Most Read

How to Beat Unemployment Scams: Protect Your Identity

How to Tell if Nikes Are Fakes: From Tags to the Stitching

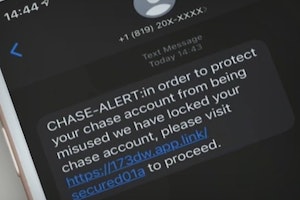

Real Chase Fraud Text Alert or Scam Message?

Received an Amazon OTP Text? It Could Be a Scam

How to Spot Fake Air Force 1s: 7 Signs of a Fake

Employment In Depth

United States Employment Scam Statistics 2020

Source: 2019-20 Consumer Sentinel Report

- What Are Job Scams?

- How Do Job Scams Work?

- Red Flags of Job Scams

- Most Common Job Scams

- How to Beat Job Scams

- Fallen Victim to a Job Scam?

Job scams have been around for decades, but according to the FBI, the invention of the internet has resulted in a significant rise in the number and nature of employment scams. These types of scams are evolving as scammers find new ways to trick innocent people into handing over their money.

Whether it is a flyer taped to a street pole or an offer through social media, scammers use fake jobs to lure people in. The end goal of employment scams is to ultimately steal your money, either by asking you to pay a fee to secure a new job or they first steal your identity once you give them your personal information.

Read on to learn how job scams work, what red flags to look out for, how to beat these types of scams, and what to do if you’ve fallen for one.

What Are Job Scams?

Job scams involve a supposed employer (a scammer) offering a job applicant employment, often in exchange for money. At times, the scammer will require their victim to pay for the opportunity to apply or perhaps to cover expenses associated with products they will have to sell for a profit.

Some job scams are more after your personal information than a quick payout. The scammer will then use your personal data to impersonate you or sell it to another hacker.

This type of job scam can be effective because people are often accustomed to providing personal details, such as their social security number, when applying for a job as part of an identity verification process. A scammer, however, will take your information and use it for their own profits.

Scammer's Tricks

- Requiring you to pay an admin fee upfront via wire transfer.

- Sending you a faulty check with overpayment and ask you to pay back the difference via wire transfer.

- Requiring you to pay for compulsory training before you start again through wire transfer.

How Do Job Scams Work?

Job scams are evolving as scammers find new ways to trick innocent people into handing over their money. Regardless of how much the script changes, the general story is usually the same.

You Get Notified About a Potential Job

First, you see a job that offers the potential of good money—either without a lot of effort or due to the position being a well-respected one that tends to earn applicants a decent salary.

For instance, someone may pretend to offer a job at well-known company so that you already start off trusting the “company.” Or, you may get an offer for a job via email for a company that doesn’t actually exist.

You Are Asked For Personal Details

Next, the scammer either asks you for money, personal information, or a mix of both. They may tell you that you’ll be selling valuable merchandise, but you have to pay upfront before they send you the goods.

When the fraudster is after your personal information, they may send you a form or direct you to a website, where you enter sensitive data like your social security number or banking information.

They may also say you have to pay a training fee before starting the job.

The Scammer Takes Your Money Or Information

After collecting any fees that you supposedly owe them, the scammer vanishes leaving you without a job and less the money you paid them. If they are after your personal information, once they have it, they will use it to try and steal your identity, money, or both.

Red Flags of Job Scams

You can avoid job scams by keeping an eye out for several red flags. For example, if you’re required to make a purchase to receive merchandise or equipment before getting started, the job is likely a scam.

