- Real Estate Wire Fraud: Targeting Homebuyers

- Real Estate Wire Fraud: Targeting Renters

- Signs You May Be Getting Scammed

- How to Beat This Scam: Real Estate Best Practices

- What To Do If You’ve Been Scammed

- Frequently Asked Questions

Not only is real estate wire fraud becoming more and more common, but the losses are devastating, costing victims thousands of dollars. Imagine putting a down payment on your home only to realize you sent it to the wrong person—the money is lost, and you no longer have enough money to purchase your dream home.

Real estate wire fraud involves a scammer impersonating a realtor, mortgage company, or landlord and having you transfer money to the wrong account—this is also known as a business email compromise. There are two versions of this scam, one targeting homebuyers, and the other targeting renters.

Real Estate Wire Fraud: Targeting Homebuyers

The version of this scam that targets homebuyers is far more severe than the one targeting renters, as more money is at stake. Here’s how the scam works.

You Find a Home and Are Ready to Make a Deposit

After finding your new home, you’ve signed the contract or purchase agreement and are ready to start the closing process—the first step is making your down payment or earnest deposit.

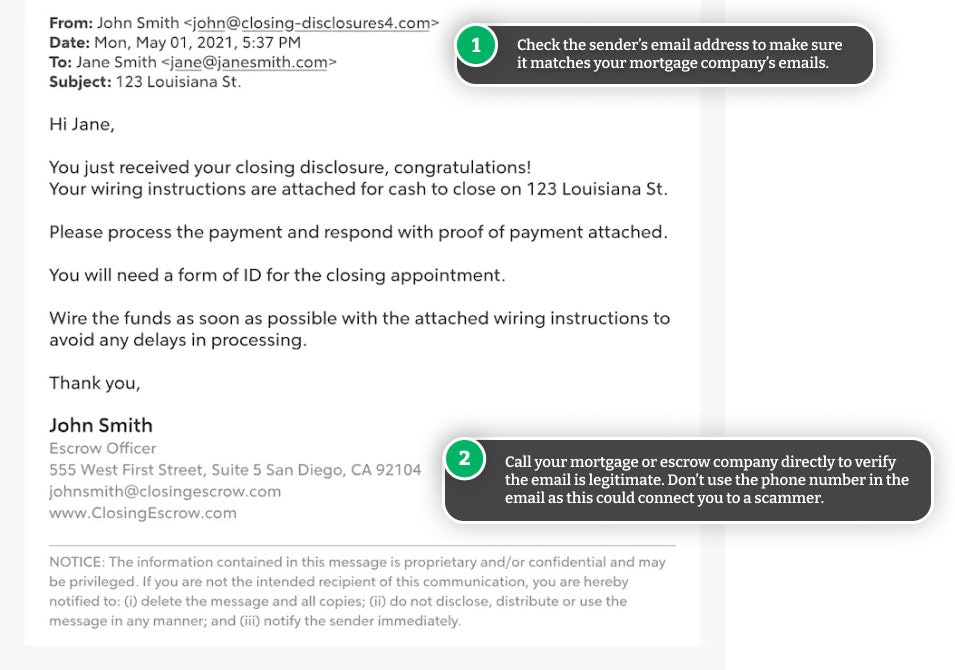

You Receive An Email Asking for Payment

Shortly after signing the contract, you receive an email from your mortgage broker (or at least it seems to be from your broker) giving you instructions on how to deposit the money. You follow the instructions and continue with the next steps to close on the house.

Scammers use spoofed emails to send you wire transfer instructions—these are fake emails intended to make you think they’re coming from your mortgage broker.

Your Mortgage Company Contacts You Asking for Payment

Even though you have already transferred your deposit, your mortgage company contacts you, asking you to wire funds to them. You tell them that you’ve already made the deposit, but they cannot see the transfer on their end.

After providing them with the bank information you received, they can confirm that you’ve transferred the money into a scam account. You’ve now become the victim of mortgage wire fraud, and your money is lost to a scammer.

