- What Is Social Security Scam Mail?

- How To Beat and Avoid a Social Security Mail Scam

- What Social Security Scam Mail Looks Like

- What To Do If You Receive Social Security Scam Mail

- Frequently Asked Questions

Scammers are not afraid to masquerade as government officials to get your sensitive data and steal your hard-earned money—the goal of Social Security scam mail. To beat this scam it's important to look for red flags, such as misspellings, typos, or threats. Most importantly, don't give out your personal information unless you've confirmed you're talking to the legitimate Social Security Administration.

What Is Social Security Scam Mail?

In this scam, you receive a letter in the mail claiming to represent the Social Security Administration (SSA) asking for your details.

With over 65 million people receiving social security benefits, it’s not surprising that this scam is so popular among scammers. Here's how the scam works.

You Receive an Official-Looking Letter in the Mail

Scammers have no shortage of tricks up their sleeves. You would think scams using the mail system would be a thing of the past when so much happens electronically, but scammers still use this tactic. They primarily target older people who may still prefer non-electronic means of communication.

The scammer using this tactic will invest in envelopes and stationery that look official, even using the official SSA logo, hoping you will judge a book by its cover.

The letter may use fear or greed in an attempt to trick you into giving away personal data or banking information. This letter could state:

- You are eligible to receive an extra benefit check.

- The administration will cancel your benefits unless you update your details.

- You have an upcoming scheduled telephone appointment.

