- How Venmo Sends Notifications and Alerts

- Popular Venmo Scams Using SMS

- How to Spot a Venmo Text Scam

- Examples of Fake Venmo Text Messages

- How to Protect Yourself Against a Venmo Text Scam

- What to Do If You’ve Fallen for Venmo Scams

More than 83 million people use the Venmo app to receive or send money for peer-to-peer and business transactions. So, it’s no surprise that scammers are taking advantage of the app’s popularity by posing as Venmo to trick users into giving up their personal or financial information via text. There are many versions of the Venmo text scam, but thankfully, if you know what to look for, you can avoid falling for this con.

- Financial Fraud Protection

- Identity Theft Protection

- Family Protection & VPN

How Venmo Sends Notifications and Alerts

First, it’s a good idea to know what types of messages Venmo sends its users. When you sign-up for the mobile payment app, you’ll be required to enter your phone number and email address.

Venmo uses each for specific alerts and you can control which notifications you are sent by going to the app’s Settings > Notifications.

Venmo Email Notifications

Venmo will email you about the following if all email notifications are turned on:

- Login attempted

- Add remembered device

- Payment received

- Charge request received

- Charge request rejected

- Charge request canceled

- Direct deposit received

- Likes

- Comments

- Friend joined

If you opt out of all email notifications, you will still get one email from Venmo if you have been active on Venmo in the past month. Venmo is required by federal financial regulations to send you a transaction history at the beginning of the following month. Those who aren’t active will receive this notice once per quarter at minimum.

Venmo Text Notifications

If no text notifications are turned off, Venmo will notify you of the following:

- Payment received

- Payment sent

- Charge request received

- Direct deposit received

- Transactions

- Comments

- Friend requests

- Friend joined

Although the app will send text alerts, what it will never do is ask for personal information or send you to a second location (website) to complete or confirm a transaction.<

Popular Venmo Scams Using SMS

In general, there are many ways scammer tries to impersonate Venmo to scam people. But when it comes to SMS text message scams, there are three that are most common:

