Phishing In Depth

Phishing Statistics 2021

Source: Digital InTheRound, 2021

- What Are Phishing Scams?

- The Goal of Phishing Scams

- Red Flags of Phishing Scams

- How Do You Beat and Avoid Phishing Scams

- Common Phishing Scams

- How to Recover From a Phishing Scam

From 2015-2020, the FBI’s Internet Crime Complaint Center (IC3) received more than 2.2 million fraud complaints and reported losses of $13.3 billion. The largest numbers of complaints and most significant monetary losses were attributed to phishing scams.

In 2019, the Anti-Phishing Working Group (APWG) (an international effort to reduce cybercrime made up of more than 2,200 government, industry, and law enforcement organizations) recorded a record level of phishing scams, which continued into 2021. The group detected more than 600,000 phishing websites, 325,500 unique phishing email scam campaigns, and more than 1,300 brands that scammers targeted in the first quarter of 2021.

What Are Phishing Scams?

Phishing scams are designed to steal your identity and ultimately take your money. In most cases, the scammers impersonate a legitimate business or associate to trick you into believing you are dealing with a trusted source.

For example, you might get an email claiming to be from Amazon asking you to verify a purchase or your bank asking you to confirm a charge. If you click on the link provided, you might be redirected to a fake website that looks similar to the real one and asks you to enter your login information.

You might also launch malicious software that can scan your computer to steal your account information by clicking on the link. This software might also encrypt everything on your computer and demand a payment to de-encrypt it (ransomware).

Phishing Scams Come In Various Forms

Phishing scams can happen via email, text, phone calls, and even mail. They may also use fake websites to trick you into entering your information.

Phishing scams have become more sophisticated over time. Scammers use social engineering tactics to learn personal details about you to personalize their contact with you and make their requests more believable. For example, scammers might learn the CEO of a company is traveling through social media posts or check-ins. They then launch a phishing email attack impersonating the CEO and ask the CFO to wire money using details of the trip to convince them it's really them.

The Goal of Phishing Scams

The goal of most phishing scams fall is to trick you into taking one of these actions:

- Send money to the scammers

- Click on a link or download an attachment to launch malware or ransomware

- Click on a link that sends you to a fake website to steal your passwords, credit card information, or bank account information

All phishing scams have one main goal in mind—to steal your money. Whether that is via first stealing your identity or simply getting your bank account information directly.

Red Flags of Phishing Scams

Scammers will use all sorts of tricks to get you to click on a link, provide personal information, or send the money. While there are hundreds of thousands of different phishing scams active at any time, they all have a few common elements.

- A sense of urgency requiring immediate action or threats

- Requests for money or personal information

- Asking for payments in gift cards or wire transfers

- Asking you to click on a link or download an attachment

- Inconsistency in email addresses, domain names, and links

- An overly familiar tone

Consumers and businesses need to remain vigilant to look for the red flags and avoid becoming a victim. With some 3 billion phishing emails being sent every day, scammers are working hard to fool you. Don’t let them.

How Do You Beat and Avoid Phishing Scams

Beating phishing scams requires being careful anytime you receive an email or text, especially if it asks for passwords, personal information, or money.

If you suspect suspicious activity, don’t click on any links or enter any information. If you have doubts, contact the company by finding their official website or contact information rather than responding to an email or clicking on a link.

To avoid falling for a phishing scam, remember:

- Companies typically do not contact you and ask for your login credentials, such as your username and password.

- Avoid clicking on anything in a text or email that is unsolicited.

- If you do want to respond to the email, verify the company’s information is correct. Don’t use the link, email, or phone provided in the phishing scam.

- Examine the email address and URL. Many phishing scams will include email addresses similar to a legitimate company’s name but slightly different to trick you.

- Never open email attachments from someone you don’t know.

- Be careful with the information you share on Facebook or other social media. For example, pet names, birthdays, and other information can be used by scammers to answer security questions or personalize a phishing email.

Change Your Passwords Regularly & Use Strong Ones

Make sure you’re using strong and unique passwords for all of your accounts. This way, if a scammer gets hold of one of your passwords, they won’t gain access to multiple accounts. You should also change your passwords regularly to keep the scammers at bay. You can use a password manager to help you keep track of them all.

Common Phishing Scams

To keep yourself safe from phishing scams, you should familiarize yourself with some of the most common versions so you can stay alert.