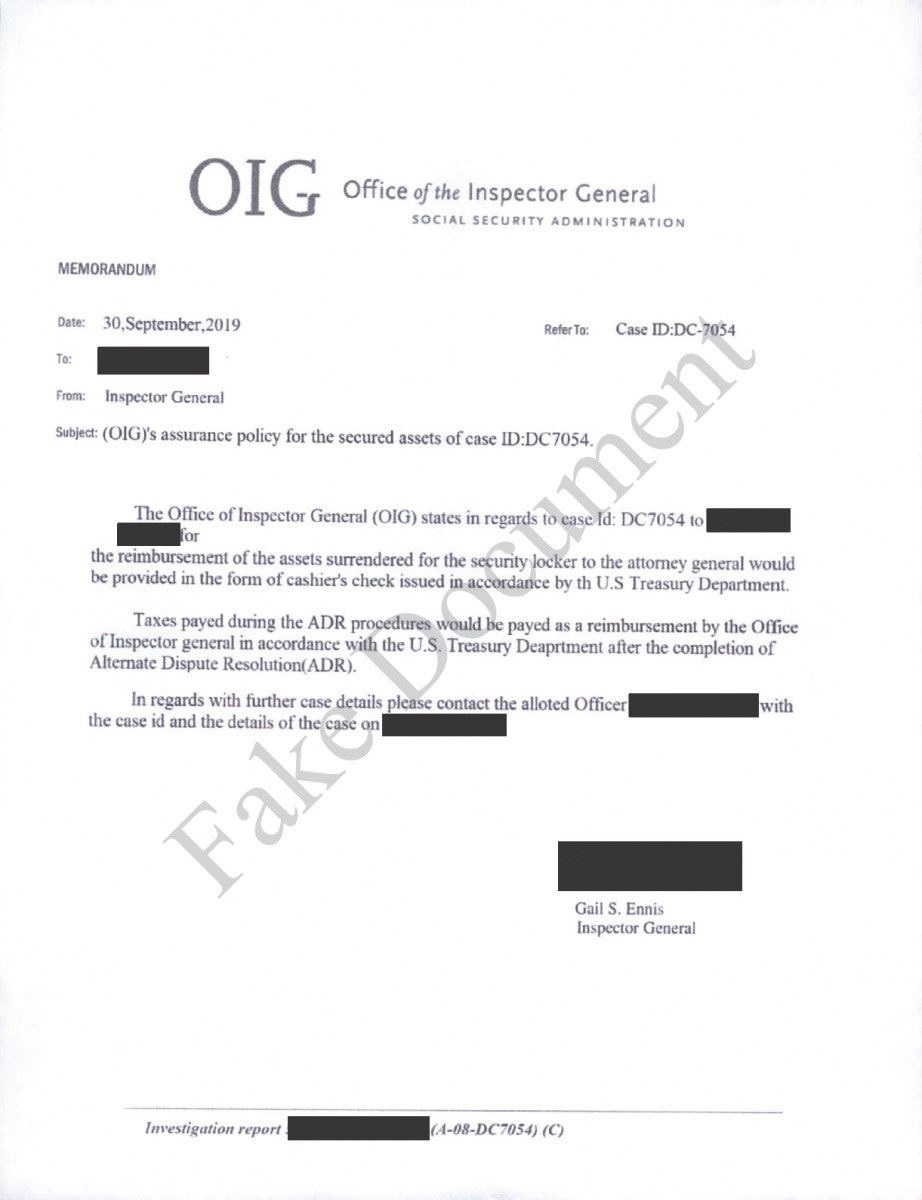

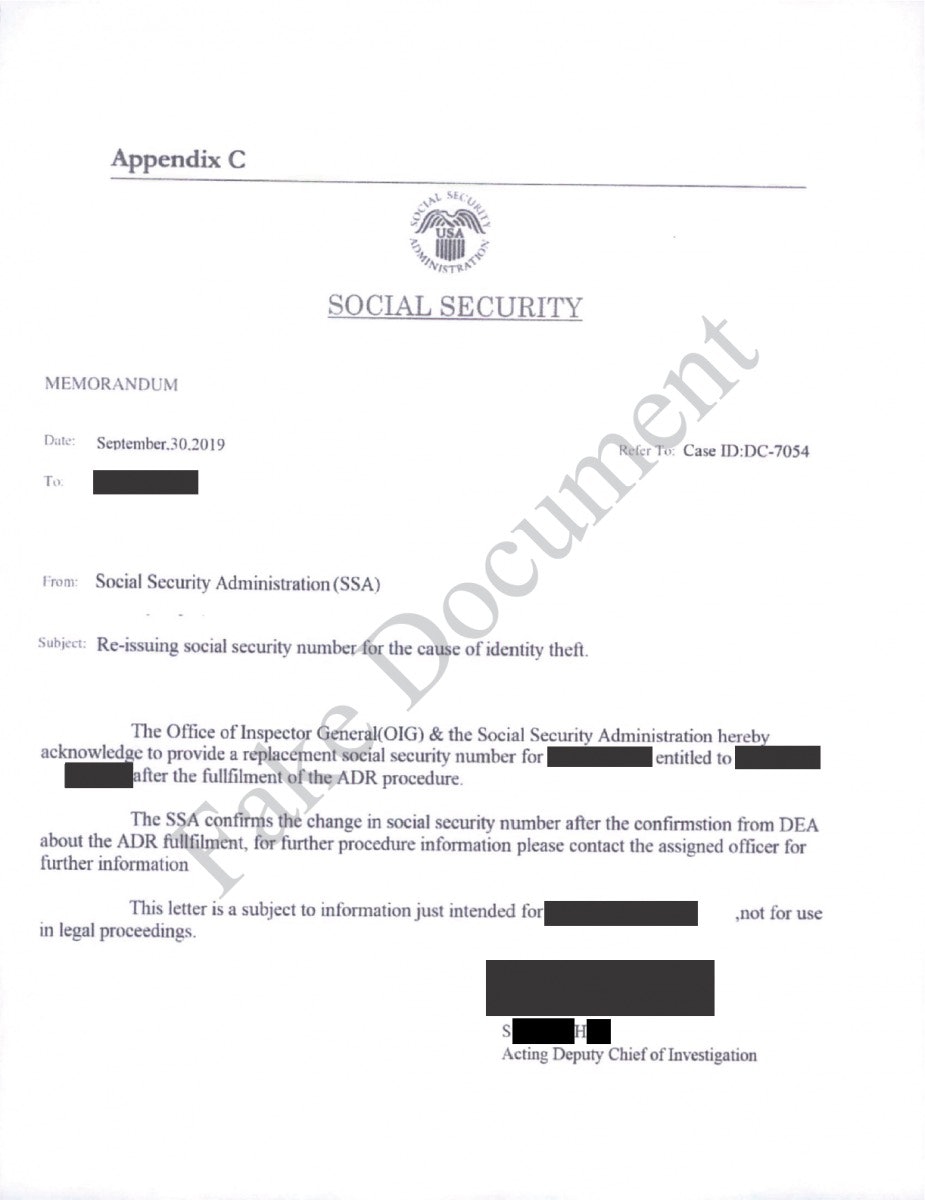

Example Scam LetterThe Office of Inspector General (OIG) states in regards to case Id: DC7054 to [NAME] for the reimbursement of the assets surrendered for the security locker to the attorney general would be provided in the form of cashier's check issued in accordance by th U.S. Department.

