Fake Checks In Depth

United States Foreign Money & Fake Check Scam Statistics 2020

Source: 2019-20 Consumer Sentinel Report

- What Are Fake Check Scams?

- Most Common Fake Check Scams

- Fake Check Red Flags

- How to Beat Fake Check Scams

- Fallen Victim to a Fake Check Scam?

"The check's in the mail" is one of the oldest scams in the book. But even in today's online world, surprisingly little has changed when it comes to people trying to get away with using a fake check.

What Are Fake Check Scams?

Fake check scams, quite simply, are schemes that involve fake checks or phony cashier's checks, which are always used to the scammer's advantage.

The plots can vary and often even seem advantageous for the person being scammed: You may be offered more money to purchase something than you were asking for, be told you won sweepstakes, or even be offered a "job" that involves a fake check.

And unfortunately, these schemes are typically successful for various reasons.

How Fake Check Scams Work

Banks are required to make any deposited funds available to you quickly, but it could be weeks before they investigate the source of the money. So you could believe a check is "cleared" and even use it to withdraw funds, but still face the consequences weeks later if it turns out to be fake.

Plus, fake checks can be made to look very real. Even bank employees can struggle with telling if a check is fake or not.

In fact, in 2019 alone, more than 27,000 fake checks were reported to the Federal Trade Commission (FTC), worth more than $28 million in fraudulent payments. According to the government body, young adults—especially those in their early 20s—were the most widely-targeted group for fake check scams.

Generally, the plots allow scammers to get something from you for nothing, whether that's a tangible item or the actual money the fake check is supposedly worth. Still, there are a few tell-tale signs that may help you determine whether you're receiving a legitimate payment or if that check isn't worth the paper it's printed on.

Most Common Fake Check Scams

Since the only common thread in fake check scams is the actual fake check, these types of fraud can be wrapped up in several different plots.

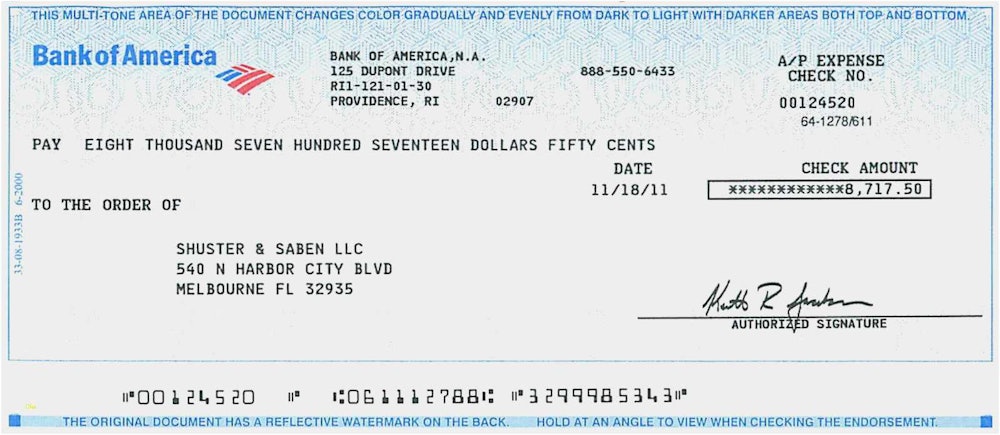

Fake Cashier's Check

Cashier's checks are slightly different than personal checks. These checks come from—and are signed off on by—a financial institution, so it's the bank, rather than the checking account holder, who guarantees the payment.

Because of this, cashier's checks are often considered "safer" forms of payment, especially for expensive purchases. But this is also what makes them so susceptible to scams.

In fake cashier's check scams, the scammer will send you a fake version of these "guaranteed" payments, then ask you to wire them money or send them goods in return. And since it takes days to weeks for the check to process, the scammer will already have what they want by the time you're informed that the check is fraudulent.

Mystery Shopper

Mystery shopper plots are very common and represent nearly 25% of all fake check scams.

These schemes involve a scammer "hiring" you to evaluate a business that sells gift cards or provides money transfer services. You'll be mailed a fake check and told to deposit it, then wire the amount or send the equivalent amount in gift cards to someone else—in the name of "evaluating" the service.

But the check is fake, so the money you send is actually yours, and the person you're sending it to is actually the scammer.

Car Wrap Decals

Another popular plot, these scams also represent roughly 25% of the fake checks reported to the FTC in 2019.

