Money Transfers In Depth

- What Are Money Transfer Scams?

- Red Flags of Money Transfer Scams

- Most Common Money Transfer Scams

- How to Beat Money Transfer Scams

- Fallen Victim to a Money Transfer Scam?

Money transfer scams seek to target people, often online, by leveraging the anonymity of the scammer and manipulating the target into making an emotional decision to send funds to someone they don’t know.

In some cases, the person may pretend to be a trusted friend or relative, or mimic someone from a reputable organization. Regardless of the pretext, they attempt to disappear after the money has been transferred without providing any of the promised payment.

Fortunately, if you know how these scams work, the red flags to look out for, and how to beat them, you can stay a step ahead of scammers and protect your hard-earned funds. In some cases, it may be possible to get your money back if you’ve already fallen victim.

What Are Money Transfer Scams?

Money transfer scams typically involve someone asking you to help them transfer money in exchange for payment.

One example of a money transfer scam looks like this:

- You get a letter or email from a friend or trusted business (the scammer) and are asked to help them send a large amount of money to another country

- They give you a story about how they can’t do it on their own and that’s why they need your help

- They promise you a share of the money if you agree to help out

- Once you agree to help, they say you’ll need to pay a fee to get your portion of the money

- After you pay them, you never get the funds and the thief is gone with your money

The ultimate goal of money transfer scams is to get your money quickly and then move on to the next victim.

Red Flags of Money Transfer Scams

There are several red flags you can keep an eye out for to protect yourself from these kinds of scams, which include:

- If someone asks you to transfer money on their behalf, this is likely the sign of a scam.

Example Nigerian Prince LetterURGENT BUSINESS PROPOSAL

We have thirty million U.S. dollars which we got from over inflated contract from crude oil contract awarded to foreign contractors in the Nigerian National Petroleum Corporation (NNPC). We are seeking your assistance and permission to remit this amount into your account. Your commission is thirty percent of the money.

Please notify me your acceptance to do this business urgently. The men involved are men in government. More details will be sent to you by fax as soon as we har from you. For the purpose of communication in this matter, may we have your telefax, telex and telephone numbers including your private home phone telephone number.

Contact me urgently through the fax number above.

Please treat as most confidential, all replies strictly by DHL courier, or through above fax number.

Thanks for your co-operation.

Yours faithfully,

Prince Jones Dimka

- If someone asks you for your online banking or credit card information, there’s a good chance they’re trying to steal from you.

- If you get a notification that you won a prize (for something you never entered), but you need to pay a fee to claim your winnings.

- If someone asks you to deposit a check for them, promising to transfer a portion of the money to your account or through a wire as payment, it’s most likely a scam.

