- How Personal Loan Scams Work

- How To Beat Personal Loan Scams

- Examples of Personal Loan Scams

- What to Do After Falling for Personal Loan Scams

- Frequently Asked Questions

In personal loan scams, someone offers you a personal loan without the intention of actually extending a loan to you. The scammer’s goal is to obtain your personal information, your financial information (or both), and get you to pay “loan fees.” Scammers can rope you into the personal loan scam within just a few steps.

How Personal Loan Scams Work

Most personal loan scams follow the same general script—understanding how they work can be the difference between becoming a victim or staying safe.

The Scammer Contacts You

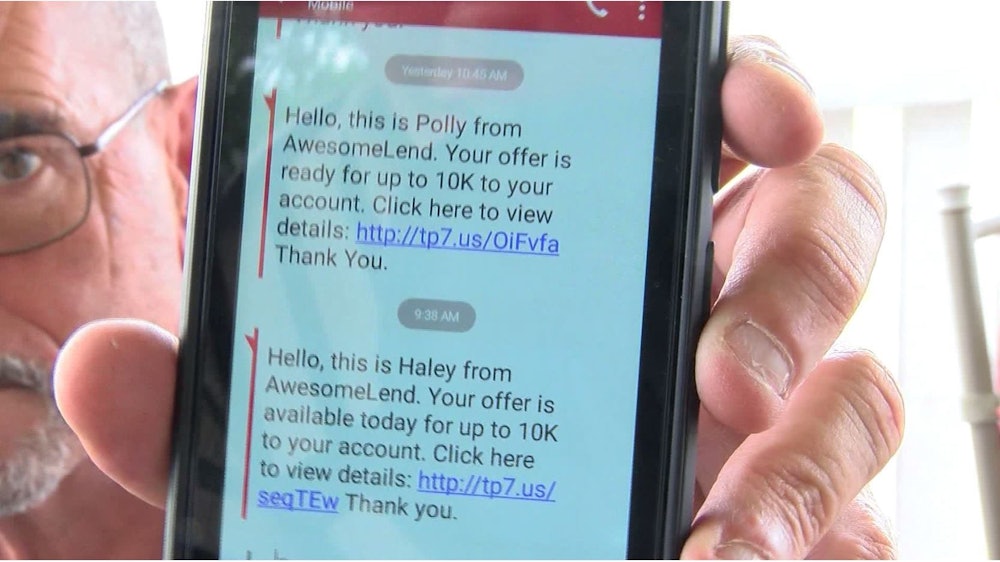

A person impersonating a legitimate loan provider contacts you by phone, email, or text message. At this point, the scammer pitches a personal loan offer to you.

The goal of the loan offer is to hook you into the scam. The scammer will use a sense of urgency, so you fall for the scam. For example, they may tell you that the loan is a limited-time offer.

They may also try to entice you by saying that you are already preapproved for the loan or that they do not need to check your credit because your loan approval is guaranteed.

Example Message from ScammerHi, this is Sam from AwesomeLend. Your offer is ready for up to $10,000 to your account. Click here to view details: https://tp2.us/OieFja

You Are Asked To Provide Information or Pay a Fee

Once you show interest in the personal loan, the scammer asks you to provide your personal information, like your Social Security number (SSN), and may also ask you to pay a fee.

If they ask you to pay a fee, they may request for you to provide your financial information, like your bank account number or credit card details.

The Scammer Takes Off with Your Info and Money

Once you provide the scammer with your information, they will disappear, and you won’t actually receive your personal loan. With your information, the scammer can:

- Steal your identity

- Charge your credit card

- Apply for credit in your name

Don't Fall For This Scam

It can take years to recover from identity theft and get your credit back in shape it was in before you were scammed.

How To Beat Personal Loan Scams

You can beat and avoid the personal loan scam by never providing your personal information over the phone, especially if a “lender” called you out of the blue or the offer came through as a robocall.

Lending Fees Aren't Typically Paid Upfront

If someone offering you a loan tells you that you have to pay for any upfront fees, this should be a red flag that it is a scam. In most cases, legitimate financial institutions will roll any lending fees into the loan.

If you have credit card debt, student loan debt, or poor credit, be aware that you may be at high risk for the personal loan scam. If you are in one or more of these situations, scammers may claim to offer a personal loan as a quick fix.

