- What is the Scam?

- Red Flags To Watch Out For

- How to Beat This Mobile Payment App Scam

- How to Contact the Real Customer Support

- How Others Have Been Scammed

- Have You Fallen For This Scam?

- Frequently Asked Questions

Protect yourself from this scam by knowing the red flags to watch out for and what to do if you receive a suspicious call. The key to beating this scam is to keep your two-factor authentication codes to yourself and never give out your personal information to someone over the phone.

What is the Scam?

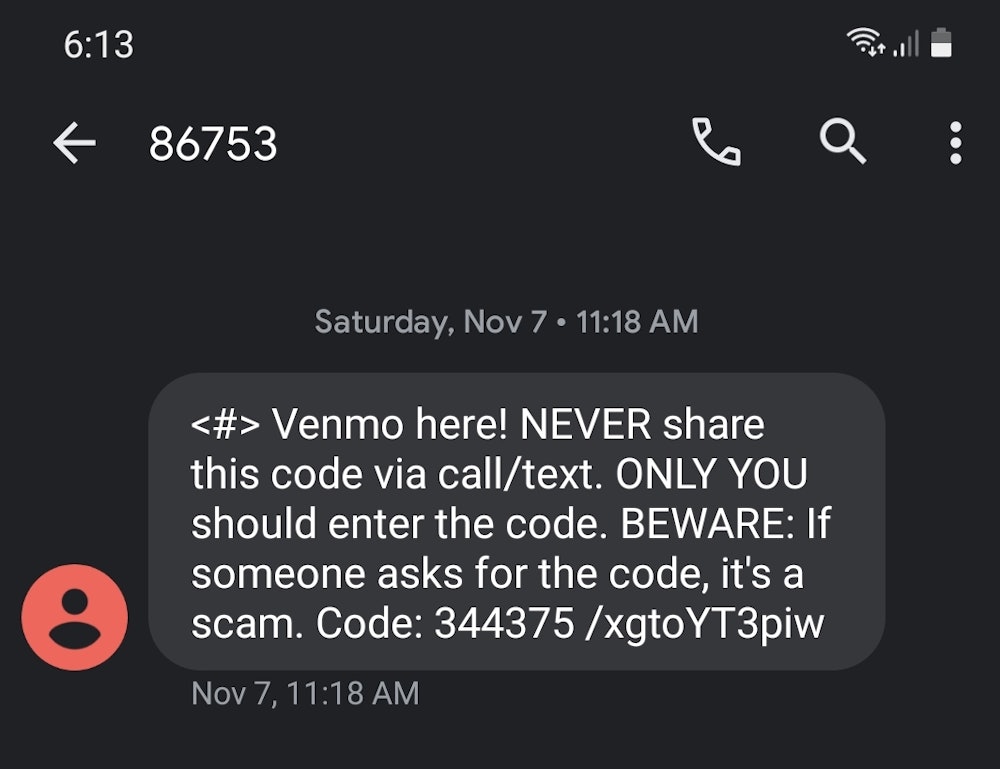

In this scam, scammers pose as representatives from the mobile payment app and attempt to gain access to your account by having you send them a two-factor authentication (2FA) code. It's important never to give anyone your 2FA code, even if they say they're from the "Fraud Department" of a well-known company.

Representatives from money transfer apps like Zelle, Cash App, and Venmo will never ask for this code.

Here's how this scam works.

You Connect With a Fake Customer Support or the Fraud Department

There are two different ways this scam is set up:

- You receive a phone call from a fake "Fraud Department" or "Customer Support" from the mobile payment app company. The call is actually from a scammer posing as a representative of the company.

OR - You find the customer support number online and call the number yourself. In this case, you may have found a fake number that has been posted online by scammers.

Example Phone CallThis is the fraud department from Venmo. We have received some suspicious activity on your account, but don't worry, we'll take care of it right away for you.

I'm going to send you a code to your registered phone number so I can verify your identity. Please tell me this code when you receive it.

The scammer will be super helpful and act like they're just trying to get you your money back. Even if you tell them that you don't see any suspicious activity on your account when you're logged in, they will

You're Sent a Verification Code

The scammer on the phone will tell you that there is suspicious activity on your account and will ask whether you made certain transactions. When you're unable to verify them, the scammer says they will send a verification code to your phone, which you need to relay back to them.

Example Phone CallYes, I can see there are several transactions in your account that are very suspicious. You cannot see them on your end but I assure you they are there. If you give me the code I just sent to your phone I can take care of it right away.

You can see all transactions by logging into your account, which is the first thing you should do if you ever receive a phone call like this. The scammer will continue to push for your 2FA code, but the only thing you should do at this point is hang up and change your password.

This code is, in fact, the two-factor authentication code that the app sends you when you (or the scammer in this case) log into your account from an unknown device. 2FA codes are becoming more common across apps, accounts, and emails to provide additional protection for your account. Without this 2FA code, scammers can't log into your account even if they have your username and password.

If you give the 2FA code to the scammers, they'll be able to log into your account—whether it be your Venmo, PayPal, Cash App, or another mobile payment account—and gain access to your account balance and any linked bank accounts or credit cards.

