- How the Truist Text Alert Scam Works

- How to Tell if a Truist Text Alert is Real or Not

- What to Do If You Receive a Fake Truist Text Alert

- Additional Measures to Protect Yourself Against Scams

- Frequently Asked Questions

Truist was formed after the recent merger of BB&T and Sun Trust, making it the 6th largest bank in the U.S. As part of rolling out the Truist brand, customers were merged onto a common banking platform, giving scammers the perfect opportunity to trick their customers. They have been impersonating the bank, sending fake Truist text alerts containing links to fake websites designed to steal customers' online banking login details.

- Financial Fraud Protection

- Identity Theft Protection

- Family Protection & VPN

How the Truist Text Alert Scam Works

These Truist text alert scams are successful because the scammers do their best to make you think it's the actual bank messaging you. However, if you understand how it works and the red flags to look out for, you can keep your money and identity safe. Here's how the scam works.

You Receive a "Truist" Text Alert

As a Truist customer, you receive a text message that appears to be from the bank. It alerts you to an issue with your account and instructs you to immediately click on a link to resolve it. The messaging ranges from "suspicious transaction activity noticed on your account" to "your account has been frozen."

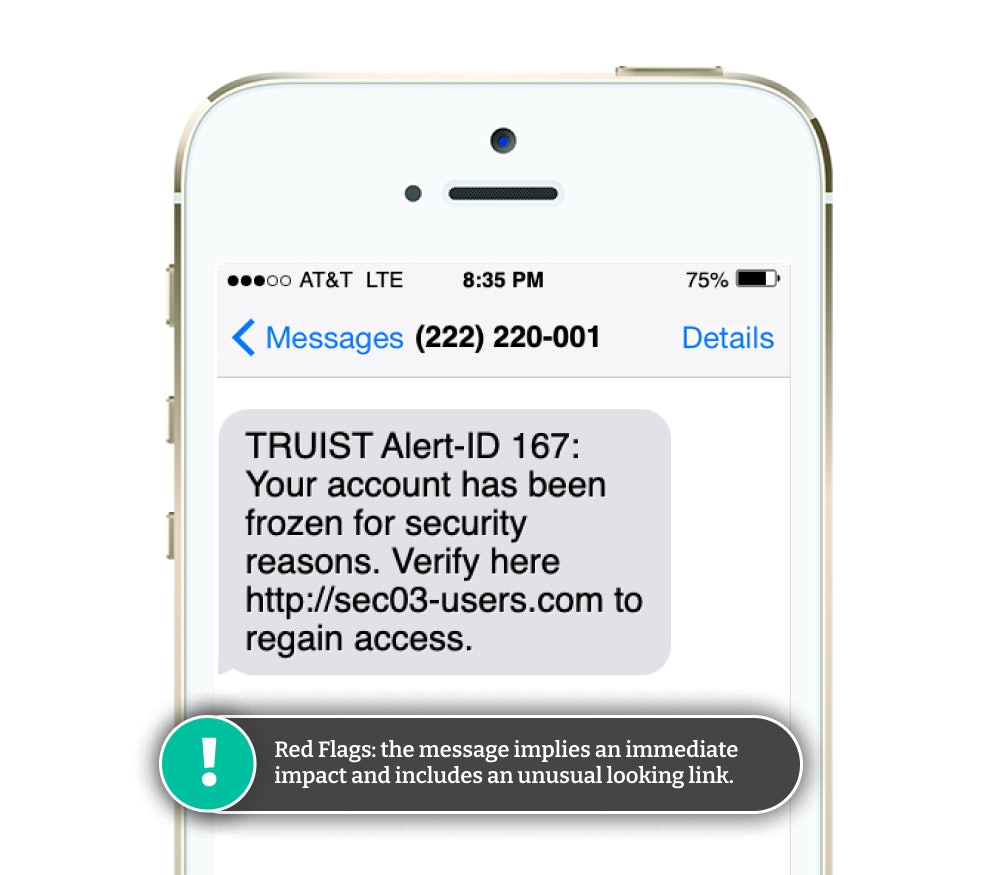

Truist Text Alert Scam: Frozen AccountTRUIST Alert-ID 167: Your account has been frozen for security reasons. Verify here http://sec03-users.com to regain access.

