Investments In Depth

United States Investment Scam Statistics 2020

- What Are Investment Scams?

- Warning Signs of an Investment Scam

- Common Investment Scams to Be Aware Of

- How to Beat and Avoid Investment Scams

- Fallen Victim to an Investment Scam?

According to the Federal Trade Commission (FTC), investment-related scams account for less than 1% of all reported scams. While this number might seem small, it should still be taken seriously.

78% of the people who fell for investment scams also reported losing money. This is higher than any other category of scams, making it one of the top ten fraud categories. Investment scams also have the third-highest average loss per person and the second-highest total loss, right after imposter scams.

What Are Investment Scams?

In an investment scam, a scammer tries to trick you into investing your money. They could tell you that you are investing in any number of things, including:

- Cryptocurrency

- Stocks

- Bonds

- Notes

- Commodities

- Real estate

They may do this by giving you fake information about a real investment so that the investment looks more lucrative than it really is. Or they could create a phony investment opportunity out of thin air.

An investment scammer may tell you they are a financial advisor or work for a well-known financial company. They will be friendly, charming, and talk to you like they know you in order to gain your trust.

A common tactic the scammer will use is telling you that the investment opportunity is urgent and that you must act immediately or the opportunity will be lost. But the scammer has no interest in helping you earn money—they’re only interested in stealing it.

Warning Signs of an Investment Scam

When you work hard to earn money and want to invest some of your earnings for the future, it is important to be sure you are investing in something real and not just handing your money over to a scammer.

Here are some of the red flags you might see when dealing with a scammer who is trying to steal your hard-earned money:

- You are promised high returns on your investment that are too good to believe.

- You are told that the investment is only available for a limited time, and if you don't invest immediately, you will miss out.

- The "financial advisor" claims they know a lot about your retirement or investment needs.

- The "financial advisor" is aggressive, pushy, and wants/needs your answer right away.

- The "financial advisor" can't provide you with the required documentation on the investment. For example, a prospectus is required for stocks or mutual funds, and a circular is necessary for bonds.

- You are told you can double your money in only a few minutes.

- You are told you can "flip" your cash.

- You are directed to a cryptocurrency exchange that you or your friends have never heard of.

Common Investment Scams to Be Aware Of

Investment scams have been around for a long time, and there are several different versions. Modern-day investment scams may involve new technology like cryptocurrency. Or scammers may look to the past for inspiration for their scam.

Ponzi/Pyramid Scheme Scam

Pyramid schemes have been around for a long time. They are often called Ponzi schemes after a famous scammer, Charles Ponzi, who took investors for $10 million in the 1920s by promising investors a 40% return on investment.

A pyramid scheme can seem legitimate for a while because early investors get paid by the funds deposited by later investors. But eventually, the pool of new investors stops growing, the scheme collapses, and most of the "investors" lose all the money they put into the scheme.

Cash App Flip Scams

In a Cash App flip scam, the scammer will tell you they can "flip" your money using the money transfer app, Cash App. They will most often contact you through social media or create a social media ad to lure you in. They will say they will invest the money for you, and you will see huge returns, often double your initial investment or more.

Sometimes they will even get you to invest a small amount like $20 and give you $100 back to "prove" the system works and to gain your trust. Then they will get you to invest even more, which they will then take off with.

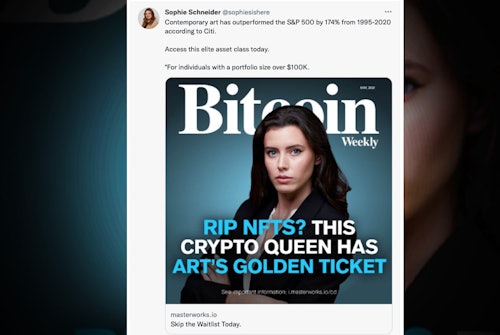

Bitcoin Exchange Scams

In a Bitcoin exchange scam, the scammer will set up a website to look like an exchange for Bitcoin or another cryptocurrency, including current prices that update regularly.

It may even guarantee returns or tell you that you will get free money if you make a large deposit upfront. But once you make the deposit, you will no longer have access to it because the scammer took off with it—the website was not a real bitcoin exchange.

Pump and Dump Scam

In a pump and dump scam, the scammer will try to sell you legitimate but low-priced stock. The scammer will also own a large amount of this stock but may not tell you this.

As more investors buy the stock, its price will naturally go up. Then the scammer will sell the stock they own to make a profit, the price of the stock will plummet, and you will lose money.

How to Beat and Avoid Investment Scams

If you are thinking of investing money and notice some of the red flags of an investment scam, don't worry. You can protect your money and keep it away from scammers. Here are some tips to help you do that:

- Only use well-known exchanges if you invest in Bitcoin or other cryptocurrencies.

