TransUnion In Depth

TransUnion was founded in 1968 as a holding company for the Union Tank Car Company, a company that leased rail cars to other businesses. The following year, the Credit Bureau of Cook County acquired TransUnion, which maintained over 3.6 million credit accounts. Since then, TransUnion has grown and now aggregates information on over 1 billion consumers in over 30 countries and has over 65,000 business customers.

Of the top three credit agencies, which include Experian and Equifax, TransUnion is the smallest. Its principal business is credit reporting, using both the credit and public records of individuals to create a comprehensive picture of the financial state of consumers. It also provides many other products and services related to credit.

TransUnion

It's important to verify links and contact details to beat imposters.

TransUnion's Products and Services

TransUnion provides over 100 products and services for consumers, businesses, and the public sector.

Credit Reporting

TransUnion uses a formula called VantageScore 3.0 to generate a credit score that helps companies determine whether a consumer is a good credit risk. To come up with your credit score, TransUnion compiles information about your credit and financial history. Some factors that go into a credit score include:

- How often you apply for credit

- How much of your credit you use

- How long you have had credit

- If you pay bills on time

- What types of credit you use

This score can range from 300 to 850. Here is how that score relates to a credit grade scale:

- 781-850: A

- 720-780: B

- 658-719: C

- 601-657: D

- 300-600: F

By law, TransUnion must also provide consumers with one free credit report a year upon request. They can only provide your credit report to a business when you give them permission, for example, when you sign up for a new credit card or car loan.

Credit Monitoring

TransUnion also provides services to help you manage your credit. TransUnion Credit Monitoring is available for a monthly fee and includes the following services:

- Identity Theft Protection: You get access to an ID theft hotline and ID theft insurance with a subscription.

- CreditCompass: This feature will give you tips on how to improve your credit score by changing parts of your credit history.

- Credit Lock Plus: This feature will allow you to lock and unlock your credit report with TransUnion and Experian.

- Credit Score Simulator: With this feature, you can test how your credit score will change if you sign up for more credit accounts or make other changes to your finances.

- Credit Protection: Get emails each time a business pulls your credit report to help prevent any fraudulent accounts from being created in your name.

TrueIdentity

TrueIdentity is a free app that helps protect your identity and provides you with information on your credit report. With TrueIdentity, you can:

- Lock your TransUnion report

- Sign up for credit alerts (so you know if your credit report changes in any way)

- View your TransUnion report any time you like

TransUnion Identity Theft Insurance

TrueIdentity also comes with ID theft insurance of up to $25,000 to cover losses when your identity is stolen.

TransUnion Fraud Alerts

Creating a fraud alert is an option for anyone who suspects that they have become victims of fraud or identity theft. It doesn't prevent anyone from viewing your credit report, but it notifies anyone checking your credit that they have to take extra steps to verify your identity.

Creating a fraud alert with TransUnion is simple, free, and will not affect your credit rating. There are three types of fraud alerts you can set up.

- Initial: This type of fraud alert is a good option if you think you may be the victim of identity theft or fraud. This alert will last for one year.

- Extended: This type of fraud alert lasts for seven years. You won't be able to create this type of fraud alert online because you will have to provide documents to prove your identity and confirm identity theft. But it is a good option if you are sure you are the victim of identity theft and have documented proof.

- Active Duty Military: This type of fraud alert is only for eligible military personnel worried about identity theft or fraud and lasts for one year.

If you create a fraud alert online, it will show up on your credit report the same day you place it.

TransUnion Credit Freezes

Freezing your credit protects your credit even more than creating a fraud alert. Freezing your credit will keep the sensitive data in your credit history from being accessed without your consent.

If you don't plan on applying for a credit card or loan, then freezing your credit is an excellent option to choose. If you think that your data may be at risk from a data breach or something similar, then you should freeze your credit, especially if your Social Security number was compromised. Once you freeze your credit, scammers can't use your credit identity to open new accounts using your name—but neither will you until you unfreeze it.

Freezing your credit with TransUnion is a free, straightforward process that can be done online. You'll need to create a TransUnion account, so you can easily unfreeze it when you need to apply for credit.

You can also freeze your credit with TransUnion by mail or phone if you don't want to create a TransUnion account. However, freezing your credit by mail is not recommended because it takes the longest time, and your information could be compromised when sending it.

Scams Impacting TransUnion

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

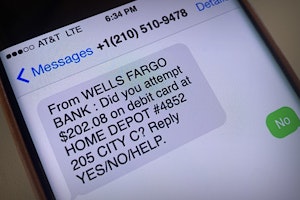

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

How to Avoid PayPal Shipping Label Scams: Top Tips

PayPal is a convenient way to pay for online purchases and has a reputation for safety and security. But scammers still find a way to use PayPal to help them steal products.

PayPal Shipping Scams: Tips to Protect Your Money and Items

Scammers take advantage of PayPal's buyer protection program to scam sellers out of their money and items for sale.

Guides To Protect Against Banking & Finance Scams

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

How to Recover from Identity Theft: 7 Steps to Take

It's estimated that $13 billion is lost each year to identity thieves. Knowing how to recover is important to minimize your losses and get your life back on track.

5 Reasons Why You Need to Check Your Credit Score Regularly

You may not pay much attention to your credit score until you need to apply for credit, but we have important reasons why your credit shouldn't be out of sight, out of mind.

How to Place a TransUnion Fraud Alert & Protect Your Credit

Placing a fraud alert can help protect your credit if you've fallen victim to a phishing scam or have had your identity stolen.

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.