- At Least $3.3 Billion Lost By Americans to Fraud in 2020

- Why is Fraud Increasing?

- Fraud & Scams are 14x Worse Than 2001

- Top 10 Fraud Types & Losses 2020

- Fastest Growing Types of Identity Theft

- Where Are The Targets? Here Are Fraud Reports by State

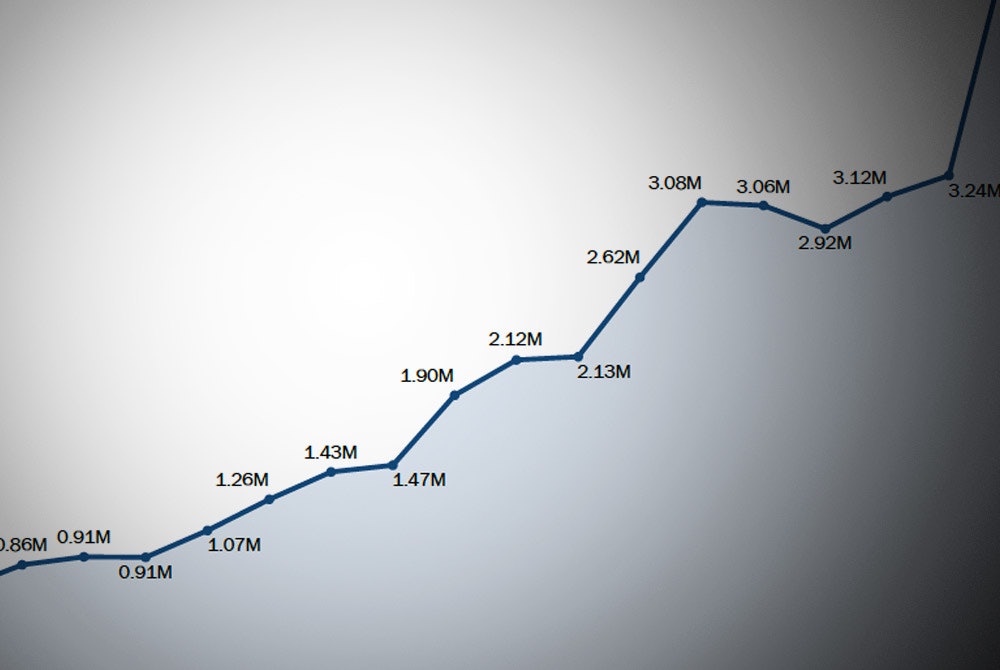

The Federal Trade Commission compiles an annual report on fraud and scams using the numbers of reported events across partner agencies (the Consumer Sentinel Reports & Databook). Their most recent numbers for 2020 show that fraud, scam, and identity theft cases in the U.S. rose to 4.72 million reported events.

This represents a massive 45% increase on the previous year's 3.24 million reports in 2019.

The numbers in the Consumer Sentinel reports are based on quantified reports to agencies. However, other research and reports show an even larger number based on research across segments of the population. Some estimate that almost 1 out of every 3 Americans fell victim to fraud or scams in 2020.

These larger estimates reflect that many people suffer through their losses and don't report the fraud to the FTC or other authorities.

At Least $3.3 Billion Lost By Americans to Fraud in 2020

The reported amount of losses from scams and fraud starts with the FTC showing a massive $3.3 billion lost to fraud in 2020, with upper estimates as high as $56 billion lost in other reports.

Globally, the number of scam events is much larger than the 4.72 million reports in the U.S., as this is an issue everywhere. For example, in the U.K., one in three people have been a victim of a scam. Thus, to understand the scale of the problem, we can choose a middle ground between the FTC and numbers from other reports and conclude that tens of millions of people fall victim to scams and fraud every year worldwide.

We all know that things continue to get worse—we've all been harassed by some robocalls, phishing emails, and scam text messages, and there are over 50 billion spam calls blocked every year in the U.S. alone. Unfortunately, it's become a part of daily life, and this increasing rate of fraud is here to stay and will continue to worsen.

For consumers, there has been a lack of tools to help avoid the traps. Verified.org was launched to help you understand what can be trusted and what can't. This is a huge problem to solve.

To put the scale of victims into perspective, the 4.72 million reported scam events in the U.S. in 2020 is equivalent to more than every single person in Los Angeles falling for a scam or fraud in a single year.

