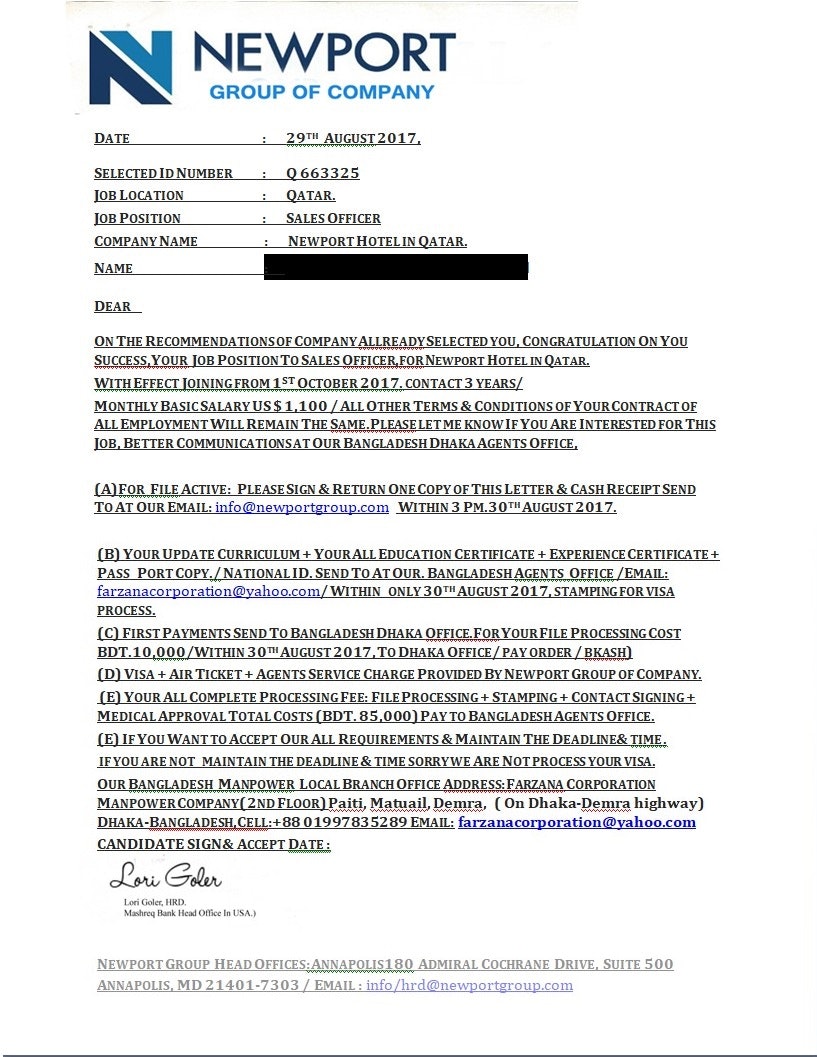

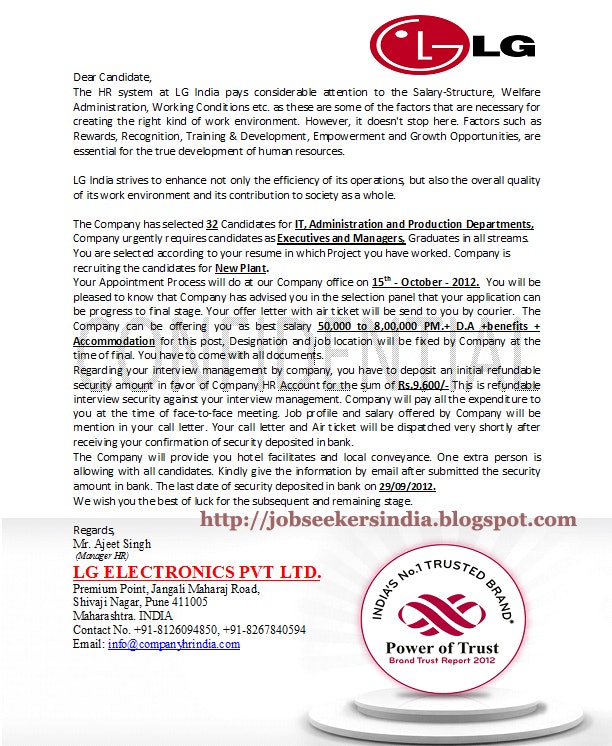

Career Opportunity Scam

This type of scam occurs when people respond to job adverts posted by fake companies. After an initial consultation, the scammer asks for an upfront fee, with the promise of kickstarting your career. Scammers will say the fee will be used to undertake further work on your behalf, but the promised employment and benefits are never delivered.

