- How Do Cash App Flips Work?

- Scammers Use Legitimate Hashtags

- How to Avoid Cash App Flips

- Fallen for Cash App Flips?

- Frequently Asked Questions

Half Venmo, half PayPal, Cash App offers yet another way to wield your wallet online, but the new-age payment option also offers plenty of ways to fall prey to Cash App scams, with the most popular being Cash App flips.

Cash App flip scams have provided lucrative for money flipping scammers because of how they lure in Cash App users with the promise of free money. The best way to beat these scams is to simply ignore messages about Cash App flips and certainly don't invest any money into them.

How Do Cash App Flips Work?

This scam promises users that they can turn a small investment into much more money with little effort. But, of course, these scammers are only investing your money in themselves and often run away with your funds before you realize what's happening.

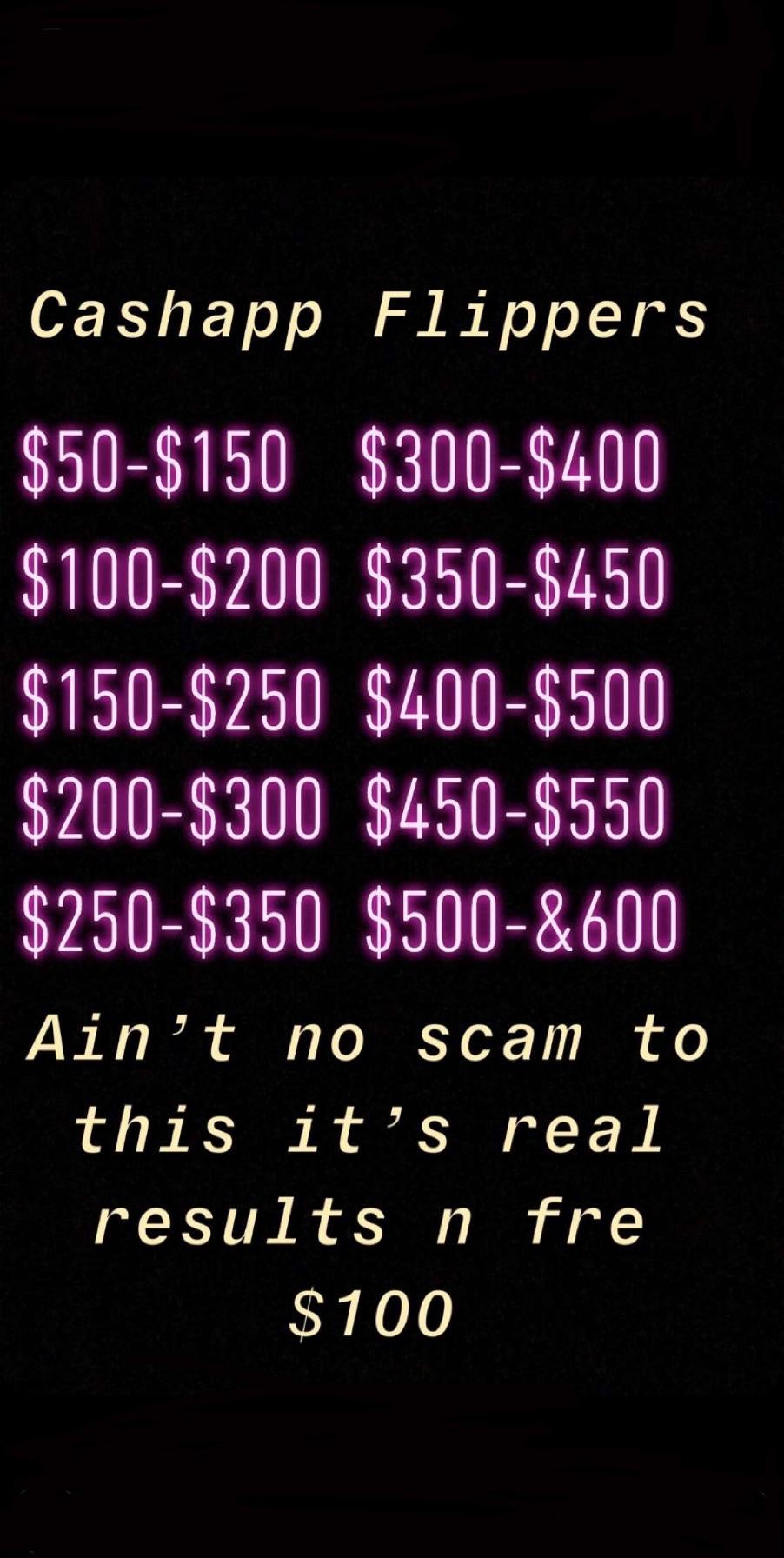

