Will My Credit Union Refund Me If I'm Scammed?

Credit unions offer similar protections against fraudulent transactions as regular banks and card companies.

Watch Out for These Common Credit Union Scams

If you bank with a credit union, keep an eye out for these common scams, especially if you're a Navy Federal, Alliant, or First Financial member.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

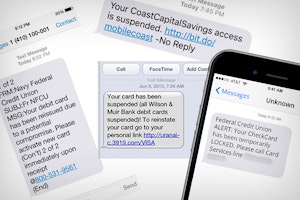

Fake Credit Union Texts—Red Flags and How to Beat a Scam

Scammers are using text messages to impersonate credit unions, tricking you into sending your sensitive information and even money.

8 Crucial Steps To Follow After a Malware Attack

Malware attacks have become sophisticated enough that even the savviest of tech experts can fall victim to them. Follow these steps to protect your identity and sensitive information.

How Much Is Your New Car Really Going to Cost You? We Break It Down

Buying a car is one of the biggest purchases a person may make in their lives, and being aware of these often-forgotten expenses may help you make a more informed decision.

Red Flags of Fake Credit Union Emails: Prevent Phishing

Scammers have turned their phishing attempts to members or credit unions by sending out fake emails hoping to get their hands on valuable personal data.

7 Important Steps to Take to Recover from Credit Card Fraud

After falling victim to credit card fraud, it's important to act quickly and monitor your statement as well as your credit report.

Am I Being Scammed Right Now? A Checklist To Keep You Safe

It can be difficult to know whether or not you're being scammed—if you're ever in doubt, use this checklist to help you figure out what to do.

Personal Loan Scams: Beware of Fake Offers for Loans

When an offer for a personal loan with great rates seems too good to be true, it often is, especially if you weren't the one who contacted them first.