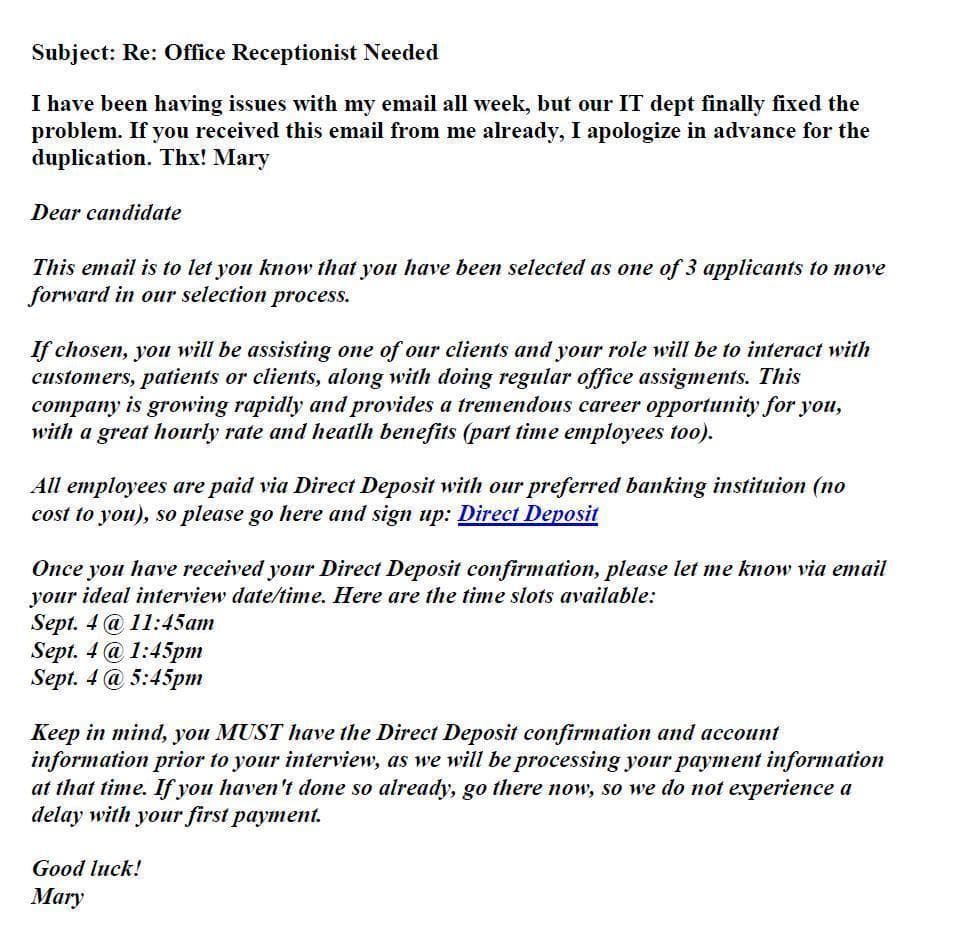

Also, anytime you’re asked to pay a non-refundable fee or asked for your direct deposit info immediately, the person is likely trying to make a quick buck off your desire for employment.

Most Common Job Scams

Fake Job Offers Sent Through Email

In this scam, you get an email for a job you never applied for. It may include extensive details about your supposed responsibilities and the nature of the company. You’re then asked to provide sensitive information, such as your driver’s license, bank account info, or social security number. They then use this to steal your identity.

Fake Work-From-Home Jobs

Scammers create fake jobs that allow you to work from home. They contact victims via email, social media, and SMS requesting that applicants fill in an application form or call them to apply. Their goal is to trick you into sharing personal information and/or steal your money.

A fake work-from-home scam will often involve the thief offering you a job that’s too good to be true, like part-time work for full-time pay or guaranteed weekly earnings. You then have to pay a fee to get trained or to receive goods that you will have to either assemble or sell as they are. After you pay for the products or training, the scammer disappears with your money.

Fake Job Placement Services

Many job placement agencies legitimately help many people find real jobs. It is crucial to understand how a legitimate agency works to make it easier to spot a fake. Real agencies do not charge the job seeker a fee for their service. Instead, the employer pays a fee, usually a percentage of the new employee's starting salary.

A scammer may reach out pretending to be a headhunter and then ask you to pay a fee for access to high-paying jobs. After you pay the headhunter their fee, they don’t send you any jobs.

Mystery Shopper Scam

This scam uses the same tactics as the work from home scam and job placement scam. In this case, the job offer is to get paid to be a mystery shopper. Scammers choose mystery shopping because it is harder to validate and doesn't require a face-to-face meeting. It seems like easy money, and the pool of victims is large because it is easy to convince someone that pretty much anyone can do it.

There are many other variations of this scam. The things to watch out for are any kind of request for payments upfront or any overpayment by check. The ramifications for victims of job scams are losing money, having your identity stolen (which can lead to other scams), and personal impacts like loss of confidence and humiliation. The chances of getting your money back are low, particularly if the scammers are based overseas.

How to Beat Job Scams

If you come across what looks like a fake job scam, take these steps to protect yourself and your money:

- Don’t respond to the job listing. They may have a script prepared in the event someone replies, designed to reassure you of the “authenticity” of the position.

- Never apply to or accept jobs from employers from another country (unless can verify the listing, company information, how you'll get paid, etc.).

- Never apply to jobs that were emailed to you out of the blue. If you're unsure about the job, contact the company directly from its website.

- Make sure you're visiting the company's real website as well. A secured site should start with "https://" before the webpage address.

- Don't click on any link in an email about a job that sounds suspicious because the link may lead to a website designed to steal your personal information.