We can boil down the Cash App money flip appeal to three words: get rich quick. That's the scam's fundamental basis, and what scammers promise Cash App users will happen to them once they send over their money.

But of course, the only people making a profit, in this case, are the scammers themselves. Here's how the scam works.

You Hear About a Great Investment Opportunity

Most likely, you'll see an advertisement on social media. The exact "money-making scheme" can take many forms, but it promises to return a significant profit on your investment with little-to-no effort.

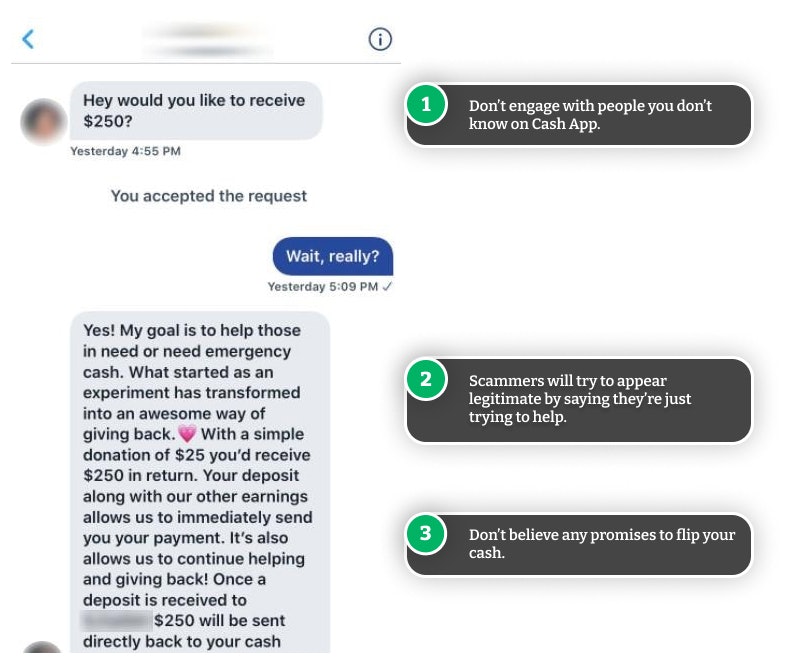

Sometimes, a Cash App scammer directly messages you with an offer that sounds too good to be true.

Rather than leaning on a business angle, these direct appeals are often disguised as a "charity" run by a non-profit. They will also try to tempt you with claims of outrageous fortune, saying that a small investment will return its worth many times over and fast!

Example Cash App Flip ScamI can flip your money using Cash App and give you back 5x your original amount.

