- What is the Scam? Red Flags to Look For

- Red Flags of Fake Carrier Text Messages

- How to Beat this Scam

- How to Recover After Falling For this Scam

- Frequently Asked Questions

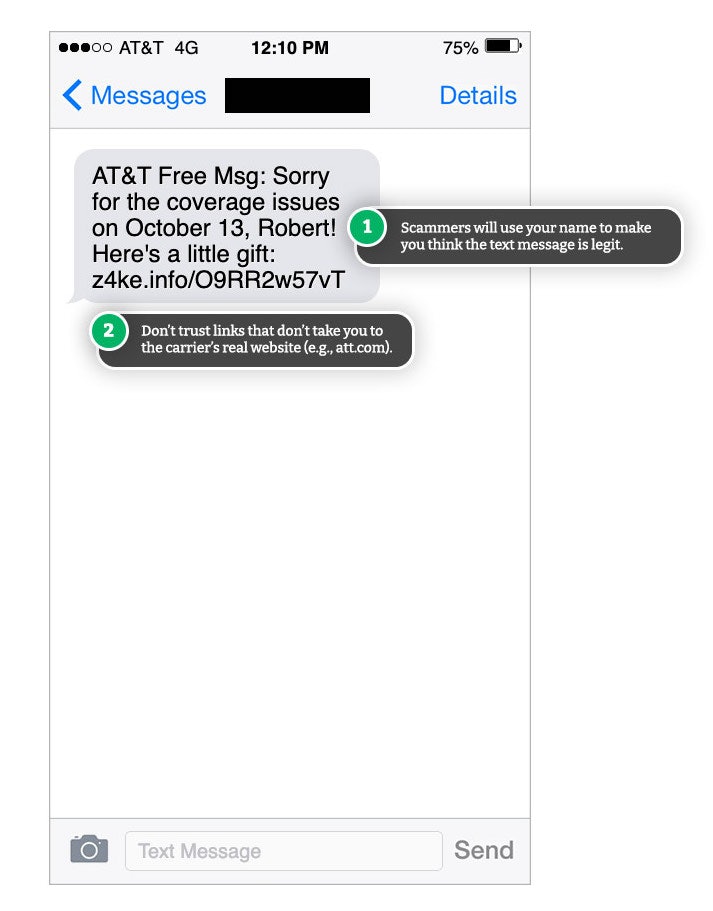

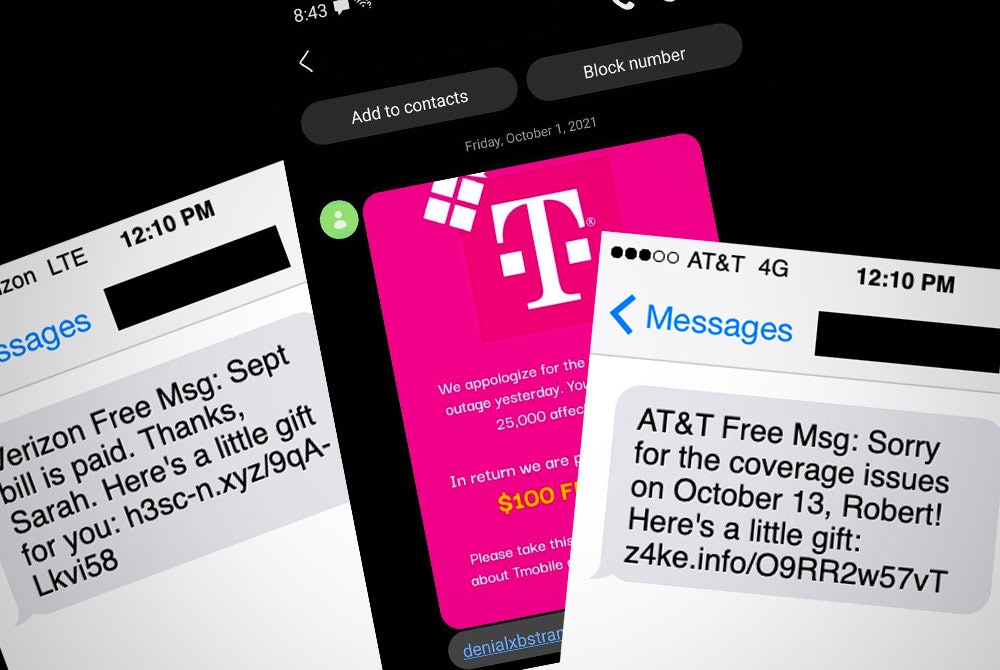

If you're an AT&T, Verizon, or T-Mobile customer, you may have received a text message that appears to be from your carrier. Don't be fooled by the promise of a gift—these messages are from scammers trying to steal your identity.

