Real Estate In Depth

- Email Compromise—The Biggest Culprit

- Other Real Estate Scams

- Warning Signs of a Real Estate Scam

- How to Beat Real Estate Scams

- How to Recover From a Real Estate Scam

2021 was a groundbreaking year in real estate—according to a study by the National Association of Realtors, homes sold at a record pace between June 2020 and July 2021. In addition, the Federal Housing Finance Agency's House Price Index reported in November that U.S. house prices rose 18.5% from the third quarter of 2020 to the third quarter of 2021. This means happy sellers, lots of desperate buyers, and very busy real estate agents. But unfortunately, it also makes for very fertile ground for scammers.

Real estate is big money, making it a magnet for scammers. Scammers target home buyers and renters in the most common real estate scams.

Email Compromise—The Biggest Culprit

In 2020 the FBI's Internet Crimes Complaint Center (IC3) reported that real estate wire fraud is the 7th largest fraud type, with more than $213 million lost. Business Email Compromise (BEC) and E-mail Account Compromise (EAC) is the most prevalent where scammers compromise email accounts and attempt to intercept wire transfer payments.

Real Estate transactions are confusing for many people and are made more complex by the number of players. In any transaction, you have more than half a dozen parties requesting your personal information, including:

- Financial institutions

- Real estate agents

- Lawyers

- Escrow agents

It's hard to keep track of everyone involved.

Scammers know that if they can infiltrate the email accounts of any of the critical parties, they can attempt to intercept wire transfers and steal money. Anyone that sends or receives money is a target.

Generally, scammers access compromised email accounts well before any transaction takes place, and they monitor them for any activity that looks like a wire transfer. When they pick up an activity that interests them, they will create a spoof email address requesting that funds be transferred to their account.

If they get their timing right, they have made off with their money by the time the purchaser realizes what has happened.

Other Real Estate Scams

Real estate draws scammers like a magnet, and they can be creative when coming up with new scams. Here are some of the most common types of real estate scams out there.

Real Estate Wire Fraud

In real estate wire fraud, you find a home you want to buy, sign the contract, and wait for the closing process to begin. You are then contacted via email and asked for a down payment or earnest deposit; so you pay it.

A few days later, you are contacted again by the real mortgage company, and you discover you were scammed.

Loan Flipping Scams

In a loan flipping scam, you are contacted by a scammer about your existing home loan. They claim you're eligible to refinance your current loan and will save a lot of money by doing so. However, the scammer is lying to you and will use high-pressure sale tactics to keep you from reading the fine print.

Once you sign the paperwork, you discover that the new loan has a longer-term, higher interest rate, or you are charged high fees and points to close.

Moving Scams

Scammers have also found a way to scam people when they are moving by setting up fake moving companies. You find one of these companies online while comparing prices. They offer better rates than the other companies, so you pay the deposit. However, the moving company doesn't exist, and no truck shows up on moving day.

Rental Scams

Rental scams involve a scammer listing a fake rental property on a site like Craigslist. Once you show interest in the property, the scammer will immediately ask you for a deposit but will conveniently be unable to show you the apartment or house in person. Once you make the deposit, the scammer takes off with your money.

Warning Signs of a Real Estate Scam

When you are thinking of buying a house, renting an apartment, or moving, here are some of the red flags to look out for so you can steer clear of real estate scams:

- Grammar errors and misspellings in the email, letter, or website.

- Online reviews about the company are either negative or overly positive and seem fake.

- Parts of the email or website seem broken or formatted incorrectly.

- You are asked to pay via questionable methods like MoneyGram, Venmo, PayPal, or Cash App.

- The email you received isn't coming from the corporate email domain you expect.

- The loan officer, landlord, realtor, or mortgage company is pushy and tries to get you to make the transaction without reading the fine print or asking questions.

How to Beat Real Estate Scams

Despite the professional bodies like the National Association of Realtors, the American Escrow Association, and the American Land Title Association banding together to form stopwirefraud.org to raise awareness and reduce the impact of real estate scams, the number is still exploding.

Buying a new house, renting a new apartment, or moving all of your things cross country can be very exciting but also very stressful. Worrying about whether you are getting scammed only adds to the stress. To help you navigate the process, here are some tips to help you avoid getting scammed:

- Before hiring a moving company, get multiple quotes, read customer reviews, and read the contract closely.

- Pay close attention to emails you receive and make sure they come from the right web domain and have no grammar errors, misspellings, or other mistakes.

- Never deposit money before seeing a house or apartment.