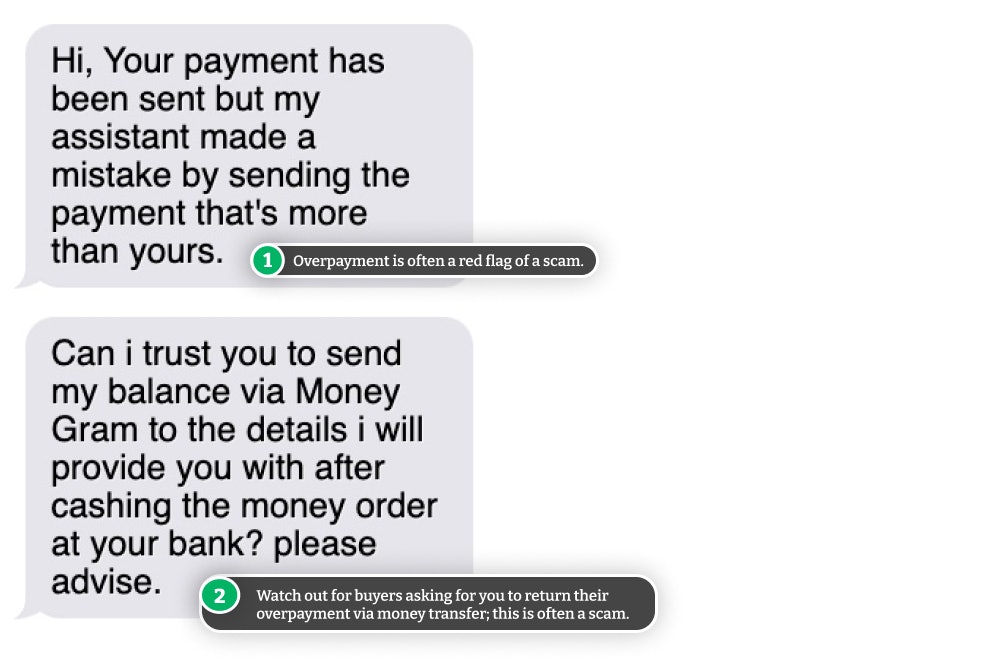

- You get an overpayment via check on an item you’re selling and are asked to wire the overpaid amount back.

- The check will often fail to clear and you’ll be left with bank fees and less the money you paid the scammer

- You apply for an apartment and before you can see it, you need to pay a deposit, first month’s rent and a security deposit over wire transfer.

- A romantic connection online requests financial help to come see you in person and needs you to wire the funds, it’s likely a romance money transfer scam.

Most Common Money Transfer Scams

There plenty of money transfer scams out there, with new ones being created daily, but some of the most common ones include:

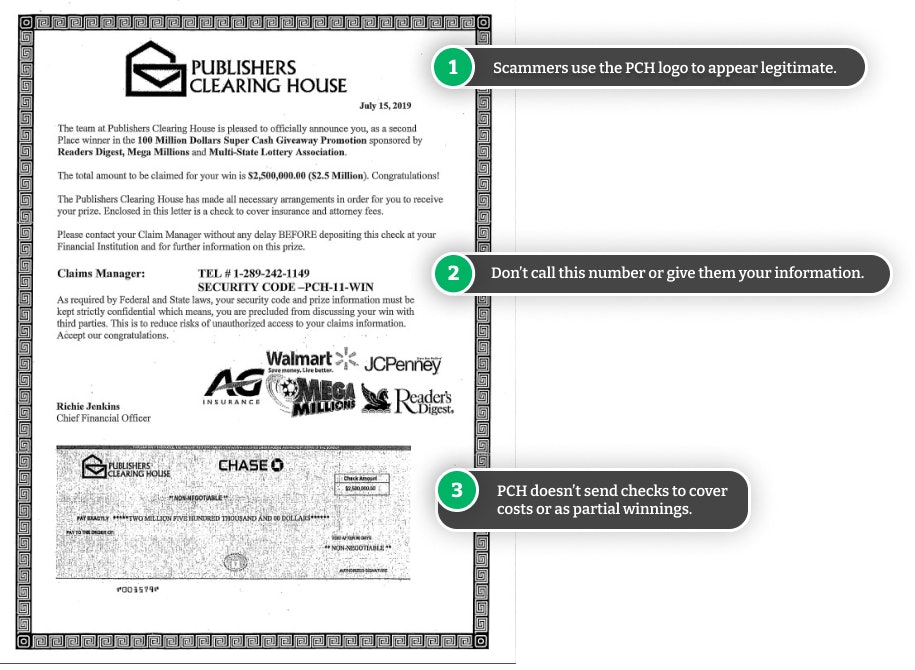

Lottery/prize scams

Lottery and prize scams involve scammers telling their victims that they’ve won a prize, sometimes sending them a fake partial check for their winnings. They'll tell their victims that all they need to do to claim their prize is send money to cover taxes or fees associated with their winnings. Soon after the victim sends the money, the original check bounces and they never receive a prize or get their money back.