Beware of Similar Scams

In a similar scam, the scammer asks you to download an app called Team Viewer, which enables them to control your phone remotely. If this happens, hang up immediately—do not download Team Viewer, and don't give the scammer access to your phone. Representatives from these apps will never ask you to control your phone remotely.

The Scammer Steals Money from Your Accounts

Shortly after you provide the scammer with the verification code they asked for, your money will start being transferred out of your account and any linked bank accounts or credit cards. You've essentially lost your money.

Red Flags To Watch Out For

These are the key ways you can identify whether the person on the other end of the line is a scammer or not (even while they are on the phone):

- They ask for your verification code that is being sent to your phone.

- They ask you to download another app (e.g., Team Viewer).

- You check your money transfer app, and you're not seeing the same suspicious activity that they are seeing.

If any of the scenarios above happen, you can be sure it's a scammer on the other end of the line. Hang up and do not give out any personal information or your two-factor authentication code.

Safety Tip: Link a Credit Card Instead of a Bank Account

Linking a credit card to your money transfer app instead of your checking or savings account will protect your money. Credit cards generally have added protection that your other bank accounts don't have, and the scammers also won't get access to your savings, which could be more than your credit card limit.

How to Beat This Mobile Payment App Scam

The most important thing to know is that these mobile payment apps will never ask for your login information or two-factor authentication code over the phone. This is the primary way the scammers get access to your account and money.

If the representative asks you for this information, hang up and call the correct number.

To beat this scam:

- Never give out your 2FA code: The minute someone asks you for this code, you can be confident that they are attempting to scam you.

- Make sure you're calling the right number: Scammers have set up web pages with fake numbers in an attempt to have you call the wrong number and give out your account information. When contacting customer support yourself, be absolutely sure you are calling the right number.

Looking for a Cash App Support Number? There Isn't One

Cash App does not have a customer support number to call. The only number you can call is for an automated system. If you have called Cash App customer support via a number you found online and get a real person on the other end, it's a scam.

How to Avoid Being a Target

Scammers in this scam target anyone with a mobile payment app account, such as PayPal, Cash App, and Venmo. However, you likely won't receive a phone call from these scammers until they have your login information—they call you when they need your two-factor verification code.

The best way to avoid being on the scammer's hit list is to make sure you're using secure and strong passwords for all of your accounts—and don't use the same password for more than one account.

How to Contact the Real Customer Support

Although you can't stop a scammer from calling you, you can avoid calling the wrong number if you need help with your account.

Many of these money transfer apps, banks, and other similar institutions offer a secure way to get in touch with their customer service and fraud departments. A standard method is to send a secure email to them while logged into your account. These apps and banks have this requirement to avoid you having to provide confidential and personal information to them via email or even over the phone.

Once the real customer support department has received your email, they will give you a callback or continue to help you via email.

- Cash App: According to the Cash App website, there is no phone number that you can call to speak to someone from customer support. You must contact them via email or mail and wait for them to respond.

- Venmo: Venmo also doesn't publish its phone number on the contact page, but you can chat directly with a customer support representative within the app itself or by sending an email.

- PayPal: For issues with your PayPal account, PayPal prefers a secure message to be sent while logged into your account.

- Zelle: If you have any issues using Zelle for money transfers, contact your bank or institution for help.

If you don't want to wait to talk to someone on the phone, make sure you're calling the correct phone number. If you're searching online for the right phone number to call, make sure it's from the right website.

How Others Have Been Scammed

In the grand scheme of things, this is a fairly new scam since the usage of these apps in the U.S. is relatively new—Venmo users have increased from 3 million to 52 million in just 5 years. In 2020, we saw more scammers using targeting these users, and the number is only going to increase.

- Wade Hankins lost $21,800 from his Cash App account and an additional $2,200 from his linked checking account (total of $24,000).

- Derashia Gist lost $4,600 from her Cash App account after thinking she was talking to the fraud department.

- Cameron Howell lost $1,400 from his Venmo account after giving his 2FA code to the scammer.

- Sakala Lewis lost $5,800 from her Cash App account after calling what she thought was calling

- Cash App customer support. The scammer had her download the Team Viewer app to verify her identity, but what Lewis didn't realize was that she gave the scammer remote access to her phone.

Have You Fallen For This Scam?

If you've unfortunately fallen for this scam, you're not alone. Others have lost thousands of dollars because the scammers seem legit and communicate the urgency to verify your account.

If you have fallen for this scam, follow these steps:

- Log into your account and change your password immediately. Unfortunately, your money may already be gone at this point, but you can stop the scammers from gaining access to more money.

- Remove any devices that you don't recognize. This can be found within the "Security" settings of your account. This also may be labeled as "Remembered Devices."

- Report the fraud to the money transfer company. Unfortunately, there may be very little that they can do since you technically willingly gave your information out, but it's worth reporting anyway.

- Contact your financial institution if money was taken out of your bank or credit card account. They may be able to retrieve some, if not all, of your money. Money taken from your credit card will likely be more protected.

Comments