Most Read

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

How to Identify a Fake Email from Your Bank & Protect Yourself

Real Chase Fraud Text Alert or Scam Message?

Wells Fargo Text Alert - Is It A Scam?

Capital One Fraud Text Alert Scams: Spotting a Fraud

Citibank In Depth

- About Citibank

- Types of Scams Targeting Citibank Customers

- How to Beat Citibank Scams

- Protection for Citibank Customers

- Reporting a Scam or Vulnerability with Citibank

Although Citibank is a global leader in banking and wealth management and one of the world’s largest credit card issuers, it’s not exempt from being the subject of scams. You could potentially become a victim of a Citibank scam run by imposters and thieves, from phishing emails to credit card and high-yield bond investment scams.

About Citibank

Citibank is the consumer subsidiary of Citigroup, an American investment bank and financial services corporation. Citibank offers a range of services, including but not limited to:

- Rewards and travel credit cards

- Small business credit cards

- Checking and saving accounts

- Personal loans and lines of credit

- Financial planning and investing

- Wealth management

Citibank Facts and Statistics

- Year founded: 1812

- Industry: Financial services

- Net income for Q2 2021: $6.2 billion

- Number of Citibank branches: 2,649 in 19 countries

- COVID-19 relief and recovery: Committed over $100 million in support

- Citibank customers: More than 110 million clients in the U.S., Mexico, and Asia.

Types of Scams Targeting Citibank Customers

Various scams target Citibank customers, from fake emails to stolen cards and money.

Citibank Phishing Scams

Citibank phishing scams manipulate you into surrendering online banking information, such as your

- Username

- Password

- Account numbers

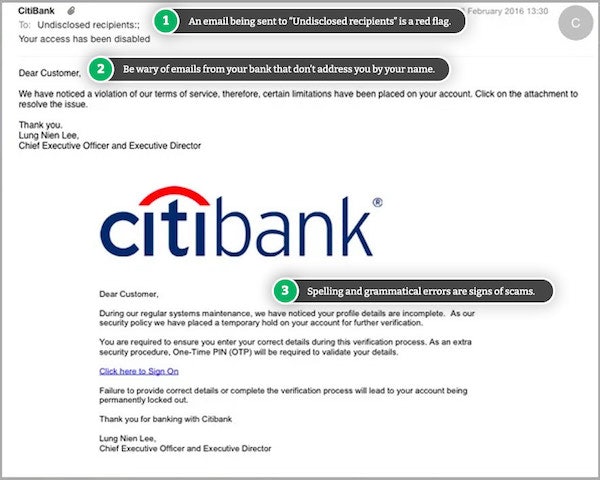

Often, these emails appear to originate from Citibank, using the Citibank logo, brand colors, etc., but they’re coming from scammers. These phishing email scams may tell you that your account access has been revoked or placed on hold until you submit additional information.

If you click the link provided in the email, you’ll be directed to a fake Citibank landing page that looks incredibly similar to the bank’s login page. Avoid entering any personal information on pages like these.

Citibank Credit Card Scam

As a Citibank client, you may receive phone calls from people posing as bank representatives and offering free credit card upgrades with no annual fee for life or credit limit increases and free gift cards. They’ll attempt to schedule a meeting so you can surrender your credit card, debit card, and/or one-time PIN to receive the upgrade or other benefits.

In doing so, you are giving the scammer the ability to make unauthorized withdrawals on the account, request cash advances, or create new accounts using these credentials. If someone calls and asks for any of these details, you are encouraged to report it immediately to Citibank.

High-Yield Bond Investment Scam

Scammers targeting Citibank have started posing as representatives of the bank or other financial institutions offering high-yield investments to investors. When the scammers hook you in as a potential investor, you’re asked to fill out a fake online inquiry form for investment advice.

This form collects personal and bank details from you, which the imposter will use to steal your money. This type of imposter bond scam may also ask you to complete an application form and scan your ID.

How to Beat Citibank Scams

- Always update your computer and mobile device software. Automatic updates can ensure you have the latest security software.

- Set strong, complex passwords for your online accounts, and make sure each password is unique. Strong passwords include at least eight characters with a mix of upper and lowercase letters, numbers, and special characters.

- Never click suspicious links in unsolicited emails, especially if the email sender is trying to gain access to sensitive information, such as your social security number, your banking information, or your login credentials.

- Change your online user ID and password periodically. Citibank recommends changing these credentials every 30-60 days. Change these in the Citibank Online Service Center.

- Refrain from sharing any of your personal information. Scammers use social media to figure out passwords and answer common security questions.

- Always secure your wireless network and internet connection with a password. Also, be cautious about using and sharing information on public Wi-Fi networks.

- Use two-factor authentication for an extra layer of security on your online accounts. This requires a password as well as another piece of proof to verify your identity. If a scammer gains access to your login information, they likely won’t also have your smartphone in their possession, which would be your second layer of protection.

- Shop online with your safety in mind. Always look for the padlock to ensure the website uses secure technology to keep your payment details safe. Make sure the web address begins with HTTPS before making a purchase.

- Be careful when downloading programs or apps online or from emails. Many scammers and cybercriminals will attempt to trick you into downloading malware. Malware can decrypt information stored on your computer and expose your sensitive data.

- Always remember government agencies or banking institutions won’t call you to confirm or request sensitive information. Refrain from giving away any personal details or financial information over the phone.

Protection for Citibank Customers

Citibank is dedicated to helping customers protect their banking accounts from day one. Citibank provides a range of advanced security features and services, such as:

- Identity theft solutions

- $0 liability on unauthorized transactions

- Fraud detection and warning alerts

- 128-bit SSL encryption security

- Biometric sign-on

- One-time use passcodes

- Extended Validation SSL Certificate

- Session timeouts

Reporting a Scam or Vulnerability with Citibank

Citibank encourages customers to report suspicious e-mails or phishing to [email protected]. In addition, if you have a concern or question about banking accounts, cards, fraud, ATMs, or malware, you should contact Citibank at 1-800-248-4226.

Citibank

Website: https://www.citi.com/

Contact page: https://online.citi.com/US/ag/contactus

It's important to verify links and contact details to beat imposters.

You can also submit reports about other potential security vulnerabilities through Citi's Responsible Disclosure Program on Bugcrowd.

Scams Impacting Citibank

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

How to Identify a Fake Email from Your Bank & Protect Yourself

Scammers impersonate well-known banks, such as Citibank and Chase, to trick you into giving up your sensitive information—learn how to beat these scams.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

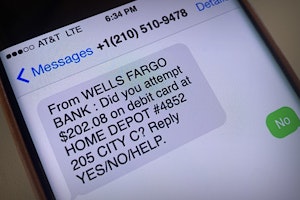

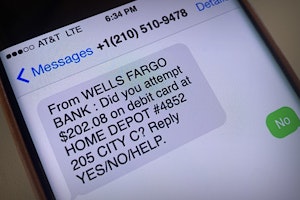

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

How to Avoid PayPal Shipping Label Scams: Top Tips

PayPal is a convenient way to pay for online purchases and has a reputation for safety and security. But scammers still find a way to use PayPal to help them steal products.

Guides To Protect Against Banking & Finance Scams

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

How to Place an Experian Fraud Alert: Online, Call, or By Mail

Placing a fraud alert on your credit report is important when trying to recover from identity theft.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.