Experian In Depth

- Experian’s Products and Services: Consumer

- Experian Fraud Alerts

- Experian Credit Freezes

- Experian’s Products and Services: Commercial

Experian is one of the world’s most well-known global information services companies, providing information, analytical tools, and marketing services to help guide commercial and financial decisions. Founded in 1980 by Michael A. Barron and Bernie Brenner, Experian now employs 17,800 people across 44 countries.

Experian is most recognizable as one of the three major consumer credit bureaus. Creditors use the reports from Experian and the other two major bureaus (TransUnion and Equifax) to help them determine whether to lend money to consumers who are applying for credit or a loan.

In addition to its claim to fame as a leading credit bureau, Experian provides a wide range of services to both commercial clients and individuals. On the commercial side, the company helps organizations:

- Manage credit risk

- Prevent fraud

- Target marketing offers

- Automate decision-making

Individuals can also use Experian to:

- Check their credit report

- Check their credit score

- Protect against identity theft

Experian’s Products and Services: Consumer

Experian provides free and paid services designed for first-time credit-holders and savvy consumers looking to protect their identities and boost their credit scores.

Credit Reports and Scores

Experian offers both free and paid options for checking your credit report and score. You can access your credit report and score for free once per year. However, if you prefer to access all three of your credit reports at once, you can purchase your 3-Bureau Credit Report and FICO Score for $39.99. You’ll also be able to view which factors are affecting each of your credit scores, including:

- Payment history

- Recent credit card usage

- Length of credit history

Check Your Bank Before Paying for Your FICO Score

Many banks and credit unions provide free FICO scores for customers. So if you want to monitor your credit score regularly, save yourself some money and see if your bank offers this service.

Experian Boost

Experian Boost is a free service designed especially for consumers looking to increase their credit score. When you sign up for the service, you can get credit for bills like your phone, utilities, and even your Netflix account, which your Experian credit score will reflect.

Credit Monitoring

Credit monitoring is available through Experian if you want to keep close tabs on your credit to prevent unauthorized access. You can choose from both free and paid options. The CreditWorks Basic plan offers:

- Monitoring of credit reports from Experian

- Monthly Experian credit report and FICO score

- Score tracking and alerts

- Access to Experian Boost

For $24.99 a month, Experian’s CreditWorks Premium adds the following premium features:

- Monitoring of credit reports from all three major credit bureaus

- Experian credit report and FICO score access provided daily

- Monthly 3-bureau credit report and FICO scores

- FICO Score Simulator

- Ability to lock and unlock your Experian credit file with no waiting period

- Real-time alerts on attempted credit inquiries

- Identity theft insurance up to $1 million

- Dark web surveillance

- Lost wallet assistance

- Identity theft monitoring and alerts

Identity Theft Protection

Recognizing the significant threat posed by identity theft, Experian also offers two levels of identity theft protection packages which combine credit monitoring with a higher level of fraud protection.

Its IdentityWorks Plan costs $9.99 a month and includes:

- Protection for one adult

- Dark web surveillance

- Identity theft insurance up to $500,000

- Lost wallet assistance

- Identity theft monitoring and alerts

- Monitoring of Experian credit file

- Lock and unlock Experian credit file with no waiting period

- Daily FICO score tracking

- Real-time alerts when someone attempts to apply for credit in your name

At $19.99 a month, IdentityWorks Premium includes those features as well as the following:

- Identity theft insurance up to $1 million

- Quarterly access to 3-bureau FICO scores

Both plans extend a free 30-day trial.

Experian Fraud Alerts

Like the other major credit bureaus, Experian allows you to add a fraud alert to your credit report for free. Fraud alerts add a layer of protection if you’re in a situation that leaves you vulnerable to identity theft. When potential lenders see the fraud alert, they will know your personal information may have been compromised and that someone may be trying to apply for credit in your name fraudulently. This will prompt them to take additional steps to verify your identity.

When you request a fraud alert from Experian, the company will automatically notify the other bureaus (TransUnion and Equifax), which will automatically add the alert to your credit profiles there as well.

A fraud alert on Experian will last for 12 months or until you remove it. You can also opt to add an extended fraud alert if you are a confirmed victim of identity theft. You’ll need to provide a copy of a police report or identity theft report to prove your need for an extended alert, which will remain on your credit report for seven years.

Experian Credit Freezes

Experian’s credit freeze is a free tool to help victims protect their credit as they recover from more extreme identity theft cases.

Freezing your credit report on Experian means that most companies won’t be able to view your report until you lift the freeze—identity thieves won’t be able to open fraudulent accounts in your name, but you won’t be able to apply for credit, either.

According to Experian, a credit freeze is helpful if you know that someone has access to your financial details. However, it isn’t a cure-all for identity theft. While scammers won’t be able to apply for credit in your name, you’ll still have to notify your bank and credit card companies to prevent them from making unauthorized purchases.

Experian will activate your credit freeze within 24 hours of your request. This differs from a credit lock, which is available for a fee through Experian’s CreditWorks Premium and identity theft protection plans, which you can turn on and off instantly and has no waiting period.

Experian’s Products and Services: Commercial

While most consumers are familiar with Experian as a credit bureau, the company also provides a wide range of services to commercial customers. Aside from its consumer services, Experian has three other business lines: credit services, marketing services, and decision analytics.

For businesses, Experian provides both one-time report purchase options and an ongoing subscription-based monitoring plan for the credit profile of a chosen company. Businesses can also check their customers’ or clients’ credit reports using Experian’s paid services.

In addition to credit reports and monitoring, Experian also provides an extensive menu of services to larger companies seeking help with other business needs, including:

- Advanced analytics and modeling tools to help organizations transition to artificial intelligence and machine learning

- Cloud applications and services for marketing, customer data, fraud prevention, and other data management

- Data reporting and furnishing

- Data-driven marketing solutions to improve customer acquisition

- Collection and debt recovery assistance

- Regulatory compliance

- Risk management

Scams Impacting Experian

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

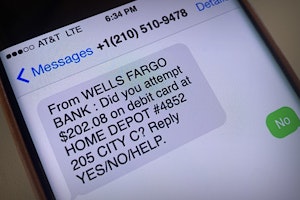

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

How to Avoid PayPal Shipping Label Scams: Top Tips

PayPal is a convenient way to pay for online purchases and has a reputation for safety and security. But scammers still find a way to use PayPal to help them steal products.

PayPal Shipping Scams: Tips to Protect Your Money and Items

Scammers take advantage of PayPal's buyer protection program to scam sellers out of their money and items for sale.

Guides To Protect Against Banking & Finance Scams

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

How to Place an Experian Fraud Alert: Online, Call, or By Mail

Placing a fraud alert on your credit report is important when trying to recover from identity theft.

How to Recover from Identity Theft: 7 Steps to Take

It's estimated that $13 billion is lost each year to identity thieves. Knowing how to recover is important to minimize your losses and get your life back on track.

How to Report Scam Calls, Websites, Emails, and More

Getting scammed isn't fun, and there's often little you can do to recoup your losses, but there are steps you should take to protect yourself.

5 Reasons Why You Need to Check Your Credit Score Regularly

You may not pay much attention to your credit score until you need to apply for credit, but we have important reasons why your credit shouldn't be out of sight, out of mind.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.