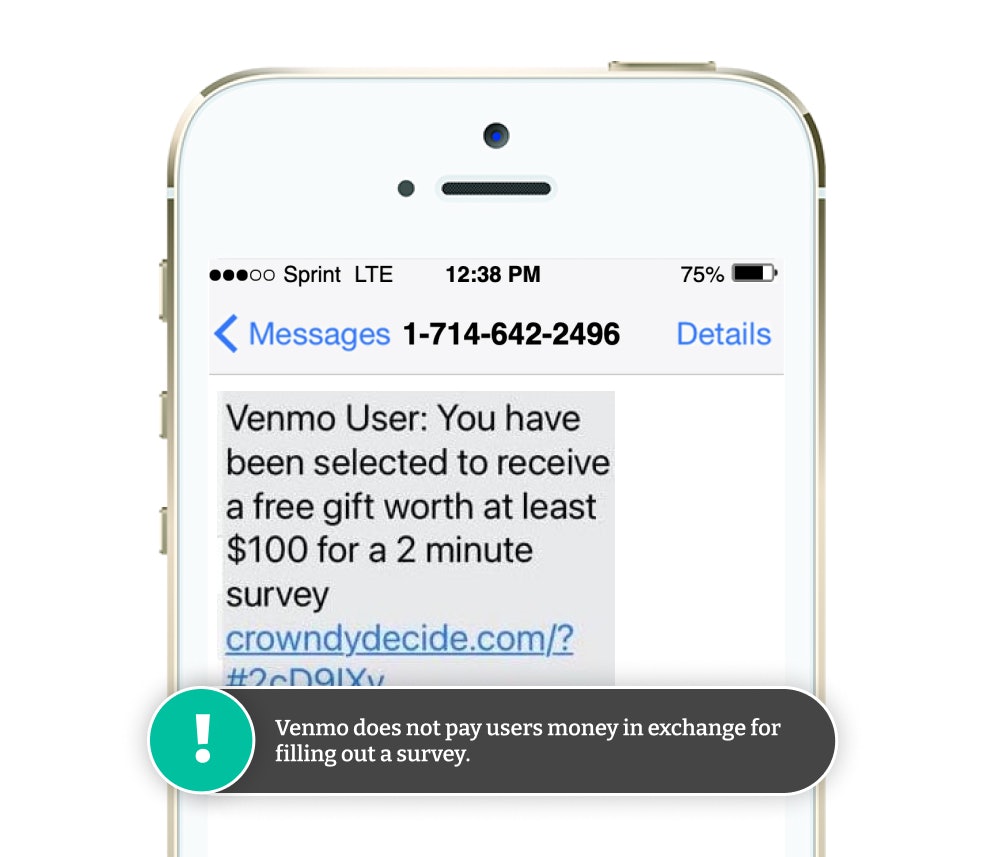

Fake Survey Scam

This type of scam involves the sender (scammer) sending a text saying that you’ve been selected to win $100 by simply filling out a two-minute survey. But to take the survey you’ll need to click on a link which takes you to a site set up to look like a real Venmo website but is actually a phishing website.

The link may ask you to sign into your Venmo account or ask for other personal information. Doing so, however, will give the scammers access to this information and there will be no money after completing the survey.

Don't Fall for Fake Surveys

Venmo does not send out surveys in exchange for money. If you get this type of request, it’s a Venmo scam.

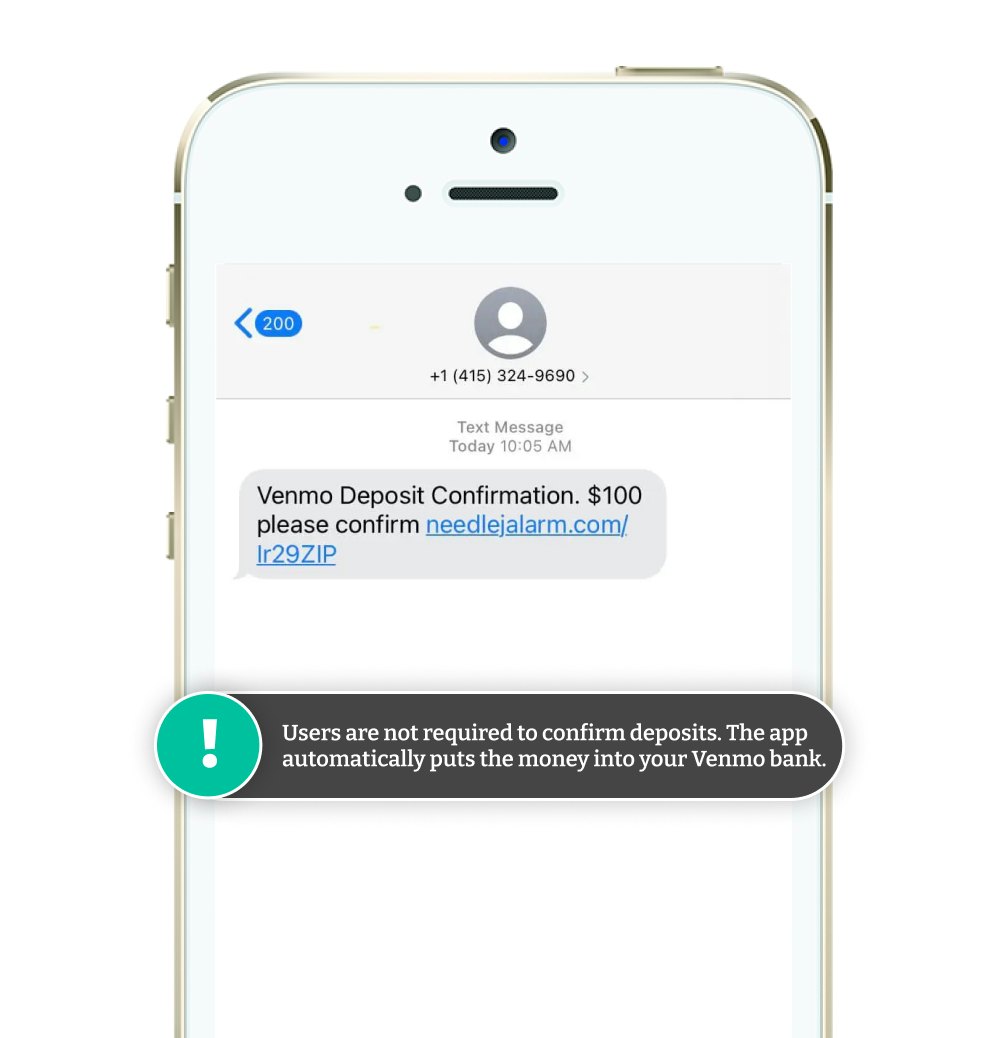

Fake Deposit Confirmation Scam

In this type of scam, you’ll receive a text about a deposit into your Venmo account. You’ll be asked to confirm the amount by clicking on a link within the text. If you click on it, you’re sent to a phishing website mimicking Venmo’s actual site.

