In recent reporting disclosures it was revealed that Michael Burry, from the brilliant Big Short, had some new open positions which would profit if there was a negative movement in the market. This was reported as 'Michael Burry bets against the market' and was widely circulated in the media.

The media reporting of this disclosure has been largely incorrect and out of context. We will break down the errors in reporting, specifically that:

- The size of the bet (representing his conviction) was mis-reported, and

- The idea of Burry being 'all in' and that he will feel 'pain for being wrong' (representing his conviction) was mis-reported.

The Source

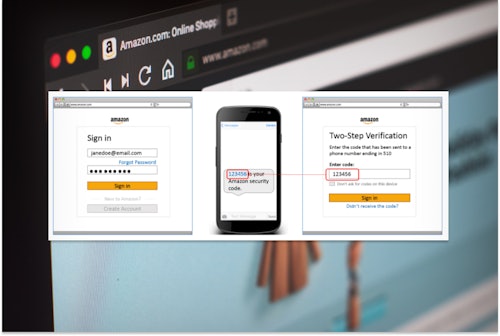

The information came from a standard disclosure in a 13F which reports the changes that an asset manager has made in a quarter. Someone picked up on the new 'put' position that was on the sheet. Put positions will profit from declines in the stock market (and are largely used for hedging against crashes).

This should not cause alarm bells. If you have a $200 Million plus portfolio under management, as Michael Burry's Scion Capital has, the simple update in the 13F was that he spent 10% of the portfolio on insurance if the market declines. Not a massive allocation, but slightly fearful of a decline to be sure.

The media reporting of $1.6Billion is incorrect as that is the notional value, but not the actual money spent and not the size of the bet he made (see below).

The Real Size of the Position is $20M+

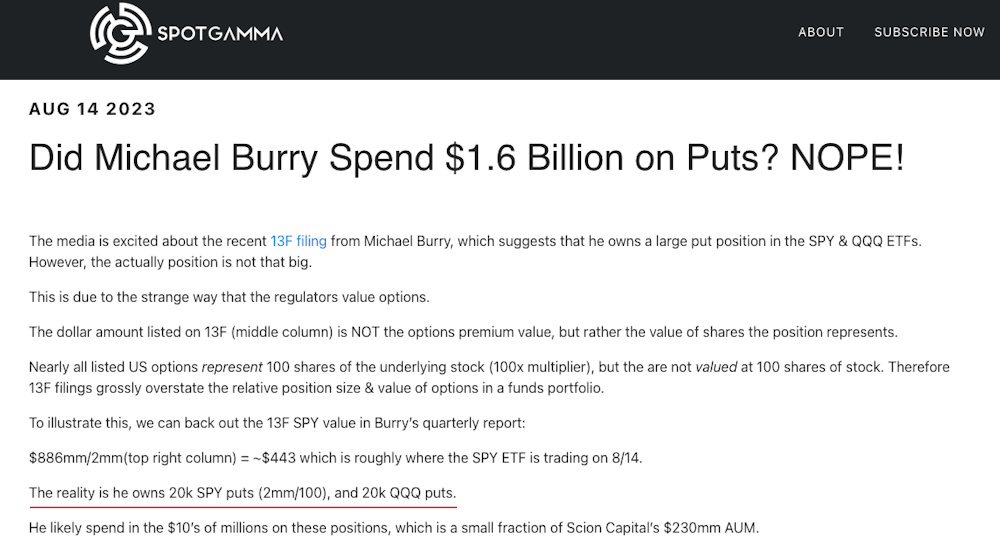

In almost every source, the media widely reported this as a $1.6 Billion bet against the market. This is designed to spook retail (mum and dad) investors and get clicks whilst the big money hedge funds laugh it off.

SpotGamma broke this down:

Nearly all listed US options represent 100 shares of the underlying stock (100x multiplier), but the are not valued at 100 shares of stock. Therefore 13F filings grossly overstate the relative position size & value of options in a funds portfolio.

The reality is he owns 20k SPY puts (2mm/100), and 20k QQQ puts.

He likely spent in the $10’s of millions on these positions, which is a small fraction of Scion Capital’s $230mm AUM.

20,000 puts in SPY and a further 20,000 puts in the QQQ is a significant position, but it is not something he spent $1.6 Billion on.

As SpotGamma and others pointed out, the actual purchase price was not reported in the 13F but is between $10 - $50M and likely just over $20M.

The strike and expiration of these positions is not reported but is important to know to understand the strike and expiration to know how these Burry's positions may / may not profit in the future. Having 20,000 puts in the SPY and 20,000 puts in the QQQ is not wild, but it is more than most $200M funds would have. However, if you invest with Michael Burry, you would expect a bias to the downside.

Shock & Fear Get Clicks

Almost every media outlet ran with the $1.6 Billion number which grossly exaggerated the position and was designed to get clicks from fear. The financial press were not as quick to report in the same way, especially sites like Unusual Whales which track unusual options activity. However, CNN and others jumped on the $1.6 Billion bandwagon as fear sells!

