Most Read

How Alliant Credit Union Protects You From Scams

Scammers Use Fake Alliant Credit Union Emails & Texts to Steal Your Data

How to Identify a Fake Email from Your Bank & Protect Yourself

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

Real Chase Fraud Text Alert or Scam Message?

Alliant Credit Union In Depth

- Scams to Watch Out For

- How to Beat Alliant Credit Union Scams

- Protection Against Alliant Credit Union Scams

Alliant Credit Union is the largest credit union in Illinois and one of the largest in the U.S. When Alliant was first founded in 1935, it was called the United Airlines Employees’ Credit Union. A group of United Airlines employees wanted to organize a credit union that was a safe place to save and get loans at fair rates.

Alliant Credit Union is a not-for-profit financial cooperative that has 600,000 members nationwide. They offer “better-than-bank” rates and have a strong focus on member benefits, which include:

- Online banking

- Award-winning mobile banking app

- Retirement and investment services

- Ongoing personal finance education

- 24/7 customer service (holidays included)

Scams to Watch Out For

Scammers will often try to impersonate Alliant Credit Union and target its customers, so staying alert and aware is essential. Some scams you should be cautious of as an Alliant Credit Union customer include:

- Card skimming

- Phone number spoofing (phishing calls)

- Phishing

Card Skimming

Scammers will buy and attach a skimming device to ATMs, self-service payment kiosks (like at gas pumps), or anywhere else you slide or enter your debit or credit card.

When you use the machine, the device reads and stores your card information. Some devices are so advanced they can get the information from just the chip on your card.

Scammers may also set up cameras near the PIN pad to record the PIN association with your card. Other times they might use PIN pad overlays that record these numbers. The overlay just sits on top of a pad and may make it look and feel thicker than usual.

Once your card is skimmed, the scammer will be able to make fraudulent purchases online and may even withdraw money from an ATM after making a copy of the card.

Phone Number Spoofing

This occurs when a scammer intentionally changes what appears on your Caller ID. They will either:

- Change their number, so it appears they share the same zip code with you (under the assumption that a local number is more trustworthy).

- Have their name appear on your phone as “Alliant Credit Union” or something similar.

You should never automatically trust a caller based on what the Caller ID is telling you. It’s easy for scammers to change what you see when they’re calling you, so you should always proceed with caution.

Phishing

Scammers can target Alliant Credit Union customers in various types of phishing scams. Scammers send text messages, emails, and even call you, pretending to be from the Credit Union, hoping that you’ll provide them with your information. They’re after things like your:

- Full name

- Date of birth

- Social Security number (SSN)

- Bank account number

- Alliant Credit Union login information

- Answers to your security questions

The different types of phishing that you should be aware of include:

- Spear phishing—targets a specific group or individual and may include personal information in the email.

- Smishing—using text messages to send a link with a virus or link to a phishing website while pretending to be from a company or organization.

- Vishing—scammers will try to contact you through voice calls while pretending to be from a legit company to get your personal or banking information. (Often utilizes number spoofing.)

Look for Fake Emails

Legitimate emails from Alliant Credit Union will come from: [email protected]. If you receive an Alliant Credit Union email from any other email address, it's a scam.

How to Beat Alliant Credit Union Scams

Scammers are always targeting people who are not vigilant about their banking accounts or are easily convinced to give out their information. If you want to protect yourself from Alliant Credit Union scams, follow these tips:

- Pay close attention to any devices you put your card into.

- Don’t use ATMs or other machines in sketchy areas.

- Try to use Apple Pay or touch-free options instead of inserting your card.

- Never answer phone calls from phone numbers you don’t recognize.

- Never give out your personal information if you are suspicious of the caller.

- Avoid clicking on links sent to you through text message or email.

- Go directly to websites or contact companies directly if you are suspicious of a call or email.

- Report any scams directly to Alliant so they can investigate and put a stop to them.

Protection Against Alliant Credit Union Scams

Alliant Credit Union offers several perks for its members to help protect them against all sorts of scams.

Fraud Monitoring

Alliant will automatically monitor your account for any suspicious activity. If there are any red flags, they will place a hold on your account and get in contact with you before it can be approved.

Travel Notification Feature

Notify Alliant Credit Union if you are planning to travel out of state or overseas. This will allow you to use your card without them automatically locking your account for suspicious activity. You can access this feature through their app or their online banking website.

Alliant Credit Union

Website: https://www.alliantcreditunion.org/

Contact page: https://www.alliantcreditunion.org/help/contact

It's important to verify links and contact details to beat imposters.

Secure Browsing

Because Alliant is a primarily digital financial institution, they guarantee secure browsing when using their app or website. They want customers to be confident their data is protected.

Victim of Identity Theft

If you are a victim of identity theft, Alliant Credit Union offers protection if you have shown responsible card use in the past. You will be liable for a maximum of $50 if your credit or debit card is used fraudulently (some cards have $0 liability).

Device Verification

Alliant urges all members to register each device they plan on using the Alliant app or website on. If you or someone else attempts to login on to an unregistered device, they will have to answer additional security questions.

Touchless Card Security

As a way to protect you against ATM skimming devices, Alliant offers a touchless way to pay. You can tap your card against the device rather than putting it directly into the machine. This will protect your PIN and card numbers from scammers and their skimming devices.

Insurance

Your Alliant Credit Union account is insured for up to $250,000.

Mail Fraud

You are given the option to make your account paperless to protect your mail from being stolen and reduce the risk of receiving fake Alliant Credit Union mail. Going paperless means all your account information will be online, and Alliant will never try to contact you through the mail.

Debit Card Protection Program

If you have a suspicious transaction, Alliant will send you a text asking, “Is this transaction fraudulent?” You can quickly reply “No,” and the transaction will be approved. Otherwise, you can answer “Yes,” the transaction will be declined, and a fraud specialist will contact you shortly to help protect your account in the future. If you don’t reply promptly, they will attempt to get a hold of you over the phone.

The only numbers they will contact you from are:

- Text: 72718

- Phone: 855-219-5399

Scams Impacting Alliant Credit Union

Scammers Use Fake Alliant Credit Union Emails & Texts to Steal Your Data

If you receive an Alliant Credit Union email or text, make sure you verify that's it's legit before clicking on any links—scammers are targeting the financial institution's customers.

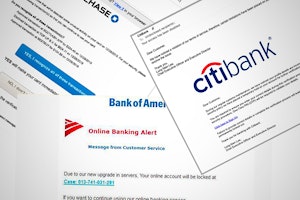

How to Identify a Fake Email from Your Bank & Protect Yourself

Scammers impersonate well-known banks, such as Citibank and Chase, to trick you into giving up your sensitive information—learn how to beat these scams.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

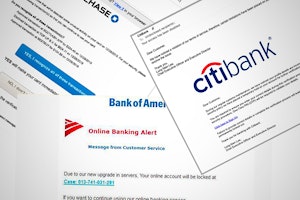

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

Guides To Protect Against Banking & Finance Scams

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

How to Place an Experian Fraud Alert: Online, Call, or By Mail

Placing a fraud alert on your credit report is important when trying to recover from identity theft.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.