Cash App In Depth

- Types of Scams Targeting Cash App Customers

- Protection Against Cash App Scams

- How to Use Cash App Safely

- Report Cash App Scams

Cash App is a mobile app that powers peer-to-peer payments, much like Venmo, PayPal, or Zelle. The app has extended its services to include banking and investing, but its primary product is sending and receiving money on the go. Cash App (formerly known as Square Cash) launched in 2013 under Square, Inc., and its grown to over 30 million active users. Unfortunately, Cash App scams have also grown.

The app's popularity surged in 2020, driven by pandemic customer behavior and direct disbursements from the government's Coronavirus Aid, Relief, and Economic Security Act (CARES Act) stimulus payments. However, the increased user base didn't just draw in more Cash App customers; it also attracted more scammers.

Peer-to-peer payment apps make it easy to pay friends and family, but it also makes it simple for scammers to steal your money. If you use Cash App or a business requires payment via Cash App, you should be well aware of the platform's potential risks.

Our guides offer detailed step-by-step instructions to help you identify and avoid scams. We help you recognize the tell-tale signs of fraud, and we provide real-life examples so you can see what potential risks look like. Our advice helps you beat the scams. And if the scammers have already gotten you, we provide the quickest, most up-to-date steps to protect yourself and fix the issue.

It's important to verify links and contact details to beat imposters.

Types of Scams Targeting Cash App Customers

Scammers use the same tried-and-true methods on a variety of channels. On Cash App, these are the primary ways scammers are tricking users:

- Payment requests

- Giveaway scams

- Fake Customer Support calls

- Fake Customer Support sites

- Impersonation

- Cash flipping

Payment Requests

Fake businesses and scams request payment via a peer-to-peer platform, but they never deliver the goods or services after receiving your money.

Example Communication from ScammerUnfortunately, as I am in the military and deployed out of state, I can't show you the apartment in person, but don't worry, it's clean and in good shape.

You seem like a trustworthy candidate so I would like to offer you this place to rent. All I need is your rental deposit of $1,200 and I will ship you the keys via FedEx once I receive it. Please send payment via Cash App.

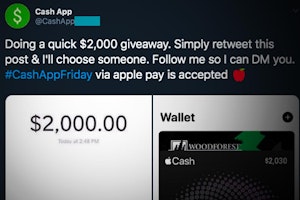

Cash App Scams Using Giveaways

With legit Cash App giveaways happening regularly, scammers have ample opportunity to trick people into thinking they've won money. They will message you on social media telling you you have won a giveaway but must transfer a small amount of money to them to verify your account and claim your winnings.

Fake Customer Support Sites

Scammers target support-relevant keywords that customers search for on Google (e.g., "cash app customer support"). They create fake websites, blog posts, and contact information to convince you they're an authentic site.

Fake Customer Support Calls

Scammers call customers pretending to be support representatives. They initiate fake transfers or request account information to steal your money.

Example Phone CallThis is the fraud department from Cash App. We have received some suspicious activity on your account, but don't worry, we'll take care of it right away for you.

I'm going to send you a code to your registered phone number so I can verify your identity. Please tell me this code when you receive it.

Impersonation

Scammers create fake account IDs to look like real users. Customers go to pay a friend or family member and accidentally pay a scammer who's impersonated them.

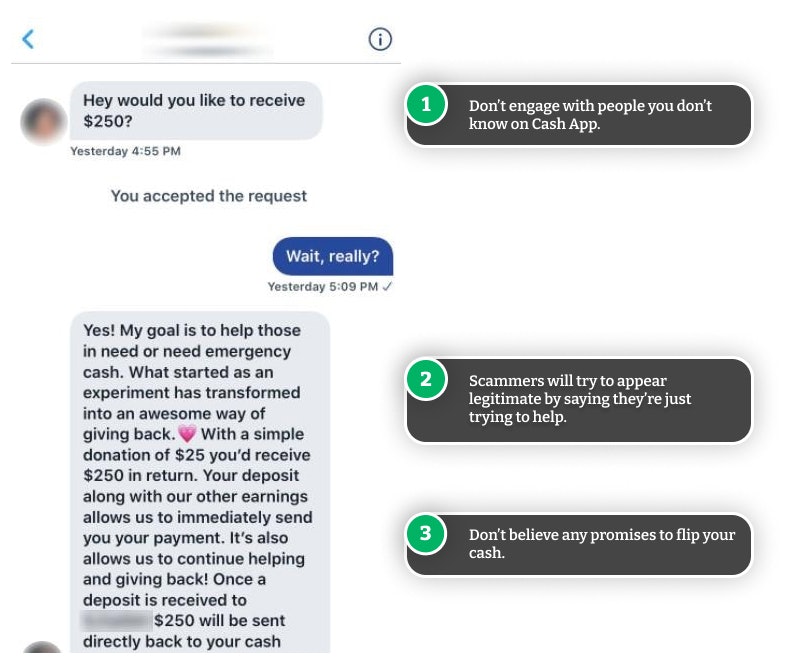

Cash Flipping: A Very Common Cash App Scam

Scammers claim to be able to "flip" your money, promising to double or triple any amount you send them. Once you send them the funds, you'll never see your money again. "Cash flipping" is not a legitimate business—it's always a scam.

