- Commonly-Forgotten Costs of Owning a Car

- Breakdown of Costs

- How to Calculate Your Annual Driving Costs

- Frequently Asked Questions

So you're in the market for a new car—you've done your homework, researched the best makes and models for your needs, and read all the reviews for the vehicle you've chosen. When budgeting for a car, buyers often only prioritize purchase price and monthly payments and can forget about other common costs of owning a car.

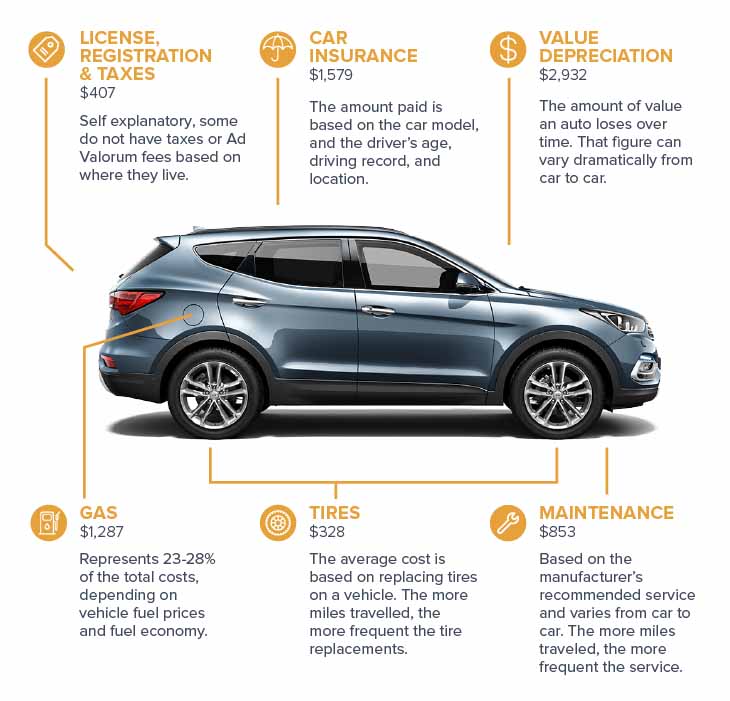

From its immediate depreciation off the lot to insurance premiums, license, registration and tax fees, and maintenance costs, the expenses of owning a car can make a noticeable dent in your bank account if you're not aware of these extra costs.

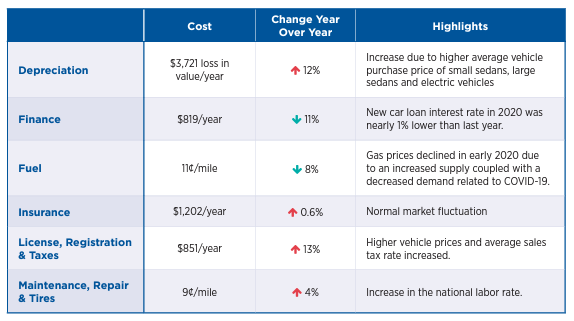

The average cost of owning a new car is around $9,500/year, according to AAA. This information was based on the top-selling models in nine vehicle size/type categories and an average cost of a new car at $31,401 in 2020.

Learn more about the costs associated with owning a vehicle and how to budget for your car so that you're fully prepared when making your purchase.

Commonly-Forgotten Costs of Owning a Car

If we look at typical costs associated with owning a car, we can see what other factors come into play beyond the sticker price. Edmunds outlines eight car-ownership costs that buyers should account for when budgeting.

These costs include:

- Car depreciation: The amount the car loses in value each year.

- Interest on financing: Typically paid over five years, this is the amount of interest accrued.

- Taxes and fees: This is the total annual cost of sales tax, registry, and fees.

- Insurance premiums: The cost to insure a car.

- Fuel: Dependent on your engine and whether it takes regular, premium gasoline or diesel fuel.

- Maintenance: All cars have schedule maintenance needs, and buyers can find upkeep costs in the owner's manual.

- Repairs: The cost of fixing common mechanical problems.

