- What is Comic Book Insurance?

- What a Comic Book Insurance Policy Protects

- Options for Comic Book Insurance

- Why You Should Consider Comic Book Insurance

- Frequently Asked Questions

Insurance exists to protect you from financial risk. If you have a car, you buy auto insurance to cover repair costs after an accident. You buy homeowners insurance to pay for storm damage if you own a home. It stands to reason, then, that comic book owners should protect their collections with comic book insurance. But in the world of comics and collectibles, things aren’t quite that simple.

As a comic book collector, theft, fire damage, and shipping damage surely are risks you worry about. Comics insurance exists to protect against these risks. However, not all comic book owners truly need comics insurance.

In some cases, your comic books may already be insured under a homeowners or renters insurance policy. Or the value of your collection may not be high enough to warrant insurance. On the other hand, collectors with extensive and valuable collections genuinely do need the protection of a good insurance plan.

What is Comic Book Insurance?

Collectibles insurance policies are designed to cover high-value collectibles, such as comic books. Some policies are explicitly sold as comic book insurance. Others are sold more generally as collectibles insurance—which could also cover coins, stamps, dolls, and other valuable items.

If you have comics insurance and something happens to one of your comics, the insurance company will reimburse you for the loss. Most policies insure your books for the complete collectors’ value. For example, if you own and have insured a Superman #1 worth $507,000 and lost it in a fire, your insurance company will give you $507,000.

Who Needs It?

The casual comic book enthusiast with a handful of comics worth $20 or $30 does not typically need insurance for comic books. If the books were damaged or lost, replacing them would not present a significant financial hardship.

Also, if the books were damaged during a flood, fire, or natural disaster, they would typically be covered under a homeowners or renters insurance policy, just like any other personal items.

Comics insurance is advantageous for more serious comic book enthusiasts with an extensive collection of high-value books. For example, someone who owns 300 comics with a collective value of $300,000 would certainly want to insure their collection.

Comics insurance is also a wise purchase for anyone with one or a few precious comic books. For instance, if you own an Incredible Hulk #1 worth over $300,000, you’ll want to insure that book—even if it is the only valuable comic book you own.

