Most Read

Real Chase Fraud Text Alert or Scam Message?

How to Identify a Fake Email from Your Bank & Protect Yourself

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

Wells Fargo Text Alert - Is It A Scam?

Capital One Fraud Text Alert Scams: Spotting a Fraud

Chase In Depth

JPMorgan Chase Bank is the largest bank in the U.S., making Chase scams prevalent thanks to imposters and fraudsters. John Thompson founded Chase Bank in 1877. Thompson named the bank "Chase" after the former United States Treasury Secretary and Chief Justice Salmon P. Chase, even though he had nothing to do with the bank. The bank was commonly known as Chase Manhattan Bank until 2000 when it merged with J.P Morgan & Co.

Chase was primarily a wholesale bank that dealt with other financial institutions and corporate clients in its early history. In 1955, it merged with The Manhattan Company. Later in the century, it acquired and merged with many other banks, including Chemical Bank and J.P Morgan & Co. It also expanded its influence over many non-financial corporations during this period. Today, it has more than 5,100 branches, 7,000 ATMs, and over a quarter of a million employees worldwide.

Chase

Website: https://www.chase.com/

Contact page: https://www.chase.com/digital/customer-service

Email: [email protected]

Contact page: https://www.chase.com/digital/resources/privacy-security/security/report-fraud

It's important to verify links and contact details to beat imposters.

Types of Scams Targeting Chase Customers

Scammers are constantly working on new ways to steal your personal information and hard-earned money. Unfortunately, the Chase name is something they often use to aid them in their efforts. Here are some of the most common Chase scams.

Chase Phishing Scams

The most common type of scam is phishing. Scammers use phishing to trick you into giving them your personal details or Chase login credentials using either an email, a text, or a phone call. For example, this scam may start with a text that says you have limited access to your account. This email says that you need to verify your account details because of a software upgrade or some similar type of message about the state of your bank account.

The fake Chase text or email will then use a link to direct you to a website set up to look just like the official Chase bank website with a form to enter your username and password. Once you enter your login details, the scammers will have them and be able to access your account.

Chase Fraud Alert Scams

This other type of Chase scam uses a fake fraud alert to steal user information and login details. This scam may start with what looks like a legitimate fraud alert from Chase notifying you that a large purchase has been made on your account.

The text will ask you to respond with a yes or no, just like legitimate fraud alerts. Once you respond, the scammers now know they have a valid phone number, and you will get a phone call from a person claiming to be a representative of Chase. The person will ask you for personal information like your Social Security number or your Chase login details to steal them or your money.

New Account Scam

In this Chase scam, your money won't be stolen, but your credit could be affected. This scam is targeted at people whose personal details have already been involved in a data breach and are being used for identity theft.

Scammers use stolen personal information to open up multiple Chase bank accounts to get the $200 Chase is offering to new checking account customers, which they quickly transfer to another account. As a result, you will eventually get a debit card in the mail from Chase for an account that you never signed up for.

Chase Money Transfer Scam

In this scam, you receive a text message or call saying that someone is attempting to withdraw a large sum of money from your account. The scammer will tell you that the best way to prevent the hacker from stealing your money is to transfer it to another bank account temporarily.

The scammer will use fear tactics and claim they are currently tracking the "hacker," and the transfer has to be done quickly. Once the money is transferred, the scammer will have it.

Chase offers credit cards that offer protection from scams and fraudulent purchases. In addition, the bank provides 24/7 monitoring for unusual activity, and you’re not liable for any unauthorized charges to your card.

How to Beat Chase Scams

While there are new scammers every day who are after your hard-earned money, you don't have to be a victim of their scams as long as you don't fall for the scammer's tricks. Here are a few ways to guard yourself against their tactics:

- Don't click on email links: If you receive an email or text about your Chase bank account, don't click on the link in the message. Instead, check your account at the Chase website or by using the official Chase banking app.

- Don't send money to or share account information with someone you don't know: Chase employees will never need the password for your account, or a code sent to you as a text message, so there is no reason for you to ever give this information to anyone else.

- Use two-factor authentication with your Chase account: Two-factor authentication will prevent scammers from accessing your account even if they have your username and password from a data breach, as long as you never give the code used for two-factor authentication to another person.

- Look for social engineering cues: Double-check all messages and emails that you think are from Chase. Does the link go to the official Chase website? Is the person trying to use fear to make you take action before you think? Why would this person need your password? Always be suspicious when it comes to your money.

- Use spam protection with email and text accounts: A good way to prevent phishing is to make sure you don't get the messages in the first place. Many email and cell phone providers have spam protection software that will block most phishing messages.

Protect Yourself From Chase Scams

Scams are so prevalent that you may run into one, or you may even fall victim to one. If you do, don't beat yourself up, but do take action. If a scammer contacts you, here are some things you can do to prevent any further damage and help catch the scammer.

Secure Your Chase Bank Account

If your Chase bank account has not yet been compromised, the first thing you will want to do is change your password to a new, long password that you aren't using with any other account. If you haven't set up two-factor authentication yet, also do that. If the scammers have accessed your account and you no longer have control over it, you need to contact Chase.

You can do this by calling:

- 1–800–935–9935 if you are located in the U.S.

- 1–713–262–3300 if you are outside the U.S.

Chase may be able to help you secure your account and recover lost funds.

Report Chase Scams

If you have been contacted by a scammer and did not become a victim of the scam, you should still report this to Chase so they can inform other banking customers and prevent future scams. You can do this by forwarding the email or text to [email protected].

Report the Scam to Authorities

You can report the scam to the Federal Trade Commission. Additionally, you can contact your state attorney general. Reporting the fraud to the local authorities is another option.

Scams Impacting Chase

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

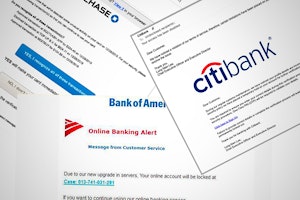

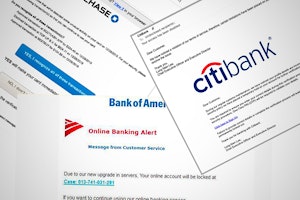

How to Identify a Fake Email from Your Bank & Protect Yourself

Scammers impersonate well-known banks, such as Citibank and Chase, to trick you into giving up your sensitive information—learn how to beat these scams.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

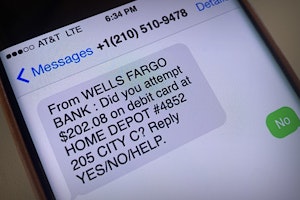

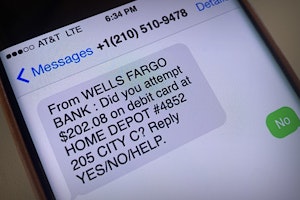

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

How to Avoid PayPal Shipping Label Scams: Top Tips

PayPal is a convenient way to pay for online purchases and has a reputation for safety and security. But scammers still find a way to use PayPal to help them steal products.

Guides To Protect Against Banking & Finance Scams

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

How to Place an Experian Fraud Alert: Online, Call, or By Mail

Placing a fraud alert on your credit report is important when trying to recover from identity theft.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.