- Federal tax credit: Tax credits are available for alternative fuel vehicles (such as natural gas, methanol, or electricity).

Breakdown of Costs

When budgeting for a new car, most people calculate the cost based on the type and price of the car and the loan used to finance it. But it's essential to keep all costs in mind when budgeting for a new vehicle. Keep these commonly forgotten costs of owning a car in mind when researching your next ride.

Car Depreciation

According to Car and Driver, cars typically depreciate by 20% in the first year of ownership. Depreciation is one of the biggest things consumers fail to consider when buying a car, even though it accounts for around 40% of the cost of owning a new vehicle. For some, this can translate to more than $3,000 per year.

In 2019, the average price of a new sedan was around $37,185, with a 20% depreciation value in the first year. So, in one year, that car would now be worth approximately $29,600. However, in five years, the depreciation rate slows down, giving you a better value for your money.

Though you might not notice it right away, if you ever plan to sell your car, this is a factor that can mean a more significant loss financially if it depreciates faster than other cars. However, you can minimize this hidden cost by researching cars that don't depreciate as fast as others. For example, AAA found that in 2018, consumers were buying more SUVs and pickup trucks over sedans, leading to an increase in depreciation values over time for standard sedans.

Additionally, electric and hybrid cars have continued to grow in popularity, with Americans stating that their next car will be one of the two in the future. This has decreased the depreciation rate of these vehicles, which already offer many cost benefits such as lower maintenance bills and repairs.

If you really want to get the best bang for your buck, plan to keep your car for a long time and keep up with regular maintenance. This will offset your car's depreciation and offer a better value for your money in the long run.