Protection Against Cash App Scams

Cash App is well aware of these scams, and they're proactively messaging customers about how to stay safe on the app. Here are a few ways Cash App is protecting customers:

- Ability to cancel payments: Cash App payments are instantaneous and can't usually be canceled. However, if you realize a mistake immediately, check your activity feed and click the "cancel" option if it's displayed. There's a chance you can prevent the transaction.

- Refunds: If you bought something via Cash App that never arrived, you can request a refund. If the business or scammer doesn't honor your request, you can process a chargeback—a forced refund through your bank or credit card issuer.

- PIN change: If you believe you've fallen for a phishing scam, change your Cash App PIN immediately and report the incident to Cash App Support.

- Contact Cash App Support: Cash App does not currently have a phone support number. If you see one online, it's likely a scam. You can contact Verified Cash Support in-app or via the Help site.

- Verified emails: Emails from Cash App will always come from @cash.app, @square.com, or @squareup.com email addresses. If you receive an email from any other address claiming to be Cash App, it's a scam.

- Security lock: Users can enable Security Lock to require every Cash App payment and Cash Out to need your passcode. This is an additional security layer that scammers will have to steal if they attempt to phish your account.

- Notifications: Turn on notifications via text message or email to receive immediate updates after every Cash App transaction. If a scammer steals your money, you may be able to prevent additional theft by receiving these notifications and quickly changing your password.

How to Use Cash App Safely

Just because scammers are exploiting people on Cash App doesn't mean you should delete the app or stop using it. By following a few best practices, you can keep your money secure while safely using the app:

- Never pay someone you don't know: You should only use Cash App to pay people you know, such as friends and family. If you're meeting in person with a stranger for a transaction, such as a Craigslist or Facebook Marketplace purchase, be careful using the service. It's safer to pay and receive money with cash.

- Double-check recipient information: Verify the Cash App account is the person you're trying to send money to. Ask your recipient to verify their exact account ID to ensure you found the right one.

- Contact Cash App through the app: If you need to contact customer support at Cash App, don't look for numbers online. Contact Cash App through in-app support.

- Don't give out your personal information: Cash App will never ask for your sign-in code, PIN, or email account. They'll never require you to send a test payment, empty an account, or download any additional software. If anyone claiming to be Cash App asks for these things, they're a scammer.

- Don't use Cash App for business purposes: If you operate a small business, don't use Cash App to pay or receive money.

- Never click unknown links: Cash App emails will only contain links to websites at square.com, squareup.com, cash.app/help, or cash.me. If an email impersonating Cash App contains links to any other URL, then it's a scam.

Report Cash App Scams

If you've fallen victim to a Cash App scam or have been contacted by a scammer, you should:

- Report the scam to Cash App Support

- Report the scam to the authorities

- Change your Cash App PIN or password

Scams Impacting Cash App

Avoid Paying for a Pet via a Cash App Deposit—It's a Scam!

Keep your money safe by only paying for your new pet once you have the pet in your possession and avoid using Cash App.

Cash App Flips: Don't Be Fooled By Promises of Free Money

One of the most common scams found on the app, this is an attempt to steal your money by promising more in return for a small deposit—like flipping houses but for cash.

Cash App Rental Scam: Don't Fall For These Common Tricks

Scammers are taking advantage of renters desperate and in a rush to find a new home, stealing thousands from innocent people.

Cash App Free Money: It Really Is Too Good To Be True

If you enter Cash App giveaways or sweepstakes, be extra cautious. Scammers will try to trick you into thinking you've won but are really just trying to steal from you.

Protect Your Money From Fake Cash App Giveaway Scams

If you enter giveaways on Cash App, don't get too excited if you're told you've won—this could be a scam.

Venmo, Cash App, Zelle: Scammers Posing as Fraud Department

Beware of calls from the "Fraud Department" of mobile payment apps like Cash App, Venmo, and Zelle—you could lose all of your money in seconds.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

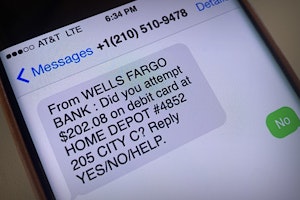

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Guides To Protect Against Banking & Finance Scams

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

Protect Your Funds: 6 Safe Ways to Send Money in the U.S.

Nowadays, there are many options for quick peer-to-peer money transfers. Here are six safe ways to send electronic funds via mobile payment apps.

How to Get Money Back on Cash App if Scammed

If you've been scammed on Cash App, there are a few things you can try to get your money back, but you need to act fast.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.