- Alliant Credit Union's Protection from Scams

- How to Get Your Money Back After Being Scammed

- What to Do if You See a Fraudulent Transaction

- Fraud Prevention Checklist

- Frequently Asked Questions

A member-owned financial institution, Alliant Credit Union is an online credit union. It is one of the largest credit unions in the U.S., with more than 600,000 members and more than $14 billion in assets. Unfortunately, scammers are known to target Alliant Credit Union customers, attempting to steal information and money.

Because of the ongoing threat of scams, Alliant Credit Union takes proactive steps to protect your information and guard against scams.

Alliant Credit Union's Protection from Scams

Alliant Credit Union has various security protocols in place to protect customers from imposters and fraudsters running common credit union scams.

Account Monitoring and Fraud Alerts

Alliant Credit Union provides continuous account monitoring to alert you to suspicious activity on your account that may indicate fraud. Suspicious activity could be anything from:

- Purchases suspicious websites

- Large purchases that are out of the ordinary to your spending habits

- ATM withdrawals in a different city or country

The credit union will send you a text message when they think a transaction is suspicious.

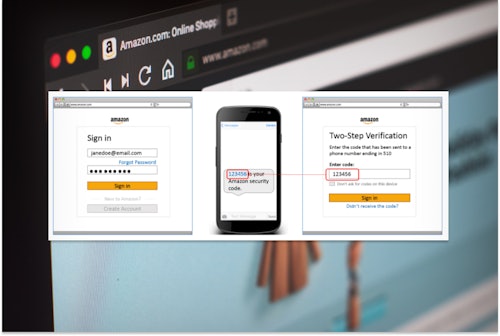

Beware of Fake Alliant Credit Union Texts

Scammers have been impersonating Alliant, sending fake texts and emails to trick you into clicking on a link and entering your personal data. If you're unsure whether a text message has come from Alliant, log into your account directly from the website or app—don't click on the link.

Encrypted Information

Alliant uses secure protocols to encrypt transactions and data transmission to ensure that your information is protected when you use their website, apps, or digital channels. Visa credit cards issued by Alliant Credit Union also include an EMV chip for embedded security and protection against fraud.

Insured Accounts

Accounts are insured by the National Credit Union Administration (NCUA) for up to $250,000. NCUA is a U.S. government agency that backs credit unions, just like the FDIC provides protections for bank customers.

How to Get Your Money Back After Being Scammed

Alliant Credit Union protection plans ensure you are not liable if you fall victim to a scam or fraudulent activity that involves a Visa card or Interlink transaction. However, you must report it promptly.

You need to report it within two business days for Alliant ATM transactions or electronic fund transfers (eChecks). If so, your losses are capped at $50. However, if you do not notify Alliant within two days of discovering the scam, you may be responsible for the first $500 of fraudulent charges.

If you discover unauthorized transfers from your Alliant Credit Union account on your statement, report it within 60 days to attempt to recover any missing funds.

If your debit card has been lost or stolen or you are concerned you are a victim of a scam or fraud, contact Alliant Credit Union at (800) 328-1935.

What to Do if You See a Fraudulent Transaction

If you notice a suspicious transaction or fall victim to a scam that involves your Alliant Credit Union account, it’s essential to act quickly. Cybercriminals hope you won’t notice fraudulent transactions or take your time reporting them. The longer an incident goes unreported, the more likely scammers will get away with your money or do additional damage.

The sooner you report an incident, the more likely you are to recover your money or limit the amount of your loss.

Alliant recommends a four-step process when you see suspicious activity on your account:

- Identify the type of fraud

- Close accounts (if necessary)

- Gather documentation

- Report fraud

Identify the Type of Fraud

The type of fraud you suspect will determine what you need to do. However, regardless of what kind of scam occurred with your Alliant account or cards, you should report it to the credit union.

Alliant Credit Union

Website: https://www.alliantcreditunion.org/

Contact page: https://www.alliantcreditunion.org/help/contact

It's important to verify links and contact details to beat imposters.

Gather this information to help determine your proper course of action:

- How much money is involved in the scam

- How transactions were processed (mail, online, etc.)

- The location of the crime if you know it (whether it’s U.S.-based or international)

- The accounts that were accessed (credit union or investment accounts)

- Whether the fraud happened online

Close Accounts if Necessary

If an account is compromised, you may need to close the account to prevent further action. Contact Alliant to close an account or issue a new credit or debit card. If you are using online banking, change your log ID and password and use a new and unique PIN for replacement cards.

Gather Documentation

Recovering any money lost in a scam may require you to document your report. Evidence might include:

Written communication, such as texts or emails from scammers

- Bank statements, canceled checks, receipts for money orders or gift cards

- Phone logs of contacts along with notes of what was promised

- Police report to verify claims

Report Fraud

Besides contacting Alliant Credit Union and/or your credit card company, you should also report scams to credit reporting agencies and governmental bodies.

- Contact local law enforcement.

- Report it to the Consumer Financial Protection Bureau.

- File a report with the Federal Trade Commission online or call (877) FTC-HELP.

- If the scam occurred online, file a report with the FBI’s Internet Crime Complaint Center (IC3).

- If the scam used the postal system, contact the U.S. Postal Information Service (USPIS) by calling (877) 876-2455, filling out an online form, or by mail.

- Contact Equifax, Experian, or TransUnion to add fraud alerts to your credit file. Fraud alerts help prevent scammers open up new lines of credit in your name. If you contact one of these three credit bureaus, they will share the information with the other two.

Fraud Prevention Checklist

Alliant recommends you watch your accounts closely to look for any signs of fraud or scams. If you do not report fraudulent transactions within 60 days, you may jeopardize your protection. To help protect you from scams, you should:

- Review your accounts at least once each month.

- Opt in to receive transaction alerts when there is activity on your account.

- Use online/mobile banking rather than paying by check or mail.

- Ensure the correct contact information is up to date to notify you in case of scams.

- Sign up for real-time fraud alerts for your Alliant debit card or Visa card.

- Use electronic statements and online resources rather than mail for account reviews.

Comments