Most Read

Navy Federal Fraud Protection: Keeping Your Money Safe

Genuine Navy Federal Email Or a Fake? 6 Ways to Spot a Scam

How to Identify a Fake Email from Your Bank & Protect Yourself

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

Real Chase Fraud Text Alert or Scam Message?

Navy Federal Credit Union In Depth

- About Navy Federal

- Possible Navy Federal Scams

- How to Beat Navy Federal Scams

- How Navy Federal Protects You From Scams

Navy Federal Credit Union has been serving its members since 1933, during the Great Depression. The credit union has grown to be a large and reputable company, which has, unfortunately, made them a target of Navy Federal scammers trying to obtain your personal information.

About Navy Federal

Navy Federal Credit Union, otherwise known as just Navy Federal, was founded by 7 Navy Department employees who wanted to help themselves and their co-workers reach their financial goals. They have now expanded and have 346 branches worldwide with 26 international locations.

Navy Federal is exclusively for active members of the military, veterans, and their families. As a non-profit credit union, they have 10.7 million member-owners.

The founders of Navy Federal wanted to create a credit union that would:

- Offer loans with affordable rates and manageable terms

- Encourage building financial security by providing a safe place to deposit your money

Navy Federal believes military members should have the best service possible from a credit union, so they offer additional benefits. These benefits include:

- Dedicated VA mortgage loans and servicing

- Financial education presentations to military recruits

- 24/7 stateside contact center

- Active-duty early release of direct deposits

- Free active duty checking and discounts

Possible Navy Federal Scams

As Navy Federal continues to do right by the military community, scammers continue to take advantage of the trust the credit union has built to scam its customers. Some common scams affecting Navy Federal and credit unions in general include:

- Phishing emails

- Vishing (scam calls)

- Credit and debit card fraud

- Catfishing via social media

- Card cracking scams

Phishing Emails

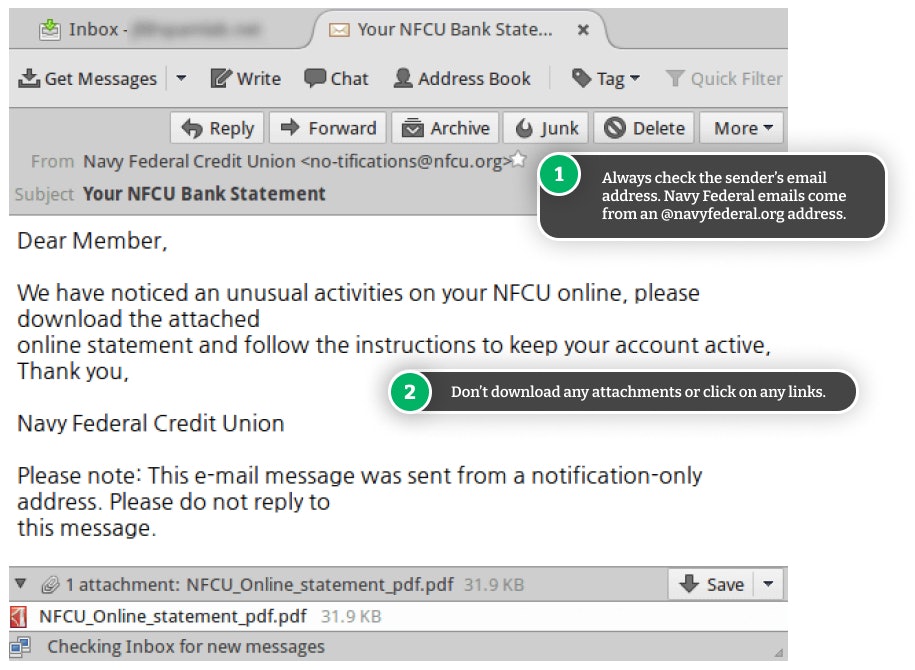

Navy Federal has quite a long history with phishing email scams. Phishing emails are sent by scammers who pose as a trusted institution or company to get you to click on an untrustworthy link or send personal information.

Since 2005 there have been several reports of fake Navy Federal emails sent out by scammers. In 2017, a man received an email, allegedly from Navy Federal, claiming he had won a prize. All he had to do to retrieve his prize was click on the link provided.

Navy Federal announced that they have no such reward program that gives out monetary prizes. They urge their members to report any suspicious emails that claim to be from Navy Federal to their email at [email protected].

If you believe you may have fallen for a scam or did click on a suspicious link and provided your information, you should call 1-888-842-6328 to get immediate help from Navy Federal.

Vishing Scam Calls

Like phishing emails, vishing is when a scammer calls you and impersonates a company or organization while trying to get your personal information. Vishing scam calls are so common that they make up almost half of all phone calls people receive.

Scammers will use vishing when they want an immediate response from you. The scammer will usually pressure you to act right away—they don't want to give you time to think because you might figure out it's a scam. This is why they often will make you a one-time deal and threaten that if you hang up the deal is off.

Most commonly, a scammer might call you and ask for a code you just received on your phone. Never give this code to anyone over the phone. If you are being sent a code from Navy Federal it is most likely a two-factor authentication code, so if you give that out, you could be giving someone access to your account.

Navy Federal Will Never...

Navy Federal will never call you and ask:

- For your code word

- You to download anything on your phone or computer

- For your two-factor authentication code

- For your login information

If you receive any calls asking for this or any other personal information do not give it out.