What is the Scam? Red Flags to Look For

The goal of this scam is to get you to click the link and then enter your information into a web form. Although the text message and the website it directs you to may look legitimate, they aren't. If you enter your information, the scammers will be able to use it to log into your accounts and steal your money.

Here's how the scam works.

You Receive a Text

You receive a text message from your carrier, whether it be Verizon, AT&T, or T-Mobile. Although the messaging will differ, every text message will attempt to have you click on a link to claim a gift or some kind of compensation.

Example Scam Text MessageAT&T Free Msg: Sorry for the coverage issues on October 5, Julia! Here's a little gift: z3ekr.info/O3QQ3w4fnt

Variations of the text message scam include:

- Sorry for the coverage issues on [date]

- Sorry for the signal down time on [date]

- Free Msg: [Month] bill is paid. Thanks, here's a little gift for you.

- Latest bill is paid.

- Thanks [Name] for paying your phone bill on time for 10 years!

- AT&T Free Msg: Joe, we accidentally overcharged your phone bill last month. Please your compensation here [link].

- Free msg: Your bill is paid for March. Thanks...

- Your bill is paid for March. Thanks, here's a little gift.

- ATT Free Msg: December bill is paid. Thanks, here's a little gift for you.

- VZN free msg: December bill is paid. Thanks, here's a little gift for you.

The text will also likely include your name to make it seem more believable.

Regardless of the messaging, all of these scam texts will offer a "little gift" and include a link for you to click on. Do not click the link.