Finance Charges

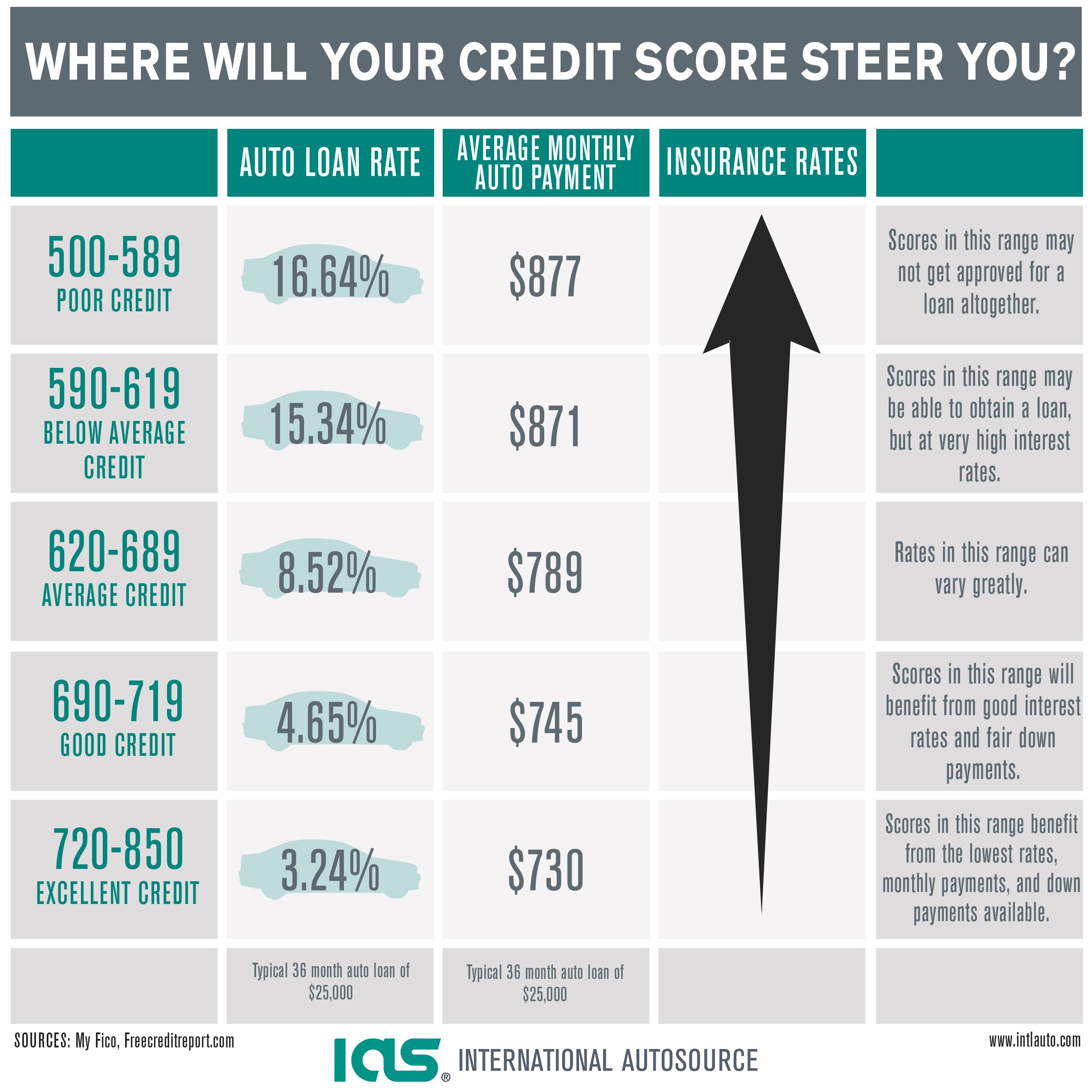

It's common for most individuals to finance a new or used car through a bank, credit union, online financial institution, or a home equity loan—the most important things to consider when financing is the length of your loan and the interest rate.

According to Car and DriverA car owner who puts 10% down, will spend an average of $669 each year on financing with a five-year loan.

One of the biggest influences on the terms of your loan agreement is your credit rating. Lenders want to see your credit history and score to understand your money habits and give them an idea of what the risk is as your lender. If you have a low credit score, you may be considered a high-risk borrower, which may mean higher interest rates.

When it comes to the length of your loan or the loan term, a shorter period (such as five years versus six) typically means a lower interest rate. Other factors that go into your financing terms include:

- Your geographical location (where you live)

- Your down payment (how much you put down)

- Whether the car is used or new (the former having higher rates than the latter)

To save money when buying a new car, shop around for the lowest interest rate possible and avoid long-term loans, which can be easier on your wallet in the short term but often cost you more money overall.

If you find yourself qualifying for a higher interest rate, consider refinancing your auto loan once your credit score has improved to help lower monthly expenses. When buying a used vehicle, check if the lender offers the same rates for all cars; some reserve their best rates for those under three years old.

License, Registration Fees, and Taxes

Your registration fee is due annually and can vary based on how old the car is or its value; you'll need to complete this payment each year to keep your vehicle on the road. For some, license fees, annual registration, and taxes have already been factored into the price when buying from a dealership.

If you buy from a private seller or receive a transferred title, you'll need to account for these additional fees when budgeting for your new car. In this case, your fees will need to be paid in person at the DMV. Going forward, you may have the option to renew your registration online.

Registration fees + driver's license + smog tests = $700/year

The average cost of maintaining your license and registration can be around $670 a year, depending on what state you live in. Other fees you may encounter include ad valorem excise taxes or "according to value," and are based on the price of your car and its depreciation over time.

Plus, some states require emissions testing, which is an additional cost and may be required before you're able to complete your vehicle registration. This can cost typically range anywhere from $15-$70, depending on your state. Keep in mind that electric car owners don't need to worry about this fee. Though these fees are unavoidable, you may qualify for a tax deduction based on your registration fee.

Car Insurance Premiums

To drive a car in most states (New Hampshire and Virginia are exempt), you must be legally insured. And most lenders require borrowers to have the minimum liability coverage required for your state as well as collision and comprehensive insurance. This helps providers recoup the amount remaining on the loan in case of an accident or stolen vehicle.

