Banking & Finance In Depth

Banking & Finance Scam Statistics 2020 USA

Source: 2019-20 Consumer Sentinel Report

Finance and banking scams are designed to deceive people into giving over sensitive banking information like PINs and credit card information or even facilitating remote access to your home computer to access your online banking via saved passwords.

Many scams are designed to steal money, making banks and financial institutions the primary end target. However, banking scams can often be part of broader schemes like identity theft, brand or government impersonation, or even "tech support" scams.

Common Finance and Banking Scams

Some of the most common banking and finance fraud events involve credit cards, debit cards, and mortgage payments.

Credit Card Scams

Credit cards are used as the primary transaction tool for online shopping and most in-store transactions. Most people will be familiar with the experience of lost, stolen, or compromised credit cards. Many stolen credit card numbers are for sale on the dark web.

Credit card details are vulnerable in many ways:

- Skimmers: Credit card skimming devices can be installed on existing ATMs and credit card payment systems like those used at the gas station. These devices skim the secure credit card information from the magnetic stripe found on the back of the card. Falling victim to a credit card skimming device is particularly confronting since it happened right before you.

- Careless security: Many credit cards are compromised due to carelessness. This can include not physically being with your card during events like leaving credit cards in cars when valeted or leaving cards in garments at the coat check.

- Observational weakness: Many people use cafes and libraries to do their online day-to-day laptop sessions and daily tasks. This is a criminal's playground. For example, reading the credit card number out when paying by phone in a cafe is very vulnerable to being overheard. Or, with a small camera, a customer's card can be filmed when handing it to a cashier or restaurant staff.

- Website hacks and data dumps: Many websites and businesses store our credit card details to make our recurring transactions and direct debits easier. This includes the biggest brands in the country, all the way down to small mom-and-pop stores. Unfortunately, hackers go after businesses and stored financial information to get large batches of cards in one hit.

- Bad vendors: Some e-commerce sites are set up in foreign countries with great deals to encourage you to purchase a cheap item but actually scrape, steal, and re-use the credit card

Mortgages

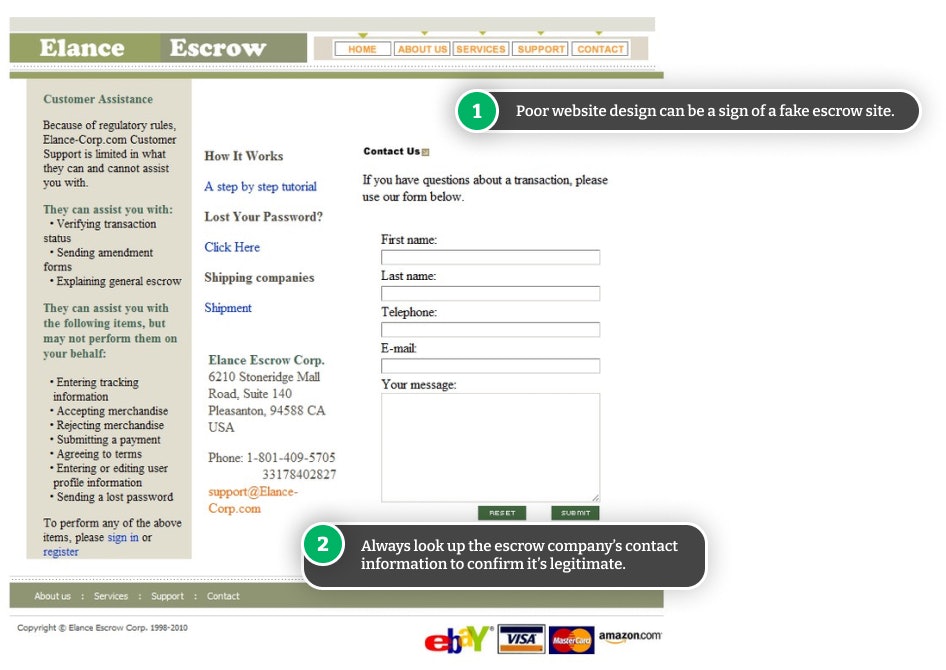

Home loans and mortgages are the largest single transaction that a customer will perform with the bank. As such, they provide an opportunity for scammers to try and intercept communications and get the settlement funds diverted to their own "escrow" accounts.