In car wrap decal scams, you'll be contacted by someone who wants to use your vehicle for advertising their product. They'll send you a check, both to pay you for the opportunity and to pay the decal agent to put the wrap on your car. The catch? The check is fake, and the decal agent is the scammer—so you'll end up just sending your own money away.

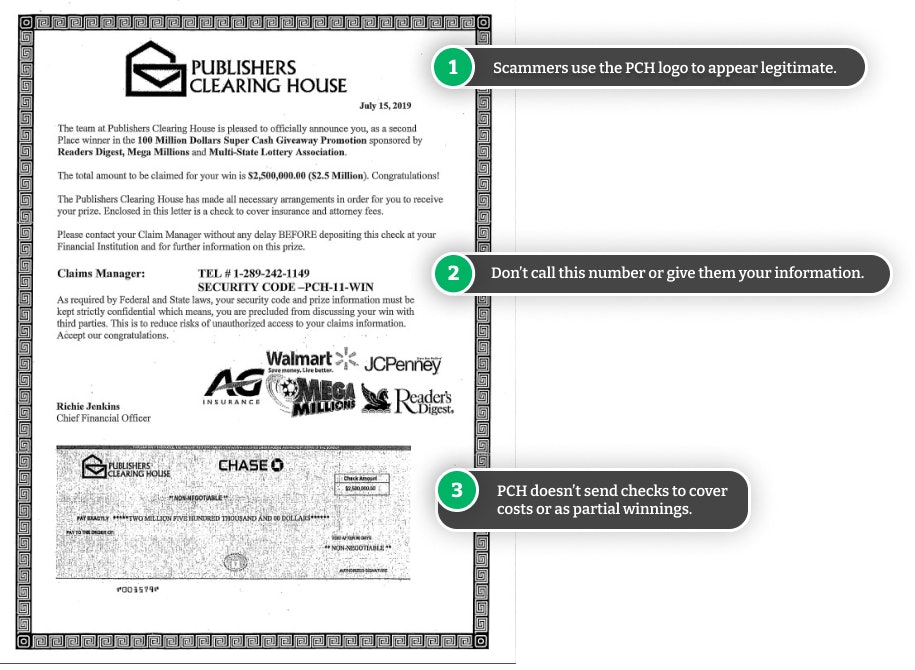

Sweepstakes Prizes

Hardly anyone can resist a prize, which is why sweepstakes giveaways are perennial plot devices when it comes to scams.

In this instance, you're told you won a sweepstake—and the check you're given is your winnings. But then you'll be asked to pay money to cover taxes or fees, which will actually go to a scammer instead. And, eventually, you'll find out that the "winning" check is no good.

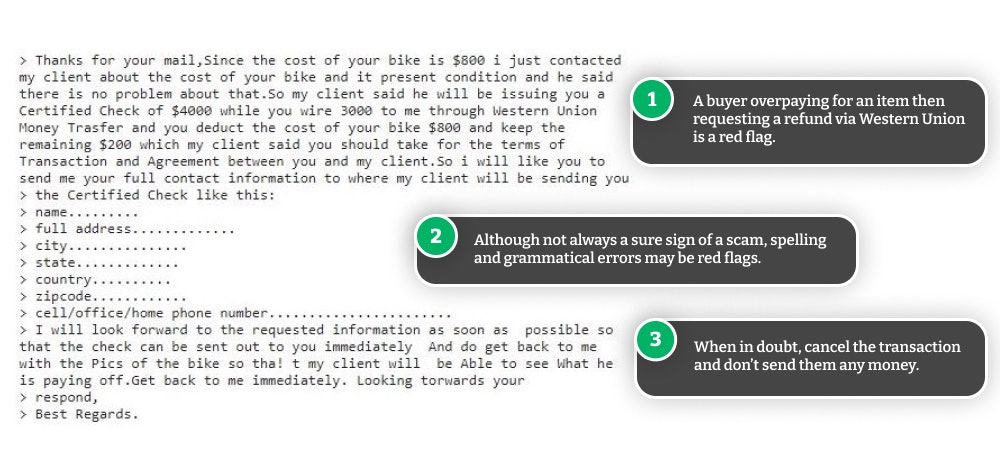

Overpayments

Scammers often use this form of fraud when purchasing something from someone online.

