- What Types of Texts Does Navy Federal Send?

- How Scammers Use Texts to Trick People

- How to Spot a Navy Federal Scam Text

- How to Protect Yourself Against Navy Federal Scam Texts

- What to Do If You’ve Fallen for a Navy Federal Scam Text

- Frequently Asked Questions

Navy Federal Credit Union has been around since 1933 and since then has grown to be one of the largest natural member credit unions in the United States with more than 11 million members worldwide. So, it’s no surprise that scammers have found a way to spoof the financial institution with fake Navy Federal scam texts.

- Financial Fraud Protection

- Identity Theft Protection

- Family Protection & VPN

Scammers are hoping to trick you into giving away your personal information such as your login credentials, passwords, or even your Social Security number (SSN). Learn more about this scam, how to avoid it, and what to do if you’ve fallen for it.

What Types of Texts Does Navy Federal Send?

It’s important to note that Navy Federal does send text alerts to its members and which ones it sends is based on each person’s personal preferences. You can choose these options by signing into your account on its mobile app.

Once you sign in, you’ll see a Notifications tab in which you can select, Account, Tab, or Security. From there you can specify which texts you want to receive either for your account, debit card, or both.

The options for each include:

Account Text Alerts

- Available balance falls below $0.00

- Check cleared

- Current balance

- Deposit confirmation

- Overdrawn balance/insufficient funds

- Withdrawal transaction exceeds $0.00

Debit Card Text Alerts

- Single transaction of $0.00 or more

- Online/phone/mail order

- ATM

- Auto-pay/Recurring

- Card used outside the U.S.

- Payment due reminder

Although the credit union sends these types of correspondence messages, they will never ask for your personal or account information via text.

How Scammers Use Texts to Trick People

According to the Federal Trade Commission, some of the most popular tactics scammers may use to try and trick you into falling for a fake Navy Federal text scam include:

- Claiming issues with your payment information

- Asking you to verify purchases

- Warning you of suspicious activity on your account

- Offering prizes or gift cards

Typically, fraudsters will send a text that’s intended to trick you into giving away personal information by clicking on a link which takes you to a website posing as Navy Federal.

From there you may be asked to enter personal information such as your username and password, which will then give the scammers access to your account.