The scammer's goal is to scare you enough, so you take action immediately, following the instructions in the text message (i.e., clicking the link or calling a phone number). They'll often say that your account is frozen, there has been suspicious activity on your account, or another similar variation.

You're Directed to a Fake Website

In most cases, the fake Truist text alert tells you to click on a link to reopen your account, verify your information, or fix your account. This link will take you to a fake Truist website that the scammers have set up. It may look pretty legitimate, using the Truist logo and branding throughout.

You are directed to enter your personal details into the website, which can include your:

- Truist online banking username and password

- Bank account information

- Credit card information

- Social Security number (SSN)

- Full name

- Address

The information you enter into the fake website is captured by the scammers and can be used to:

- Gain access to your Truist account (and lock you out)

- Withdraw funds from your account

- Make online purchases from other websites

- Steal your identity

- Access your other online accounts that share the same login credentials

How to Tell if a Truist Text Alert is Real or Not

We are all used to getting bombarded with text message alerts, and technology allows scammers to send out millions of fake messages every day. It is easy to get tricked if you are not constantly paying attention.

Sometimes scam messages are easy to spot, particularly if the grammar is bad, but others take a bit more analysis. You might remember when you could immediately tell a scam text message by the overseas phone number. Today, scammers spoof phone numbers, which means that the messages appear to be from a local number.

This is why it's important to have a checklist to help you spot a Truist scam text message.

- Do you have a Truist account? If you don't have a Truist account, then it's pretty likely this message is a scam and can be ignored!

- Does the message include grammatical errors? Are there spelling mistakes, unusual characters, or spacings? These are all signs of a scam.

- Is the message asking you to take urgent action? Scammers know they are more likely to get people to act if the message implies an immediate impact.

- Does the message include a link, and does it look unusual? Scammers want you to click on a link to install malware on your computer or take you to a fake website. Don't click on any link that doesn't take you to the actual Truist website at https://www.truist.com/.

- Are you being asked to share personal details? Truist will never ask you for sensitive information via text.

What to Do If You Receive a Fake Truist Text Alert

Along with the checklist above to help identify the red flags of a fake Truist text alert, there are some additional precautions that you can take to beat the scammers:

- If you ever receive a message from Truist, always search for their website using your browser, find their contact details, and call them to confirm if the text is legitimate. Never use links or phone numbers provided in a text message.

- Familiarize yourself with Truist's policies on text message alerts. It is equally important to know which are legitimate messages from Truist.

- Report any messages that you receive to Truist's fraud prevention department. This allows Truist to monitor activity and proactively alert other customers.

Additional Measures to Protect Yourself Against Scams

You can take some other more general steps to protect yourself from scams and make it harder for fraudsters to get hold of your personal information:

- Ensure that you have strong, unique passwords that you change regularly on all of your accounts. Password managers are an excellent way to keep a secure vault of your passwords.

- Use two-factor authentication (2FA) wherever you can. It adds an extra layer of security to your accounts and makes it much harder for scammers to gain access.

- Monitor your bank accounts weekly and look for any unusual activity. Don't just look for large transactions—sometimes scammers test small transactions first to see if you notice.

- Block spam and scam text messages from reaching your inbox.

Other Types of Scam Texts to Be Aware Of

Scammers are sending more and more scam text messages pretending to be from legitimate companies and banks:

- Amazon

- Amex

- Apple

- AT&T

- Capital One

- Chase

- Citibank

- Citizens Bank

- Fedex

- Navy Federal

- Netflix

- PayPal

- Truist

- UPS

- Venmo

- Verizon

- Walmart

- Wells Fargo

Don't click on links within these texts or call the phone number listed. You should always find the genuine number for the company on their official website.

Comments