You may be asked to enter your login credentials, but when after you do, you won’t see any money in your account, but the scammers will have your info.

Venmo will never require you to confirm a payment before receiving it via text. The app automatically puts the money into your Venmo bank when it is sent by the sender.

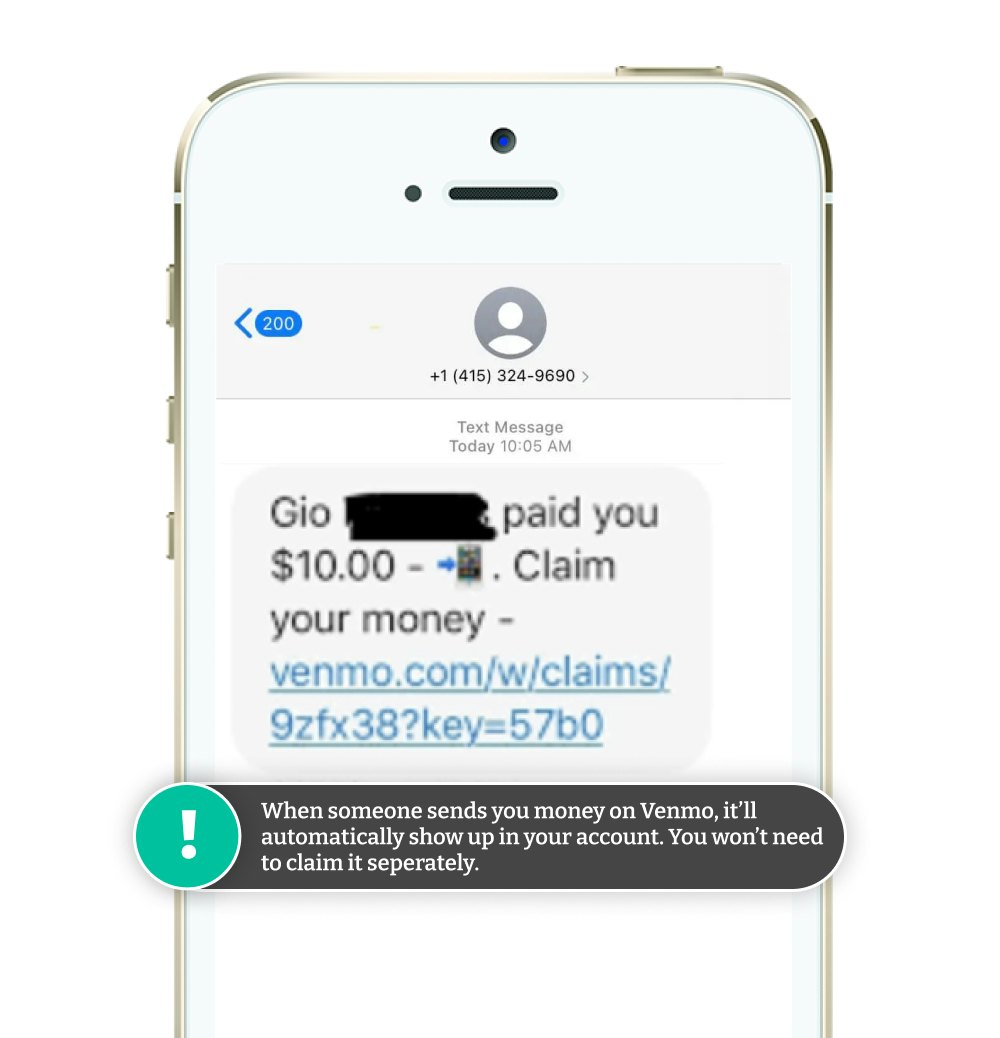

Unclaimed Money Scam

In this Venmo texting scam, you will get sent a message regarding a payment received that has not yet been claimed. You’ll be asked to click a link to have the money be transferred into your Venmo account.