Identity Theft Was Extreme

In 2020, there were over 1.3 million victims of identity theft in the U.S.

Unfortunately, identity theft was the most reported type of fraud in the year. Identity theft is an extremely inconvenient and painful process that can take many months to unravel and can ruin a person financially for an extended period of time.

This type of fraud also is un-settling to victims who feel the acute impact of this crime which makes them feel powerless for an ongoing period, beyond the life cycle of a typical fraud or crime.

Why is Fraud Increasing?

When globalization began, it started with companies manufacturing and selling products across the globe. However, when communication became globalized, we all became global citizens.

When Bank of America wanted us to log on to the internet and use our bank accounts online, the mere fact that we were using our web browsers meant that we were opening ourselves up to criminals.

As residents of the U.S., the explosion of the internet worldwide means we are all now exposed to the best and worst of the globe.

As an economic and financial powerhouse, Americans wear a target for scammers from poorer countries—the internet and mobile communication provide an open passage from criminals from the far corners of the earth. As a result, billions of dollars are unwittingly paid out to scammers each year, with more and more criminals are joining their ranks.

Compounding this problem is a peculiar contradiction—there's no training required to get on the internet. Anyone from any age can instantly mix with the worst people on the internet.

As technology improves, scammers can scale their activity to increase the number of targets they can hit—the volume has moved from one to one and on to one too many.

Fraud & Scams are 14x Worse Than 2001

Back in 2001, the dot com boom was in full swing. Both personal internet and email access exploded.

Back then, the new online banking tools and the use of other essential services online were either new novelties or future dreams.

Fast forward to 2020, where banks, investments, medical information, and all of our data are now managed online—the stakes are much higher. The 14x growth of fraud and scams from 2001 matches in line with the rapid growth of the internet and our reliance on it for everything we do.

The internet has opened up a world of content and shopping from every corner of the globe, but it has also opened up a world of fraudsters and impersonators.

There are more criminals on the web than any other single destination.

Top 10 Fraud Types & Losses 2020

This table from the 2020 Consumer Sentinel report shows where the categories of the most common frauds are, as reported to the FTC and their Sentinel partners.

| Fraud Category |

Reports |

Total Loss |

Median Loss |

|---|---|---|---|

| Identity theft | 1,387,615 | Unreported | Unreported |

| Imposter scams | 498,278 | $1.19 billion | $850 |

|

Online shopping |

352,805 | $246 million | $100 |

| Internet services | 123,479 | $170 million | $210 |

| Lotteries and prizes | 116,205 | $166 million | $1,000 |

| Telephone and mobile services | 81,221 | $32 million | $225 |

| Travel and timeshare | 73,388 | $175 million | $1,100 |

| Business and job opportunities | 58,263 | $168 million | $1,950 |

| Healthcare | 49,821 | $21 million | $134 |

| Foreign money and fake check | 38,420 | $46 million | $1,950 |

| Investments | 24,467 | $387 million | $1,556 |

(Source: FTC Consumer Sentinel Data Book 2020)

Fraud is Much Worse Than Reported

Many people don't report fraud events, as they are either embarrassed or don't know who or how to report them. There's also a hesitancy to report to law enforcement as remedies are lacking, and there's no formal requirement to report it. Finally, most people think that once the money has gone, there's no way to get it back, and for the most part, that is true— scrambling to recover from fraud can result in many dead-ends.

For the above reasons (and many others), the number of actual fraud events is understated in any formal count from government agencies.

Researchers in both the U.S. and U.K. estimate 1 out of every 3 people has been a victim of scams and fraud.

The Consumer Sentinel report has losses at $3.9 billion in 2020, but other reports estimate that up to $56 billion was lost in 2020 to fraud and scams.

Most Financially Damaging Fraud Events

In terms of damaging fraud events, there's no question that Identity Theft is one of the most pervasive and lingering fraud events due to the time it can take to resolve.

For many types of scam categories, the amount lost on average can be well over $1,000. Scams where the loss is mostly over $1,000 and above include:

- Investment-related scams: Median loss of $1,566

- Business and job opportunity scams: Median loss of $1,950

- Fake checks: Median loss of $1,980

- Travel and timeshares: Median loss of $1,100

- Lotteries and prizes: Median loss of $1,000

A massive 176,848 Americans reported losing over $1,000 in 2020.

A further 39,374 reported losing more than $10,000 to a scam or fraud in 2020.