Taxes payed during the ADR procedures would be payed as a reimbursement by the Office of Inspector general in accordance with the U.S. Treasury Department after the completion of Alternate Dispute Resolution(ADR).

In regards with further case details please contact the allotted Officer with the case id and the details of the case on [PHONE NUMBER}.

The whole point of this letter scam is to steal sensitive information. For example, it may state that you need to call a phone number to contact a “Social Security representative” before they cancel your benefits. The letter may even list your name and address correctly but have the wrong social security number or phone number. This adds to the scam and adds false validity to the claim that there has been trouble with your social security benefits.

The letter may also not have a phone number to call and instead have you fill out a form that you have to mail back. The form will require sensitive information and ask you to pay a filing fee to get your additional benefits or update your account. This will require you to give data like your Social Security number and bank account or credit card details.

Red Flags of a Scam

Main red flags that a letter from the SSA is a fake include misspelling, grammatical errors, and typos. In the example above, there are a few of these, which should immediately alert you of a scam.

The Scammer Steals Your Information and Starts Accessing Your Accounts

Whether you mail in the form with the information the scammer is requesting or call the "helpline” to provide the information over the phone, once the scammer has your details, they have accomplished their goal.

You will never hear from them again, and they will steal money from accounts they can access and use your Social Security number (SSN) to steal your identity.

How To Beat and Avoid a Social Security Mail Scam

To avoid this Social Security mail scam, it helps to know how the actual Social Security Administration operates. While the SSA may contact you via the phone or with a letter, there are a few things they won’t ask you for. If a phone call or letter you receive fits any of the following patterns, you are being scammed:

- Threats

- An ask for personal information

- Misspellings and grammatical errors

- Requesting payment by gift card, prepaid cards, cash, or wire transfer

- An offer to increase your benefits for a fee

Threats of Arrest and Legal Action

If the letter contains a threat of legal action if you do not pay a fee or fine, it is a scam. The Social Security Administration will never threaten you with arrest or other types of legal action.

Personally Identifiable Information

If the letter contains what looks like complete Social Security numbers, then the letter is a scam. It may be an attempt to get you to call a number or fill out a form to “correct” the number listed in the letter. Don’t fall for it.

Misspellings and Grammar Errors

Look for misspellings and errors in the letter you receive. The scammer may use an official-looking document, but any errors are a tipoff that you are dealing with a scammer.

Requesting Payment by Gift Card, Pre-Paid Card, Cash, or Wire Transfer

If you ever need to make a payment to the Social Security Administration, they will request payment through standard means like checks or credit cards. If the letter requests payment through unconventional methods, it is because payments made this way are hard to trace, and you are being scammed.

Offering To Increase Your Benefits After You Pay a Fee

No one who works with Social Security will require you to make a payment to increase your benefits or get help.

What Social Security Scam Mail Looks Like

Scammers use snail mail in their scams because it gives them a chance to make everything look more official. For example, they will use the official Social Security Administration seal on the letterhead, and they may add official-looking case numbers and a lot of government jargon.

But look for misspellings and typos and always contact Social Security through their official website, phone number, or at a local office instead of using any of the details contained in the fake letters.

What To Do If You Receive Social Security Scam Mail

If you receive a fake letter, you don't need to do anything other than ignoring it. However, you can report it to the SSA and authorities to help them stop the scammers.

If you have fallen victim to the scam and responded with your details, it is time to take action immediately. Here are some steps to follow:

- If you gave any of your bank account or credit card information to the scammer, you need to contact the affected financial institution and have them shut down your cards or your account. They may also be able to cancel fraudulent charges that occurred before you could contact them.

- Report the scam to the authorities (e.g., Federal Trade Commission, FBI).

- If the scammer stole personal information like your Social Security number that they can use for identity theft, you can call the FTC’s identity theft hotline toll-free at 1-877-IDTHEFT or report it online.

- You may also want to place a fraud alert on your credit reports to make it harder for a scammer to open new accounts using your social security number.

- Spread the news of the scam to your social circles so that people you know learn what to look out for and don’t fall for the same scam.

Comments