- Never invest in a system that claims you can "flip" your money or cryptocurrency.

- Investigate investment companies and salespeople offering investments to be sure they are legitimate. Here are a few places to look them up:

- Only invest in a business that can provide the required documentation on the investment.

- Don't trust reviews regarding the investment. These could be part of the scam.

- Beware of anyone contacting you out of the blue with an investment opportunity.

- If you are only given a limited time to invest, don't invest.

- Never invest in something you don't understand.

Fallen Victim to an Investment Scam?

If you have fallen victim to an investment scam, here are some actions you can take to protect your hard-earned money, help catch the scammers, and prevent others from falling victim to the scam in the future.

Report the Scam

You will definitely want to report the scam to the authorities to help catch the scammer. Make sure to have any details regarding the scam ready when you do. Here are some places to report it:

- The FBI Internet Crime Complaint Center.

- The Federal Trade Commission.

- Your state's attorney general office.

- Your local police department.

- The U.S. Securities and Exchange Commission.

- The Financial Industry Regulatory Authority.

- The U.S. Commodity Futures Trading Commission.

Contact Your Financial Institutions

If you have been scammed, notify your bank, credit card company, money wire service, or gift card provider, depending on how you made the payment. Request that your charges be reversed or dispute the transaction.

They could be able to help you prevent the loss of your money if you have sent money to a scammer. Many, but not all, credit card companies offer protection against fraud, and you could get all of your money back if you paid with one.

Notify the Social Network or Website the Scammer Used

If the scammer contacted you on a specific website or through social media, contact the site owner and tell them the details of the scam. This could help prevent more people from falling victim to it.

Scams Relating to Investments

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Cash App Flips: Don't Be Fooled By Promises of Free Money

One of the most common scams found on the app, this is an attempt to steal your money by promising more in return for a small deposit—like flipping houses but for cash.

Fake Bitcoin Exchange Scams: Top Tips to Avoid Falling Victim

Using a new bitcoin exchange might not seem like a big deal, but if you don't do your research first, you could end up losing thousands of dollars.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Amex Fraud Text Alert Scams: Spotting a Fraud

If you receive a text message from American Express, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Citizens Bank Text: Scam or Real Message?

If you received a text message from Citizens Bank asking for personal information such as your password or login credentials, it may be from a scammer trying to steal your money.

Fake Verizon Text Messages: How to Avoid a Scam

Verizon may send you text messages from time to time with account updates or data usage alerts, but beware—most of these aren't really from Verizon but scammers.

Get an Unexpected Delivery Alert? It May be a UPS Text Scam

Scammers are using SMS messages to send fake alerts to customers regarding a package delivery. Here's what to know about this scam.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Guides Relating to Investments

Don't Be Spooked by Michael Burry's Bet Against the Market. The Reporting is Mostly Wrong

If you're worried that Michael Burry's has bet a large amount of money ($1.6 Billion) against the stock market and you are on the wrong side, don't be. The media reporting on this topic has been incorrect and we break it down.

Tips and Strategies to Protect Yourself from Stock Investment Scams

Imagine waking up one morning, coffee in hand, only to find your hard-earned savings vanished into thin air. Shocking, isn't it? Welcome to the sinister world of stock investment scams.

How to Beat Forex Scams: Stay Safe on the Foreign Exchange

Trading currency may seem like a quick and somewhat easy way to make money, but it comes with its own risks outside of those associated with trading in general.

How To Verify Your Mortgage Escrow Agent & Prevent Scams

Mortgage escrow scams can steal the entire value of your house during a transaction. Follow these steps to ensure that you verify your escrow agent before any transfers.

How Financial Advisers Can Be One of Your Most Important Defenses Against Money Scams

Investment scams are everywhere and people lose billions yearly to scammers who trick investors with fake assets. Getting protection means verifying everything.

News Relating to Investments

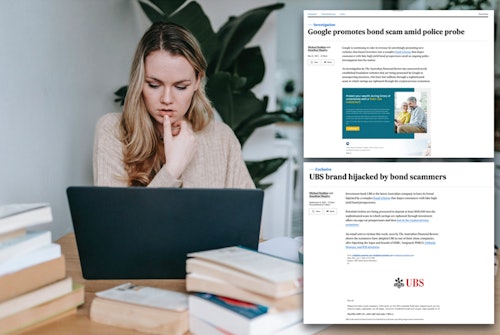

Social Media: The New Favorite Amongst Scammers

Social media platforms are possibly the most used tools in committing fraud, responsible for $770 million in losses.

$3.38 Million Lost in Squid Game Cryptocurrency Scam

Jumping on a social media or entertainment trend isn't always a good idea, especially when it comes to cryptocurrency.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.