Business Email Compromise Scam

Scammers impersonate a company employee or customer and trick the business into sending money, such as asking them to wire money to pay a bill or sending a deposit for a fake invoice. In 2020, business email compromise (BEC) phishing email scams cost companies approximately $1.8 billion.

Microsoft 365 Phishing Scams

Scammers send a message saying you need to reset your Microsoft password or claim there is an issue with your account that needs immediate attention. When you click on the link, you are directed to a fake site where scammers can steal your passwords and then use your email to scam others.

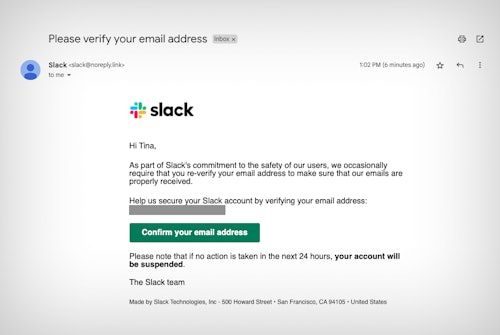

Account Suspension Phishing Scams

A phishing email arrives saying your account has been suspended due to lack of activity or suspicious activity. Another version of this is when scammers say your account will auto-renew at a specified rate if you do not act. These scams are common with brands like PayPal and Amazon.

Fake Delivery Phishing Scams

Scammers impersonate FedEx or UPS, claiming they could not deliver a package, and ask you to provide additional details to reschedule the delivery. This message can come as either a text message or email.

Employer Phishing Scams

A phishing email may appear to come from your employer, alerting you to changes in personnel policies that you need to indicate you received. Always check with your employer directly if emails seem suspicious.

Fake Purchase Phishing Scams

Another common phishing scam is an email from a company such as Amazon, Walmart, or Target asking you to verify a large purchase. Scammers hope people will click on the links they provided to avoid being charged for a purchase they didn’t make.

COVID-19 Phishing Scams

Scammers offer free COVID-19 tests, government stimulus payments, or Medicare prescription cards in exchange for personal information used to steal your identity.

Government Service Phishing Scams

These phishing scams include offers about government services, such as unemployment benefits or student loan deferments.

How to Recover From a Phishing Scam

To recover from a phishing scam, you need to take the following specific actions.

1. Contact Financial Providers

If you have been scammed out of money, you will want to call the bank, credit card issuer, money wire service, or gift card provider to alert them you have been scammed. Ask them to reverse the charges.

2. Update and Scan Your System

Often phishing scams involve placing malicious code on your device. Update your antivirus software and run a full system scan to ensure your computer, laptop, or electronic device has not been infected.

3. Change Account Passwords

If you have any reason to believe your email, social media, or any other accounts have been compromised, change the passwords as soon as possible.

4. Contact the Credit Bureaus

If you are concerned about identity theft, bank account, or stolen credit card information, you can place a fraud alert or credit freeze. If you place a fraud alert with Equifax, Experian, or TransUnion, they will report it to the other agencies; therefore, you only need to create a fraud alert once. If you wish to freeze your credit, you must contact each consumer credit reporting agency separately.

- Equifax: 800-685-1111

- Experian: 888-397-2742

- TransUnion: 888-909-8872

5. Report Phishing Scams

Report phishing scams to the FBI Internet Crime Complaint Center (IC3). You will need to provide the following information:

- Name, address, phone, and email contact.

- Information about any financial transactions that occurred, such as amounts, transaction dates, where money was sent, and account information.

- Any details you know about the scammer, such as email, website, or IP address.

- Copies of related texts or emails (including headers).

- A description of what occurred.

While the IC3 does not undertake investigations, it does forward your complaint to the appropriate federal, state, and local law enforcement agencies.

Has Your Identity Been Stolen?

If you’ve become a victim of identity theft and someone is now applying for things like credits cards and loans in your name, follow these steps to recover.

