Imposters In Depth

United States Imposter Scam Statistics 2020

Source: 2019-20 Consumer Sentinel Report

- What Are Imposter Scams?

- Red Flags of Imposter Scams

- Most Common Imposter Scams

- How to Beat Imposter Scams

- Fallen Victim to an Imposter Scam?

An imposter scam involves a dishonest person(s) who work to trick victims into sending them money. In 2020, imposter scams accounted for more than 10% of all reported scams, second only to identity theft, according to the Federal Trade Commission (FTC).

Nearly half a million incidents were reported that year with 1 in 5 people losing an average of $850. In total, victims of imposter scams lost more than 1 billion dollars collectively in 2020.

What Are Imposter Scams?

In an imposter scam, the scammer impersonates either a specific person or a representative of a business or government agency. The scammer could call on the phone or send a text or an email. There are many varieties to this type of scam. Sometimes the scammer will say you have a bill due and must pay immediately or something drastic will happen, such as getting your power shut off.

Other times they’ll say you won a prize but have to pay a fee to receive it or that a friend is in trouble and needs money to help them out. The imposter may ask for payment in some unconventional form, like a gift card or via wire transfer. The result is that your money is gone once you have send them what they have asked for.

Red Flags of Imposter Scams

Scammers will use all kinds of techniques to get you to send them money. Here are some of the most common red flags to look out for:

- The money is needed immediately or bad things will happen. The scammer may say utilities will be shut off if you don’t pay a bill, or bad things will happen to a relative if they don’t get money immediately.

- You have to pay a fee in order to get something that is “free.”

- You won a prize for a contest you never entered or it requires you entering more personal information to claim your prize.

- A company you have never heard of is suddenly concerned about the health of your computer.

- A relative or friend needs money, but they will not meet you in person, call you on the phone, or use video chat.

- A person or business requests payment in an unconventional form, like a gift card, wire transfer, or prepaid debit card.

- The details of the story a caller is telling you don’t add up.

If you detect anything off about your interaction with someone requesting money and they can’t face you, it is best not to take the chance—it could be a scammer.

Most Common Imposter Scams

In its 2020 Consumer Sentinel Data Book, the FTC breaks down imposter scams into five major categories. The below are listed in order of highest number of reported incidents from 2018 to 2020:

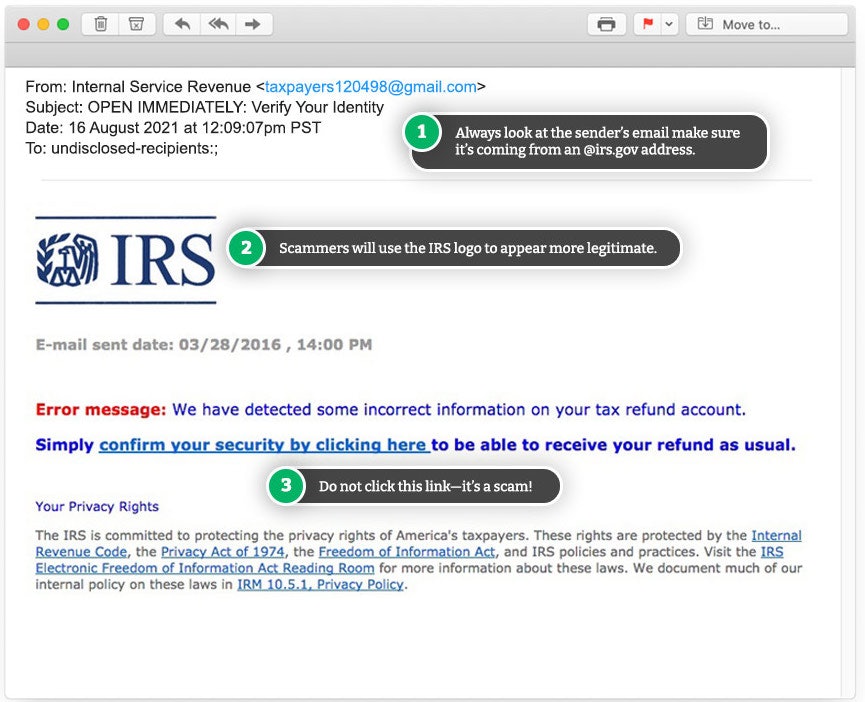

Government Imposter Scams

More than half of all reported imposter scams involve someone impersonating a government official. Scammers commonly impersonate IRS officials claiming that their targets owe back taxes and will go to prison immediately unless they pay them. Or they could act like they are representing the Social Security Administration and inform you that your benefits are in jeopardy of being canceled unless you pay a bill.