Romance scams

Romance scammers lie to people, making them think they truly want a long-term relationship with them. They then ask their victim to send them money to either go see them in-person or help with an urgent need. After the scammer gets the money, they end the relationship or delete whatever social media or dating website account they used to target their victim.

Overpayment scams

Sometimes, a scammer will pose as a buyer for an item you’re selling. They’ll send you a check for over your asking price and then will ask you to transfer money back to them after “mistakenly” sending you too much. For example, you’re selling an item using an online marketplace or classifieds service. A buyer (the scammer) will send you a check for $1,500, but you were selling it for only $1,300. They then ask you to transfer them the difference, $200. However, after you’ve repaid them, the bank will flag the fake check and you’ll be out both $1,300 and the $200 you sent the scammer.

Online shopping payment scams

Online shopping scams typically involve a seller setting up a fake website or advertising products they don’t actually have at an extremely low price. After the victim sends money to the seller (scammer), they refuse to send them the goods they paid for. In some cases, a buyer can execute an online shopping scam by sending the seller too much money with a fake check and asking for some of it in return. In other words, they run an overpayment scam while pretending to shop online.

Overseas Money Transfer

One of the most common money transfer scams involves someone overseas claiming they don’t have the ability to send a large amount to someone in another country. They say they need your help—in exchange for a portion of the money. They then ask for your bank account information so they can supposedly deposit the funds into your account. At that point, they take money out of your account without asking and disappear.

How to Beat Money Transfer Scams

If you come across this kind of scam, the best way to beat it is by:

- Not clicking on any links if it was sent through email

- Clicking on a link from a potential scammer can be dangerous because the link may contain malware that they could use to steal personal data off of your computer or infect it with another kind of virus

- Never transferring or send any money at all to people you don't know

- Never replying to any email where the sender asks for personal information or money—even if it seems to come from someone you know

- Always hovering over a sender’s email address or long-tap it to reveal the actual source to ensure it's not a spam email address

- Asking a potential buyer or seller to meet in person to do the transaction

- Be sure you go to a public, well-lit area and only do so if you feel like it is safe option for you

Fallen Victim to a Money Transfer Scam?

If you’ve fallen victim to a money transfer scam, below are some ways to potentially get your money back, protect your identity, or report the incident to the authorities.

Contact Your Financial Institutions

If you’ve fallen victim to a money transfer scam, you should first report the incident to your bank or credit card company you used to make the payment. You may be able to get your money back.

Some banks reimburse their customers when they’ve been scammed, and others are able to stop payments to people, especially if they haven’t claimed the funds yet.

If you used a service like Western Union, you should reach out to them immediately and describe what happened. If the thief hasn’t claimed the cash, they may be able to prevent them from getting it and refund your money.

Protect Your Identity

If you provided the scammer with sensitive information such as your login credentials, financial accounting information, or any other identifying information, you’ll want to do the following:

- Contact your bank to alert them of the incident

- Contact your credit companies to freeze or cancel your accounts

- Place fraud alerts on your credit report

- Freeze your credit

- Report it to the authorities

- Change your passwords, especially if you use the same one for multiple accounts

Report it to the Authorities

It’s always a good idea to report a scam to the authorities, both locally and on the federal level. While you may not get your money back, your information can help protect others from falling for the same scam or help the authorities catch the scammer.

You can report the incident to the:

Scams Relating to Money Transfers

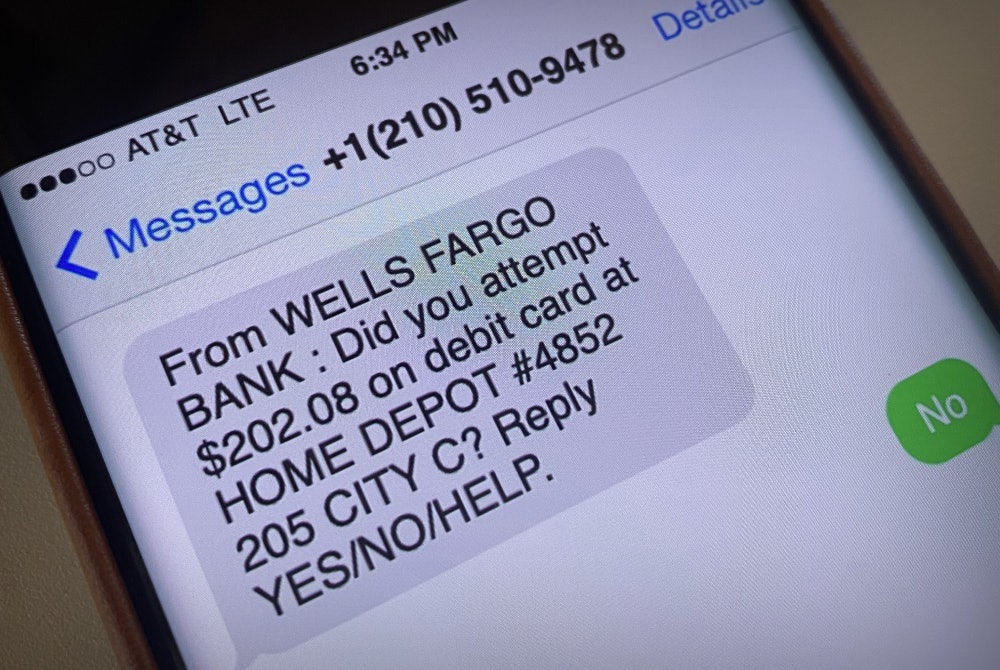

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

How to Beat Airbnb Payment Scams That Can Leave You Stranded

When booking your next travel destination via Airbnb, be sure to always pay using the site's online system, or you could be scammed out of your money.

Fake Escrow: Craigslist Users Beware of This Common Scam

Escrow services are supposed to keep your money safe, but in this Craigslist scam, these escrow sites will do more damage than good.

Avoid Paying for a Pet via a Cash App Deposit—It's a Scam!

Keep your money safe by only paying for your new pet once you have the pet in your possession and avoid using Cash App.

Venmo Email Scams: Red Flags & How to Beat Them

Venmo users are noticing suspicious emails hitting their inboxes with claims of a large sum of money waiting to be transferred by a PayPal user.

Cash App Flips: Don't Be Fooled By Promises of Free Money

One of the most common scams found on the app, this is an attempt to steal your money by promising more in return for a small deposit—like flipping houses but for cash.

How to Protect Yourself from 6 Common Apple Pay Scams

Apple Pay may be a convenient way to send money, but it's also become a favorite among scammers looking to make a quick buck at your expense.

Cash App Rental Scam: Don't Fall For These Common Tricks

Scammers are taking advantage of renters desperate and in a rush to find a new home, stealing thousands from innocent people.

Warning Signs of Publishers Clearing House Fake Checks

If you receive a check in the mail from Publishers Clearing House from winning a sweepstake, don't celebrate just yet.

How to Beat Grandparent Scams: Top Tips To Keep Seniors Safe

Scammers have taken to posing as relatives of senior citizens in an attempt to steal hundreds and even thousands of dollars by playing the sympathy card.

Guides Relating to Money Transfers

New Apple Pay Text Scam Claims Account Has Been Suspended

Multiple text message scams are circulating around the world which claim that your Apple Pay has been suspended. We provide multiple examples of this scam and how to avoid this Apple Pay scam.

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

15 Ways to Protect Your Bank Account from Scammers

Keeping your bank account and money secure isn't as simple as keeping your PIN a secret. Hackers and scammers find numerous ways to gain access to your funds.

Protect Your Funds: 6 Safe Ways to Send Money in the U.S.

Nowadays, there are many options for quick peer-to-peer money transfers. Here are six safe ways to send electronic funds via mobile payment apps.

News Relating to Money Transfers

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.