According to 2021 data from Quadrant Information Services, the average car insurance cost is $1,674 per year for full coverage or $565 for minimum coverage in the United States. The cost of car insurance is based on several factors, including but not limited to:

- Age

- Years driving

- Credit score

- Location

- Gender

- Claims history

- Vehicle type

- Amount of coverage

Similar to your auto loan financing options, these factors help an insurance provider determine its financial risk. Low-risk drivers can expect to pay less than those with multiple accidents, a DUI, or a long list of claims.

While it may seem cheaper to opt for only liability insurance to reduce your monthly or yearly fees, in the event of an accident or any property damage, the out-of-pocket costs you may incur can be extremely high without full coverage. Full coverage includes collision and comprehensive coverage, which can cost more initially but may pay off later on, should you run into any car issues in the future.

Be sure to shop around and compare rates while also exploring which providers offer reduced fees for members of certain groups or organizations, such as safe driver discounts, accident-free drivers, active military or senior discounts. Always ask your insurance agent what types of deals may be available to you.

Fuel Costs of Owning a Car

Likely, fuel costs aren't something you've overlooked when considering what type of car to get. But the price of gas can quickly sneak up on if you aren't careful. While gas prices tend to fluctuate not only state-by-state but also by city, two things won't change when it comes to how much you'll pay at the pump: your vehicle's fuel economy and the size of your gas tank.

Compared to SUVs and larger cars, hybrids and smaller vehicles tend to have lower fuel costs. If you drive a lot for your job or plan to use the car for road trips, you'll want a more fuel-efficient option. Other ways to avoid high gas prices include:

- Joining a fuel rewards program

- Carpooling when possible

- Enrolling in a credit card with cashback at gas stations

- Considering an electric vehicle

Before purchasing a car, it can be beneficial to compare fuel economy on sites such as fueleconomy.gov to find out how your car stacks up against different models. Their comparison tool estimates how much you'll spend to fill up your tank and what your annual fuel costs may look like.

Car Maintenance Costs & Repairs

Maintenance costs and repairs—regardless of the make, model and year—can be somewhat difficult to compare since the way the car is used can be different from owner-to-owner. For example, a person who uses the vehicle infrequently may have less upkeep and repairs needed than someone who drives their car more often.

However, Kelly Blue Book (KBB) offers a free 5-Year Cost to Own Calculator that allows individuals to put in the make and model of their car to evaluate the lowest cost option for them. It also includes other costs associated with owning the vehicle, along with depreciation.

Common Maintenance & Repair Costs

- Oil changes.

- Brake pads.

- Windshield wipers.

- Powertrain and transmission.

Regular oil changes can vary in price depending on which type of oil to put into your car. Premium, full synthetic oils are more costly but may improve the shelf-life of your car over time, while conventional oil is cheaper upfront but may cause your car to perform less optimally. Yet this is not always the case. Ask your mechanic about which type of oil is best for your car based on your unique driving needs.

For any service, parts and labor will be added to the bill. And, if you take your car to a dealership for maintenance, you may incur higher costs for the same work done with a mechanic. So it's a good idea to shop around and talk to different mechanics and dealerships to get the best price on your service.

How to Calculate Your Annual Driving Costs

To calculate your annual driving costs, it's a good idea to keep a record of what you've paid for in the various categories above over the years. Doing so can be a good reference for understanding what you may spend when purchasing a new car.

Start by keeping a record of how much it costs to fill up your tank from day one. Each time you fill up, track:

- The number of gallons

- The number on your odometer

- How much you paid

At the end of the year, these numbers will help you calculate your average miles per gallon as well as your gas cost per mile.

AAA Example of Cost CalculationsYou drove a total of 867 miles and used 37.6 gallons of gas, which cost $100.73.

Miles per gallon: 867/37.6 = 23.1 mpg

Gas cost per mile: $100.73/867 = $0.11

With this information, you can now determine the driving costs of your vehicle per year. If you'd like to take it a step further, keep a record of all associated costs of your car for one year, from routine maintenance to repairs, insurance payments, and miscellaneous fees such as parking tickets.

These numbers will give you a better idea of the costs of owning a car, including its operation costs driving cost per mile. You can also use AAA's online calculator to estimate the cost of owning your vehicle.

Comments