When you buy a house, a mortgage escrow agent suddenly becomes a central player in the most significant financial transaction in your life.

The problem? You've never met this person before!

Your risk is huge. Scammers wait for this moment as they know there's a lot of money at play, and they also know there's confusion when new accounts are introduced (this is not your regular monthly bill payment). Additionally, time pressure can force people to rush and make mistakes (but you can protect yourself).

Here's how you are at risk:

- When you buy a house, an escrow company acts as a middle-man to hold funds between you (the buyer) and the seller. This ensures the funds are only released when both parties are satisfied.

- The seller nominates an escrow company with the realtor, and the buyer is sent an email with new account transfer details.

- If a scammer has compromised someone's email account in the chain, they will have been monitoring accounts for words like "escrow" as a trigger for them to spring into action.

- From there, the scammer will impersonate a person from the escrow company in the email chain, cutting out the other respondents and impersonating everyone with similar-looking email addresses. Victims are left communicating only with the scammer as they control all the channels, and the scammer blocks legitimate emails.

- The scammer introduces themselves as the escrow company representative, has CC'd everyone (these are spoofed email addresses that show the correct names), and provides official documents for the transfer.

- You rush to meet the deadline and send the money to the new account, which you think is correct, but you've actually sent the money to the scammer's account.

It's a widespread and heartbreaking scam. It's essential to recognize that any person in the chain of emails may have been compromised, and the person won't know about it. This can even include assistants, temps, realtors, or it might even be you that was compromised years ago.

The size of the mortgage transaction makes it very lucrative for scammers to spend extra effort on this scam, and they will have been monitoring accounts for years to get to this payday.

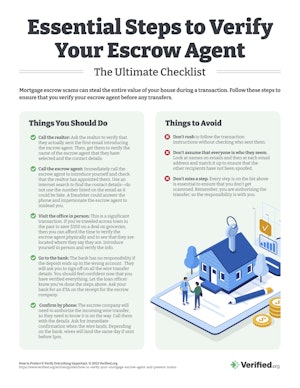

Mortgage Escrow Checklist

Print our handy checklist to make sure you stay safe throughout the entire transaction process.

Download Checklist (947 KB PDF)

Essential Steps to Verify the Escrow Agent

When you've signed the contract to purchase the house, the realtor will send the information about the escrow company via email.

The escrow agent will respond with the transaction instructions, asking for money by a deadline.

Don't panic. This is the point of weakness. You've never met these people before, and scammers will rush to send this email before the real escrow agent can.

If scammers have been watching someone inside a compromised email, they will know the address of the property and the deposit amount. They will make their transfer requests look very formal, but the account in the documents will be the scammer's account. Don't ignore this risk.

How to Verify an Escrow Agent

- Call the realtor: Ask the realtor to verify that they actually sent the first email introducing the escrow agent. Then, get them to verify the name of the escrow agent that they have selected and the contact details.

- Call the escrow agent: Immediately call the escrow agent to introduce yourself and check that the realtor has appointed them. Use an internet search to find the contact details—do not use the number listed on the email as it could be fake. A fraudster could answer the phone and impersonate the escrow agent to mislead you.

- Visit the office in person: This is a significant transaction. If you've traveled across town in the past to save $100 on a deal on groceries, then you can afford the time to verify the escrow agent physically and to see that they are located where they say they are. Introduce yourself in person and verify the info.

- Go to the bank: The bank has no responsibility if the deposit ends up in the wrong account. They will ask you to sign off on all the wire transfer details. You should feel confident now that you have verified everything. Let the loan officer know you've done the steps above. Ask your bank for an ETA on the receipt for the escrow company.

- Confirm by phone: The escrow company will need to authorize the incoming wire transfer, so they need to know it is on the way. Call them with the details. Ask for immediate confirmation when the wire lands. Depending on the bank, wires will land the same day if sent before 1 pm.

These are simple steps, but escrow scams are very common. You must do these things as banks will not be responsible if you send the money to a scammer who intercepted you.

Don't Do These Things

- Don't rush to follow the transaction instructions without checking who sent them.

- Don't assume that everyone is who they seem. Look at names on emails and then at each email address and match it up to ensure that the other recipients have not been spoofed.

- Don't miss a step. Every step is on the list above is essential to ensure that you don't get scammed. Remember, you are authorizing the transfer, so the responsibility is with you.

The process of verification is with the buyer. If the transaction goes to the wrong location, the seller, bank, and the escrow agent are not responsible.

Comments