- $10 -> $50

- $20 -> $100

- $30 -> $150

- $50 -> $250

- $100 -> $500

You Start Talking to the Scammer

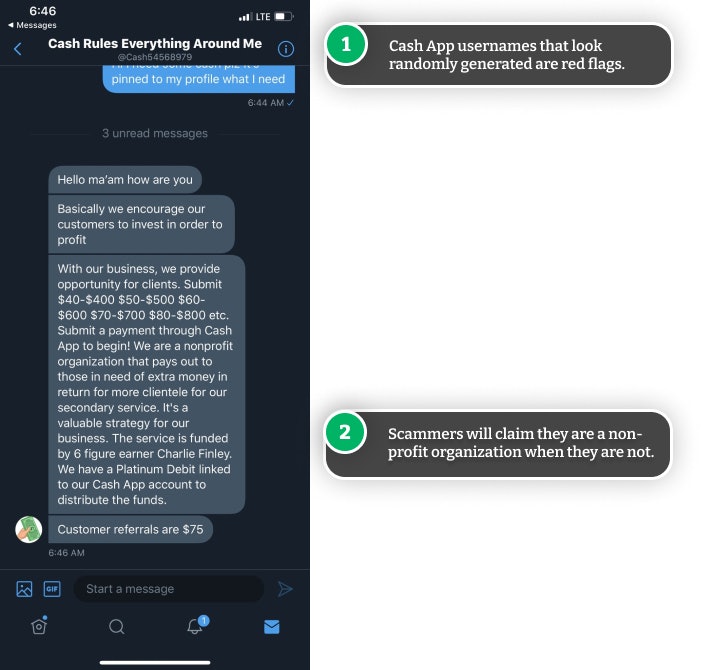

If the scammer doesn't message you directly, their ad tells you how to reach them, which is, more often than not, through social media. Their pages are usually filled with fake stories about the scammer and the scam itself, talking about how easy and successful the scheme is.

You direct message the scammer, and they try to convince you that they're worthy of your investment and that the money flipping scheme is legitimate.

They even may try to entice you with other incentives, such as free money for referring others to their services.

Typically, scammers can make a Cash App flip seem easy—much more straightforward than playing the stock market.

Investing is a highly complex process, which can yield all kinds of results. Promising someone "$5,000 for an investment of $500" is far too clear-cut to be realistic.

You Make the "Investment"

Once the scammer has you hooked, they start asking for money.

In a Cash App flip scam, the scammer asks you to send money through Cash App. Any profits are sent back to you through the app, as well.

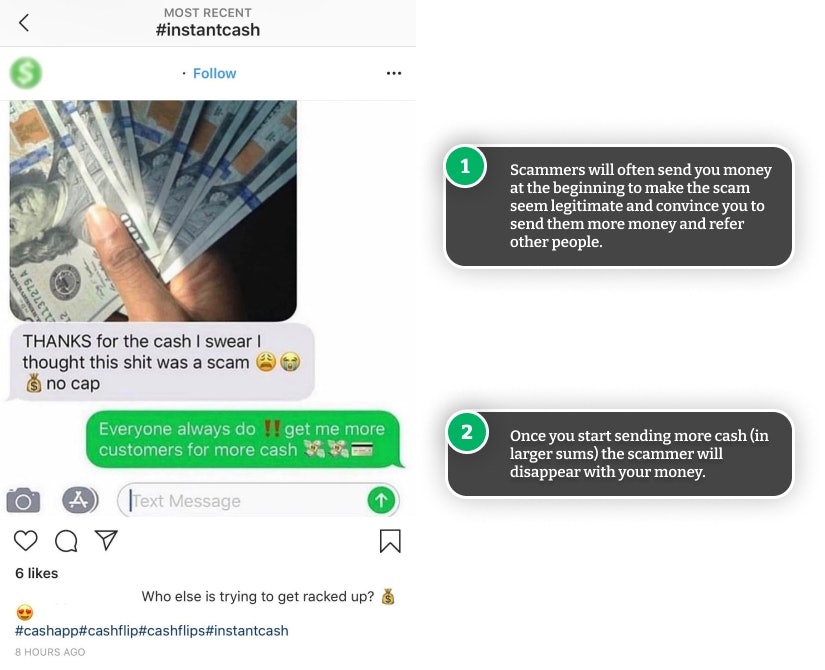

Some scammers start with a small trial investment to gain your trust and send you money shortly after investing. Some people have even claimed to initially receive real money (a smaller flip) from scammers.

But at some point, the scammer asks for a more significant investment—typically anywhere from $100 to $1,000. That's when the scam starts to set in.

A Cash App flip scammer will often send you back real cash at least once in an attempt to have you send more money the next time, so don't be fooled. Most people will only send a small amount of money the first time, for example, $20. The scammer will then send back $100 as promised and encourage you to invest even more to get more back or refer other customers.