What a Comic Book Insurance Policy Protects

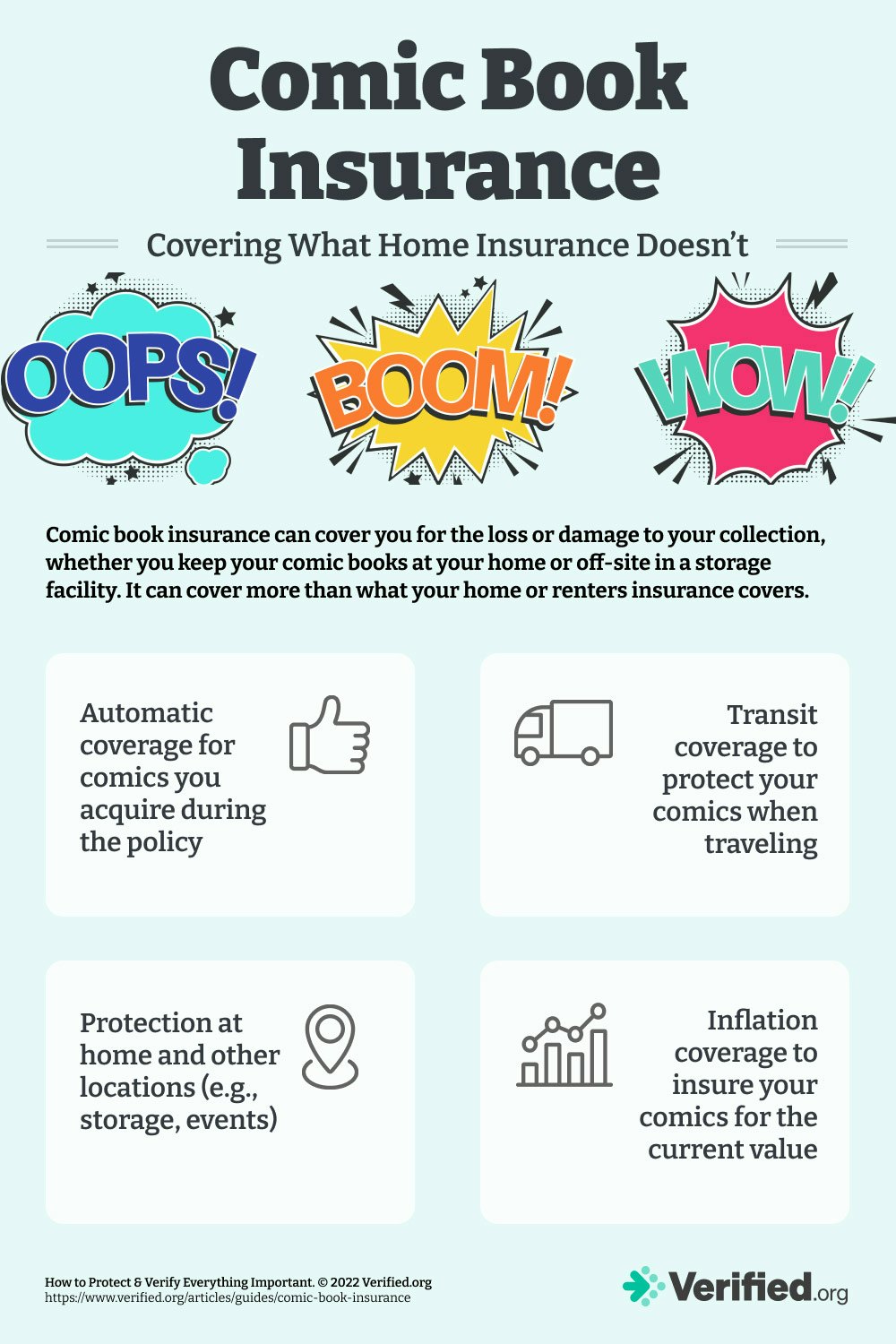

Every insurance company structures its policies a bit differently, so you should always read thoroughly before purchasing insurance. However, most general comic book and collectibles insurance policies provide the following types of coverage, at a minimum:

- Accidental Damage: If your comics are accidentally damaged by a natural disaster such as a fire, flood, or earthquake, they’re covered.

- Theft: If someone steals your comics, either by breaking into your home or by other means, your insurance will reimburse you for their value.

- Shipping: Anyone who ships valuable comics should have insurance coverage. A good policy will reimburse you for books that are lost or damaged during the shipping process.

- Off-Site Storage: If you store your comics outside of your home in a safety deposit box, public storage facility, or other location, most insurance policies will still cover them.

There are also a few good features or policies to look for in a comic book insurance policy.

Low Deductible

The deductible is the amount you have to pay before your insurance comes into effect. For some comic book policies, deductibles start at $0, which means your insurance covers everything.

Others have a low deductible, such as $100, which you'll need to pay before your insurance company covers the rest of the loss.

The lower the deductible, the more you’ll generally pay for the insurance policy (monthly or yearly). If you are worried you won’t have the cash available to pay a deductible, it may be worth paying slightly more for a zero-deductible policy.

In-Transit Coverage for Valuation

You will need to have your comics appraised to establish their value before insuring them. Some insurance policies cover the comics when they are in transit to the appraiser. This way, if they are lost or damaged before being appraised, you’ll still have recourse.

Inflation Adjustments

The value of comics tends to rise over time with inflation. Good insurance plans account for this, increasing your amount of coverage yearly in proportion to inflation.

Automatic Coverage for New Additions

If you buy a new comic book, most insurance policies will insure it up to a certain amount—such as $2,000—until you can have it appraised to learn its true value. This ensures your new books are insured when in transit to your home and while you’re working on integrating them into your collection.

Options for Comic Book Insurance

If you have valuable comics you’d like to insure, there are several ways to purchase this coverage.

Homeowners or Renters Insurance

While homeowners or renters insurance offers some coverage of comic books as personal property, the standard policy won’t reimburse you for the collector’s value of the books. So, if your comics are worth more than their original sticker price, you’ll want additional insurance.

One option is to purchase additional coverage through your home insurance or renters’ insurance company. For instance, you can tell your homeowners insurance company that you have $1,000 worth of comics. They’ll add a rider to your policy specifically to cover these books, and you’ll pay an additional premium every month for that coverage.

This can be a good option for smaller, less valuable collections. However, valuables coverage through a homeowners insurance policy does not always include inflation adjustments (i.e., covering the current market value). It also won’t always have automatic coverage for new additions. As such, those with larger and more valuable collections don’t usually choose this route.

Collectibles Insurance

Buying a dedicated policy through a collectibles insurance company is suitable for most passionate collectors. Insurance for collectible items tends to come with better features, such as in-transit and inflation coverage. In addition, agents who work for collectible insurance companies are experienced in working with collectors and can adequately assess your needs, making intelligent policy recommendations.

The coverage limits on collectibles insurance policies are usually high enough to cover even the most valuable comic book collections. For example, if your collection appraises for $500,000, you can insure it for that value. If it appraises for $30,000, you can buy just $30,000 worth of insurance.

If you have other collectibles, such as coins or antique furniture, you can often insure them under the same policy as your comics.

Comic Books Only

Some companies limit coverage to just comics and no other valuables. The key benefit of working with such a company tends to be agents who genuinely know comics and can better discuss your collection and your unique needs.

However, the coverage offered by these companies tends to be quite similar to that offered by more general collectibles insurance companies and can also include automatic coverage.

Why You Should Consider Comic Book Insurance

If you have a valuable comic book collection, you should consider insurance for your own financial protection. Theft and natural disasters like fires and floods are unpredictable. It would be a shame to lose thousands of dollars worth of comic books in a natural disaster and have no means of replacing them. While insurance won’t bring back your comics, it will at least give you the financial means to rebuild a collection.

Peace of Mind

Comic book insurance also gives you peace of mind. You may find more enjoyment in bringing your books to comic book shows, shipping them to fellow comic book collectors, or paging through them if you know they’re adequately insured.

Protect Fragile Items

Comics are more fragile than many other collectibles. Since they’re made from paper, they’re apt to go up in flames in a fire or be ruined if a pipe bursts.

Inheritance

Insurance also helps you preserve your comic books as an inheritance. Your plan may be to pass your comics on to your children one day. Even if something happens to your books, you can still count on passing on their financial value with insurance.

Comments