How to Spot a Navy Federal Scam Text

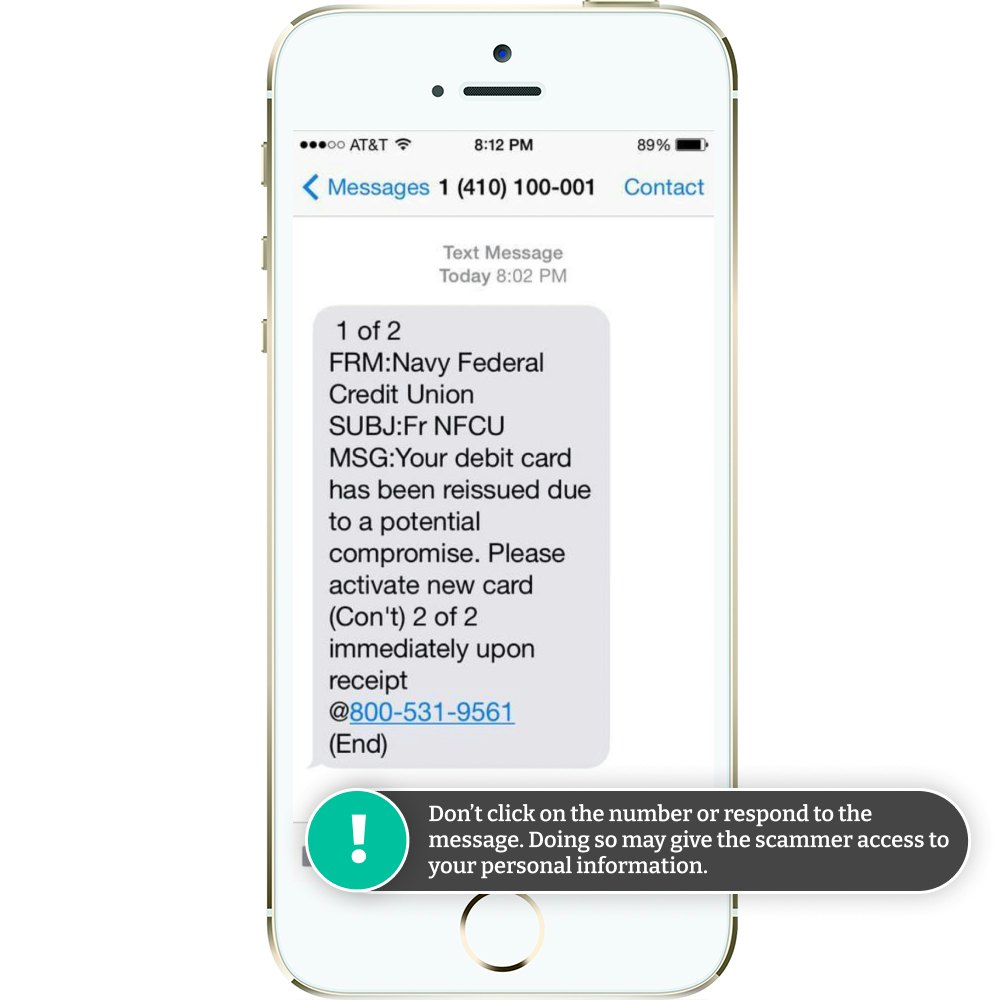

One example of a fake Navy Federal text is below:

Example of a fake Navy Federal text1 of 2

FRM: Navy Federal

Credit Union

SUBJ:FR NFCU

MSG: Your debit card has been reissued due to a potential compromise. Please activate new card (Con’t) 2 of 2 immediately upon receipt @800-531-9561 (END)

The purpose of this text is to trick members into calling a fake number to activate a fake card. After calling, a recording will ask for your card number and other personal information. This is of course a scam meant to disclose your financial information.

Here are some ways to spot a fake Navy Federal text:

- Review the above lists of legitimate texts that Navy Federal sends and verify if it fits into one of those categories.

- Notice if there are any spelling or grammatical errors within the message, this is usually a telltale sign of a scam.

- If you’re asked to click on a link within the message, you’re probably being targeted for a phishing scam.

- If there is an urgency within the message, it’s likely fake. This is a tactic scammers may use to try and force people into acting without thinking.

How to Protect Yourself Against Navy Federal Scam Texts

DO

- Do call Navy Federal via the number on their official website or the number on the back of your card to verify whether they sent the text or not.

- Do forward spam and scam texts to 7726 (SPAM), doing so alerts your carrier to investigate further.

- Do block the phone numbers it was sent through (and block incoming spam texts if you don't already).

DON’T

- Don't trust a familiar area code or the number that pops up on your text. Scammers are able to spoof real phone numbers (such as Navy Federal’s customer service number) to trick people into thinking it’s a legitimate text.

- Don’t click on any links in text message. They are usually used to install malware or software that tracks what you type.

- Don’t respond to a suspicious text message because doing so can be used to verify your phone number and gain access to your personal information.

What to Do If You’ve Fallen for a Navy Federal Scam Text

If you think you’ve fallen for a fake Navy Federal text, follow these steps to protect your identity and financial information:

- Login to your account and change your password immediately.

- Make sure the new password is a mix of letters, numbers, characters, and avoids real words.

- Screenshot the text and the website (including the URL) and then delete the text.

- Report the text message to Navy Federal directly.

Navy Federal Credit Union

Website: https://www.navyfederal.org/

Contact page: https://www.navyfederal.org/contact-us.html

Email: [email protected]

Contact page: https://www.navyfederal.org/services/security/report-fraud.html

It's important to verify links and contact details to beat imposters.

Other Types of Scam Texts to Be Aware Of

Scammers are sending more and more scam text messages pretending to be from legitimate companies and banks:

- Amazon

- Amex

- Apple

- AT&T

- Capital One

- Chase

- Citibank

- Citizens Bank

- Fedex

- Navy Federal

- Netflix

- PayPal

- Truist

- UPS

- Venmo

- Verizon

- Walmart

- Wells Fargo

Don't click on links within these texts or call the phone number listed. You should always find the genuine number for the company on their official website.

Comments