Coming across one of these Cash App flips may feel like your lucky day, but try to remember: If these investors were so good at what they did, they wouldn't be advertising their services on social media.

You Pay "Fees"

Most scammers in these situations charge you a fee for their service—whether it's a flat rate or a percentage of your investment.

To add insult to injury, some scammers also tell you that you must pay a transfer fee to have the money sent back to your account. Sometimes, the story goes that you have to give them money to pay the IRS.

These are all phony claims and only add to the total amount of money the scammer takes from you.

You Never Hear from the Scammer Again

After you send money to the Cash App flip scammer (whether one time or multiple times), they disappear.

They may delete their Cash App account, block you on social media or simply stop responding to your messages, but either way, they have your money and have no plans of giving any of it back.

The money flipping scheme is complete, and they're off to find their next victim using a different account.

Scammers Use Legitimate Hashtags

There are legitimate Cash App giveaways and sweepstakes that you can enter on social media. The company uses hashtags #CashAppFriday, #CashAppWednesday, and #SuperCashAppFriday to promote these giveaways, which scammers then use to trick their next victims.

If you want to enter a legit Cash App giveaway, make sure you're entering one that's posted by the legitimate Cash App social media accounts:

Note that if you use these hashtags on your own posts, scammers will likely target you and DM you about an excellent opportunity to flip your money.

Advice from Cash App

The company advises Cash App users to contact their customer service personnel if they have fallen for a scam using the app. They also note that they will never ask customers to:

- Send them money

- Give their PIN or sign-in code

Cash App warns that their employees are often impersonated by scammers circulating fake phone numbers online. The only legitimate 1-800-969-1940.

How to Avoid Cash App Flips

Although flipping cash may seem enticing, it can be devastating, causing you to lose thousands of dollars. There are a few strategies to beat and altogether avoid money flipping scams, including:

- Not investing in the scheme, no matter how good the deal seems.

- Never giving out financial information, especially your bank account details.

- Never giving out your Cash App password or PIN.

- Never giving out additional identifying factors that can be used to masquerade as you online.

As a general rule of thumb, don't believe scammers claiming to be able to flip your money—it's as simple as that.

You can further avoid running into trouble with such scams by:

- Researching any opportunity you're interested in. That includes investigating the person posting it and the actual scheme they're proposing.

- New Cash App accounts with usernames that seem randomly generated are usually signs of a scam.

- Running ad blockers on your social media platforms. This won't completely protect you but may limit the number of "get rich quick" scam ads you see.

- Staying wary of buzz words. Things like "guarantee," "low risk," "high reward," or "fast-acting" are hardly ever what they seem—but almost always red flags.

Unfortunately, with Cash App money flip scams, as with most things, if it looks too good to be true, it most likely is.

Fallen for Cash App Flips?

If you've fallen victim to a Cash App money flip scam, there's often little you can do.

One of the reasons many scammers have started using Cash App is because it's challenging to get your money back through the platform. Most direct deposit money transfers are instantaneous and almost always irreversible.

Report Cash App Flips to Cash App

It may be possible to take matters up with Cash App directly. The company allows customers to dispute completed transactions made through their cash cards, though it's unclear how much they can help with direct deposits.

Still, you can contact Cash App support through your app or on Cash App's customer support website.

If the Cash App team can't offer any help, you can try disputing the charge with your bank.

It's important to verify links and contact details to beat imposters.

Report the Cash App Scam to Your Bank

You can, and should, also get in touch with your bank, and:

- Tell them you lost your money on Cash App because of a money flipping scammer.

- Put a stop to any further payments.

- Cancel any credit or debit cards associated with your Cash App account.

Unfortunately, in these cases, the best offense is a good defense.

Report the Scam to the Authorities

Whenever you fall for a scam, it's a good idea to report it to the authorities. Although it won't always help you get your money back, it will help stop the scammers on a larger scale and help warn other potential victims.

Comments