Savings Accounts & Debit Cards

Debit cards that are linked to savings accounts pose a massive financial risk. For example, if you only have a single savings account and use a debit card for transactions with this account, the loss or compromise of a debit card (in the same way that credit cards are compromised) can expose your entire savings.

Bank Fraud

Direct attempts to defraud banks are widespread and mainly involve loans for things that don't exist, loans for items that have been overvalued, or loans for things that other banks have already loaned money for.

There are many sophisticated and terrifying techniques that people use to defraud banks. Examples include a couple featured on American Greed, whose plan was to use multiple banks to finance mortgages of the same value on the same property at the same time—all without any of the banks knowing each other's financing agreements.

Over $50 million in loans was stolen from local banks.

Many people who are involved in this type of fraud live by John Paul Getty's maxim:

John Paul GettyIf you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem.

Overpayment & Refund Banking Scams

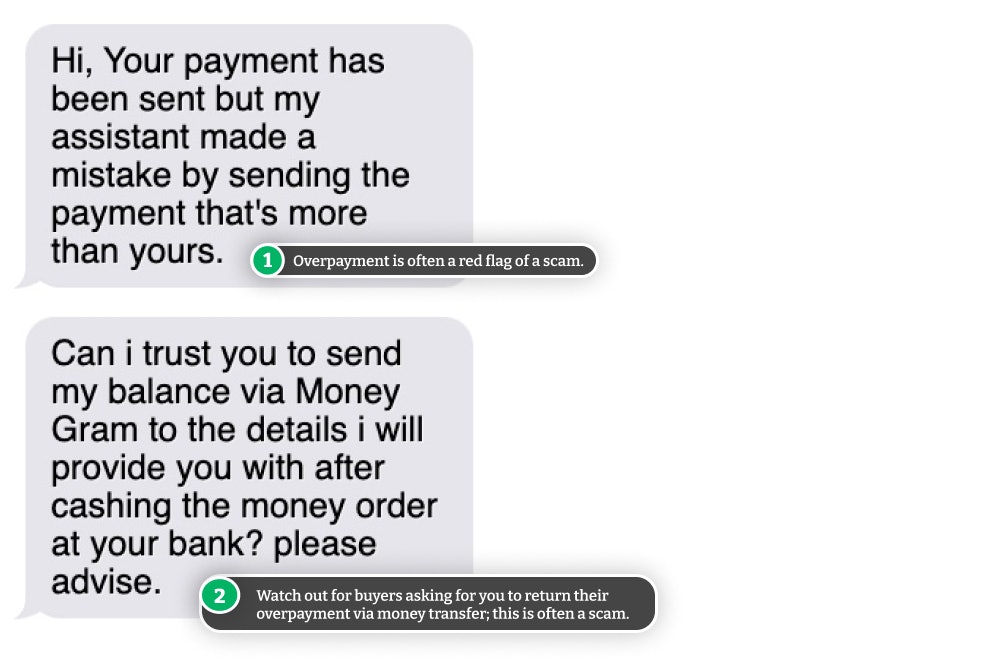

Scammers often use the overpayment technique in online transactions on auction websites where they act as a purchaser to send a check for more than the agreed sale price. They wait for you to notify them of the error, and they ask for a quick return of the overpayment.

When you cash their check, the bank will take a few days and realize their check is fake or canceled, but you have already sent the money.

How to Beat Banking Scams

It's almost impossible to avoid being the target of an invoice or banking scam, but there are certainly best practices you can follow to keep your money safe.

Some Payment Methods Offer More Protection Than Others

Using credit cards, PayPal, and some other payment methods offer pretty good protection against scams and fraudulent activity. Most requests for payment via wire transfer, such as MoneyGram or Western Union, should be met with caution.