Online Dating or Romance Fraud

Romance fraud occurs when criminals go to extreme lengths to convince you that your online relationship is genuine. They will use manipulative and persuasive tactics so that when they ask you for money, the request doesn't ring alarm bells.

Scammers will use highly emotive or urgent requests, like emergency medical care, to convince you to part with your money. However, the scammer's promises to pay you back and to move your relationship forward are worthless.

Online Dating Rules To Protect Yourself From Scams

If you haven't met the person you are talking to online, never:

- Send them money

- Take out loans on their behalf

- Give them access to your bank accounts

- Transfer money for them

- Provide them with copies of your personal documents

- Agree to send or receive parcels on their behalf

- Invest your money based on their recommendations

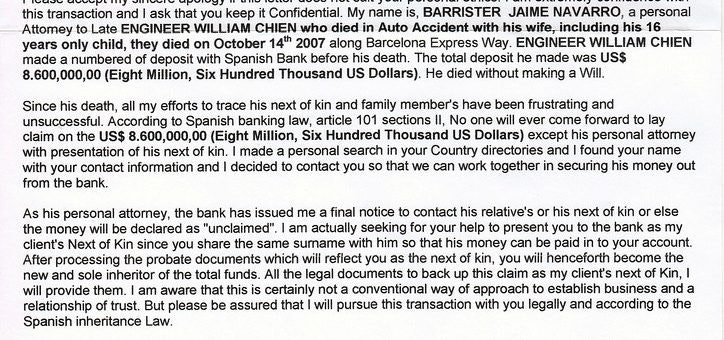

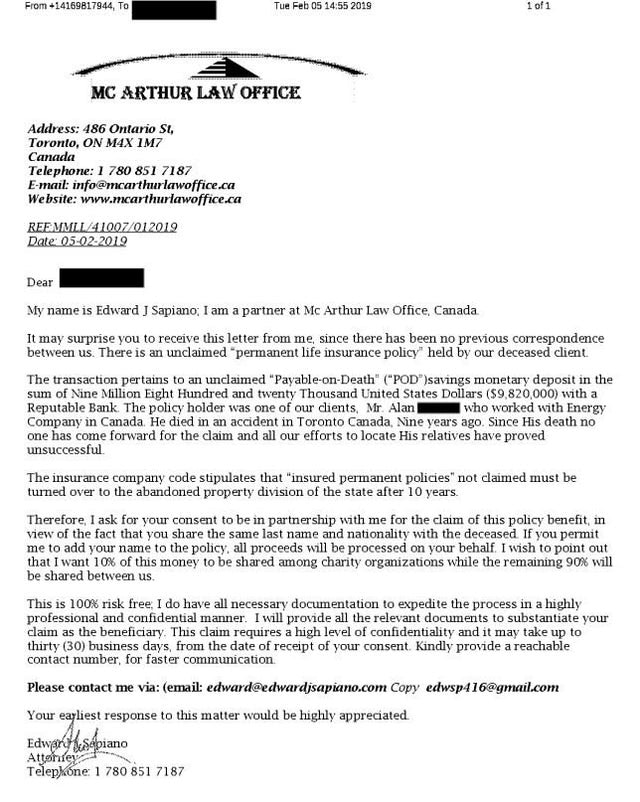

Inheritance Scam

A scammer, claiming to be a legal official, contacts you with the news someone has died, and you're in line to receive a large inheritance. They inform you that they can't trace any relatives of the deceased, but as you share the family name, the estate can be paid to you. So instead of the government getting the money, you would split the inheritance between you.

They will stress urgency and ask you to pay administrative or legal fees to release the inheritance. The scammers may also ask for your bank details so they can pay the inheritance directly into your account. Unfortunately, there is no inheritance, and you've not only lost money but also potentially given the tools the scammer needs to steal your identity.

Impersonation of Officials

Scammers impersonate official government departments, such as the IRS or the Social Security Administration, to demand payments for tax arrears or to restore your compromised identity.

WARNING!

Government agencies will rarely contact you unsolicited, and they will never demand payment or threaten legal action via email, text message, or phone call.

If you receive concerning communication from an official organization, don't respond. Instead, contact the agency directly, using contact information from the official website.