- Don't rush the home buying or rental process.

- Have a third party like a lawyer or real estate agent review any legal documents before transferring money.

- When dealing with loans, verify the loan officer online with the Nationwide Mortgage Licensing System & Registry's database.

- Refuse to send payments via Cash App, Venmo, or other cash transfer apps.

- Don't click any links in an email you don't trust.

- Always deal face-to-face and locally when renting or buying.

In addition, you should always do some research into the people handling your transaction, including your:

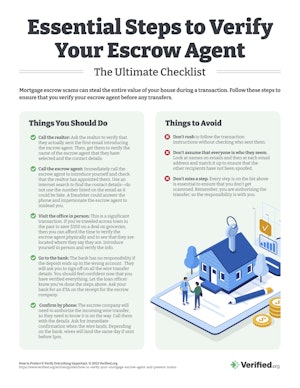

Mortgage Escrow Checklist

Print our handy checklist to keep yourself safe when finalizing a real estate transaction.

Download Checklist (947 KB PDF)

How to Recover From a Real Estate Scam

If you have fallen victim to one of these real estate scams, you can do a few things to ensure you don't lose any more money, the scammers get caught, and there are fewer victims in the future. You can start by reporting the scam.

Report the Scam

Depending on the type of real estate scam you are dealing with, there are a few places to report it. To catch the scammers, you need to report them to the authorities. Here are some places to start:

- The FBI Internet Crime Complaint Center (IC3)

- The Federal Trade Commission (FTC)

- Your state Attorney General

While not the authorities, you can also report the scam to these places to get the news out about the fraud:

- The Better Business Bureau (BBB)

- The Federal Motor Carrier Safety Administration if it was a moving scam

- Craigslist, Facebook Marketplace, or the website you saw the scam listing

Contact Your Bank

A wire transfer can take some time, so you may have a chance to call the bank and cancel it before it happens. Or the bank may be able to reverse the transaction. It will only take a few minutes and is worth the try.

If you paid with a credit or debit card, the card company may offer protection against fraud and get your money back. If the scammer has your account details, you will also want to freeze your account or disable your card.

Protect Your Identity

If you reveal personal information like your Social Security number during a fake loan process or other ruse meant to steal your data, you will want to either place a fraud alert or freeze your credit.

Scams Relating to Real Estate

Fake Escrow: Craigslist Users Beware of This Common Scam

Escrow services are supposed to keep your money safe, but in this Craigslist scam, these escrow sites will do more damage than good.

Moving Scams: Red Flags to Look Out For & How to Protect Yourself

Moving house can be expensive—the last thing you want is to be screwed over by your moving company.

Real Estate Wire Fraud: Beat the Biggest Scam in Real Estate

Real estate wire fraud was responsible for more than $213 million in losses in 2020—find out how to beat this scam and keep your money safe.

Loan Flipping Scams May Result in Losing Your Home

Loan flipping scams target the elderly and first-time homebuyers. Learn the red flags of this scam to protect yourself from financial loss or foreclosure.

Cash App Rental Scam: Don't Fall For These Common Tricks

Scammers are taking advantage of renters desperate and in a rush to find a new home, stealing thousands from innocent people.

Craigslist Rental Scam: What It Is and How to Beat It

In this Craigslist rental scam, potential renters send money to the scammer before seeing the property only to realize the listing was fake and lose their money.

Craigslist Fake Escrow Sites Are Phishing For Your Personal Info

If a Craigslist buyer or seller insists on using their recommended escrow site to complete the transaction, beware. They could be trying to steal your information.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Guides Relating to Real Estate

Received a Rent Increase Letter? Your Rights As a Tenant

If you live in California, Oregon, or a handful of other states, your landlord may be raising your rent illegally—read on to learn more about rent increases in your state.

4 of the Most Common Real Estate Scams & How to Protect Yourself

Whether you're buying or selling a property, scammers are out to get you. Being aware of the most common scams is the first step to protecting yourself.

How to Look Up a Real Estate Appraiser's Licensing (By State)

Having your real estate appraised is necessary to estimate the value of your home or property—but if you're not careful, you may get stuck with a fraudulent appraiser.

How to Verify a Moving Company in 5 Easy Steps

There are thousands of complaints against moving companies every year—learn how to avoid scams by choosing the right movers.

7 Essential Steps to Ensure a Safe Real Estate Transaction

Buying or selling a home is a complex process that can open you up to various scams if you’re not careful.

News Relating to Real Estate

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.