Safety Tips: Stay Safe From Banking Scams

- Keep your credit and debit card information secure:

- Don't save your credit card information online.

- Cover your PIN when entering it at ATMs or POS machines.

- Don't ever give your card information to anyone you don't know.

- Monitor your bank statements regularly and report any unauthorized activity or charges.

- Check for card skimmers, especially at gas stations.

- Avoid using public WiFi when accessing your bank and credit card accounts. If you need to, use a virtual private network (VPN) when using public WiFi.

- Look for signs of scams when receiving emails, phone calls, texts, and mail from your bank or financial institution.

- Report lost credit/debit cards immediately and dispute any unauthorized charges.

- Don't give anyone your sensitive information, such as your bank PIN or login credentials.

- Verify that websites are legitimate before entering your information.

- Be wary when sending payment via untraceable methods, such as money transfer. Only pay for items/services when you have already received them.

- Don't trust buyers who overpay you for your items for sale, especially when they request a refund for the overpaid amount.

- Always wait until checks have cleared before sending items you're selling.

Scams Relating to Banking & Finance

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

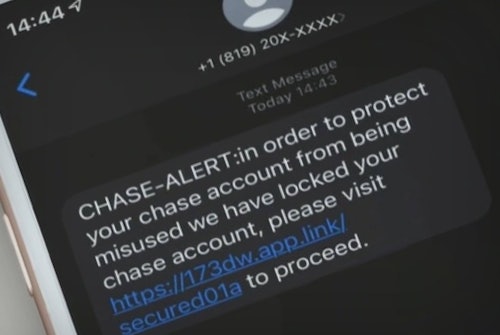

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Citizens Bank Text: Scam or Real Message?

If you received a text message from Citizens Bank asking for personal information such as your password or login credentials, it may be from a scammer trying to steal your money.

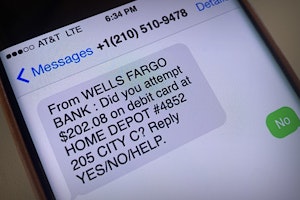

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

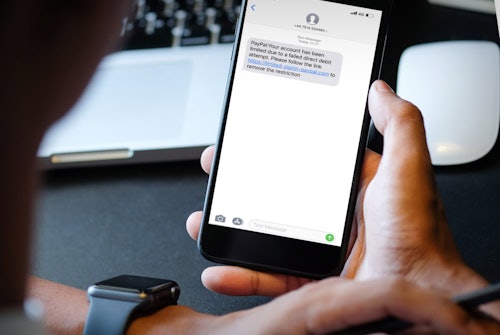

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Navy Federal Scam Text: What to Know to Avoid Identity Theft

A Navy Federal scam text is going around looking to trick individuals into giving up their personal or account information. Here's what you need to know.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Truist Text Alert: How to Identify a Real Text from a Scam

You may think that that Truist have sent you a text alert about your account. Here's how to check if it is actually a scam.

Guides Relating to Banking & Finance

Don't Be Spooked by Michael Burry's Bet Against the Market. The Reporting is Mostly Wrong

If you're worried that Michael Burry's has bet a large amount of money ($1.6 Billion) against the stock market and you are on the wrong side, don't be. The media reporting on this topic has been incorrect and we break it down.

Personal Loans for Car Maintenance: Pros and Cons

Do you need to maintain your car but are cash-strapped? A personal loan is one way to help deal with financial burdens, but does it apply when trying to repair a vehicle?

15 Ways to Protect Your Bank Account from Scammers

Keeping your bank account and money secure isn't as simple as keeping your PIN a secret. Hackers and scammers find numerous ways to gain access to your funds.

How to Protect Yourself from Fake Bank Text Messages

Learn how to spot the difference between a genuine and fake bank text and protect yourself from fraud.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

News Relating to Banking & Finance

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

$3.38 Million Lost in Squid Game Cryptocurrency Scam

Jumping on a social media or entertainment trend isn't always a good idea, especially when it comes to cryptocurrency.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.