Representing as much as 18% of the fake check scams reported in 2019, these overpayment schemes involve someone sending you a check to pay for your items. They'll either offer to pay you more than you're selling it for or "accidentally" overpay you and ask you to send back the difference.

You're paid with a fake personal check or a fake cashier's check in either scenario.

Fake Check Red Flags

Fake check scams can't happen without the phony check. So paying particular attention to why you're getting a check is a great way to figure out whether or not it's real.

Many fake checks or fake cashier's check stories will include some of these types of details:

- Promises of making "easy money."

- Overpaying you, whether on purpose or by accident.

- Strange payment methods, including gift cards or money wiring services.

- Paying taxes or any type of fee to claim a check.

- Using a check as a deposit to pay someone else.

Learning to tell if a check is fake is another way to avoid fake check scams. This can be pretty tricky, even for seasoned bank employees, but there are some details scammers may skimp out on, including:

- The bank name. Make sure the check comes from a legitimate establishment.

- If the check includes the bank's address, verify this as well.

- Security features, including watermarks, holograms, and microprinting.

- Smudges or discoloration on the check itself or the filled-in details.

How to Beat Fake Check Scams

Fake check scams aren't only common; they're on the rise, with 2019 seeing the number of reported scams jump up 65% from 2015 levels.

Always Wait for the Check to Clear

The key to beating fake check scams is to wait for the check to clear with your bank before sending any money or items. Note that this can take a few days, sometimes even about a week. Wait until the deposit in your bank statement no longer says "Pending" and has fully cleared.

But there are still some ways to avoid becoming the next victim, including:

- Not accepting checks from someone you don't know.

- Verifying the check is genuine before cashing it by calling or visiting the branch or financial institution supposedly sponsoring it.

- Verifying the check is cleared by calling your financial institution.

- Saving all documentation that may have come with the check—especially in the case of a fake cashier's check.

- Not accepting a check that's made out for more than your selling price.

- Never sending payment via gift cards, money orders, or money transfers, especially to someone you don't know.

And, as always, the best way to avoid a scam is to follow your gut. If something feels off—it probably is.

Fallen Victim to a Fake Check Scam?

Another reason fake check scams are so popular is that they're challenging to track or undo once they're done.

If you deposited the fake check into your bank account, not only will you not receive the money—or have it taken away from you—you could also possibly face some pretty severe consequences.

Still, if you think you're the victim of a fake check scam, there are still a few options left for you.

If you paid a scammer using gift cards, money order, wiring, or transfer service, you should contact that company as soon as possible to report the problem.

You should also immediately contact your financial institution to report the issue.

And you can—and should—always file a complaint with the Federal Trade Commission.

Scams Relating to Fake Checks

Beware of Fake Cashier's Checks in Craigslist Transactions

Beware of buyers on Craigslist who only want to pay for your item with a cashier's check, then overpay you for your items—they're trying to steal money from you.

Warning Signs of Publishers Clearing House Fake Checks

If you receive a check in the mail from Publishers Clearing House from winning a sweepstake, don't celebrate just yet.

Know the Telltale Signs Of Fake Cashier's Check Scams

When selling items online, accepting a cashier's check for payment can be a risky business as scammers use fake cashier's checks to steal from you.

Beware of Fake Cashier's Checks on Facebook Marketplace

Facebook Marketplace may seem like the best place to find a deal, but it comes with the risk of being scammed by fraudsters with fake checks.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Guides Relating to Fake Checks

9 Things to Do To Avoid Bounced Checks: Best Practices

While paper checks are not as common as they used to be, they are still a fairly common form of payment. However, they may not be the safest way of receiving funds.

How to Get Verified on TikTok

Securing that little blue checkmark can mean brand collabs, sponsorship opportunities, or protecting your unique content from impersonators.

How to Tell if Nikes Are Fakes: From Tags to the Stitching

Nike is one of the biggest brands targeted by counterfeiters and scammers - be extra careful with Nike products from non-official retailers as you could end up with a fake

Funeral Homes & Prices - What Are The Costs & Your Rights?

Average prices from funeral homes range between $8k to $14k and consumers are meant to be protected by a 'Funeral Rule' - what are your consumer rights?

How to View Your Amazon Archived Orders & Hide Search History

If you share your account with multiple users, archiving your past orders is a good way to keep others from seeing your orders and ruining a surprise or seeing private orders.

News Relating to Fake Checks

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.