Tech Support Imposter Scams

Tech support scams account for the second highest number of reported scams involving imposters. In this type of scam, a person claiming to be from a computer support company will tell you that your computer is infected with a virus or malware and that they have a solution to remove the problem before your equipment is damaged or your data is stolen. They will then ask you to install software or to access your computer remotely to fix the problem and steal your data and passwords.

Business Imposter Scams

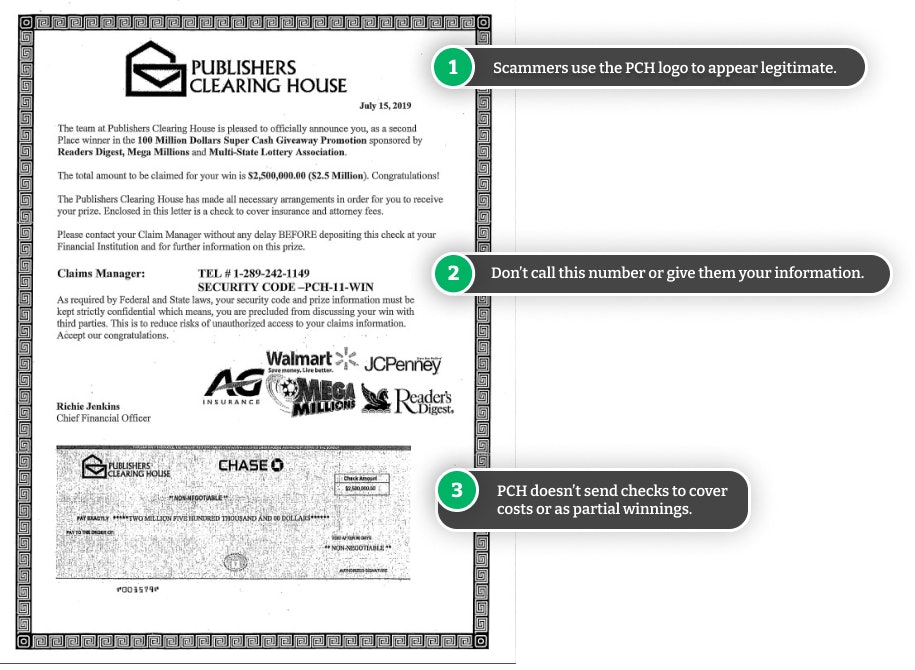

The third most reported imposter scams are ones that use the name of a well-known business to steal money from consumers. A scammer could claim they are from Publisher’s Clearing House and tell you that you’ve won money but have to pay a fee to get it. Or they might claim to be from your bank and say that your account has been compromised and they need your details to transfer your money to a new account.

Romance Imposter Scams

Around 5% of reported scams involving imposters are romance scams. In this type of scam, the scammer pretends to fall in love with you online, but they never seem to meet you in person. The scammer eventually asks for a loan or financial help to come see you and then disappears.

Family and Friend Imposter Scams

Of the reported imposter scams, 5% involve a scammer impersonating a family member or friend of the targeted individual. The most common of these is the grandparent scam, where a scammer poses as a relative of senior citizens and claims that the relative needs to post bail, pay hospital bills, or pay lawyer’s fees and asks for money.

How to Beat Imposter Scams

If you think an imposter has contacted you, there are a few things you can do to make sure that you don’t fall victim to an imposter scam.

- Research the person, business, or government agency: Find out what you can about the person who contacted you online. For a business or government agency, research how they do business with the public.

- Hang up on unsolicited calls about computer issues: If you didn’t ask for computer help, then it is most likely a scammer.

- Don’t trust caller ID: Scammers can use software to spoof real caller IDs.

- Don’t send money to someone you don’t know: Only make payments through the official channels of government agencies and businesses and to people you know.

- Validate messages from people claiming to be friends or relatives: Find someone else in your circle of friends or family who may know the person who is supposedly in trouble and get them involved.