Instead, you should report it to Navy Federal immediately by calling them at 1-888-842-6328.

Credit and Debit Card Fraud

Credit and debit card fraud can happen in so many ways, including:

- Online

- Over the phone

- Via email

- As a result of data breaches

- Due to lost or stolen cards

- Via mail theft

- Due to skimming devices

It is best to keep a close eye on your accounts just in case there is ever any suspicious activity on your Navy Federal account. Unfortunately, it's almost impossible to predict when you will become a victim of debit or credit card fraud.

Luckily Navy Federal also offers account tracking for any suspicious activity—if they see any purchases that might be suspicious, they will contact you right away.

Catfishing Via Social Media

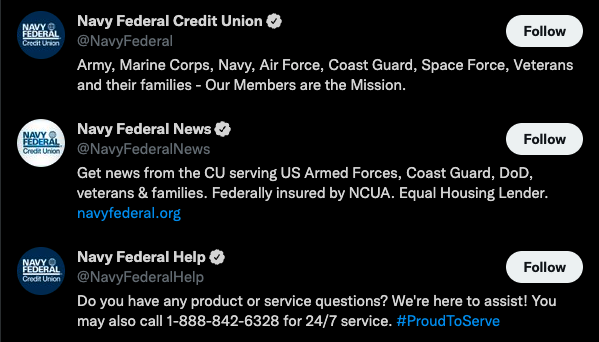

Navy Federal has social media accounts that they use to stay engaged with their customers or members. However, some scammers use this as an opportunity to trick unsuspecting victims into giving out their information.

Navy Federal emphasizes that they never use their social media accounts to obtain information from their members or anyone else—their social media accounts are strictly used to respond to people's comments.

They also provide a list of their verified and official accounts for Facebook, Instagram, Twitter, and LinkedIn. If you receive a message not from any of these accounts claiming to be affiliated with Navy Federal, block and report them immediately. Then reach out to Navy Federal to let them know they are being impersonated.

Card Cracking Scams

Card cracking is another scam that takes place over social media. Card cracking scammers will do the same thing as Navy Federal catfishers—the only difference between the two is their approach to getting your information.

Card cracking scammers will post stories, run ads, or contact you directly to get you to cash checks for them in return for payment. However, in order to cash the check, you'll first need to provide them with your banking information, such as your:

- Account number

- PIN

- Social Security number (SSN)

- Debit or credit card numbers

- Other personal information

How to Beat Navy Federal Scams

Don't be an easy target for scammers—keep your information safe and protect yourself from becoming a victim. If you want to protect yourself from Navy Federal scams you should follow these tips:

- Always double-check the caller or sender's credentials—make sure they match Navy Federal's information.

- Never answer phone calls from numbers you don't recognize—let the call go to voicemail.

- Save phone numbers of important organizations or companies so you know who is calling.

- Never share passwords or card information over social media, via email, or over the phone, especially when someone contacts you unsolicited.

- Don't respond to an organization on social media unless they are verified.

- Keep a close eye on your debit or credit accounts and look for fraudulent activity.

- Never click on suspicious links when you don't recognize the sender.

- Always keep your account information private.

How Navy Federal Protects You From Scams

Navy Federal wants to give its members the best service possible, so they have a few benefits to provide their members some extra protection.

Navy Federal Credit Union

Website: https://www.navyfederal.org/

Contact page: https://www.navyfederal.org/contact-us.html

Email: [email protected]

Contact page: https://www.navyfederal.org/services/security/report-fraud.html

It's important to verify links and contact details to beat imposters.

Advanced Fraud Protection Systems

Navy Federal offers to scan members' accounts for unusual activity and protect their accounts from unauthorized purchases. If you do become a victim of fraud, Navy Federal wants to work with you to help restore your information and prevent further damage.

Identity Verification

The only time you will ever be asked to provide personal information is if you call Navy Federal and try to access your account details. This is to verify your identity and keep your account safe. Navy Federal will never call you requesting your personal information.

Travel Notifications

Because Navy Federal protects your account against any unusual purchases, you should always update them when you are planning a trip out of state or further. By letting them know beforehand you can avoid the possibility of them locking your account for suspicious activity. You can call them at 1-888-842-6328.

Zero-Liability

Navy Federal has a zero-liability policy for their members who are victims. They even promise to try to get you your money back the same day you report the fraud. However, they only cover transactions that are obviously fraudulent and have been reported in a timely manner.

Scams Impacting Navy Federal Credit Union

Genuine Navy Federal Email Or a Fake? 6 Ways to Spot a Scam

Be careful before clicking on links in Navy Federal emails—scammers impersonate the popular credit union in an attempt to steal your information.

How to Identify a Fake Email from Your Bank & Protect Yourself

Scammers impersonate well-known banks, such as Citibank and Chase, to trick you into giving up your sensitive information—learn how to beat these scams.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

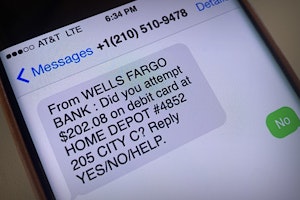

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

Guides To Protect Against Banking & Finance Scams

Navy Federal Fraud Protection: Keeping Your Money Safe

As a Navy Federal Credit Union customer, you're protected from hackers, imposters, and credit card fraud.

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.