Bigger Bets ($50M) Against The Market Have Already Failed This Year

Renowned activist investor Carl Icahn took a position against the market earlier in 2023 in February when the SPX (the cash index of the S&P 500) when trading in the 4100 range.

This position was larger than Michael Burry's current position.

Icahn purchased short term puts at the 4050 strike which would have profited if the index dropped below that price.

If this had been reported in the same way the media ran with the Michael Burry position, it would have been reported well over Michael Burry's $1.6 Billion as Icahn spent $50M on short term put options which would have been cheaper, giving him more actual put options and more notional value than Burry.

Icahn was wrong - the puts that he purchased lost all of their value. It did not wipe him out and he simply lost the premium paid.

However, Icahn has been so wrong that the Financial Times has reported that he lost more than $9Billion in positions against the market since 2017.

High Conviction Trade?

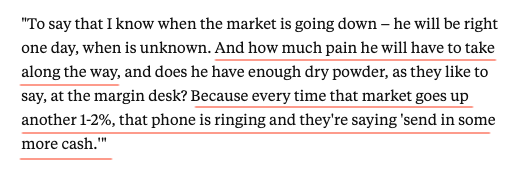

To get some context on Michael Burry's position, the team at Business Insider turned to Kevin Leary from Shark Tank for comment

O'Leary also got it wildly wrong.

O'Leary said to Business Insider about Burry: "he will be right one day, when is unknown. And how much pain he will have to take along the way, and does he have enough dry powder, as they like to say, at the margin desk? Because every time that market goes up another 1-2%, that phone is ringing and they're saying 'send in some more cash.'"

This reporting again hypes Burry's position as if Burry's position is an 'all in' bet and 'how long can he hold on?'

The article hypes the idea that is high stakes and could go horribly wrong.

This is incorrect -- there is no margin requirement when you buy puts. You are simply exposed to the premium paid at the time of the purchase. The margin desk will not be calling him like O'Leary suggested (this could only happen if he actually shorted the stock i.e. selling stock he does not own, on margin).

Burry's position is likely ~$20M and that is all it will cost. It won't wipe him out.

The same 13F disclosure that kicked off this media frenzy shows that he has over $200M of stocks (long positions which will naturally profit if the market goes against Burry's bet on puts)

If, as O'Leary suggests, the market does not decline and instead it grinds up and, say 20%, that will mean Burry's stocks are up 20% ($200M*20% = $40M). If you subtract the loss on the puts he paid for at ~$20M, ending with a net gain of $20M. The margin desk is not calling.

Margin calls only happens if you net sell S&P Futures or short stock without protection. Michael Burry will not be getting phone calls saying 'send in more cash' as it is not a shorting position.

Michael Burry’s purchase of some put options is not significant. It won’t wipe him out, it is not an ‘all in’ bet.

Burry Has Already Been Wrong

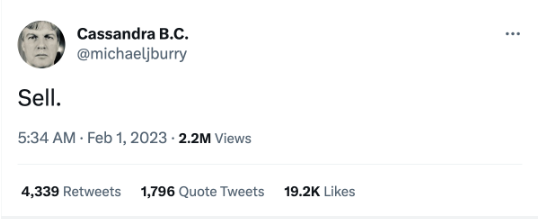

In trying to fear monger this story, the media also ignored the fact that Burry's reputation as the Nostradamus of crashes is less than perfect. At the around the same time that Carl Icahn was establishing his short position in early 2023,Burry famously tweeted.

February 1 , 2023

The tweet was deleted. After this tweet, the index went on to gain 11% within 5 months.

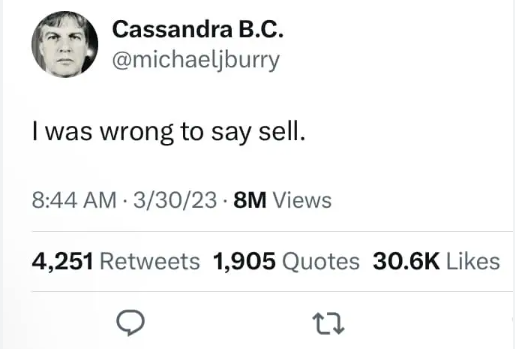

And in good form, Michael Burry apologized for his call two months later.

It is VERY important to note that Michael Burry has not been in the media making claims that we are definitely heading into a crash. The media is simply taking a number from a filing and spreading it far and wild, even if they took the wrong number and took the notional value instead of the real value spent.

Predicting Crashes - A Stopped Clock is Correct Twice a Day

After Burry's disclosure hit the media, the Wall Street Journal published a short history of stock market crash calls.

- 1929 Stock Market Crash - Roger Babson, a newsletter writer wrote “Sooner or later a crash is coming, and it could be terrific.” As the WSJ points out he "would reap fame and fortune from his timely call, founding a college and even running for president. Few remember that he also predicted trouble in 1927 and 1928, and later on made a premature recovery call."

- 1987 Stock Market Crash - Elaine Garzarelli predicted a the crash a few days preceeding Black Monday. As the WSJ points out, "She became the best-paid strategist on Wall Street for a while and went on to run some poorly performing mutual funds."

Comments