Fallen Victim to an Imposter Scam?

Here are a few things you can do to help catch the scammer and prevent others from falling victim to similar scams:

Contact Your Financial Institution

It’s hard to recover your money if you paid via gift card, prepaid debit card, or wire transfer. If you paid with a credit or debit card, you should be able to contact your financial institution and dispute the charge to recover your money. But most scammers won’t request payment in these forms because of this reason. If you gave the scammer any of your financial details, contact your financial institutions to stop payments and prevent any further fraud.

Report the Scam

You will also want to report the scam to the authorities.

- Contact the FTC at 1-877-382-4357 or online

- Report the scam to the FBI’s Internet Crime Complaint Center

- Report it to your local police department

Protect Your Equipment

If you have fallen victim to the tech support variety of the imposter scam, you will want to do a few extra things to protect your computer and data.

- Disconnect your computer from the internet immediately to prevent the theft of your data

- Use another PC to change the passwords of any internet accounts that are important to you, like financial accounts and email accounts

- Check your browser for any unfamiliar extensions or add-ons and remove them

- Run antivirus and anti-malware to remove any software that may be a threat

Scams Relating to Imposters

The Real Cost of Publishers Clearing House Scam Calls

Fabulous wealth and life-changing prizes aren't always what's to be expected after receiving a call from PCH—it could just be a scam to steal your information and money.

Beware of Social Security Scam Calls and Robocalls

Not every phone call from a government agency is legit, in fact, the majority of calls that have a "Social Security Administration" caller ID are actually from scammers.

Beware of the Parcel Tracking Text Scam

Delivery companies like FedEx, USPS, and UPS are being impersonated in text messages instructing recipients to visit a scam website—here's what you need to know.

How to Beat "Amazon Prime Renewal" Phone Scams

This scam starts with a recorded message about an early (or unwanted) Amazon Prime renewal. To 'cancel,' you will unknowingly be transferred to a scammer impersonating 'Amazon.'

Common Amazon Scam Texts and How to Protect Yourself

If you're one of the millions of people who buy products from Amazon, you've likely received a text message or two that seem a bit suspicious. We teach you how to identify a fake text and avoid being scammed.

Common eBay Gift Card Scams & How to Protect Yourself

Don't trust anyone who asks for payment via eBay gift cards, even if they claim they are from a legitimate company or government agency.

Beware of Fake Prize Giveaways Posted in YouTube Comments

If you regularly read comments on YouTube videos, you may have come across promises of cash and prizes from who you think is the YouTuber—all is not as it seems!

Genuine Navy Federal Email Or a Fake? 6 Ways to Spot a Scam

Be careful before clicking on links in Navy Federal emails—scammers impersonate the popular credit union in an attempt to steal your information.

Publishers Clearing House Scam Mail: Red Flags

It may be exciting to receive a letter telling you you've won a huge sweepstakes prize, but before you celebrate, verify the letter first. More often than not, it's a scam.

Publishers Clearing House Scam: Red Flags of Fake Websites

When entering PCH sweepstakes to win money and other prizes, make sure you're on the actual PCH website and not a fake version.

Guides Relating to Imposters

Common LinkedIn Scams to Watch Out For

LinkedIn has become one of the most impersonated brands and targets of scammers. Learn how to protect yourself and use the platform safely.

Hidden Tinder Swindler Red Flags - 6 Dead Giveaways (Did You Catch Them?)

There were tell-tale red flags of a scam all the way through the Netflix documentary, which could have helped the victims identify him as a scammer. Learn from these markers to avoid being a victim.

How To Verify Your Mortgage Escrow Agent & Prevent Scams

Mortgage escrow scams can steal the entire value of your house during a transaction. Follow these steps to ensure that you verify your escrow agent before any transfers.

Facebook Marketplace Scams: How They Work & Red Flags

Online marketplaces may offer you opportunities to find some great deals—but they offer scammers just as much of a chance to score.

How to Recover from Identity Theft: 7 Steps to Take

It's estimated that $13 billion is lost each year to identity thieves. Knowing how to recover is important to minimize your losses and get your life back on track.

News Relating to Imposters

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Beware of this New Scam Involving A Fake Call from CBP

Sometimes it just safer not to pick up calls from unknown phone numbers.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.