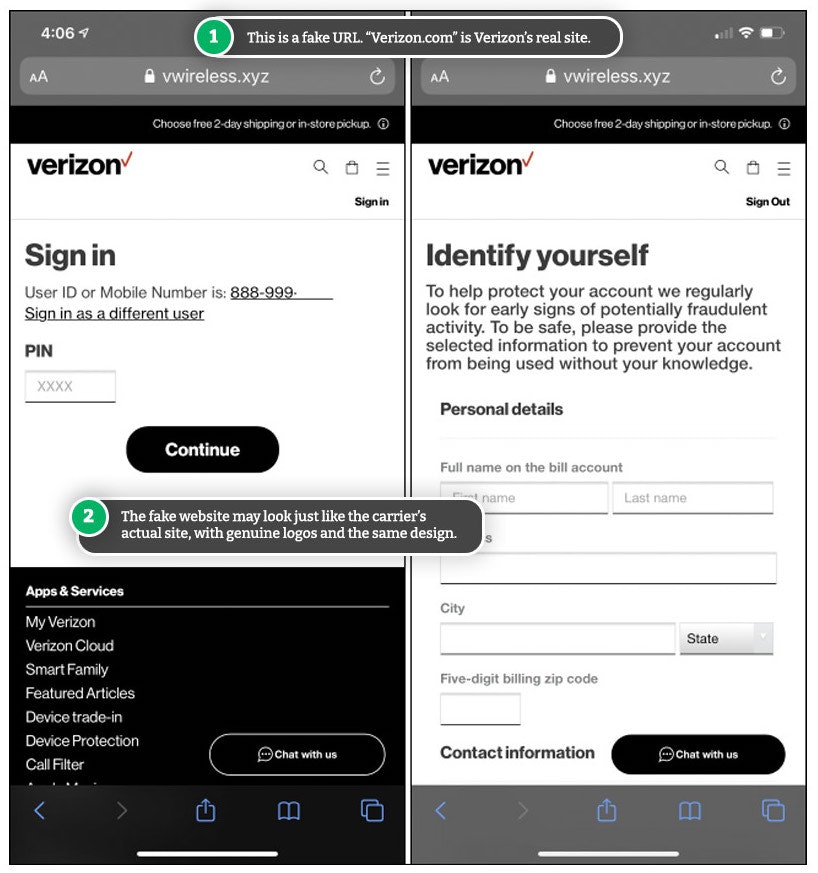

You Click on the Link and Enter Your Information

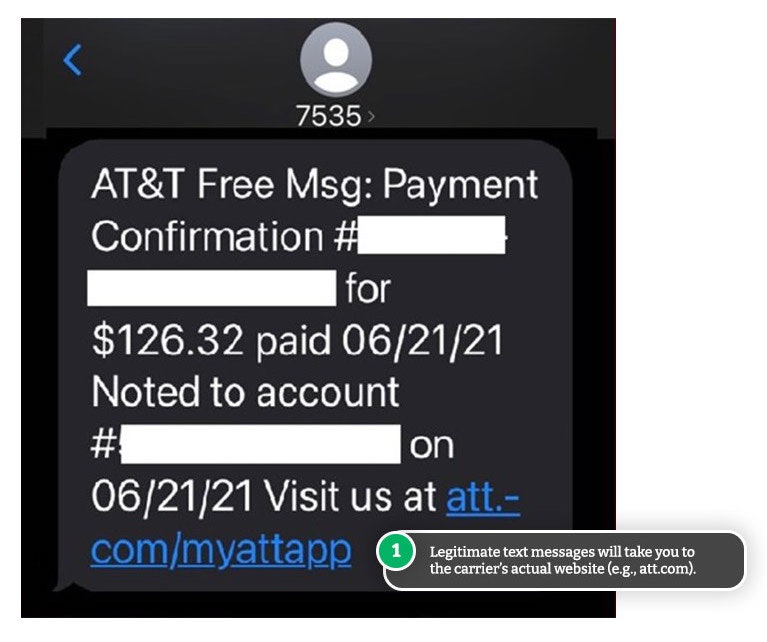

If you click on the link within the scam text message, it will take you to a page that looks like it could be a legitimate Verizon, AT&T, or T-Mobile website. It may include the carrier's logos and branding to seem trustworthy.

At this point, your information is still safe—it's the next step that's the most important to avoid.

To claim your "gift," you'll need to enter your information. The fake site may ask for your:

- Full name

- Address and zip code

- Phone number

- Account login information (i.e., username and password)

- Account number

- Social Security number (SSN)

Do not enter any information. Once you enter your information, the scam is complete. Your details are now in the hands of the scammer.

The Scammer Steals Your Identity

Armed with your information, the scammer can now try to:

- Gain access to your cell phone account.

- Hijack your SIM card to access your two-factor authentication codes.

- Gain access to your bank and credit card account.

- Log into your email account.

- Apply for credit in your name.

- Fraudulently use your debit/credit cards.

The possibilities are almost limitless when it comes to having your information stolen by a scammer.

Red Flags of Fake Carrier Text Messages

If you receive a text message from your carrier, before clicking on any links or replying, look for these red flags of scams:

- A link that takes you to a non-carrier website. Genuine URLs for these carriers include:

- Verizon:

- https://www.verizon.com/

- https://secure.verizon.com/vzauth/UI/Login

- go.vzw.com

- T-Mobile:

- https://www.t-mobile.com/

- https://account.t-mobile.com/signin/

- https://t-mo.co/

- AT&T:

- https://www.att.com/

- https://signin.att.com/

- Verizon:

- The text message sent from a regular phone number.

- Verizon usually sends text messages from a 12-digit phone number (without an area code).

- T-Mobile's text messages are usually sent from a 3-digit phone number (usually "456")

- AT&T's text messages usually do not come from a regular phone number with area code.

How to Beat this Scam

The key to beating this scam is simple: DON'T CLICK THE LINK.

If you're unsure whether or not the text message is legitimate, access your account by typing in the carrier's website address into your browser or logging in via the app. From time to time, Carriers will send you SMS updates (if you opted in) but will usually only include links to send you to the login page for your account.

If you do happen to click the link, DON'T FILL IN THE ONLINE FORM. If the site takes you to a login page, don't try to log into your account from there. Instead, close the window and go to your carrier's website directly (by typing it in or Googling it) or log in via the app.

How to Recover After Falling For this Scam

If you enter your information into a fake website, it's essential to act quickly to protect your identity and money. Follow these steps:

- Change your online account password. If you use the same password for any other online account, change the passwords for those also. (Use a password manager if you have trouble remembering all of your logins or need help coming up with strong passwords.)

- Call your carrier and request to have an account PIN set up if you don't already have one (this is different from your online password). If you entered this PIN on the fake website, ask to change the PIN. The scammer won't be able to change or access your account information without this security PIN.

- Monitor your cell phone account. If the scammer has gained access to your account, they're going to try and order cell phones using your saved credit card. They may even change your email address on your account, so you don't receive notifications of their fraudulent purchases.

- Monitor your bank and credit card accounts. If you notice any unauthorized purchases, contact your bank, dispute the transaction/s and cancel your cards.

- Place a fraud alert on your credit report. This is especially important if you entered your Social Security number (SSN) on the fake website. For additional security, you can completely freeze your credit.

Identity theft can take years to recover from, so you need to act quickly and take all the necessary steps to prevent scammers from taking over.

Comments