Scams Relating to Phishing

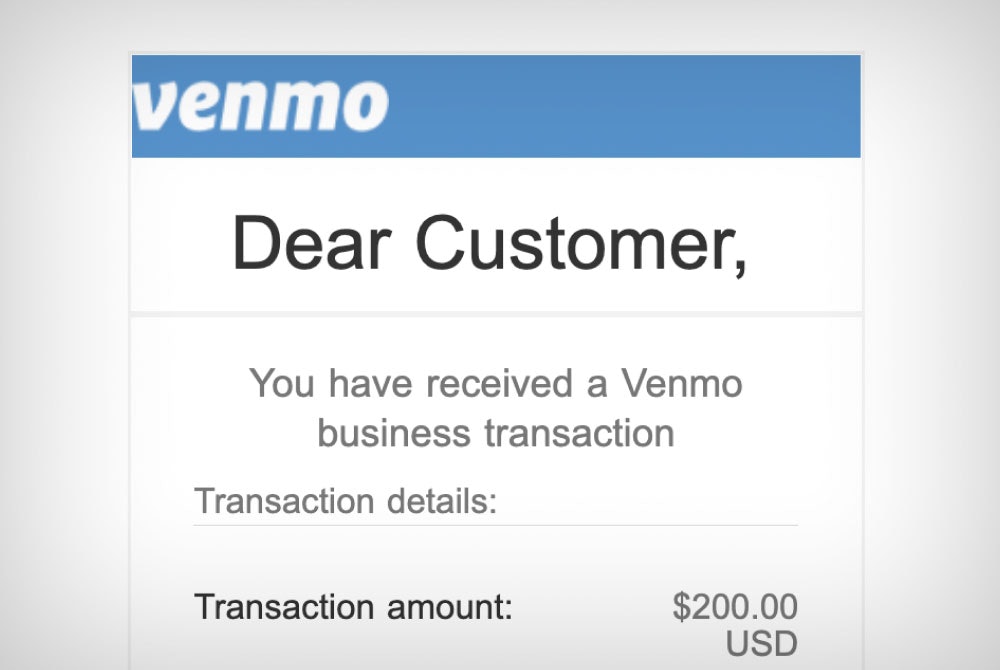

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

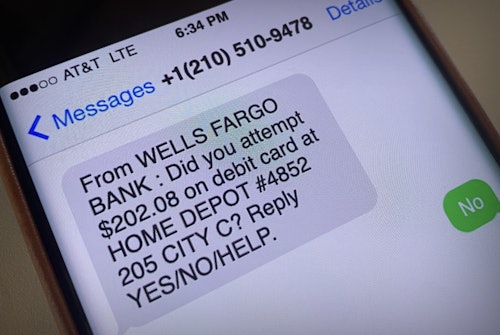

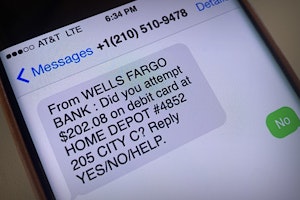

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Netflix Text Message Saying Your Payment is Declined is Fake

Scammers are sending text messages claiming to be from Netflix and saying your subscription has been put on hold. Here's how to tell the texts are fake and what to do about it.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

AT&T Spam Text: How to Identify and Avoid Scam Texts

AT&T customers who have received spam text messages need to be careful not to click the link included. Find out how to identify scams and how to block spam texts.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Wait! That Walmart Giveaway Text May be a Scam!

Fake texts are being sent to consumers claiming a hefty sum is waiting for them on a Walmart gift card, but falling for this scam puts you at risk of identity theft.

Guides Relating to Phishing

New Apple Pay Text Scam Claims Account Has Been Suspended

Multiple text message scams are circulating around the world which claim that your Apple Pay has been suspended. We provide multiple examples of this scam and how to avoid this Apple Pay scam.

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

McAfee Scam Email Claiming That Your Device is At Risk

Phishing emails from scammers posing as McAfee are attempting to steal your private information such as credit card details, account logins, social security number, date of birth and more.

Beat eBay Scams and Stay Safe When Shopping Online

Whether it's a counterfeit product, a sketchy seller, or a price too good to be true, eBay scams are widespread, so it's important to know how to protect yourself.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

News Relating to Phishing

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

UK Teen Uses Google Ads to Lure Victims to His Scam Website

A teenager was found guilty of money laundering and fraud after scamming several people out of thousands of dollars.

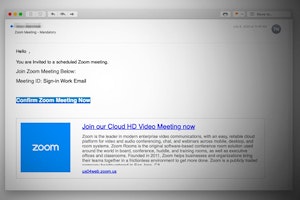

Zoom Phishing Scams On the Rise Thanks to the Pandemic

The global pandemic has unleashed several changes upon the world, from the work-from-home revolution to the phrase “social distancing,” and now, Zoom phishing.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.