Learn About Legitimate Lenders

If you are interested in a legitimate personal loan, you can avoid this scam by familiarizing yourself with legitimate lenders. The most common types of lenders are online lenders, banks, and credit unions. If someone contacts you using the name of a financial institution that you do not recognize, it is a potential red flag.

Research Prospective Loan Providers

Keep in mind that even if someone contacts you and claims they are with a financial institution you recognize, they could be impersonating the actual bank. Regardless of whether you are familiar with the bank that the person contacting you mentions, you should always research prospective loan providers.

Research loan providers by reading online reviews and asking for recommendations from family and friends. You can also vet your potential lender by searching for them on one of these sites:

You can also check your state’s registration resources to see if a lender is legitimate. This is key because legitimate lenders must register with state agencies before legally giving you a personal loan.

Your state’s finance department usually maintains a registry of approved lenders that you may be able to locate online by searching your state’s name, followed by “state-licensed lenders.” If you live in Arizona, for example, search for “Arizona state-licensed lenders.” You may also find information on your state’s Attorney General’s office — they may also provide info on recent loan scams.

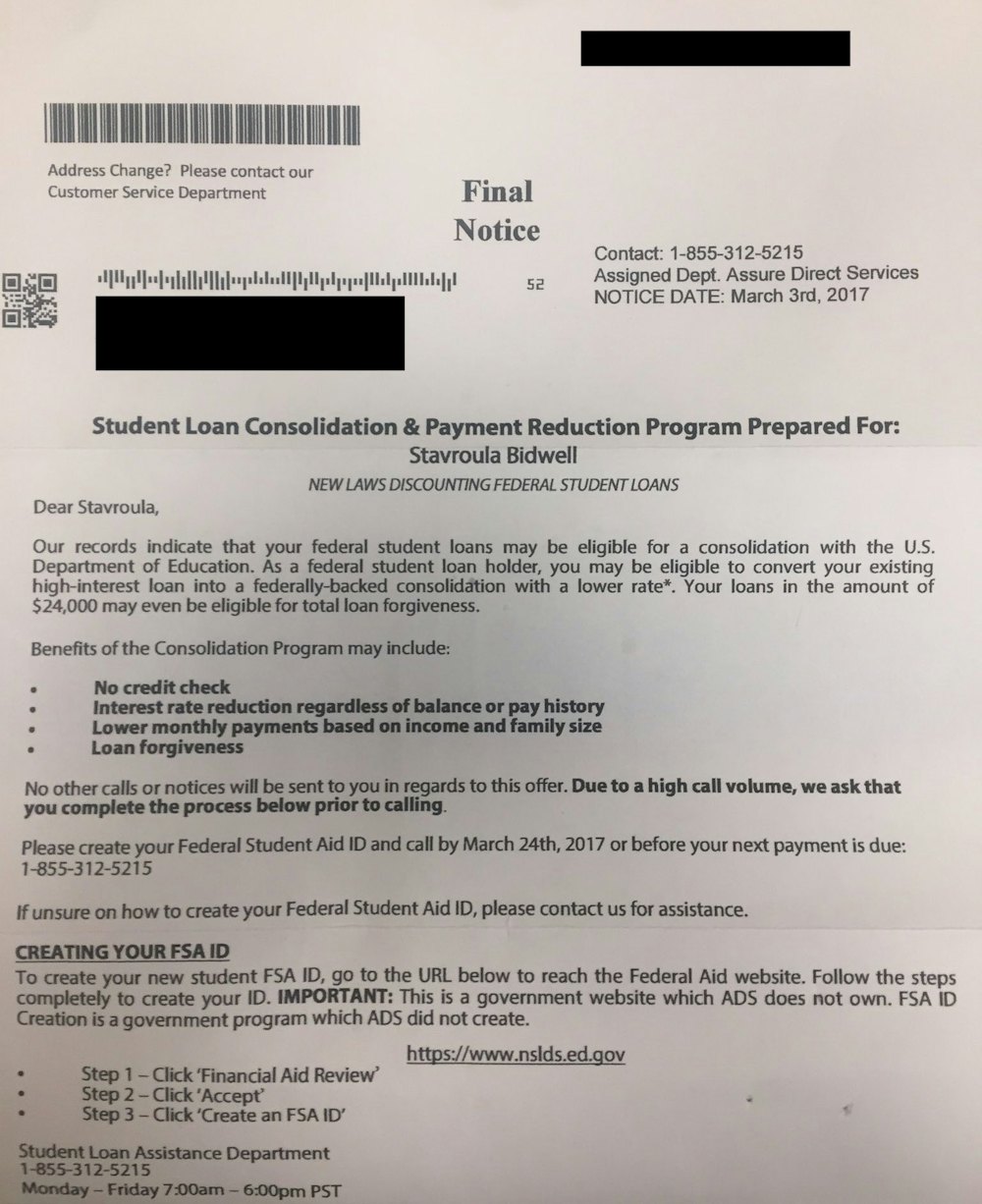

Avoid Offers That Sound Too Good

If someone contacts you with an offer that sounds too good to be true, it most likely is. A scammer may promise you that by simply paying an upfront fee, you will receive a personal loan with one or more of these conditions:

- A guaranteed approval

- Waived personal credit check

- No lending requirements

If the lender makes guarantees to you before checking your financial history, consider it a red flag. In general, all of the conditions are a part of the scam.

Don't Provide Your Personal Information

Whether by phone, email, or text, a good best practice is not to share any personal details if the person contacting you asks for personal information. In general, you should never share personal or financial information with someone you don’t know.

Don't Click On Any Links

If you received an email or text message about a personal loan that you didn't apply for, don't click on any of the links. The links will likely take you to a fake loan website designed to steal your information and/or money.

Ignore and Block Texts and Emails from Unverified Contactors

Do not respond if you receive a text or email from someone who claims that they represent a legitimate personal loan lender. It is best to ignore the person contacting you so you can research if the person contacting you is who they say they are. If you determine that they are not legitimate, block and report the text or email as spam.

