Most Read

Spot & Avoid These 11 Common Facebook Messenger Scams

Red Flags of Advance Fee Scams and How to Beat Them

How to Tell if Nikes Are Fakes: From Tags to the Stitching

Real Chase Fraud Text Alert or Scam Message?

Received an Amazon OTP Text? It Could Be a Scam

Inheritance In Depth

- What are Inheritance Scams?

- Red Flags of Inheritance Scams

- Most Common Inheritance Scams

- How to Beat Inheritance Scams

- H2: Fallen Victim to Inheritance Scams?

If you’ve ever received a letter stating that you are owed an unclaimed inheritance, even though no one you know of has died, you may be the target of inheritance scams.

Often times, scammers will target their victims by telling them they have money waiting but need to pay lawyer dues, federal taxes, or other fees to claim it. Of course, this is a lie; they are looking to steal your money and personal information.

Learn more about inheritance scams, red flags to watch out for, and what to do if you’ve fallen victim to this type of fraud.

What are Inheritance Scams?

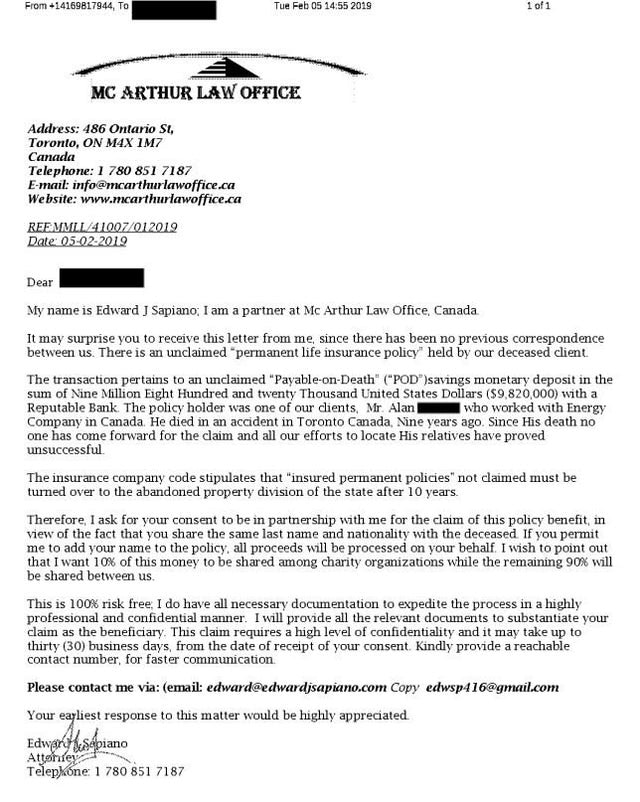

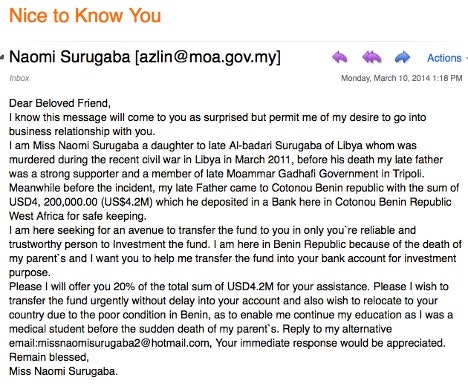

In an inheritance scam, a scammer will contact you out of the blue to tell you that you can claim a large inheritance from either a wealthy benefactor or a distant relative.

They could contact you by email, letter, text message, phone call, or social networking message. The scammer will usually masquerade as a foreign official, lawyer, or banker and claim that the deceased individual has no other beneficiaries.

They might also say that someone unrelated to you has died without a will and that with the help of some legal trickery, you could claim the entire estate.

But, whatever the scammer tells you, they will eventually either ask you for money to free up the inheritance, which they’ll take off with. Or will ask for your personal information and use it to steal your identity.

Red Flags of Inheritance Scams

Scammers are persistent. They will use many tactics to convince you of the legitimacy of the story they are telling you.

But if you are vigilant, you will usually notice one or more of these red flags and be able to spot the scam:

- You are contacted out of the blue by someone claiming to be a lawyer or banker, offering you a large inheritance from a distant relative.

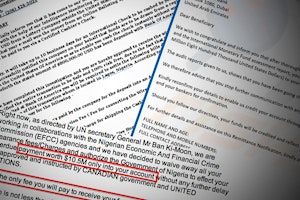

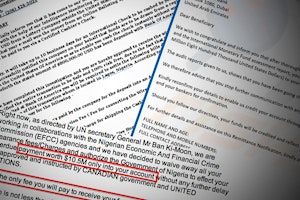

- You are sent an official-looking letter offering you an inheritance, but it contains grammatical or spelling errors, clumsy phrasing, or blurry and misaligned graphics.

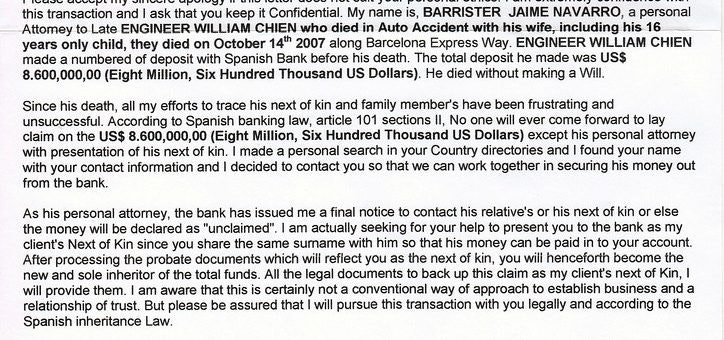

- You are asked to pose as the next of kin to an unclaimed inheritance.