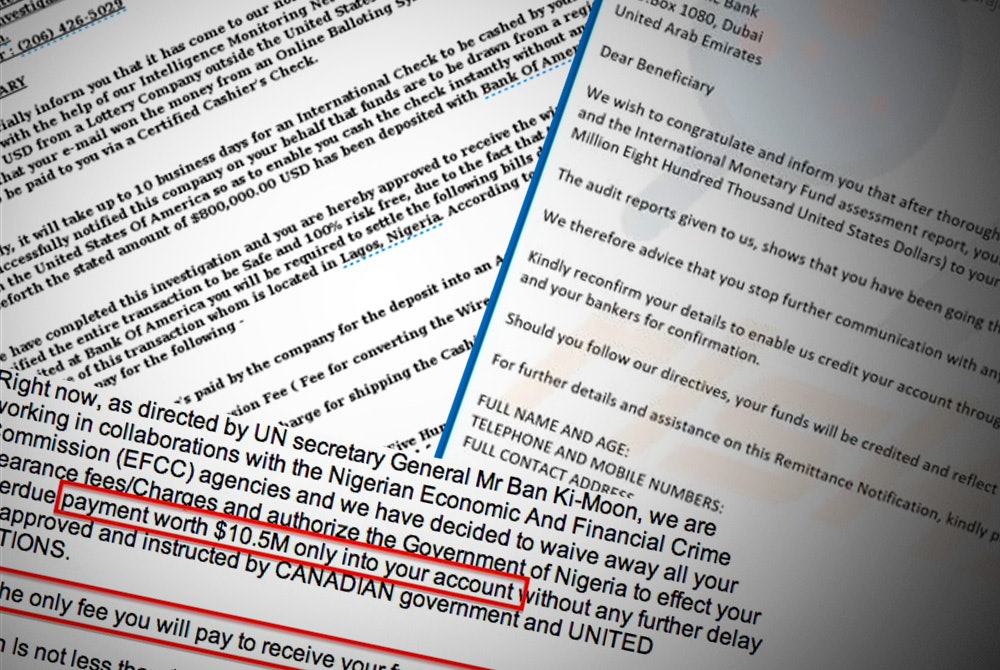

419 Fraud

One of the oldest forms of advance-fee scams, 419 fraud, is named after the country's criminal code where the scam originates. A stranger contacts you (usually via email) and asks you to help move a considerable sum of money from one country to another to be rewarded with a cut of the cash. A typical example of this scam is the infamous "Nigerian Prince Scam."

Red flags of 419 scams:

- A poorly written email with multiple grammar and spelling errors.

- The sender claims to be a distant relative or in a position of power.

- You're encouraged to act quickly and keep the request secret.

- For funds to be released, you'll need to pay a small administration fee.

Clairvoyant Advance Fees Scams

A cruel type of advance fee fraud, a supposed clairvoyant, gets in touch asking for an administration fee to reveal something awful or exciting in your future. They promise to tell you how to avoid or achieve your fate once you make payment.

Clairvoyant scammers often target elderly or vulnerable people and can approach their victims via email, post, telephone, or even face-to-face.

Ticket Scams

A "seller" offers you tickets for a concert, performance, festival, or sporting event that they don't actually possess. Once you've handed the money over for the tickets, the seller either disappears or sends you counterfeit tickets that will see you refused entry for the event.

