- Dispute Credit Card Charges

- Dispute a Debit Card Transaction

- Why You Shouldn't Dispute Credit Card Charges by Mail

- Your Card May Be Canceled

- If You've Been Scammed

Before you dispute credit card charges, the first thing you should do is make sure it's not a legitimate charge. Sometimes companies will have a different legal name that shows up on a statement rather than the name they do business with. For example, Jewelry Market LLC may show up on your bill for a payment you made to Jane's Collectibles.

As soon as you notice suspicious activity, however, take action. If any unauthorized transaction has occurred, you should dispute it regardless of the amount. Scammers will sometimes charge small amounts to see if they are noticed before making larger chargers or withdrawals.

So, as soon as possible, contact your credit card issuer or financial institution that issued your debit card to report any unauthorized charges. You will want to provide as much detail as possible, including:

- Your name and account information

- The date the unauthorized transaction occurred

- The amount you're disputing

- When you noticed the unauthorized charge

Hold on to any paperwork that might be relevant. For example, if you have a receipt showing a different amount than what was charged to your account, that can help resolve a dispute.

After reporting the fraud, you can also follow up with written correspondence. Write a dispute letter including the relevant information and the date you reported it by phone. This provides written documentation that you did report the dispute promptly. The Federal Trade Commission has a sample dispute letter you can fill out to use.

Dispute Credit Card Charges

You have the legal right to dispute a credit card charge on your credit if you believe it was made in error, the provider didn't provide the goods or services you paid for, or fraud has occurred.

If a scam, fraud, or unauthorized charge happens, call your credit card company at the phone number on the back of your credit card. Most companies have a 24-hour hotline available for reporting fraud. If you no longer have access to the card, look up the credit card company's fraud protection hotline number online.

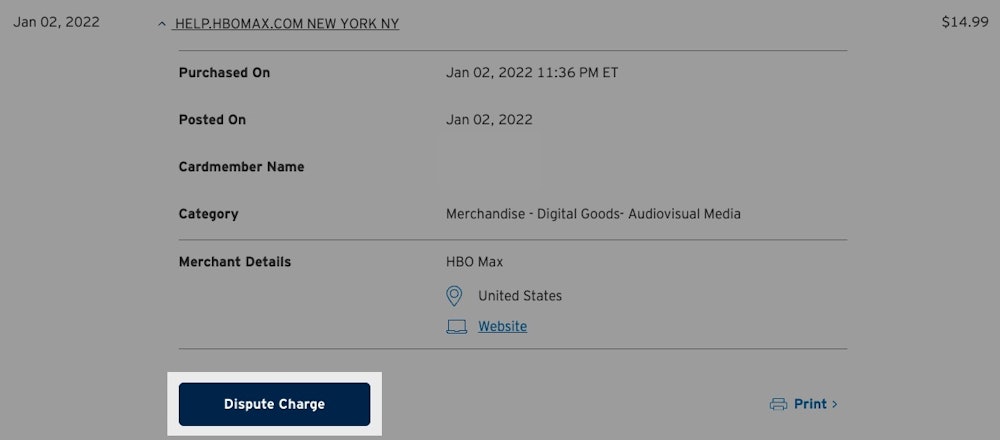

Many banks also allow you to dispute a charge by logging into your account online or via your bank's app.

You can also contact the major credit card carriers at these numbers for their fraud and security offices.

- American Express: (800) 528-4800

- Discover: (866) 240-7938

- Mastercard: (800) 627-8372

- Visa: (800) 847-2911

By law, the most you will be responsible for with unauthorized transactions is $50. The good thing is, many credit companies have a zero-liability policy so that if your credit card is lost, stolen, or used in a fraudulent transaction, you will not lose the money.

Until the dispute is resolved, you are not responsible for paying for the charge on your credit card, although you will need to pay for other legitimate charges.

You should contact the merchant first if:

- You are filing a dispute because you didn't get the merchandise you ordered

- A merchant charged you a different amount than they should have

- The products or services you received weren't satisfactory

Dispute a Debit Card Transaction

Debit cards do not offer the same level of protection as credit cards. When you charge something on credit, you can dispute the charge and ask your card issuer to withhold the payment to the merchant. When a debit is posted, it removes the money from your account and transfers it to another person or business. The money is gone from your account.

Act Quickly!

It's crucial to dispute debit card transactions quickly, as the longer you wait, the less likely it is for you to get your money back.

Calling quickly makes a difference in your ability to recoup your losses. For example:

- If you call within two days after discovering an unauthorized transaction, your liability for charges will not be higher than $50.

- If you alert your card issuer after two days, you will be responsible for the first $500 of the fraud.

- If you wait until after 60 days, you have no protection and will be responsible for the entire amount of the loss.

In the case of a dispute, you will not have access to the funds until the dispute is resolved. This can create a ripple effect—if there isn't enough money in your account, you may be charged banking or overdraft fees. Legitimate charges might also get denied due to a lack of funds.

Why You Shouldn't Dispute Credit Card Charges by Mail

Credit card companies and financial institutions give you the option to dispute fraudulent transactions by mail. While you can do that, taking this slower route can cost you money.

The Electronic Fund Transfer Act (EFTA) allows consumers to recover money lost to fraud, but time is of the essence. The sooner you report a fraudulent or unauthorized transaction for debit and credit cards, the better chance you have to mitigate your losses.

Sending a dispute by mail can easily miss the two-day deadline limiting your liability. It also gives scammers more time to place more charges before they are stopped. And, if your letter gets lost, you may be out the entire amount stolen in the scam.

Your Card May Be Canceled

When you report credit/debit card fraud, your card issuer will likely cancel your card, and a new card with a new number will be issued. As a result, you may lose the option to use your card until a replacement arrives. This is a preventative measure to make sure scammers can add more charges to your account.

Some credit card companies can block online transactions while allowing you to use your chip-enabled card for in-person purchases until a replacement card arrives.

If You've Been Scammed

If fraud is involved, you should also file a police report. While it is not required to dispute a charge, it can help police keep track of scams and scammers. It also provides you with paperwork to help document a claim in case it's needed in the future.

You may also want to report it to these government agencies:

- FTC Fraud Report Center

- IC3 (FBI Internet Crime Complaint Center)

- Consumer Financial Protection Bureau (CFPB)

- Your state's Attorney General

Contact the Credit Reporting Agencies

Once a scammer has your credit card number, they can continue to rack up charges. Combined with other personal information, they may attempt to open up more accounts in your name or get your credit limits raised.

It's a good idea to report credit card fraud to the credit reporting bureaus to put additional protections in place. If you place a fraud alert on your account with the credit bureaus, this lets merchants know they should contact you for verification before opening a new account.

You can also initiate a freeze on your credit, which restricts anyone (including you) from accessing your credit report until you unfreeze it.

There are three major credit bureaus:

While you can initiate a fraud alert or credit freeze by mail, it takes time. Therefore, it's recommended you contact the credit bureaus by phone or place a fraud alert or credit freeze online.

You can also create a fraud alert or credit freeze by visiting the credit agency's website, although you may need to create an account to do so. Creating an account to report fraud is free.

Comments