Many inheritance scams will say the deceased individual doesn't have any next of kin and you're being contacted to claim the funds. (Source: Reddit) - You are asked to pay a fee to receive the inheritance.

- You are asked to provide bank account details or copies of identity documents as verification for the inheritance.

- If you question the validity of the inheritance, you are presented with fake bank statements, birth certificates, or other fake documents.

- Despite the seeming importance of the inheritance, the representative is never able to meet you in person.

Most Common Inheritance Scams

While all inheritance scams involve the scammer trying to convince you that you are due an unexpected sum of money, scammers will adjust their story to avoid detection.

Here are some of the popular inheritance scams:

Advance Fee Scams

Some inheritance scams are a type of advance-fee scam. In an advance fee scam, scammers will ask you for an upfront payment with the promise of receiving something of greater value in return.

In this case, they will tell you that you could receive an inheritance but that you will have to pay an administrative fee in order to receive it. Sometimes this fee will seem reasonable because the scammer has a huge list of email addresses or street addresses of people with the same last name and will be collecting the same fee from anyone on that list who falls for it.

Nigerian Prince Scam

Another scam where the inheritance angle might show up is the infamous Nigerian prince scam. Although it has been labeled a “Nigerian” prince scam, the scammer could claim to be a prince from another country. Scammers also claim to be from the Ivory Coast and Lagos.

In this type of scam, the “prince” says he is the sole heir to an inheritance and may even present you with official-looking documentation. But the scammer will say that taxes or fees must be paid for him to gain access to the inheritance, and if you could pay those taxes, you will get a sizable finder’s fee. Then the scammer takes off as soon as they have your money.

Romance Inheritance Scams

Sometimes scammers combine a romance scam with an inheritance scam. The scammer will contact you via a social media site or dating app and, after a few online chats, will claim that they have fallen in love with you. But they will also never meet you in person and may claim to have a job that requires them to travel a lot or live in another country.

Once you believe the story, the scammer will claim that they could receive an inheritance if only they were married. Then, the scammer will ask you for airfare to come see you and never show up.

How to Beat Inheritance Scams

No need to panic if you’ve been targeted with an inheritance scam. If you suspect a scammer is trying to contact you, you can protect your information by taking the following steps:

- Never send money or give credit card, bank account details, or online account details to anyone you don’t know or trust.

- Never give copies of personal documents or personal information to anyone you don’t know or trust.

- Search the internet using the names, contact details, or exact wording of the letter/email to find any references of the scam online.

- Don’t respond to the scammer if you notice any of the red flags above. Scammers can be convincing and will use the personal touch to try to trick you.

- Don’t agree to any arrangement that requires an upfront fee via money order, wire transfer, gift card, cryptocurrency, or other unconventional payment methods.

- Don’t click on any links or attachments in the message or email you were sent.

- Block the sender in your email or text application if you were contacted that way.

H2: Fallen Victim to Inheritance Scams?

In the event that you are the victim of an inheritance scam, here are a few things you can do to protect your finances and keep your data safe.

Document the Scam

Inheritance scams often come with a lot of paperwork, emails, or electronic document. Make sure to collect all of this information for the authorities.

Notify the Authorities

You definitely want to report the scam to the authorities, so they know about it and have a better chance of putting a stop to it.

- The FBI at Internet Crime Complaint Center

- The FTC at ftc.gov

- Your state’s attorney general, which you can find here

- Your local police department

- The Postal Inspection Service if the scammer contacted you via mail

Contact Your Bank or Credit Card Company

If you have sent money to the scammer, you will want to contact the bank or credit card provider you used to make the payment and inform them of the incident. They may be able to reverse the charges. Many credit card companies offer protection against fraud.

Contact the Credit Bureaus

If you provided any identity documents to the scammer, you should contact one of the three credit bureaus to create a fraud alert. The one you contact will notify the others. You can also freeze your credit for an extra layer of protection against identity theft.

Scams Relating to Inheritance

Red Flags of Advance Fee Scams and How to Beat Them

A promise of a large sum of money in return for a fee should raise some red flags—more often than not, it's a scam.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Truist Text Alert: How to Identify a Real Text from a Scam

You may think that that Truist have sent you a text alert about your account. Here's how to check if it is actually a scam.

Wait! That Walmart Giveaway Text May be a Scam!

Fake texts are being sent to consumers claiming a hefty sum is waiting for them on a Walmart gift card, but falling for this scam puts you at risk of identity theft.

Guides Relating to Inheritance

Spot & Avoid These 11 Common Facebook Messenger Scams

With every Facebook Messenger scam, the attacker is trying to steal from you—whether they’re after money, login credentials, or other personal information.

How to Get Verified on TikTok

Securing that little blue checkmark can mean brand collabs, sponsorship opportunities, or protecting your unique content from impersonators.

How to Tell if Nikes Are Fakes: From Tags to the Stitching

Nike is one of the biggest brands targeted by counterfeiters and scammers - be extra careful with Nike products from non-official retailers as you could end up with a fake

Funeral Homes & Prices - What Are The Costs & Your Rights?

Average prices from funeral homes range between $8k to $14k and consumers are meant to be protected by a 'Funeral Rule' - what are your consumer rights?

How to View Your Amazon Archived Orders & Hide Search History

If you share your account with multiple users, archiving your past orders is a good way to keep others from seeing your orders and ruining a surprise or seeing private orders.

News Relating to Inheritance

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.