- The link could also result in malware getting downloaded onto your computer or device.

- Don't give the scammer any money or any personal information.

- Even seemingly “innocent” information, such as a former address, can be used to complete a fraudulent profile and enable the scammer or someone else to steal your identity.

- Always ask to meet face-to-face, either in-person or via a Zoom call.

- Do your research. Check sites such as Glassdoor to ensure that the company is legitimate. They often have current and former employee reviews as well as salary averages and other important information to verify them.

Fallen Victim to a Job Scam?

If you’ve fallen victim to a job scam, you should record any details pertaining to the attack, including:

- When they contacted you

- What they said

- What email address they used

- Which company they are impersonating (if applicable)

- What information they collected from you (if any)

There’s a chance the authorities can use this information to track down the scammer and get your money back.

Protect Your Identity

Whenever you’re interacting with people online, it’s important to protect yourself from identity theft by never supplying sensitive financial or personal data, including when you’re applying for a job. In this way, you can protect yourself from potentially harmful identity theft.

File a Report

If you’ve been scammed, you should report it to your local authorities such as:

- The FBI: Contact the FBI’s Internet Crime Complaint Center, also known as ic3. They may be able to use the information in your report to arrest, charge, and convict the scammer.

- The FTC: It can be helpful to alert the Federal Trade Commission (FTC) of the incident. This and other kinds of fraud fall under their jurisdiction.

- The Attorney General: You can also report it to the attorney general for your state, so they can follow through and possibly hold the thief accountable.

- The Employment Website: Lastly, if you’ve been targeted via an employment website, you should alert their web administrators of the scam as well. They may have records of the IP addresses of people who have posted jobs, and, in some cases, this can be used to find them and get your money back.

Scams Relating to Employment

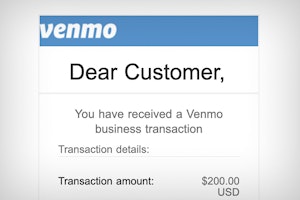

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

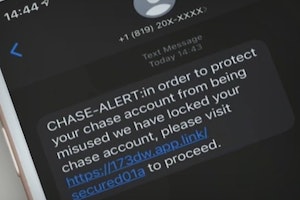

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Truist Text Alert: How to Identify a Real Text from a Scam

You may think that that Truist have sent you a text alert about your account. Here's how to check if it is actually a scam.

Wait! That Walmart Giveaway Text May be a Scam!

Fake texts are being sent to consumers claiming a hefty sum is waiting for them on a Walmart gift card, but falling for this scam puts you at risk of identity theft.

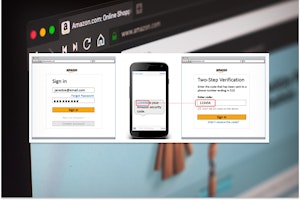

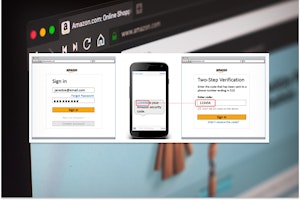

Received an Amazon OTP Text? It Could Be a Scam

If you received an Amazon OTP text message out of the blue, it could be a sign that someone else is trying to log into your account.

Guides Relating to Employment

How to Beat Unemployment Scams: Protect Your Identity

In 2020, unemployment fraud increased by almost 3,000%, with the Federal Trade Commission (FTC) receiving 394,000 complaints in that year alone.

How to Get Verified on TikTok

Securing that little blue checkmark can mean brand collabs, sponsorship opportunities, or protecting your unique content from impersonators.

How to Tell if Nikes Are Fakes: From Tags to the Stitching

Nike is one of the biggest brands targeted by counterfeiters and scammers - be extra careful with Nike products from non-official retailers as you could end up with a fake

Funeral Homes & Prices - What Are The Costs & Your Rights?

Average prices from funeral homes range between $8k to $14k and consumers are meant to be protected by a 'Funeral Rule' - what are your consumer rights?

How to View Your Amazon Archived Orders & Hide Search History

If you share your account with multiple users, archiving your past orders is a good way to keep others from seeing your orders and ruining a surprise or seeing private orders.

News Relating to Employment

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.

Roe vs. Wade Overturned: Abortion Rights in Your State

Find out what the overturning of Roe vs. Wade means for abortion rights in your state.

Searches for "COVID Vaccine 5G" Hit All-Time High, But Microchips Definitely Not in Vaccine

The number of people searching for the term "COVID vaccine 5G" on Google has just hit an all-time high, but there's one way to be sure that there are no microchips.