Real Estate Wire Fraud: Targeting Renters

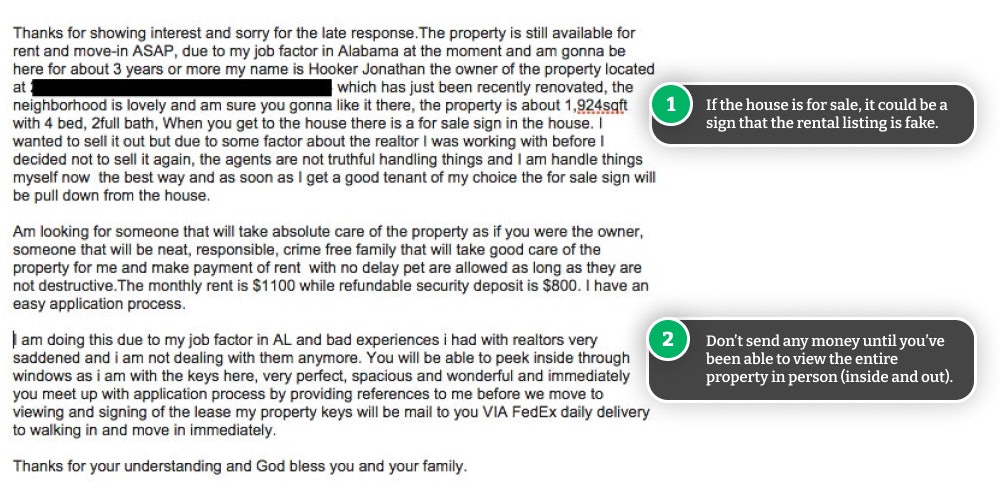

In another version of this scam, fraudsters target those looking to rent a new home. The major difference between this scam and real estate wire scams targeting homeowners is that you’re being scammed from the very beginning. Here is how these scams usually work.

You Find a Property for Rent

You find a property for rent on a site like Craigslist and contact the poster, letting them know you’re interested and would like to see the home. (Note: These scams usually only happen on classified websites, not legitimate real estate websites like Redfin or Zillow.)

The Landlord/Realtor Is Unable to Show You the Property

For whatever reason, the landlord cannot show you the property but sends you photos and tells you the home is in excellent condition. Common reasons why they can’t show you the property in person include:

- Someone is living at the property currently

- They are out of town

- They are on military deployment

You Pay the Deposit

Being impressed with the photos and taking the landlord’s word that the home is in good shape, you sign the rental agreement and pay the rental deposit. The landlord will usually ask for a deposit via wire transfer (e.g., MoneyGram).

The Landlord Stops Responding

After making the deposit, the landlord stops responding to your emails. If you had a phone number for them, the calls remain unanswered or the phone number is disconnected completely.

You’ve been scammed. The property was never for rent, and you’ve sent your money to the scammer. Unfortunately, you cannot get your money back since you used a wire transfer.

Signs You May Be Getting Scammed

Whether you’re looking to rent or buy a home, there are some signs of scams to look out for. The key to staying safe during any real estate transaction is to be diligent and look closely at all emails, documents, and information before acting on anything.

Some signs of a scam include:

- An email from your “mortgage broker” or “realtor” that doesn’t have the email address you’d expect.

- Improper English grammar and several spelling mistakes in emails and other communication you receive from your mortgage company or realtor.

- Not being able to view the property before making a deposit.

- A request for a deposit via unconventional methods (e.g., MoneyGram or Western Union vs. regular wire transfer).

How to Beat This Scam: Real Estate Best Practices

When buying or renting a home, you should follow these best practices to avoid being scammed and losing thousands of dollars:

- Look closely at emails for signs of scams: Pay close attention to the sender’s email address and any red flags within the actual content of the email.

- Verify bank account information: Before wiring any money to the mortgage company or escrow service, contact your mortgage broker directly to confirm the account number and other financial information are all correct. (Call the phone number you’ve been using during the transaction—don’t call the number in the email you received if it’s different.)

- Don’t deposit money before seeing the house: If you’re considering renting a home before seeing it in person (or having someone you know view it first), don’t.

- Have a third party review your documents: Whether you have a lawyer or just want your real estate agent to look over your documents before you transfer money, it’s a good idea to have at least one other person verify it first.

- Don’t rush: Buying or renting a home is a big commitment—a lot of money is at stake if you get it wrong. Take your time to read agreements and instructions before taking any actions.

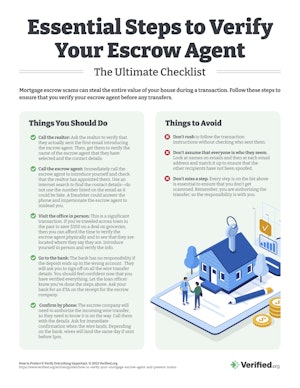

Mortgage Escrow Checklist

Print our handy checklist to keep yourself in check when finalizing a real estate transaction.

Download Checklist (947 KB PDF)

What To Do If You’ve Been Scammed

If you’re the victim of mortgage wire transfer fraud, the key is to act quickly—failure to do so will, unfortunately, mean there isn’t much you can do to get your money back. Once you’ve realized you’ve been scammed, take the following steps:

- Contact your bank and see if you can reverse the transaction. (Explain to the bank that you’ve been scammed.)

- Report the fraud to your mortgage company (their email account could have been hacked).

- Report the scam to the authorities, including the FBI’s Internet Crime Complaint Center (IC3) and Federal Trade Commission (FTC).

Unfortunately, in most real estate wire fraud cases, the money you transferred can’t be recovered (at least not all of it).

Comments