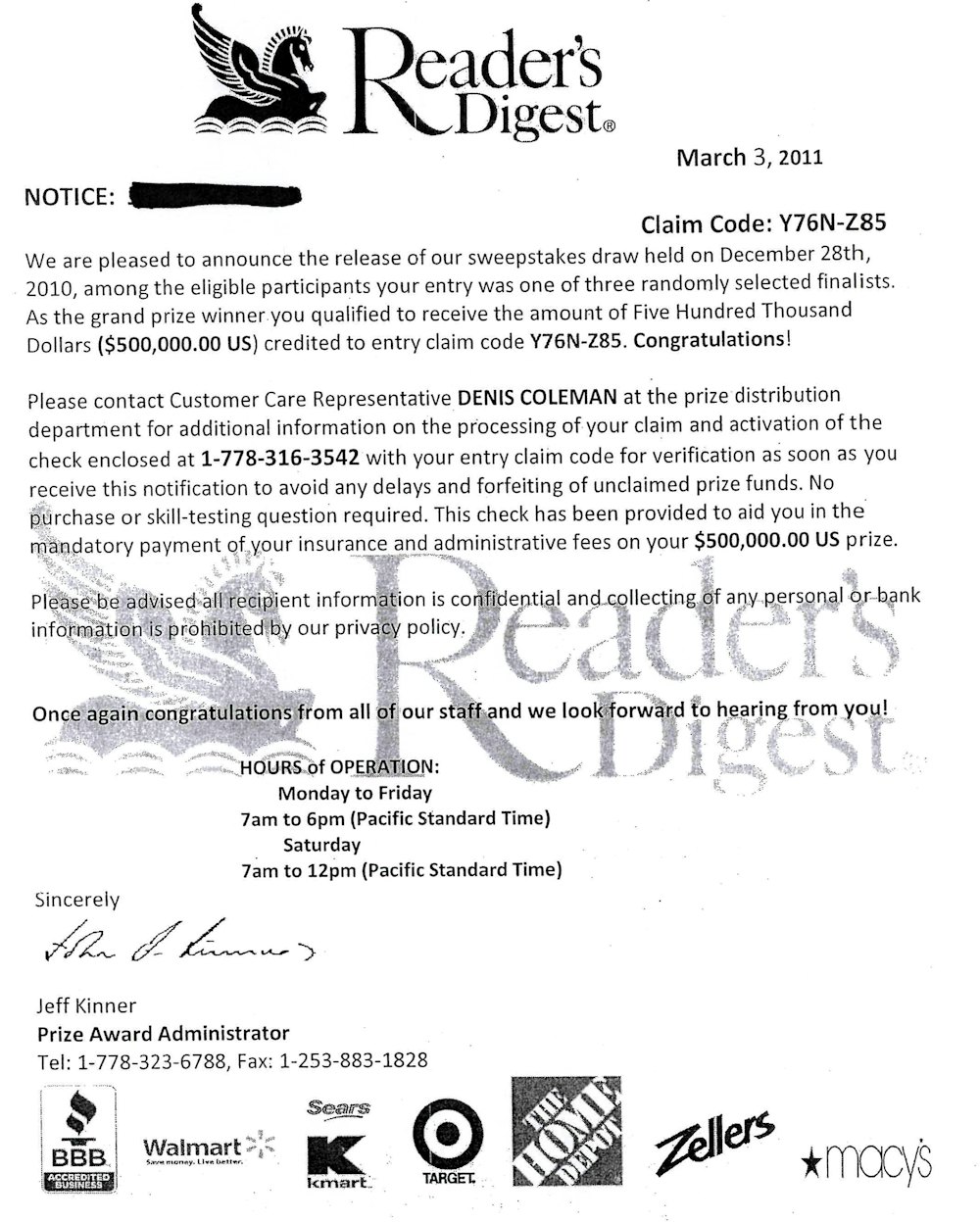

Lottery Prize Draw or Sweepstakes Scams

You receive an email or letter claiming you've won a lot of money on a foreign lottery or sweepstake. However, to claim your winnings, you need to pay a fee, whether it be to cover legal fees, taxes, etc. Once you've sent the payment, you'll end up disappointed when your big windfall never materializes.

The scammer may also ask for copies of your identification documents, claiming it is simply to verify your identity. However, your documents are likely to be used to steal your identity.

Vehicle Matching Fraud

A scammer claims to have found a buyer for a car you're selling. All you need to do is pay an upfront fee which is refundable once the sale goes through. However, as the buyer is fake, the deal doesn't materialize, and you're left out of pocket.

Fallen for an Advance Fee Scam?

If you suspect you have fallen for an advance fee scam, acting fast is key to mitigating any further damages.

- Break off all contact with the scammer at once. Block their email addresses and telephone numbers.

- Alert your bank if you have handed over your account or card details. They will cancel your card and issue you with a new one.

- Check your credit report for signs that your identity has been stolen, such as new lines of credit being opened and job applications in your name.

- If you think you've fallen victim to identity theft, you can freeze your credit report or place a fraud alert.

- Change your passwords if you're worried your online accounts may have been compromised. Use a password manager to create complex and unique passwords for your accounts and store them securely from hackers.

- Contact your credit card provider if fraudulent purchases have been made. Federal law guarantees your liability is limited to $50.

- Use a call-blocking app to protect you from further scam calls, as scammers tend to contact previous victims, using different identities to commit other frauds.

- Report the scam to the authorities.

BEWARE!

If you have already fallen victim to fraud, you're vulnerable to "fraud recovery" advance fee scams. This is when scammers contact you claiming to be lawyers or from law enforcement. They'll tell you that they can help you recover your lost money but request a fee upfront to do so.

Comments