Overpayment & Refunds In Depth

- How Do Overpayment Scams Work?

- How To Beat and Avoid Refund and Overpayment Scams

- Red Flags of Overpayment Scams

- Examples of Overpayment Scams

- What To Do If You’ve Fallen for Overpayment Scams

When you sell items online via sites like Facebook Marketplace and Craigslist, you might be a target of a refund or overpayment scam. In this type of scam, you’ll accept an offer to buy from a supposedly legitimate buyer, who then pays you for more than the amount you charged, sometimes even hundreds of thousands of dollars more. The catch? The scammer wants the money returned.

How Do Overpayment Scams Work?

While refund and overpayment scams vary, the general goal and how they work are all very similar.

A Buyer Pays For an Item

A potential buyer offers to pay for your item via check or PayPal. Even if you request payment via cash or through the site’s payment system, the buyer will refuse, giving you any number of reasons why they can’t.

You Receive a Check for More Than the Sale Price

When you receive payment, it’s for more than the agreed-upon price. The buyer usually comes prepared to explain why they sent through the incorrect amount—sometimes they say it's to cover shipping costs, other times they’ll say it’s simply an accident.

The buyer then asks you to wire back the extra funds after depositing the check. They won’t accept a check or PayPal refund—they will be very specific that they want a wire transfer.

Look For This Red Flag

Overpayment scams don't work unless you refund the extra money back using an untraceable method. Most scammers will ask for a wire transfer, even if they originally paid you using a different way.

You Wire the Funds, and the Original Payment Doesn’t Go Through

You wire the funds for the difference back to the buyer and send them the item. In the meantime, you’re still waiting for the check or PayPal payment to clear. Since it can take several days for these payments to go through, you won’t realize the payments were fraudulent until it’s too late.

If you receive a check, it will bounce. You’re now responsible for paying back the entire amount of the check to the bank. You’ve also lost the money you wired to the scammer. If the scammer used PayPal, the online payment you received will be denied.

Not only have you lost the money you wired back to the scammer, but you’ve also lost the item you “sold” them. You won’t be able to contact the scammer as they will promptly take off with your money and cease all communications.

How To Beat and Avoid Refund and Overpayment Scams

When you’re selling items online, it can be exciting to receive an offer from a buyer. However, whether you accept payment via check or online service, it’s essential to make sure these payments are legitimate. Here’s how you can beat this scam:

- Confirm the buyer’s information: Do not rely on what the buyer is telling you. Independently confirm the buyer’s details, such as their:

- Name

- Address

- Telephone number

- Do not accept payments for more than the agreed-upon amount: Despite what story the scammer might be telling you, the overpayment isn’t an accident. Walk away from any transaction in which the buyer sends payment for more than your selling price.

- Never wire funds: Legitimate buyers will not ask you to wire the funds. A scammer knows you won’t have much recourse if you wire funds in a fraudulent transaction, which is why they’ve asked you to do so.

- Wait for payments to clear: Before sending any items to the “buyer,” wait for their payments to go through. Although the check amount may appear in your account, it’s not really there until the transaction no longer says “Pending.”

Red Flags of Overpayment Scams

Overpayment scams are one of the most straightforward scams to identify since you’ll be receiving payment for an item that’s more than your selling price. Here are the main red flags to watch out for:

- Receiving payments for more than the agreed amount.

- Requests to wire money.

- Pushy buyers who are unwilling to pay using cash, via the site’s payment system, or through other traceable methods.

- High-pressure tactics.

Examples of Overpayment Scams

Overpayment scams can range from low-tech versions in which you receive a counterfeit check to variants that use technology to dupe sellers.

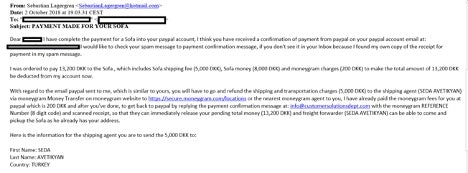

In this example, the scammer references the extra amount he’s sending via PayPal. The high-pressure language is designed to convince the seller to follow this plan and submit the extra money immediately via wiring service.

In the below example, the seller received the check for well over the asking price of $10,000 for his item. The fraudulent cashier’s check was designed to look real, but the seller was able to beat this scam by identifying the overpayment red flag.

What To Do If You’ve Fallen for Overpayment Scams

Scammers are banking on your trusting nature, hoping you’ll believe that the overpayment was made by an innocent mistake. If you’ve fallen for this scam, you’ll want to take the following steps to attempt to recover your money and item:

- Contact your financial institution

- Contact

Contact Your Financial Institution

Let your bank know that you have been the victim of an overpayment scam and unwittingly accepted a fraudulent payment. Although you may still be responsible for paying back the amount of the bounced check, the bank will likely take steps, such as issuing you a new card, to protect your identity and financial information.

Contact PayPal

If your transaction occurred via PayPal, your best bet is to contact PayPal and report the fraud. Be sure to forward a copy of the fake payment receipt. PayPal will investigate the complaint and may be able to return the funds.

It's important to verify links and contact details to beat imposters.

Contact the Shipping Company

If the item is yet to be delivered, there’s a chance you and intercept the delivery and have the item returned to you. Contact the shipping company and try to reroute the package.

Always Use Your Own Shipping Label

When selling items online, it’s important to organize shipping yourself. In another scam, fraudsters will offer to provide a shipping label. When their payment for the item doesn’t go through, you’ll be unable to cancel the shipment because it’s not under your name.

Report the Scam

Report the scam to the Federal Trade Commission (FTC). The FTC cannot resolve your complaint but can alert the public and prevent further check overpayment scams from occurring.

You should also report the scam to whichever website you sold the item on. Depending on the site, you may also be able to report the scammer’s profile.

Scams Relating to Overpayment & Refunds

Overpaid on a Craigslist Sale? You May Be Involved in a Scam

Getting more money than you've asked for may seem great, but it could actually be part of a scam to steal your money.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Truist Text Alert: How to Identify a Real Text from a Scam

You may think that that Truist have sent you a text alert about your account. Here's how to check if it is actually a scam.

Wait! That Walmart Giveaway Text May be a Scam!

Fake texts are being sent to consumers claiming a hefty sum is waiting for them on a Walmart gift card, but falling for this scam puts you at risk of identity theft.

Guides Relating to Overpayment & Refunds

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

Beat eBay Scams and Stay Safe When Shopping Online

Whether it's a counterfeit product, a sketchy seller, or a price too good to be true, eBay scams are widespread, so it's important to know how to protect yourself.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

Beat Craigslist Scams and Stay Safe When Buying or Selling

Avoiding Craigslist scams is sometimes as easy as not clicking on any links or only accepting cash payments, however, scammers are finding new ways to trick and defraud you.

How to Get Verified on TikTok

Securing that little blue checkmark can mean brand collabs, sponsorship opportunities, or protecting your unique content from impersonators.

News Relating to Overpayment & Refunds

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.