As scammers keep winning and the total amount of money increases, the volume of attacks will increase.

Another way of looking at these numbers is to see that just 40,000 targets in the U.S. accounted for $400 million in revenue for fraudsters and scammers in 2020. Remembering that many people do not report fraud makes the numbers even more terrifying.

Fastest Growing Types of Identity Theft

Identity theft stood alone as the single most frequent fraud in 2020, with over 1.3 million formal reports in 2020 and a disturbing 30% growth year over year.

The following types of identity theft are most on the rise:

| Type of Identity Theft | YOY Increase |

| Government Benefits Applied For / Received | + 2,920% |

| Tax Fraud | + 225% |

| Business / Personal Loans | + 127% |

| Federal Student Loans | + 88% |

| New Bank Accounts | + 87% |

| Auto Loan / Lease | + 85% |

| Passports Issuance & Forgery | + 85% |

| Securities Accounts | + 72% |

(Source: FTC Consumer Sentinel Data Book 2020, pg 14)

Where Are The Targets? Here Are Fraud Reports by State

Fraud and scam victims are not evenly distributed around the country. In 2020 there were three times more fraud reports in Nevada than North or South Dakota and Idaho.

| State |

Number of Reports per 100k |

Most Common Fraud Types |

|---|---|---|

| Nevada | 1,154 | Identity theft, credit bureaus |

| Delaware | 1,127 | Identity theft, imposter scams |

| Florida | 1,123 | Identity theft, credit bureaus |

| Maryland | 1,044 | Identity theft, imposter scams |

| Georgia | 1,011 | Identity theft, credit bureaus |

| Virginia | 928 | Identity theft, imposter scams |

| New Jersey | 883 | Identity theft, imposter scams |

| Colorado | 874 | Identity theft, imposter scams |

| New York | 872 | Identity theft, imposter scams |

| Pennsylvania | 869 | Identity theft, credit bureaus |

| Arizona | 869 | Identity theft, imposter scams |

| Tennessee | 866 | Identity theft, credit bureaus |

| Washington | 857 | Identity theft, imposter scams |

| South Carolina | 851 | Identity theft, credit bureaus |

| Alabama | 836 | Identity theft, credit bureaus |

| Texas | 822 | Identity theft, credit bureaus |

| North Carolina | 816 | Identity theft, imposter scams |

| Oregon | 815 | Identity theft, imposter scams |

| Arkansas | 813 | Identity theft, credit bureaus |

| California | 807 | Identity theft, imposter scams |

| Illinois | 806 | Identity theft, imposter scams |

| Connecticut | 797 | Identity theft, imposter scams |

| Missouri | 790 | Identity theft, imposter scams |

| Massachusetts | 771 | Identity theft, imposter scams |

| New Mexico | 758 | Identity theft, imposter scams |

| Alaska | 734 | Identity theft, imposter scams |

| Ohio | 760 | Identity theft, imposter scams |

| Rhode Island | 755 | Identity theft, imposter scams |

| New Hampshire | 742 | Identity theft, imposter scams |

| Louisiana | 732 | Identity theft, credit bureaus |

| Kansas | 729 | Identity theft, imposter scams |

| Michigan | 714 | Identity theft, imposter scams |

| Utah | 707 | Identity theft, imposter scams |

| Hawaii | 707 | Identity theft, imposter scams |

| Vermont | 696 | Identity theft, imposter scams |

| Minnesota | 691 | Identity theft, imposter scams |

| Wisconsin | 674 | Identity theft, imposter scams |

| Montana | 668 | Identity theft, imposter scams |

| West Virginia | 667 | Identity theft, imposter scams |

| Mississippi | 662 | Identity theft, credit bureaus |

| Indiana | 660 | Identity theft, imposter scams |

| Kentucky | 658 | Identity theft, imposter scams |

| Maine | 639 | Identity theft, imposter scams |

| Idaho | 635 | Identity theft, imposter scams |

| Wyoming | 619 | Identity theft, imposter scams |

| Nebraska | 603 | Identity theft, imposter scams |

| Oklahoma | 600 | Identity theft, imposter scams |

| Iowa | 524 | Identity theft, imposter scams |

| North Dakota | 460 | Identity theft, imposter scams |

| South Dakota | 459 | Identity theft, imposter scams |

(Source: FTC Consumer Sentinel Data Book 2020, pg 20)

Comments