The site may look like Venmo’s real website, but it is a fake website meant to trick you into giving out your personal or financial information.

Keep Your Identity Safe

Venmo will never require you to confirm a payment received via text message and will not make you input any information into a website to do so. The app already has all your banking and personal information so there is no need to fill in this information on their site again.

How to Spot a Venmo Text Scam

If you know what to look for, you can easily spot fake text messages. Below are some red flags of fraudulent SMS messages.

- Requests for personal information or payment information

- Spelling and grammatical errors

- Unexpected requests to:

- Confirm your identity to receive a payment

- Confirm an amount of money sent to you

- Claim your money before it goes into your account

- Links that don't take you to the official Venmo website

- Official Venmo links in text messages may include those starting with https://venmo.com/

- Threats to cancel or suspend your Venmo account

Examples of Fake Venmo Text Messages

Below are some examples of texts being sent to users:

Fake Venmo Text ExampleVenmo User: You have been selected to receive a free gift worth at least $100 for a 2 minute survey [link: recgonizeanextincts.com/BmvRovt]

Fake Venmo Text ExampleVenmo Deposit Confirmation: $100 please confirm [link: needlejalarm.com/lr29ZIP]

Fake Venmo Text ExampleRichard paid you $50.00 – Claim your money – [link: vnmo.com/w/claims/9zfx38?key=57b0]

How to Protect Yourself Against a Venmo Text Scam

To protect yourself from Venmo scams, take the following precautions:

- Never enter Venmo log-in information outside of the Venmo app or Venmo.com

- Never provide any of your Venmo account information on social media except to official Venmo accounts

- Twitter: @Venmo or @VenmoSupport

- Instagram: @Venmo

- Facebook: @Venmo

- Verify that an email from Venmo comes from an email address ending in "venmo.com"

- Don’t reply to a suspicious text message

- Don’t click any links within a suspicious text message

- Block scam/spam text messages

What to Do If You’ve Fallen for Venmo Scams

Whether you interacted with the text or not, there are several steps you can take to protect yourself and your identity.

- Report the text to Venmo

- Report the text to the authorities

- Contact your bank

- Contact the FTC’s Identity Theft Division

- Update your password

Report the Message to Venmo

It’s a good idea to alert Venmo of the scam so that they can investigate further and alert users so that they can avoid falling for it later. You can either call them directly at 1-855-812-4430 or email them at [email protected].

Be sure to take a screenshot of the text message to forward to them as evidence. After that, delete it from your phone.

It's important to verify links and contact details to beat imposters.

Report it to the Authorities

You'll want to report the scam to the authorities as soon as possible. Two ways to do so include contacting The Anti-Phishing Working Group and Federal Trade Commission (FTC).

- Forward the email to the Anti-Phishing Working Group at [email protected].

- Go to ReportFraud.ftc.gov and report it to the FTC.

You can also forward the text to 7726 (SPAM), which is a centralized spam-reporting service backed by a global association of wireless carriers.

Contact Your Bank

Unfortunately, Venmo is not liable for any fraudulent transactions. However, if you call your bank and let the know what happened, they may be able to reverse the charges if any funds were stolen.

Contact the FTC's Identity Theft Division

If you accidentally clicked on a link and gave your personal information such as credit card, bank account numbers, your Social Security number (SSN), go to IdentityTheft.gov. They offer a list of steps based on what information you lost to keep your identity safe.

Update Your Password

Whether you gave out your login credentials or not, it’s good to be extra cautious and update your account password. You'll want to create a strong password which typically means a 12-character minimum using a combination of phrases, upper- and lowercase letters, numbers, and symbols while avoiding common words or phrases.

This password checklist provided by the FTC can help you create a new one. Venmo also gives you the option to turn on Face ID and a pin to add an extra layer of security to your account. Turn this feature on to further protect yourself.

Other Types of Scam Texts to Be Aware Of

Scammers are sending more and more scam text messages pretending to be from legitimate companies and banks:

- Amazon

- Amex

- Apple

- AT&T

- Capital One

- Chase

- Citibank

- Citizens Bank

- Fedex

- Navy Federal

- Netflix

- PayPal

- Truist

- UPS

- Venmo

- Verizon

- Walmart

- Wells Fargo

Don't click on links within these texts or call the phone number listed. You should always find the genuine number for the company on their official website.

Comments