Most Read

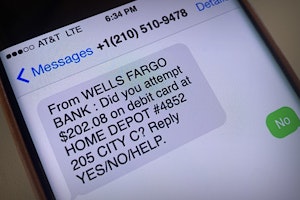

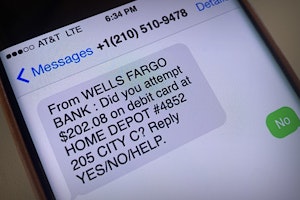

Wells Fargo Text Alert - Is It A Scam?

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

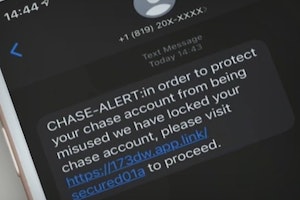

Real Chase Fraud Text Alert or Scam Message?

Capital One Fraud Text Alert Scams: Spotting a Fraud

Venmo Text Scam: Don't Fall For These Fake Messages

Wells Fargo In Depth

- Types of Scams Targeting Wells Fargo Customers

- How to Beat Wells Fargo Scams

- Protection Against Wells Fargo Scams

Wells Fargo is one of the largest multinational financial companies with offices throughout the U.S. and the world, which unfortunately has resulted in various Wells Fargo scams.

Wells Fargo was founded over a century and a half ago in 1852 by Henry Wells and William G. Fargo (who also founded American Express) to provide express and banking services to the state of California. The express part of the business involved using their famous stagecoaches to deliver money and valuables across the country, and the stagecoach became a symbol of the company.

In the early 1900s, Wells Fargo separated the banking and express divisions of the company, and the bank kept growing. In the 20th and 21st centuries, Wells Fargo acquired and merged with many other institutions, including the personal trust division of Bank of America, First Interstate Bancorp, Wachovia, and more. Wells Fargo was also the first major U.S. bank to offer internet banking in 1995.

Wells Fargo

Website: https://www.wellsfargo.com/

Contact page: https://www.wellsfargo.com/help/contact-us/

Email: [email protected]

Contact page: https://www.wellsfargo.com/privacy-security/fraud/report/

It's important to verify links and contact details to beat imposters.

Types of Scams Targeting Wells Fargo Customers

Because Wells Fargo is a well-known company, scammers commonly use the Wells Fargo name in their attempts to steal money from their victims. Here are some common Wells Fargo scams you should be aware of.

Wells Fargo Phishing Scams

Phishing scammers attempt to obtain your Wells Fargo account details or other sensitive information through an email, text, or phone call. These messages may look like they came from Wells Fargo.

The email, text, or person on the phone will claim that there have been issues with your Wells Fargo account and that you need to log in immediately to fix the problem. A text or email will contain a link to a site that looks like the official Wells Fargo website but is not. If you enter your Wells Fargo username and password on the fake site, the scammer will steal this information, and your bank account will be at risk.

Wells Fargo ATM Scam

In these Wells Fargo scams, the scammer uses a sense of urgency or danger to convince the target to deposit money using a Wells Fargo ATM. A common technique that targets grandparents specifically is claiming that the victim's grandchildren are in grave danger and need money to help them out of the emergency.

The scammer then tells the victim to go to a Wells Fargo ATM to deposit money to help out their grandchildren. Many of these victims aren't even customers of the bank. The scammer then gives the victim an access code that they got from the Wells Fargo banking app and PIN that allows the victim to deposit the money directly into the scammer's bank account without an ATM card.

Wells Fargo Imposter Scams

With this scam, the scammer will claim that they represent Wells Fargo when they are actually an imposter. This scammer will have obtained your banking information through a data breach, by buying your banking details from the dark web, or by some other means. So, they will already have various pieces of information about you. They will then call or text you and claim there has been suspicious activity on your account, and you will need to verify a code that will be sent to you via text.

The scammer will be attempting to log in to your Wells Fargo account at the time, and the code you receive will be from Wells Fargo verifying that attempt. Once you say the code over the phone, the scammer will be able to use the code to access your account and money.

Wells Fargo Fake Check Scam

In this scam, the scammer will try to convince you to deposit a fake Wells Fargo check into your account. The goal of these fake check scammers is always the same. Have you deposit the check and send some of the money back to them.

For example, the scammer may tell you that the check is the payment to wrap your car with advertising and then ask you to use some of it to pay a person to do the work. Or the scammer may try to purchase something from you, write the check for more than the purchase price, and ask for the difference back in cash. But since the check is fake, you will be out any of that money you give back.

How to Beat Wells Fargo Scams

You can prevent yourself from falling for Wells Fargo scams by looking out for red flags of scams and following these best practices:

- Watch out for a spoofed caller ID: Caller ID can be spoofed, so don't trust a phone call just because it shows up as being from "Wells Fargo."

- Don't click on email links: If you are worried about your account after you receive an email or text that says there have been problems with it, check your account in the official Wells Fargo mobile app or the official website.

- Always be suspicious: Don't believe everything you read or hear or let the sense of urgency a scammer is trying to invoke let you make rash decisions.

- Don't send money or account information to someone you don't know: If the person you are sending money to attempts to hide who they are, chances are they are trying to make off with your money.

- Double-check information when you can: If the scammer says your grandchildren are in trouble, check with them or their friends to make sure they are OK.

- Never give personal or bank information over the phone: Wells Fargo would not ask for this type of information over the phone.

Protection Against Wells Fargo Scams

If you are contacted by a scammer using the Wells Fargo name or fall victim to one of these scams, here are some of the things you can do.

Report the Scam

If you receive a phishing email or text, you should forward it to [email protected] and then delete it. You will get an automated response from this email, and Wells Fargo will review your email and take action.

Contact the Authorities

You can report the scam to the Federal Trade Commission (FTC). You can also contact your state attorney general. Another option is reporting the scam to local law enforcement.

Secure Your Wells Fargo Account

If you are a victim of one of these Wells Fargo scams and gave the scammer your login details or login code for your Wells Fargo account, then contact Wells Fargo at 1-866-867-5568 immediately. They may be able to help you get your account back in your control and out of the scammer's hands.

If you are a victim of a Wells Fargo imposter login code scam, you may still have time to change your password at the official Wells Fargo website to prevent any further damage to your account.

Scams Impacting Wells Fargo

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

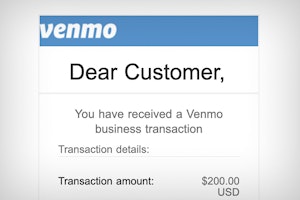

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

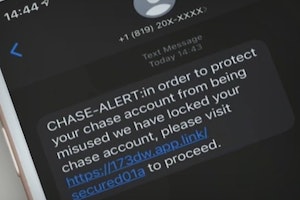

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

How to Avoid PayPal Shipping Label Scams: Top Tips

PayPal is a convenient way to pay for online purchases and has a reputation for safety and security. But scammers still find a way to use PayPal to help them steal products.

PayPal Shipping Scams: Tips to Protect Your Money and Items

Scammers take advantage of PayPal's buyer protection program to scam sellers out of their money and items for sale.

Guides To Protect Against Banking & Finance Scams

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

How to Place an Experian Fraud Alert: Online, Call, or By Mail

Placing a fraud alert on your credit report is important when trying to recover from identity theft.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.