Examples of Personal Loan Scams

Some of the most common personal loan scams involve fraudulent lenders acquiring your information or funds by promising a loan without a credit check. Others make unsolicited loan offers and then collect upfront fees or collateral before disappearing.

Impersonating a Legitimate Lender Via Text

In this scam, a person impersonating a legitimate lender may send you a text with an offer to obtain a personal loan.

Advance-Fee Personal Loan Scams

In this scam, the scammer tells you that you have to pay upfront fees to settle application fees, processing fees, or an origination fee. While these fees may be expected in a legitimate personal loan, the difference is that the scammer will not give you any other choice but to pay them in advance.

Debt Consolidation Scam

In this scenario, someone posing as a representative from a debt consolidation company contacts you and tells you that they will give you money to eliminate your debt. In some cases, they will push you to cease contact with your creditors. They may also try to pressure you to use a loan from them to pay off all of your debt.

What to Do After Falling for Personal Loan Scams

If you have fallen for the personal loan scam, there are a few things you can do to keep your identity and accounts safe, including:

- Contacting your financial institution

- Checking your credit reports regularly

- Reporting the scam

- Setting up fraud alerts and credit freezes

Contact Your Bank

If you gave the scammer your bank or credit card information, contact your bank and immediately alert them of the fraud. They may be able to reverse any charges and will also cancel your cards, so the scammer won’t be able to make any additional purchases using them.

Check Your Credit Reports

If you gave any of your financial information to the scammer, you should review your credit reports immediately. During your review, check for any unusual accounts or activity that you do not recognize. If you see anything suspicious, notify your financial institution.

Report the Personal Loan Scam

If you have fallen for this scam, you can report it to one or more agencies, such as the Federal Trade Commission and your local police. Reporting personal loan scams can help the authorities stop the scammers and help educate others on how the scam works.

Set Up a Fraud Alert and Credit Freezes with a Major Credit Bureau

If the scammer has your financial information, you can set up a fraud alert to the credit bureaus. This ensures that lenders will take extra steps to verify your identity before opening a new credit account in your name. You don’t have to contact each of the three bureaus—if you place an alert with Equifax, Experian, or TransUnion, the alert posts with all of them.

For additional security, you can place a credit freeze with all three bureaus, which stops any lines of credit from being taken out in your name.

Comments